Subscribers questions (EHL, BIN, AC8, NBI, NVDA US, RWC, SPT, MYX, EOS, TLS)

On the financial front all the main news over the weekend was continued doom and gloom around property prices as the term FONGO - “Fear on not getting out” is being banded around as the replacement to FOMO -“Fear of missing out”. The press in my opinion are adding to a tough economic position with their alarming negativity and almost scaremongering tactics but I guess that’s how they sell newspapers. i.e. bad news. Before a quick updated thought on property I would add the memory of similar almost panic commentary towards equities in December and we all know how stocks have recovered over the last 3-months.

1 – We see property being more like an oil tanker when compared to shares as say the speedboat hence when the bottom in Australian property is found we anticipate a few years plateau as opposed to a sharp “V shaped” recovery thus we understand investors patience in catching todays falling knife but this is the perfect environment to be shopping – remember all famous investors say you want to be buying blood in the streets, even if it’s your own!

2 – Investors and overseas buyers have currently vanished from the bid at auctions, they will eventually return but not overnight.

3 – Building activity is plummeting which makes sense as prices fall but this will ultimately be good news for prices as the supply of new homes dries up. As we said on the weekend “tradies” are likely to feel the first income pinch in over a decade but we need this collapse to help stabilise prices i.e. strong supply into a weak market is obviously a bad recipe.

Overall we think this is getting close to the eye of the storm for Australian property but the final spit /capitulation is probably still to come hence MM remains patient with our foray into the affected stocks / sectors like retail.

MM remains in “ buy mode” primarily due to our elevated cash levels but we are currently not planning to chase strength – we continue to slowly adopt a more neutral stance.

Thanks again a phenomenal volume of questions, sorry for not managing to cover everyone’s and the brevity in a few cases but the variety of topics was great.

ASX200 Index Chart

A quick reiteration of comments in the weekend report around Emeco (EHL) which we attempted to buy on Friday before it soared of 6% without us onboard!

MM is raising our entry level to $2.15 in EHL i.e. basically Fridays close.

Emeco Holdings (EHL) Chart

Question 1

“Hi MM BIN- Bingo Industries has traded down today as low as $1.50 Your report on 5/3/19 said " we are still bullish both short and medium term in regards to BIN " 1 – Short-term we can see BIN reaching the $1.90-$2 area i.e. another 7-10% higher. 2 – Medium term we can see a test of the $2.30 breakdown area but a pullback towards $1.60 would not surprise. MM may look to “trade” the above 2 scenarios if / when the opportunity unfolds. Is today the opportunity to BUY especially if you missed the BUY call at $1.20/ $1.30 price??” - regards Debbie.

Hi Debbie,

We added to our Bingo (BIN) on Friday just above $1.60 taking our overall position to 4% of the Growth Portfolio. We continue to see the waste management and recycling business testing $2 and then $2.30 in 2019 but we may lighten our position at the first target if / when its reached.

MM is bullish BIN with an initial target of $1.90 to $2.

Bingo Industries (BIN) Chart

Question 2

Subject:Re: Will Norwegian selling present more opportunities in our Energy Sector? (QBE, IAG, AMP, IOOF, WPL, STO, OSH, BPT, ORG, CTX)

“Great email James. I would strongly suggest looking at the attachment. Jiang is the Director of Chinas NDRC and author of Chinas new Energy Policy for 2025 priorities. The policy will be released middle of this year. Highest single share of power to be nuclear power at 28% (up from 3%). Coal moves to 7%.” – Rodney F.

Hi Rodney,

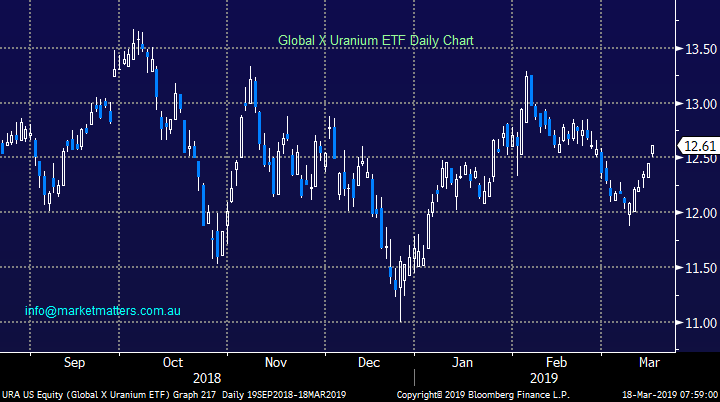

The uranium / nuclear space has recently been garnering significant press but its only in the last 3-months that the uranium stocks are attempting to rally. Below I have showed the Global X Uranium ETF over the last 6-months and secondly since the Fukushima disaster, our current observations / thoughts:

1 – Short-term we are very bullish and like the risk / reward of the ETF i.e. buy targeting a break above $13.50 with stops below $12.

2 – This has been a massive area of wealth destruction over the last 8-years hence I would only consider investing with active stops.

We are bullish the Global Uranium X ETF at current levels.

Global X Uranium ETF Chart

Question 3

“Hi James, as a sector do u look at legal medicinal cannabis. I would think ( without doing any research) that this would be a growing industry and I am sure there are a number of registered players. I have read reports on companies like AC8, BOT and CAN but would appreciate your overall views of this sector.” - Many Thanks, Greg C.

Hi Greg,

This is certainly a space where some huge returns have been enjoyed by those who jumped on board early but like most new industries many of the original players will fail and potentially become worthless - all 3 of AC8, BOT and CAN are yet to make a profit and have large capital expenditure required before doing so. Hence at this stage we regard them as high risk / speculative plays where we would be heavily dependant on technical analysis to control our risk / reward.

We only have to look at the below chart of AC8 to see the clear risks as its fallen over 80% since its 2018 high – these stocks will undoubtedly at times have big rallies in the months / years to come but we do not regard them as investment grade, they in fact remind me of Bitcoin! For the lovers of the sector our preferred pick is BOT but its hairy stuff.

MM has no interest in cannabis stocks at this point in time.

Auscann Group (AC8) Chart

Question 4

“Good Afternoon, what are your views on The initial public offering of the Pengana Private Equity Trust (PE1) and can the application be made through Shaw?” Regards Frank

Hi Frank,

Pengana have launched a Private Equity Trust which is set to list on the ASX on the 30th April . It’s a bit of a different sort of deal providing a way for smaller retail investors to gain access to Private Equity. As it stands, Pengana has a number of unlisted wholesale PE funds and they’ll leverage these existing channels / relationships to invest into Private Equity Funds around the globe with this retail offer. It’s essentially a fund of fund type structure that gives smaller investors global diversification, and importantly, diversification to a wide range of underlying private equity funds. Harry met with management last week, and here’s his notes. Yes, if you’d like to bid into the deal please contact [email protected] or call (02) 9238 1561

They are looking to raise up to $600m for its listed trust that will give retail clients access to PE unlike ever before.

Pengana invests with and alongside PE managers through:

· Primary deals – newly established PE funds available only to wholesale/institutional investors

· Secondary deals – acquiring interest in existing funds from third parties

· Co-investments – investments alongside a PE fund into a private company

Investment returns of PE is attractive, however illiquidity, minimum investment sizes and difficult capital management structures. It does however provide better return profile at lower volatility than listed equity. Pengana has a number of unlisted wholesale PE funds which help wholesale investors get access to PE through Grosvenor Capital Management (GCM). From day 1, the trust will invest in these funds, secondaries & primaries.

GCM, through their previous investments with PE, has built strong relationships with many managers which allows them better access that other wholesale investors. Since 2000 they have sourced on average over 500 funds a year, while only committing to 8% following an extensive due diligence process. In direct and co-investments, GCM review around 200 a year, while only committing to ~7%.

To entice investors into the trust, the trust will also be granted entitlement shares in the head company Pengana (ASX: PGC) to the value of 5% of the trust. The trust intends to distribute the shares to unit holders after 2 years when they will convert to common equity. Effectively this will mean that from day one units in the trust raised at $1.25 will have a pro-forma NAV of $1.3125. The Trust expects to distribute cash income of 4% per annum. The fee structure is okay for this sort of investment at 1.2% management and performance of +20% over an 8% hurdle.

We like it as an alternative asset approach, however it doesn’t it doesn’t really fit into either of our portfolio’s.

Question 5

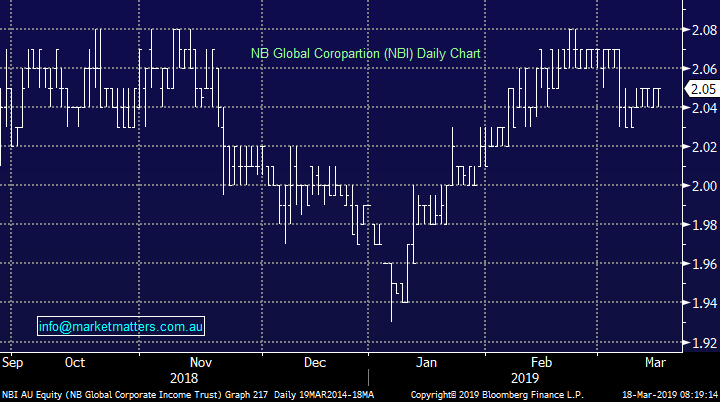

“G'day James & Co. A little more water to flow under the bridge yet I suppose but what is your current feeling regarding the proposed NBI Shareholder Offer - how big a discount would interest you in adding to the Income holding?” - Michael B.

Hi Michael,

We own this in the MM Income Portfolio and last week they made an announcement around the possibility of issuing new units in the Trust, essentially raising more money to manage. Their current Net Tangible Assets (NTA) per unit sits at $2.02 so I would presume any raise would be done at that level. We would not participate in a raise that was done above NTA, however I’d be surprised if they tried that on. Click here to see what we covered in the income note

NBI Global Corporation Chart

Question 6

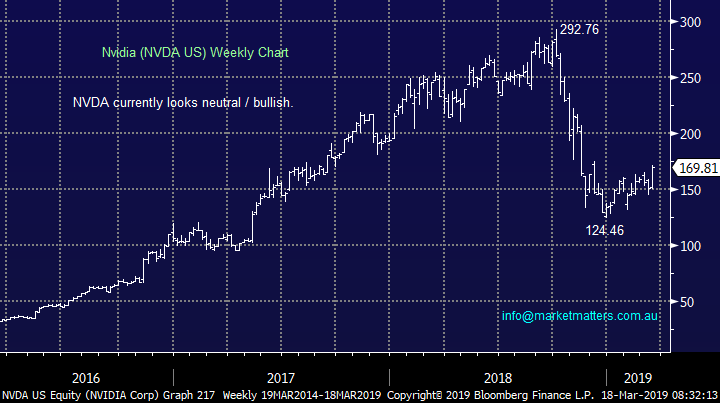

“Hi, there’s more to the NVDA story than you posted. The recent agreement to acquire Mellanox for US$6.9B in cash is the catalyst for the recent share price movement. If it drops below $160 then that’s an indication in my view that the price won’t hold. The market likes the story, i.e. the chipmaker and AI pioneer has bought a network equipment maker that will take data centres to the next level of high-speed intelligence. I bought NVDA recently prior to this acquisition.” - David H

Hi David,

Hopefully good timing on your part, certainly looks good compared to where the stock was back in mid-2018.

We agree with your stop level i.e. NVDA looks good from a risk / reward perspective while it can hold above $US160.

Nvidia (NVDA US) Chart

Question 7

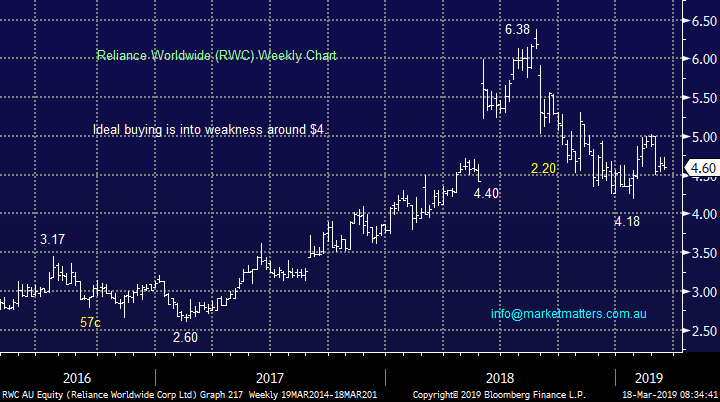

“Hi Team Do you have a view on Reliance Worldwide RWC. I view the US housing market to improve, UK as stable and AUS although down smallish in size and all supported by quality products. Still some synergies from the acquisitions to come. I read the Chairman exit and complete sale of holdings as probably part of his plan to completely exit with good management team in place but not reflecting his own value without a replacement chairman lined up.” – Ta Paul B.

Hi Paul,

RWC has experienced a tough 12-months and I can see why its caught your eye but the stocks still trading on an Est P/E for 2019 of 22.2x in an environment where we can see potential further deterioration in trading conditions for RWC.

MM will have potential interest in RWC ~10% lower.

Reliance Worldwide (RWC) Chart

Question 8

“Has MM any thoughts on the PCI IPO?” – Chris G.

Hi Chris,

Another raising in the Income space with Perpetual launching the Perpetual Credit Income Trust that is to be listed on the ASX (subject to approval) under code PCI on the 14th May. We covered this in the Income Note last week (click here) and this morning we’ve had the team from Perpetual in to cover the offer in more detail. For those that have followed the MM Income Portfolio, it’s essentially a cross between two of our existing holdings, MXT and NBI. The trust will focus on investment grade assets in the high yield Australian corporate loan market and the global high yield bond market. The trust targets a return of the RBA cash rate plus 3.25%, which is the same target held by MXT, equating to 4.75% net of fees. Distributions to be paid monthly and the fund should be a good diversifier for those looking for income that is not heavily aligned to equity markets.

They charge an annual management fee of 0.88% and no performance fee.

The deal looks good and if we didn’t already hold MXT and NBI we would look to add it to the portfolio.

Question 9

“Hi M&M, SPT has broken its awesome run at the $2.00 mark, I made a bit of coin and got out, is there any way of knowing how far it will pull back or can you guesstimate where it should be trading based on its fundamentals. I would like to buy back in at some stage. Snacking on M&M's while I wrote, this best of both worlds.” – Cheers Tony K.

Hi Tony,

Thanks for putting a smile on my face with the M&M’s and your win in Splitit Payments (SPT). You have certainly asked a tough trading question but its all about risk / reward.

MM’s ideal entry into SPT is currently around $1.10 with stops under 90c but this is likely to evolve almost daily.

Split Payments (SPT) Chart

Question 10

“Hi Guy s Just 1 question Are you `s thinking of doing a Roadshow OR seminar one night in the city for your subscribers at all” - cheers Paul M.

Hi Paul,

We have held a large event at the Four Seasons in Sydney previously and we may look at doing some in the future – all about time and there doesn’t seem to be enough of it - plus I can’t really be travelling during the week and writing reports / managing portfolios.

Question 11

“Hi guys, I recall last September, when Mayne Pharma (MYX) releases their 2018 results, the market was very excited about their strong 2nd half and 33% revenue growth. I had a trailing stop loss that I’d forgotten about, that sold me out near the top. I bought in and out again a few times since, for no gain or loss, and just noticed it was now down around 70c... almost 50% down. What have Mayne done wrong since their positive 2018 results? Is it on your radar as a ‘dog stock’? Or is the PE ratio of 24 still too high? I am interested in your opinion of where it might go from here and why.” – Thanks Charlie N.

Hi Charlie,

It’s on 24x this year’s earnings dropping to 20x in FY19, but the market is certainly not keen on the stock as its 50% fall since 2018 illustrates.

The problem for MYX is primarily President Trump who wants to crush drug prices in the US and he’s often “Tweeting” to the effect including such phrases as “getting away with murder”. If you believe he will lose the next election MYX is likely to be a good investment at current levels but that unfortunately appears to be a 50-50 punt at this stage.

MM is neutral MYX and a test below 60c would not surprise.

Mayne Pharma Group (MYX) Chart

Question 12

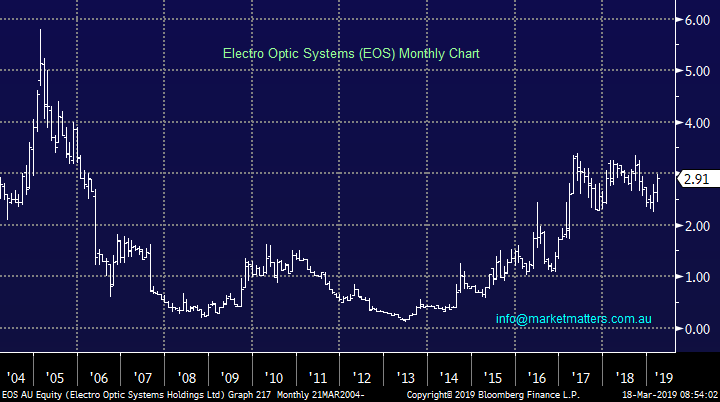

“I was wondering if you had any comments on ELECTRO OPTIC SYSTEMS HOLDINGS LIMITED (EOS). They came out with some pretty good results and future projections. Their annual report read is rather interesting.” – Laurence S.

Hi Laurence,

For subscribers who are unfamiliar with EOS it’s a technology based business specializing in electro-optic design & development for the space / defence markets – the companies current market cap. is $280m and it trades on an Est. P/E of 13.7x for 2019.

Unfortunately the stocks a touch small and illiquid for MM but I agree its performing well and looking good technically.

MM likes EOS with stops below $2.60 i.e. ~10%.

Electro Optic Systems (EOS) Chart

Question 13

“Why are you holding TLS in the Growth Portfolio. I thought that was aligned with growth and one would be looking for stocks with EPSG > 20. TLS is a dog and will probably still be a dog in 10 yrs time.” – David R.

Hi David,

We are currently up over 11% on our TLS holding which is ok for 18-months although I acknowledge not spectacular. However if I am correct in today’s dovish environment we will see another 5-6% in the next few months will take our return closer to 20%. A growth orientation in a portfolio is not just screening for companies that exhibit strong EPS momentum historically, it’s also about trying to identify companies that may improve earnings, and start growing from a low base. It seems to me that TLS is transitioning into a more growth orientated model, gone are the days of 100% payouts ratios and now, for the first time in a long time they are re-investing back into the business to take advantage of the massive opportunity in data.

In short, there’s lots of ways to skin a cat and this position was always regarded as buying an oversold business that had finally presented value (in our opinion).

MM remains bullish Telstra (TLS) targeting close to $3.50.

Telstra (TLS) Chart

Question 14

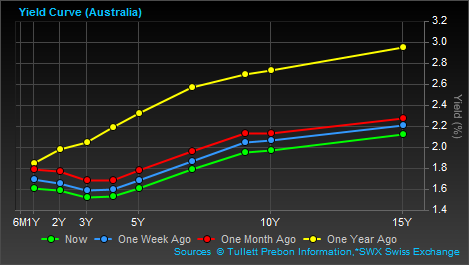

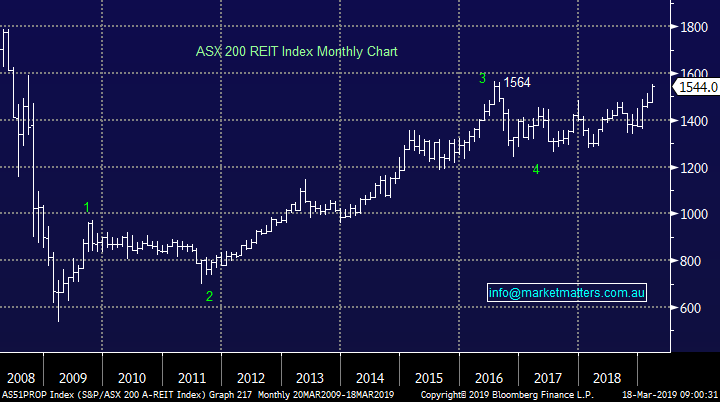

“Rising REITS - quite a few have been making new highs. Could this be related to ALP franking credits issue for SMSFs. people are already moving out of franked bank stocks into higher yield unfranked REITS because of the likelihood of an ALP win.” – David R.

Hi David,

A good question. I think it may be a small factor however the main driver here is interest rates. It’s also true that only some exposures in the REIT sector have done well, those largely exposed to office, some industrial & commercial while those exposed to retail have generally still struggled. I think more importantly, it’s around interest rates, which are a big influence of property.

The chart below looks at the difference between rate expectations a year ago, to what they are now 1 year ago (yellow) and even 1 month ago (Red).

Clearly, the market is pricing in expectations of rate cuts in the shorter term, as evidenced by the inversion between years 2-5.

Unsurprisingly, bond rate-senstive stocks like REITs have had a good performance of late.

Interestingly from purely a technical perspective I would be fading rather than following this rally.

ASX200 REIT’s Index Chart

Overnight Market Matters Wrap

The Australian market is poised to start the week on a firmer note, after the US and European markets closed last week on a high, despite little further news on the progress of US-China trade talks and the looming end of month deadline for Brexit.

With less than two weeks to the original deadline for the UK’s exit from Europe, the UK Parliament voted on Thursday to ask Europe for an extension. In the meantime, the UK Prime Minister, Theresa May, is expected to try once again to get backing for the current exit proposal, which has already been overwhelmingly rejected twice by Parliament.

Tech and consumer shares helped boost Wall St, with the tech-heavy Nasdaq leading the way, ending another strong week for equities, as both the Nasdaq and S&P 500 hit new 2019 highs. The Dow was held back slightly by Boeing’s underperformance, following last week’s fatal crash of its Boeing 737 Max plane.

Commodities were little changed, with copper slightly firmer and iron ore slightly weaker. The A$ is steady at just under US71c, while the futures are pointing to gains of about 0.6% of the ASX 200.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/03/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.