Subscriber’s Questions – (FIG, JKL, WTC, A2M, APX, APT)

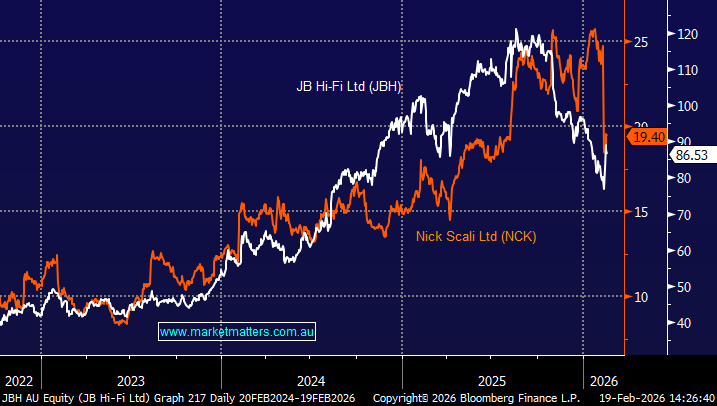

September is living up to its bearish seasonal reputation, the index is already down -2.8% and we’re only 1/3 of the way into the month. The SPI futures are pointing to another weak opening this morning and it will be a brave investor / trade to ignore last week’s downside momentum – our best guess is another few weeks of likely surprises to the downside, especially for the high valuation / growth stocks.

The weekend gave us all time to digest what is currently unfolding on the US-China trade war front and we feel it may continue to scare the markets a little while longer:

- President Trump is threatening tariffs on 100% of goods with China, basically it’s an all-in call for the Poker players, BUT is he bluffing?

- Petrol was added to the already major fire when over the weekend Chinese data showed their trade surplus with the US has risen to a record, although export growth did slow.

- We believe the US may be underestimating the resolve of China’s Xi Jinping, like his people he thinks next generation not next week.

NB We should ask Denis at MM on Trump’s play, he’s our poker expert!

- We are negative the ASX200 ideally looking for a further 5-6% downside.

While we are negative the ASX200 over the next few weeks, we are holding a large cash position plus holding negative ETF positions, hence do not be surprised if we look to accumulate stocks earlier than some may think e.g. Aristocrat (ALL) and Kidman Resources (KDR), the latter being an aggressive play.

Thanks again for some more great questions, we’ve certainly got a lot going on to stimulate plenty of thoughts and ideas.

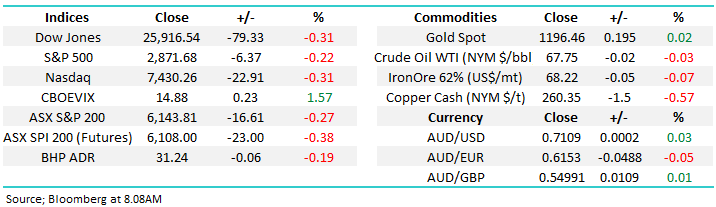

ASX200 Chart

Question 1

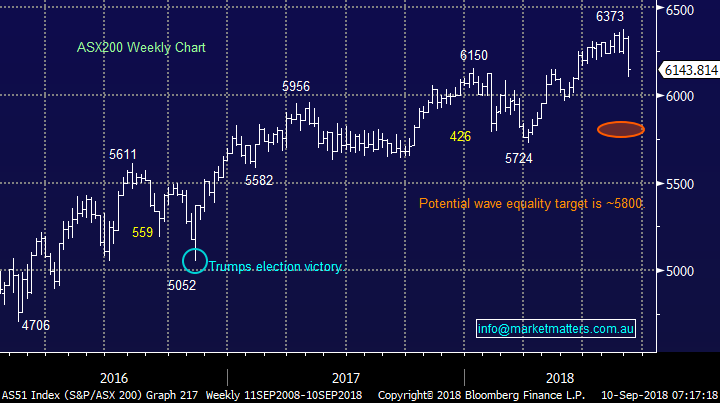

“Hi, hope to get your quick opinion. I hold FIG from 0.427 as of now I’m down 62%, due to Royal commission investigations. What would you do? Should I take the loss and exit or hold. I got convinced into buying due to Forager Investments talks. Recent report from Baillieu Holst Research states, “. there is valuation support with cash and NPV of trail commissions owing of A$92.3m (A39cps) at FY18” Today morning company announced “32m ordinary shares will be released from voluntary escrow on 20th Sept”; plus, they are launching a strategic review. Thanks. By the way enjoy all the reports.” – Regards Lakshan R.

Hi Lakshan,

I agree that this is now a cheap stock with a market capitalisation of around $34m while the business generated around $60m in revenue in FY18 with a similar amount expected in FY19. That dropped down to a profit of $13m for FY18, however there are now a number of issues facing the stock as you’d expect with the big rout in share price.

High costs seem to be a big issue (hopefully being addressed by the strategic review) while the focus of the Royal Commission on high pressure sales tactics and trail commissions could 1. Increase costs in the short term by increasing regulatory spend and 2. Make their current business model defunct.

Round 6 of the Royal Commission starts today and FIG, along with AMP, ClearView, Comminsure, REST & TAL are all being probed about their life insurance businesses.

In terms of FIG, this is a very high risk stock at the moment and given the timing of the Royal Commission, we’d prefer to wait and see what comes from that before making a call, however on face value, it does look very cheap.

Freedom Insurance Group (FIG) Chart

Question 2

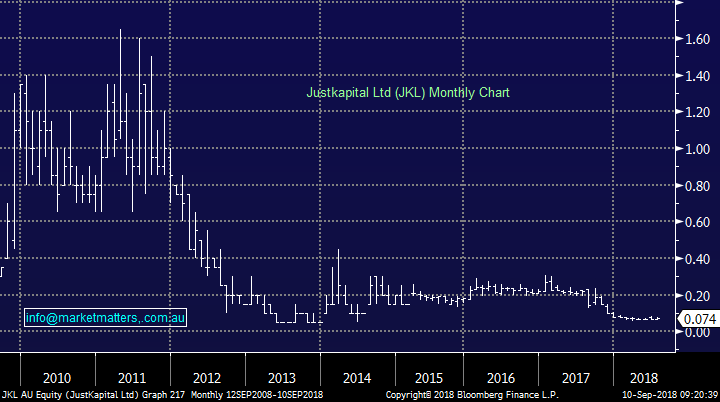

“Hi James, I'm told JKL are cheap. Can you help me with understanding this stock?” – Regards Matthew K.

Hi Mathew, JKL is suspended while I type this note, and has been since mid-July. We see nothing in the past few years price action to tell us that the professional investors have been accumulating / buying JKL. Hence we have no interest in JKL, the litigation financing business. If you are a keen reader I would suggest picking up a copy of “Reminiscences of a stock operator by Edwin Lefevre” a great read for getting a handle on what we mean when we talk about listening to what the market is telling us.

JustKapital (JKL) Chart

Question 3

“Hi Market Matters team, just wondering when you think a good time might be to short WTC (if at all)?” – cheers & regards Sean C.

Hi Sean, You must like some “action” with WTC very capable of swinging over 15% in any particular week. WTC trades on a massive Est. of 94.1x 2019 earnings while yielding 0.1% fully franked. I’m sure the huge valuation is catching your eye as that particular group of stocks are coming under pressure, WTC has already retraced 20%.

Technically we can see WTC retracing back to the $18 level, or ~10% lower but its volatility would scare us from taking a short position on a risk / reward basis.

At MM we are not interested in buying WTC with its current valuation, however expect some extreme volatility in this area of the market going forward.

Wisetech Global (WTC) Chart

Question 4

“Hi MM, thanks you for your reports, I have a question around Hybrids and the risk associated with these investments, I noted that there are different hybrids, some convertible to Equity and others a much lower risk which mature with no conversation risk. How does MM you make this assessment? Is the CBA perils CBAPF for example have a maturity date or is it perpetual and convertible to equity?” - Regards, Brendan M.

Hi Brendan,

Hybrids are fairly complex with four main types of hybrid securities currently listed: subordinated debt, perpetual securities, convertible preference shares, and capital notes. The most common new bank hybrid being issued are capital notes, which are technically perpetual debt securities. They’re perpetual so that they help to satisfy the bank’s tier 1 capital requirements which relies on the capital being permanent, or in other words, they can convert the hybrids to equity under extreme circumstances which then makes the capital permanent.

The subordinated note structure is generally lower risk than a capital note as these securities have more rights with respect to payment of interest and repayment of principal. They pay a lower yield as a result.

In terms of the CBAPF, this is a capital note which is technically perpetual in nature, however they have two call dates. The first on 31st March 2022 and the second 2 years later. In most instances, banks redeem these at the first call date and either issue a new security or simply pay back funds to investors. We would expect the same to happen in 2022 at the first call date of the CBAPF’s however, there is the risk that the bank gets into trouble, or global lending markets dry up, and these securities can remain on issue. Under some extreme circumstances, such as a big deterioration in bank tier 1 capital levels, these securities can convert to equity.

In terms of MM’s assessment of these securities, like anything we do its about risk / reward. The first part of that equation is understanding the risks, then considering whether the reward (yield) compensates for that. We think securities in most instances compensate for the imbedded risks, however we do look at each security individually. The CBAPF is a hold for us at the moment given its trading on a yield to first call of 5.43% grossed for franking, which is okay but not inspiring.

If there is enough interest in Hybrids, I’m happy to run a Webinar on Hybrids given they are reasonably complex.

Question 5

“Hi! James, feel free to shoot me down on this, I assume the great majority of subscribers are self-funded retirees or people whose ultimate aim is to have a better lifestyle in retirement than the pension can offer. It would need approx. $1.3m invested after taking in risk, etc to fund a full pension. If Labour wins the next election, and the probability is they will, this will increase to over $1.6/7and many funding their own will be worse off than on a pension and we know where that will lead. I feel I have invested myself into a giant black hole, being 70 plus, and suspect many of my inc have done the same. I live off int, dividend, franking credits, have a SMSF and the try to preserve capital and maybe some growth to offset the obvious. Both major parties by legislation have encouraged us to invest in this manner having a major priority towards shares, etc that attract franking credits. Now people who do not have the advantage to offset such against other taxable income may be disadvantaged. Personally, I will lose some 25% of income if labour wins, plus share values falling leading to further capital loss. Makes me think why someone would continue a SMSF when u can avoid the expense and complexity by simply using your imp credits to pay your tax?? Take say NAB your cost $31.44, mine $32, currently $27/8 and not much prospect of improvement in the near future under the impending change. Should they be dumped now or risk a bigger loss later. Now no one can predict the future but the odds are stacking up. Factor in the long overdue correction one could say there is potential to dump now as there is a strong probability of a lot of cheap shares around next year. How about some potential investment strategies for people like me over the next twelve months, or am I the only one out there.” - Margaret A.

Hi Margaret,

You are most certainly not the only one out there, the likely change (see the bookmakers) is pointing to a change in government and the market has already been underperforming globally because of this. Labor are indeed indicating major changes on a number of fronts with franking credits just one of them, the current majority it appears Labor will win is likely to allow Bill Shorten to eventually administer all the changes he / they wish. However elections do not always go according to plan just look at BREXIT and Trump. We cannot spend too much time worrying about the “what ifs” of the future or we wouldn’t get out of bed. US stocks were supposed to melt under Trump but they have boomed.

At MM we will simply continue to invest in stocks we believe at the time will provide the best returns which of course may see a relative switch between stocks paying unfranked dividends from the likes of the banks, time will tell. The ASX200 Accumulation Index remains in a great uptrend and although we feel a decent pullback is relatively close at hand we believe it will provide the best buying opportunity in many years implying stocks will continue to outperform cash in the bank moving forward.

Due to huge demand I have recently been asked to write an article by Livewire on the subject and will attach a link accordingly, probably within the week – this implies you are actually in the majority Margaret!

ASX200 Accumulation Index Chart

Question 6

“Hi Guys, probably the toughest I've had on the markets (4 days straight of heavy losses). I own the fab 4 A's (A2M, ALU, APX and APT). I still believe all 4 are great company's trading on big multiple's which is making me nervous. With A2M although expensive would they be a defensive stock in times of uncertainty as it is a consumer staple and baby's still need to feed. Also, your thoughts on the other 3 would be much appreciated.” – Regards Frank M.

Hi Frank,

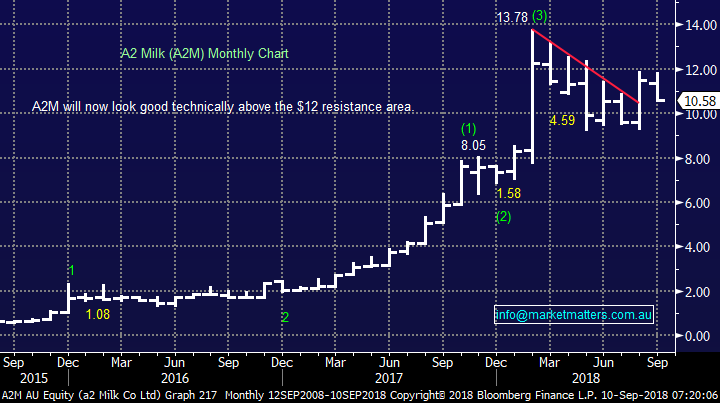

We have believed the high valuation / growth stocks were due a decent correction for a while and have written accordingly but after a savage few weeks to the downside you like many are thinking what next – this had unfortunately simply become a crowded trade. In this stage of the economic and stock market cycles growth stocks usually struggle hence we only own A2M out of the group in either of our portfolios but this doesn’t mean some of these stocks won’t have strong recoveries although we may have seen their highs for a while.

I have given you a snapshot thought on each of the 4 stocks below. A2 Milk (A2M) is trading on a Est 2019 P/E of 32x, not too scary for a company exhibiting strong growth into China. MM is long and likes A2M moving forward and is still targeting fresh highs above $14. The stock has been hit over concerns around the US – China trade war but we believe the impact is more sentiment than fundamental moving forward.

A2 Milk (A2M) Chart

Altium (ALU) is trading on a Est 2019 P/E of 46.1x, a large valuation but the software developer for Microsoft has been kicking some huge goals in 2018.

We are 50-50 here but may consider ALU as a speculative play around $20, or 20% lower.

Altium (ALU) Chart

The Appen Ltd (APX) chart below is almost a carbon copy of the ALU one above showing how money flocked into these type of stocks without necessary attention to individual fundamentals. The social technology company Appen (APX) is trading on a Est 2019 P/E of 40.4x, not too rich for the sector but very high compared to the overall local market which of course shows little growth.

We are neutral at present and would be looking towards the $11 before considering buying.

Appen Ltd (APX) Chart

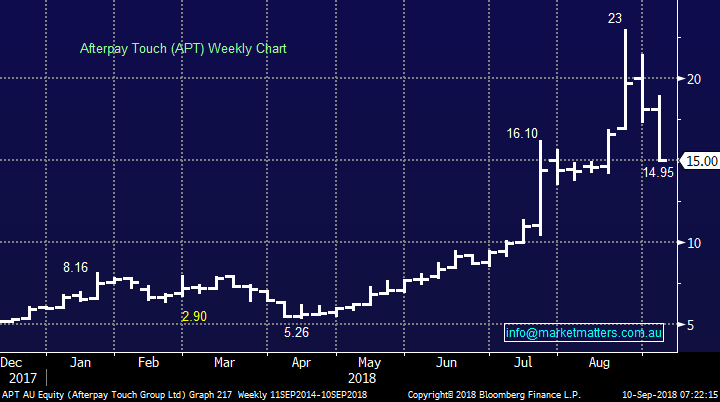

After Pay touch (APT) has been on a roller-coaster ride recently and from a technical perspective we would consider buying the current $15 area following the 35% correction but its Est P/E of 150x for 2019 obviously carries with it significant risks, we question is this yet a $3.4bn company?

At MM we have missed out on much of APT’s rally due to concerns about regulation i.e. they are a quasi-money lender encouraging debt, an area we believe it ripe for some form of regulatory intervention.

MM is going to give APT a miss but would not be surprised to see a rally / bounce from current levels.

After Pay Touch (APT) Chart

Question 7

“Hi Guys, I enjoy your reports but it's irritating to receive news at 5pm that we could have been alerted to during the actual trading day and I [we] could act on that information e.g. news about NAFTA falling over; broker alerts. Is it possible that you could broadcast this type of information to us members as it happens?” - Regards Colin

Hi Colin,

I certainly understand your thoughts, I feel almost naked if I haven’t got my Bloomberg within an arm’s length while markets are open. On a more serious note we are working on a major upgrade to the service in the next 6-months, firstly we have already set-up a news blog which is on our site and can be accessed using the “News” tab on the right hand side of the “Reports” tab. At this stage we are generally only posting a few stock specific stories daily but we will be constantly evolving and improving the service moving forward – the more people use it the more we will update it! https://www.marketmatters.com.au/news/

From an alert perspective it will be very hard to increase the volume of alerts without increasing the cost of the MM subscriptions given the costs involved, however we are investigating other mediums where more timely information / views / ideas can be provided to the MM community. Stay tuned – we do hear you!

Overnight Market Matters Wrap

- Global economic concerns continue to grow overnight as the US-China trade war reignited and piled on the current situation with the emerging markets.

- The first week of September in the US was much like down under, with both the Dow and the broader S&P 500 off over 1%.

- Base metals continued to suffer at their recent lows, along with our little Aussie Battler (AUD) trading around its 30-month lows. BHP is expected to underperform yet again after ending its US session off another 0.19% from Australia’s previous close.

- The September SPI Futures is indicating the ASX 200 to open 28 points lower testing the 6115 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/09/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.