Subscribers questions (MLD, S32, BAL, LVT, GDX, NCM, AD8, EVN, SZL)

Even after a strong Friday the ASX200 closed down last week albeit marginally as the US and parts of Asia appeared to get the wobbles. Nothing sinister showing at the moment locally as the banks in particular remain firm but the baton of weakness and strength continues to get passed between differing stocks and sectors.

Tomorrow the RBA have their October meeting with the market anticipating a 0.25% rate cut plus an additional 0.25% in 2020, in other words local official interest rates are set to halve this financial year. Its hard to imagine this not helping the market although it will be far from a surprise, any rhetoric around a potential second cut in 2020 is likely to have more influence on the market this week.

Over the weekend we saw lots of noise around a Trump impeachment, the BREXIT fiasco and further protests in Hong Kong but looking at how the currencies are trading at 6am this morning markets look set to open in an orderly fashion with no major left field surprises - assuming Trumps asleep and not tweeting of course!

No change, with the ASX200 trading above the 6700 area, MM is comfortable being relatively defensive, at least for a few weeks / months.

This morning SPI futures are pointing to an opening down around 10-points which feels about right as all eyes will be focused on the RBA tomorrow.

Thanks for the impressive number of questions this morning, we simply love seeing engagement with our members. Please excuse the brevity at times.

ASX200 Index Chart

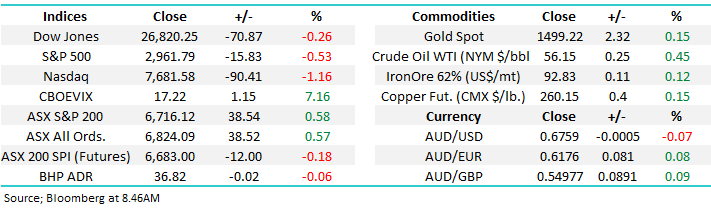

US stocks can best be described as climbing a wall of worry and although the press is continually full of their imminent demise as the chart below illustrates they’re only a few good days away from making fresh all-time highs.

While at MM our preferred scenario is US stocks will correct ~5% in the coming weeks there is still no technical sell signals in play, it’s more of a “Gut Feel” at this stage.

US NASDAQ Index Chart

The chart below illustrate Australian bond yields continuing to trade around their all-time lows, assuming all goes to plan with the RBA moving forward it appears to MM that RBA Cash Rate will be at 0.5%, while the local 3-year yields will test the 0.6% area – no contrarian view here.

What will be interesting for stocks is when fund mangers start considering what comes next e.g. will we see rates flat line for quarters to come as the economy struggle’s to gain any traction or will we see another sharp pick up in housing prices, consumer confidence and then spending which will test the RBA’s resolve to leave rates at their historical lows.

Australian3-year Bond Yields Chart

Question 1

“Gday team, I’m new to Market Matters and am really enjoying the daily reports. I have a couple of shares that I’m not sure of and would appreciate your thoughts. MLD (MACA) and S32. Hold or Sell? I just bought BHP after the Market Matters recommendation. Look forward to your thoughts.” – Thanks Dale C.

Morning Dale,

Welcome aboard and thanks for the early thumbs up, it’s an absolute pleasure.

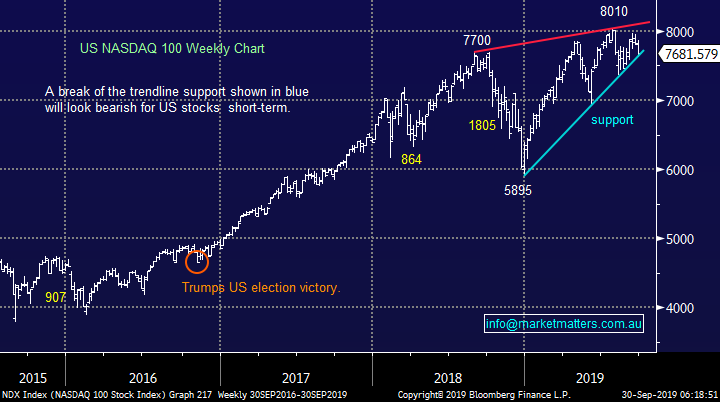

Firstly mining services business MLD , it’s been heavily traded of late but the shares remain near their lows of the last few years. MM does not follow the $254m business too closely because of size issues hence we will fall back on technicals with this one, plus with it being close to major lows quantifying risk is vital.

While the stock yields 4.7% on a historical basis, there is considerable risk around the dividend in the future – and we’d be surprised if they pay anything near that level.

Technically MLD looks ok with stops under 90c, or 6% lower.

MACA Ltd (MLD) Chart

MM has been bearish South32 (S32) for most of 2019 but we are now slowly moving towards the more neutral camp. The diversified metals and mining company looks destined to make fresh 2019 lows but it will look interesting as a short-term play under $2.36, and especially around $2.

At current levels MM is neutral / bearish S32.

Soutrh32 (S32) Chart

Question 2

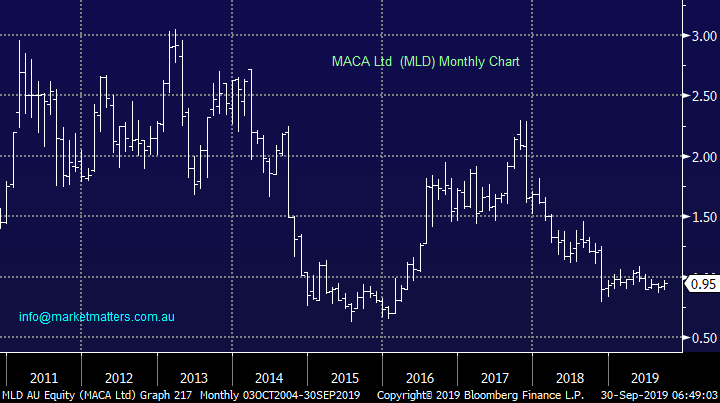

“It seems that the unanimous decision of the Board of Bellamy’s is totally driven by greed for money. Quoting from the company’s announcement, the company’s CEO, Mr Cohen stated: “This transaction can further deliver on our founder’s original vision of a truly iconic Australian brand and ‘A Pure Start to Life’ for the world”. What a piece of propaganda!!! What is “Australian” about selling that brand 100% to an overseas company? Answer, nothing! Continuation of local operations with local jobs, perhaps. Loss of local control, loss of profits all heading off overseas, absolutely! Another truly Australian brand lost, totally!” - Paul H

Morning Paul,

A frustrating fact of life at this stage of the global economic cycle, a higher $A would arguably defend a few of our companies from both hostile / friendly takeovers.

However there’s always 2-sides to the coin and shareholders in BAL are probably very happy as opposed to those in say GrainCorp (GNC) when their overseas bid was knocked back by the regulator.

Lets hope our companies become stronger and more competitive and then they can become the aggressor.

Bellamy’s (BAL) Chart

Question 3

“Good morning gentlemen, My question to you is this what share , ETF or other ( i.e. ETPMAG) can I invest in to buy gold and silver , which I at my will can call in the script and convert my shares into Physical gold and silver to do as I please and which companies would be the leader in this field with regards to safety and being able to deliver gold and silver if all goes to sh

t.” - Thanks Daniel C.

Hi Daniel,

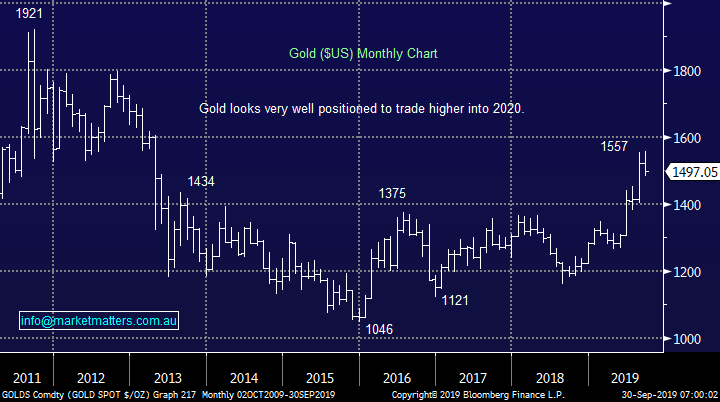

MM is long gold / silver via both stocks and ETF’s in our Platinum, International and Global Macro ETF Portfolios hence by definition we believe these are ideal vehicles at this point in time if it all goes pear-shaped.

In terms of conversion to physical, ASX code PMGOLD does this. It’s a tradable product on the ASX issued by the Perth Mint. More information is available: https://www.perthmint.com/storage/perth-mint-gold-asx.html

They also do Silver products however I don’t think these are ASX tradable. Their website is a good place to start.

Gold ($US/oz) Chart

Question 4

“Hi James, Interested in your views on LVT and the current SPP. Price popped on SPP announcement last week, bodes well for existing shareholders or is there something we don’t know about?” - David H.

Hi David,

Software business Livetiles (LVT) actually closed down last week and the $293m business looks “heavy” from a technical perspective although its strong links with global heavyweight Microsoft (MSFT US) is obviously promising for the business. The company announced a $50m capital raising earlier in the month at 35c plus as you said a $5m SPP. We had management in about a month ago and I was impressed with the presentation, however at the time I came away with the view that they were imminently about to raise cash – which they now have. They were doing a non-deal roadshow hence that same view I’m sure would have been formed by many in the market. If the market is expecting a capital raising, it can often be a sell the rumour, buy the fact sort of scenario. The looming raise could have been the main reason for the decline from 60c.

This is a potentially very exciting growth business but like so many small caps the volatility of the shares is huge, technically it looks like either an accumulation into weakness or a buy above 44c but in both cases we stress it’s a classic volatile “speccy”.

MM likes LVT into weakness as an aggressive “bottom draw” play.

Livetiles (LVT) Chart

Question 5

“Where can I find a listing of current NTAs for LICs?” - Cheers John W.

Hi John,

I use the report from Independent Investment Research which I find useful – the last report is available here

NB LIC = Listed Investment Company and NTA = Net Tangible Assets.

Question 6

“Hi James, Re: This morning’s newsletter Wed 25th Sept 19. When you said: "MM likes the gold sector now targeting ~8% upside" Is this 8% in relation to the MM suggested entry date and buy in price of EVN and NCM with an increase of 8% on that buy in price? For example, I bought into EVN and NCM on the day the buy alert came out for each. Does that mean I will looking for an 8% increase in price on each of those stocks before exiting? Hope that's not too specific a question for you to answer.” - Thanks, Kim B.

Hi Kim,

Thanks for the great question which is definitely not too specific, on the 25th we were referring to the additional upside we were targeting at the time i.e. gold stocks / sector in general had already rallied nicely at this stage.

Our target for Newcrest Mining (NCM) from date of purchase is about 15% higher, towards the $40 area.

MM still likes the gold sector but feels short-term a little further weakness is likely.

VanEck Gold Miners ETF (GDX US) Chart

Newcrest Mining (NCM) Chart

Question 7

“What is different about the last fortnight? Things seem to have turned sour over the last 2 weeks . Before that we had all the usual controversies but the market seemed to shrug it off, Is it just a pullback after doing so well? is another type of share taking over (value v growth, etc.) or something else? have you yourselves been aware of a change?” – Guy DB.

Hi Guy,

I’m not sure I would describe the last fortnight as particularly sour, the ASX200 is still up over 1300-points since its December low and is sitting just over 2% below its all-time high – still looks fairly strong to me.

MM has no sell signals on the ASX200 although we are wary short-term.

ASX200 Chart

Question 8

“Hi James and Adam, Your thoughts on Audinate (AD8) long? Do you know if their fundamentals are sound?” - Thanks, Kim B.

Hi Kim,

Software developer / digital audio visual business AD8 looks an exciting local prospect. Shaw and Partners actually listed the business and in their FY19 revenue rose over 40% to more than $28m with similar growth looking likely in 2020.

There has been some overhang recently after a change at the management level, however that has now been cleared. As a growth stocks, its not cheap and looking at it from a purely P/E perspective is irrelevant, hence we would be using technicals to quantify risk / reward.

MM likes AD8 initially targeting ~$9 while running stops below $7, solid risk / reward.

Audinate (AD8) Chart

Question 9

“Good morning James and Team. I have just been reading about the USA Federal Reserve interventions in the USA Repo market over the past week or so. Essentially Wall Street appears to have a liquidity problem following the Fed shrinking its balance sheet and this coinciding with dates, such as tax deadlines, where USA corporates required cash and there was not enough to keep the market liquid, spiking the Repo rate. I am interested in your thoughts on whether this is a storm in a teacup, or a glimpse of a much larger credit problems in the USA?” - Thanks in advance Grant L.

Hi Grant,

A fascinating subject but not one the markets appears vaguely interested in except for discussion in the press hence to us it’s a “storm in a teacup” but always worth watching. The actual spike was mostly because of an odd (and likely temporary) U.S. dollar shortage caused by 1) Corporate taxes being due and 2) A ton of Treasury issuance last week (which sucked up more cash). So, although it should not have happened, it’s more a timing issue rather than an alarm bell in my view.

The market usually tells us first where the fundamental concerns are looming.

US S&P500 Index Chart

Question 10

“HI Market Matters, I have been an subscriber to your service for a while now and love your service. One question I have been thinking about if the view is the market is going to go down say 5% why don't you just sell equities and not just buy the BBOZ and gold then

wait to buy equities again at lower levels?” - thanks Andrew B.

Hi Andrew,

A great question and one which makes sense on the surface but there are a couple of other issues to consider:

1 – Our method works better if the MM selected stocks outperform the ASX200.

2 - A few of our stocks recently traded ex-dividend, if we sell now we will lose the benefit of franking credits.

3 – Also selling stocks regularly creates issues around capital gains which we may not want if the plan is to re-enter in just a few weeks’ time.

Question 11

“I think you have probably answered the question, just to be clear....if yields are going down and all the uncertainty in HK, trade war, impeachment, etc - why has gold stocks like NCM (and gold) dropped ~7% in last 2 days. Even, if people are buying USD as safe heaven, it still increases the margins of gold producers as AUD falls when USD goes up. Looks like it is sector wide not specific to few gold producers. Confused...” - Regards Sanjay S.

Hi Sanjay,

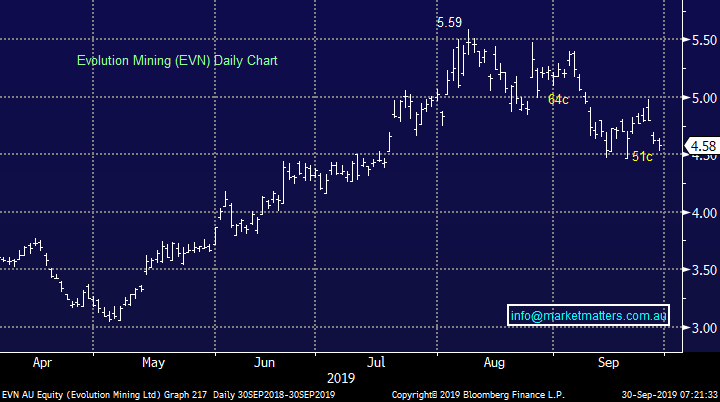

Certainly a frustrating few days for our gold positions which illustrates nicely why we regard them as short term investing vehicles.

Best to keep this one simple, gold usually falls when the $US rallies and although our companies enjoy a weak $A, strong $US, a kneejerk lower in the gold price invariably hits gold stocks.

We believe the $US appreciation is losing momentum and a pullback should push gold and the sector higher.

Evolution Mining (EVN) Chart

$US Index Chart

Question 12

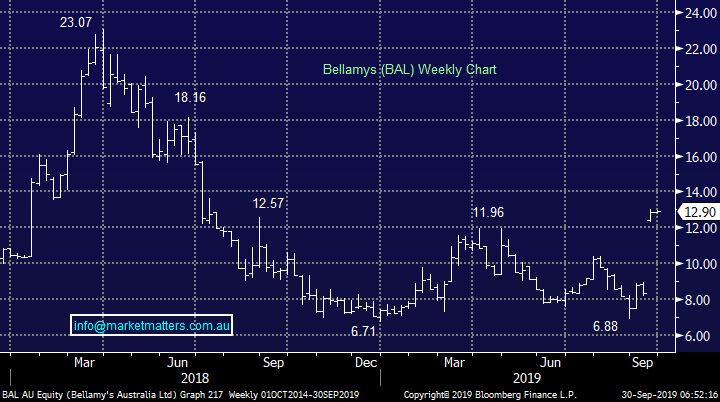

“Hi James and M&M, could you give your opinion on Sezzle as an potential investment in the "buy now pay later" space? Thank you and keep up the great work.” - Mitch N.

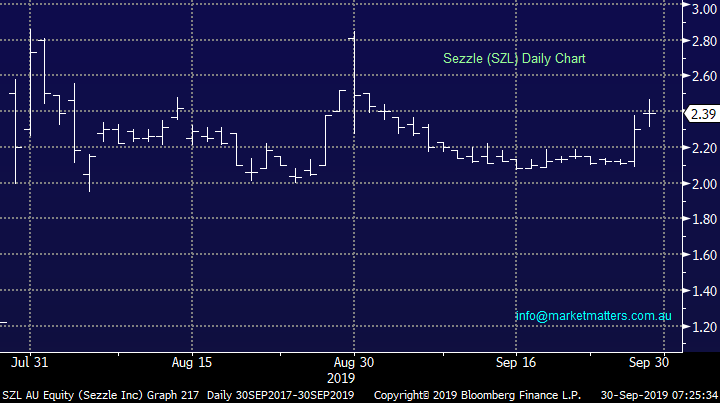

Hi Mitch,

Sezzle (SZL) is clearly in a extremely “hot” sector right now after the huge success of Afterpay Touch (APT). The stock has surged after its initial float in July before tracking sideways as investors wait for some performance hence it’s a guessing game before we see some corporate results. Growth is obviously key in these businesses and they’ve managed to grow active merchants from 100 in Dec 17 to 5048 by June 19, underpinning active user growth from 4542 to 429,898 as at June 30 2019.

The business is still loss making, will likely be for some time, so we revert to technicals.

MM is neutral SZL at current levels.

Sezzle (SZL) Chart

Overnight Market Matters Wrap

- The US equity markets lost early gains to end Friday trading lower, following reports that President Trump will look to block US investment into China and even de-list Chinese shares from the US stock exchange, further ramping up the US-China trade pressures ahead of proposed October talks.

- Crude oil remained under pressure, while gold also eased, below US$1500/Oz. Base metals and iron ore were little changed. The A$ is holding around US67.6c and the ahead of tomorrow’s RBA meeting, which is expected to result in a further 0.25% rate cut.

- The December SPI Futures is indicating the ASX 200 to openmarginally lower, testing the 6705 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.