Subscribers questions (EHL, NCM, AZJ, Z1P, UWL, DTL, PBH, WBC, MIN, CAN, RSH, NTD)

The ASX200 is again likely to be tested this morning as the virus pandemic continues to weigh heavily on the world – Victoria registered 363 new cases yesterday, a scary number but hardly a blip on the radar compared to what’s unfolding in the US where they are poised to reach an astronomical 4 million cases this week. Not surprisingly this weekend Joe Biden has opened up a 15-point lead over the unusually quiet President Trump, with only a few months until Novembers election “The Don” appears to be looking for a proverbial rabbit to pull out of his hat, it’s getting harder by the day to imagine how he can win but at this stage in 2016 I recall not many thought he would beat Hilary.

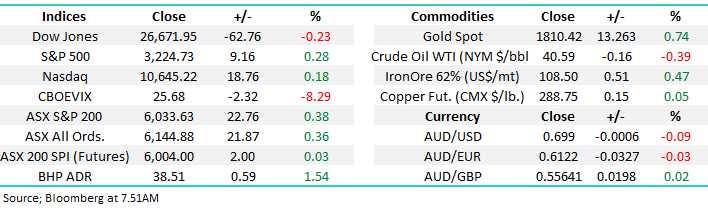

Governments resolve across the world is certainly being challenged as they battle to keep their economies firing while at the same time balancing the fight against COVID-19. On one extreme we have the US who have gone back to work even as we can see below, they’ve not remotely “flattened the curve” whereas Victoria has gone back into lockdown costing the state plenty economically. With an effective widely available vaccine still likely to be over 12-months away the balancing act looks set to continue although the rhetoric from many politicians is sounding more pro their economies by the day with “herd immunity” not mentioned but definitely being considered by many – the US has already experienced well over 1% of its population contracting the virus.

Confirmed COVID-19 cases in the US Chart

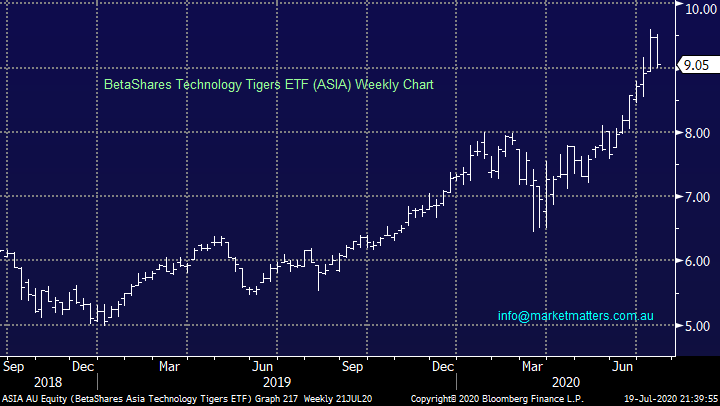

The SPI Futures are calling the local market to open unchanged this morning and with BHP trading up +1.6% in the US this feels about right or even too conservative and with the FX market opening in a very subdued manner the implications is stocks will again take the mounting pessimistic virus news in its stride. Also with reporting season almost on our doorstep a few quiet trading sessions with some stock / sector rotation is to expected, we feel the key to the 2nd half of 2020 will be how markets look through the numbers of what will undoubtedly reflect the recent tough economic backdrop.

MM remains bullish Australian stocks medium-term.

ASX200 Index Chart

On Friday night the Dow slipped slightly but it was still the highest weekly close in 6-weeks, a solid performance considering the country is being engulfed in COVID-19 with their death toll now well above 140,000. Second guessing how the pandemic will unravel is a very tough game, especially as politicians are driving the train for humanity but our focus is stocks and at this stage they remain resilient in the face of adversity.

MM remains bullish US stocks initially looking for additional ~6% upside.

Dow Jones Index Chart

Thanks as always for a great bunch of interesting and diverse questions, they’re very much appreciated as the Australian lifestyle is again being threatened by COVID-19, keep safe & be happy.

Question 1

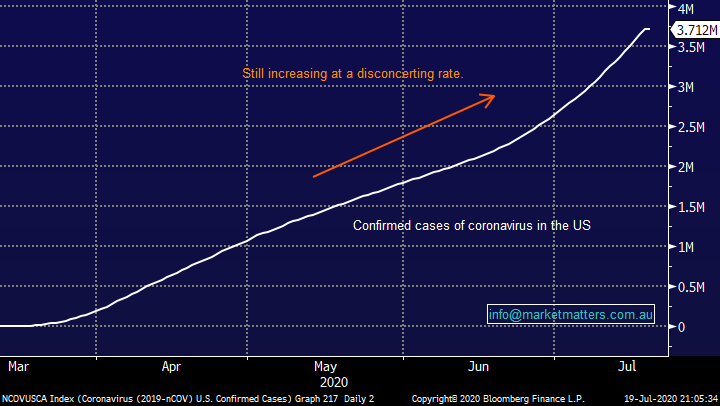

“Hi James & MM Team, not sure if this has been discussed before, however do you have any recommendations on where to park cash while sitting on the sidelines waiting to be invested? Bank accounts are yielding just a little above a zero percent return, however alternatives such as TD's will tie the money up for a number of months.” - Thanks, George B.

Morning George,

Cash is not king today and with term deposits yielding sub 1% I can see your dilemma, its hardly worth the inconvenience of losing flexibility to receive say 0.6% for 6-months, its actually why bank margins are holding up as investors are rolling our of TD’s and parking the money in at call accounts making it cheaper funding for banks.

In my view, if the goal is to re-enter stocks and the market as opportunities present themselves being able to act without delay is very important hence I think unfortunately the only course of action is to accept the almost 0% on offer in an at call account and always remember, those searching higher yields will take on higher risks to do so. To put things in perspective most stocks rotate around 2-3% even in a quiet week, way more than many term deposits.

Remain patient and focused on the goal in hand.

The RBA Official Cash Rate Chart

Question 2

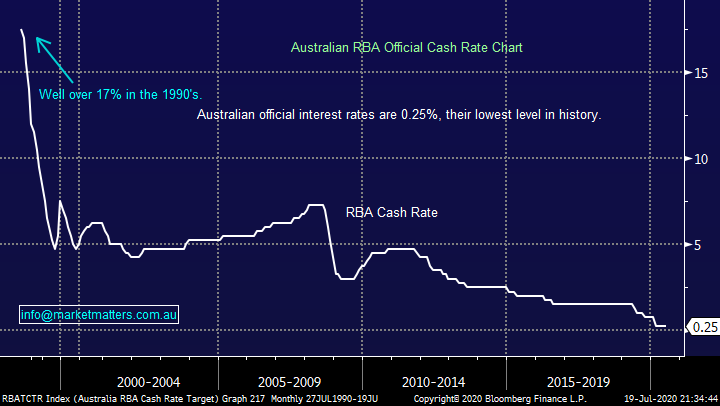

“Hi MM, I’m finding the subscription great value for money thanks! I have 2 questions. I was wondering what you think of ETF ASIA - political risk, growth and price entry? Plus, there are a few ETFs to park money short-term while waiting to be traded, which do you prefer (I would prefer a low risk option)? - As bank account attached to trading account pays no interest.” - Cheers, Jill C.

Hi Jill,

Thanks for the thumbs up, much appreciated. We like the Asia ETF for a number of reasons including MM being bullish China’s equity market and bearish the $US – for subscribers not familiar with this ETF it provides investors with exposure to Asia’s tech sector as opposed to the more usually discussed US Apple, Facebook et al. 2 of its 3 largest holdings are Tencent and Alibaba, positions MM holds in our International Portfolio

MM is bullish the ASIA ETF.

For the second part of your question refer to question 1.

Technology Tigers BetaShares ETF (ASIA) Chart

Question 3

“Hi James and team, just a quick question on stop losses. In the context of a long-term portfolio, what is your view on using stops? I have always been of the opinion that you should use stops on trading positions, but for long term investments, just ride the peaks and troughs. That being said, having stops in place during Feb/March meltdown would have saved a lot of heartache in the portfolio. Interested in your thoughts.” - Many thanks Alex P.

Hi Alex,

A great question with all your points on the money. Stop losses and risk / reward are an extremely important aspect of successful long-term investing. At MM we advocate the simple long standing phrase – “plan your trade and trade your plan” hence it’s the reasoning behind the initial purchase, or planned purchase, that should determine the exit strategy, a few scenarios are covered below:

1 – A technical trader might buy at X with a simple hard stop at Y, if its triggered they are out with a previously quantified loss.

2 – A fundamental trader will buy when they like the prospects / outlook for a business assuming its providing solid value but their “stop” will be determined when the underlying fundamentals for a company change hence not as quantifiable on entry.

3 – If either of above plan to accumulate into weakness this is part of their plan and investors shouldn’t get too concerned if a stock is following expectations even if a paper loss is being recorded.

However as we saw in March markets can experience dramatic moves from left field, MM saw a ~20% paper profit in Emeco (EHL) shown below literally blown out of the water in the blink of an eye. In this case investors became concerned that the business would struggle with debt levels through a virus led recession, panic selling ensued, this would in hindsight would have been an excellent time to have exercised a hard stop but we only trimmed our position in March believing the market had overacted, time will tell but its an example of us applying some balance to our thought process.

At MM we advocate remaining open-minded while maintaining prudent risk / reward i.e. applying a balance of Fundamental & Technical Analysis.

Emeco Holdings (EHL) Chart

Question 4

“HI James & Team, love your work, I really look forward to all your daily commentaries. Could you please comment on gold stocks, your order of preference and is now a good time to buy them?” – Indran R.

“Hi James Investing in gold can be a difficult deal, so I have to ask .... why NCM? Disclaimer: While my track record with them shows a positive outcome - my perception of them is that they are serial disappointers. Is the current risk / reward warranting this this time or is it just that their competitors have run a little harder and faster than them? I appreciate your thoughts on how they stack up against their competitors. Thanks, appreciate your work.” - Cheers, Jan P.

Hi Guys,

Gold is a subject we have discussed regularly of late as we patiently wait for ideal entry levels – hopefully not too patiently! We like the precious metal as we believe central banks will maintain official rates around zero for a few years to come plus the next macro chapter after the current massive levels of economic stimulus could well be an awakening of the sleeping giant “inflation” which could send gold sharply higher. The markets long gold hence a quick 5-8% pullback feels a strong possibility which would provide us with the opportunity to jump on board but we are considering a relatively small position sooner rather than later.

NCM has undoubtedly been a “serial disappointer” but we believe at today’s prices across the sector it does offer the best value and risk / reward opportunity as they show strong signs that they are improving from an operational perspective. Remember, investing is all about the future and I think NCM is being priced for past indiscretions, hence its ‘relative’ value.

MM likes Newcrest (NCM) around current levels.

Newcrest Mining (NCM) Chart

Question 5

“Hi guys, I have really enjoyed reading your articles over the past couple months and think the work you do is very impressive particularly in the current climate. I was just wondering your view on Aurizon Holdings Limited? What does the future of rail transport hold? and would you consider the current share price of $4.69 a good entry point if MM was to add them into their portfolio?” - Cheers Nick S.

Hi Nick,

Thanks for the complimentary words, Aurizon Holdings (AZJ) is trading at the same level as it was 5-years ago and we see no compelling story for things to change dramatically although at least the coronavirus should have a fairly muted impact on rail transport. However, for the yield chasers AZJ is forecast to pay ~6% unfranked moving forward which is far more attractive than the bank hence a definite candidate for Income Portfolios.

MM is neutral AZJ but likes its yield.

Aurizon Holdings (AZJ) Chart

Question 6

“James, regarding your ZIP recommendation, you had stated in the week prior that "some professional markets players are calling the sector a bubble as the stocks soar higher without them onboard, unfortunately MM has the last part of this equation in common", before taking the plunge at $7. You also indicated you'd buy further below $6, a trigger which occurred on Thursday. What is your next move on ZIP, ... wait until the current sentiment turns or scale down as it falls? Also, UWL is a stock I am interested in. Price has consolidated around $1.50 over the last 9 months, has just had SOL and Tribecca join their books and has general positive sentiment around management from the commentators. What are your thoughts on UWL?” – thanks Charlie N.

“Hey James and Team, I’m enjoying your commentary, just trying to understand your strategy in buying ZIP the day prior to their update (if I recall correctly). I am not being critical in anyway as picking stocks particularly in this market is tough. My approach has always to be to wait on the report / update and if positive to buy then. This may mean missing out on the initial gain, but quality stocks normally rally for some time following a positive report. Btw, I thought the ZIP update was very good (compared well v Afterpay in a relative sense) - was the market expecting a better result from Quadpay ? or just a case of investors taking profits! I would appreciate your comments on this” - Many thanks, Cheers David P.

Morning Guys,

We’ve had a number of queries around Z1P which is understandable given it’s gone backwards since we bought it, I’ll set out our thoughts below as clearly as possible.

1. MM bought a small 2% position in Zip at $7.00, only to see the stock drop ~15% after purchase

2. We bought half of our ideal position pre-quarterly update as our intel suggested the quarterly was likely to be strong driven by Quadpay, however importantly, we bought half only on the realisation that we could be wrong and we would average the position ~$6.00. This is a very volatile stock, hence our staged approach.

3. The market initially bid the stock up ~7% post quarterly before selling it off fairly aggressively. While the market is never wrong, we think its focussing on very short term run rates of Quad and missing the opportunity here. Quad is early, in the midst of an acquisition and COVID is having an impact.

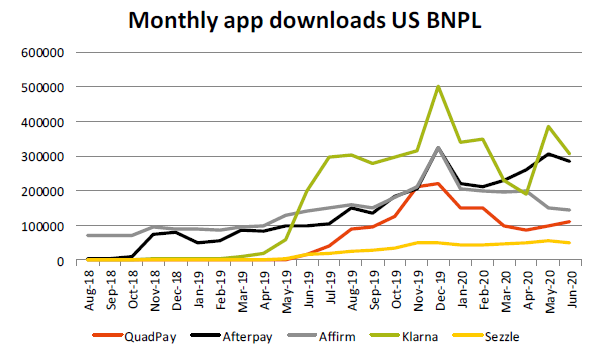

4. We had a zoom with the Z1P, CEO and CFO last week, and the key takeaway is we expect Quad to ramp up from here. The table below is a good one as it shows monthly app downloads from US BNPL companies, importantly Quad on a downloads basis (chart below), is accelerating in June.

Source: Shaw Research

5. Quad is a very good business and we believe is a real game changer for Z1P as it gives them access to the large US market.

6. In terms of averaging, downside momentum slowed on Friday, and the smaller players in the sector like Openpay (OPY) had a meaningful reversal.

MM remains bullish Z1P and we intend to average the position

Zip Co Ltd (Z1P) Chart

Adelaide based broadband business UWL has recovered virtually all of its March losses, we like the prospects for the business and its clearly encouraging to see quality operators like SOL lodging substantial ~5% buy notice.

MM likes UWL believing it will eventually rally towards $2.

Uniti Group (UWL) Chart

Question 7

“Hi MM Team, Just your thoughts and technical entry for data#3 (DTL) and PointsBet (PBH)” – Thanks Tim C.

Hi Tim,

Technology solutions company Data#3 (DTL) was looking strong in January before COVID-19 with first half 2020 earnings set to beat expectations, in the first half of 2019 revenue came in above $640m illustrating the very real nature of the business. With the stock correcting its surge from March the risk / reward is now looking attractive around $5 with fairly close stops.

MM likes DTL around $5 but would exercise stops ~$4.

Data#3 (DTL) Chart

On-line sports betting developer / operator PointsBet (PBH) actually looks very similar to DTL with our technical opinion very similar – we like PBH with stops under $4.50. Fundamentally we also like PBH whose main source of revenue is the US where the regulatory conditions are good and when they finally get on top of the pandemic, we should see a healthy improvement in earnings.

MM like PBH at current levels.

PointsBet Holdings (PBH) Chart

Question 8

“Hey James, I see 6/7/2020, the announcement of WBC, does pay dividend on 30/09/2020?” - Thanks Regards Yi

Hi Yi,

Westpac (WBC) is not expected to pay a dividend in 2020 but we believe that in 2021 there’s a good chance things will improve and markets do look 6-12 months ahead.

MM is bullish the banks medium term.

Westpac (WBC) Chart

Question 9

“Hi James & Team - questions for Mon I would like your opinion on MIN - Mineral Resources - It has done well recently and I'm up. Do you have a price target - would you hold for further upside? Also, your view on CAN-Cann Group - capital raise. The SPP issue price is heavily discounted at 40 cents with the shares trading down almost 14% to 72 cents on Friday and as low as 59.5 cents.” - regards Debbie G.

Hi Debbie,

Mineral Resources (MIN) is riding the same iron ore bull market as Fortescue (FMG), while we can envisage a few 5-10% corrections into Christmas we are bullish the reflation trade and resources in particular.

MM is bullish MIN.

Mineral Resources (MIN) Chart

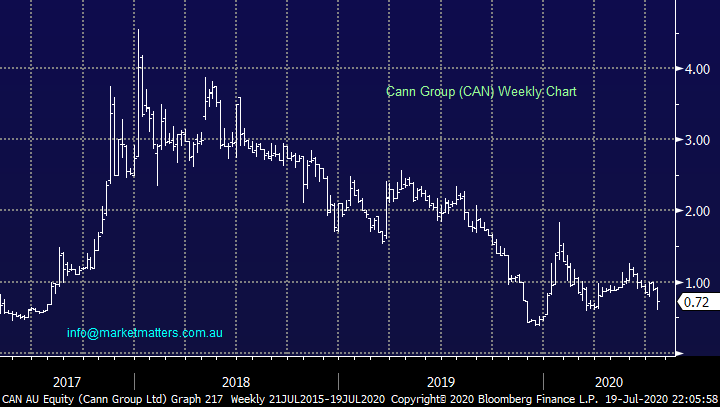

Cannabis company Cann Group (CAN) has shown what happens when air gets let out of a euphoric bubble. The SPP being offered at 40c is likely to reflect the current appetite of many investors to the stock / sector, I would be surprised if the new shares don’t show a profit for a while but similarly a test of ~50c technically looks a strong possibility.

MM is neutral CAN at best.

Cann Group (CAN) Chart

Question 10

Hi James, I realise this is a very small stock and may not have a lot of coverage but would love if you could provide any comment at all. I bought RSH at very low levels and it had a good run lately, after a decent SPP for retail holders (for once). On Friday it popped much higher on an announcement.

Any thoughts on valuation would be greatly appreciated.” - Regards Cameron F.

Hi Cameron,

Respiri (RSH) produces medical devices to monitor asthma symptoms both at home and in hospitals making it very well positioned for a second wave of COVID-19. It’s very tricky to forecast the future or value in this $94m business but technically it looks ok while it can hold above 10c.

MM is neutral RSH.

Respiri Ltd (RSH) Chart

Question 11

“Hi James, Your views on the abovementioned stocks please: Is ACQUISITION OF TYRES 4U (“T4U”) IN AUSTRALIA AND NEW ZEALAND transformational for the company?” - Sidney H.

Morning Sidney,

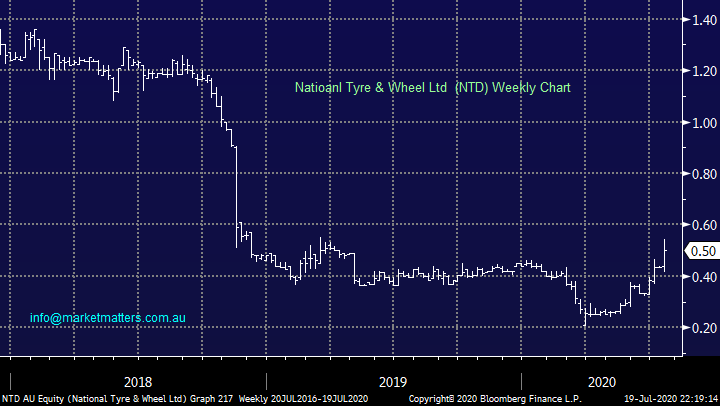

NTD’s purchase of Tyres 4U appears to be a strong strategic fit making the company one of the largest tyre manufacturers in Australia & NZ with revenue of ~$450m. The risk / reward looks interesting around 50c although I wouldn’t want to see the stock fall back under 37c.

MM is neutral to positive NTD.

National Tyre & Wheel Ltd (NTD) Chart

Overnight Market Matters Wrap

· The US equity markets ended its session flat on Friday, however finished its week in positive territory as US earnings season has kicked off.

· Of around 10% of companies releasing their earnings, 73% of those have beaten expectation, despite US consumer sentiment surprising most by falling back to April levels.

· Most metals on the LME were weaker, in particular nickel which fell 2%. Crude oil was flat, and retreated slightly this morning, while gold currently holds above the $US1800/oz level.

· The September SPI Futures is indicating the ASX 200 to gain 32 points this morning, testing the 6000 level.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.