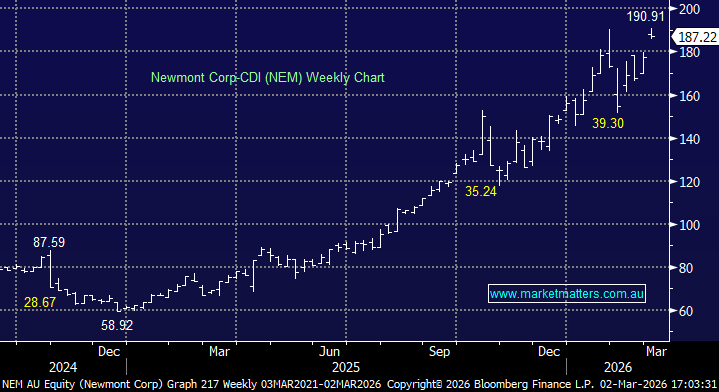

Subscribers questions (EHL, ALL, WTC, ALU, VOC, STO, SIQ, APT)

Major market news was again interesting over the weekend, both on the domestic and international level with 3 things catching my eye:

1 – Sydney’s auction clearance rate improved, while we are not for a moment calling a bottom the clear reduced downside momentum is encouraging.

2 – Labor now intend to slug our “big 4” banks $640m for a proposed Financial Rights Fund – the banks remain an easy political target as we head into an election.

3 – It was confirmed by legendary investor Warren Buffett that investing is never that easy when he announced a $25bn loss for Q4 of 2018. Also his cash levels remain over $100bn as he struggles to find value in today’s market.

US stocks were again strong on Friday night with the Dow rallying +0.7% but the SPI futures were surprisingly only up 8-points implying some profit taking may be on the agenda this week.

MM remains in “ buy mode” with our elevated cash levels but we are currently not planning to chase strength.

Thanks for the great questions with an understandable bias to the current volatile reporting season – keep up the good work!

ASX200 Accumulation Index Chart

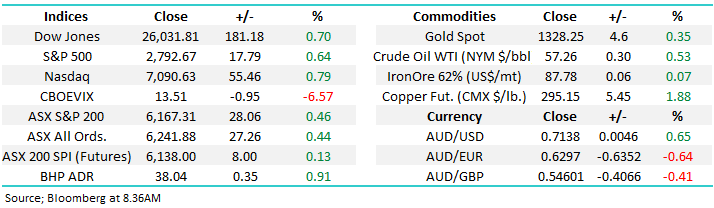

No major change, we believed US stocks will trade higher in the months ahead but a pullback feels close at hand although no sell signals are in place.

1 – Medium-term we see the current bounce initially reaching the 7200 area, under 2% higher.

2 – Short-term we have anticipated a correction to the strong rally since late December, ideally ~5% lower but it continues to allude us as stocks climb a wall of worry.

US NASDAQ Index Chart

Question 1

“G’Day again, I averaged down my ALL holding to a cost of $25-90 so I am now ahead by about a frogs appendage. Do you still have your sights set on $30+ for this stock or will you be happy to get out at breakeven? I sold my FMG for a 30% profit but missed out on a lot by selling too early, so that is why I am asking if I should hold or fold on ALL. Thanks for any help, interesting times” - Waz D.

Hi Warren,

While keeping our response general in nature, Aristocrat (ALL) just enjoyed a good week rallying almost 5% following the release of a trading update at its AGM. It was announced they are on track for continued growth in 2019 with its digital segment the standout contributor.

We hold ALL in the Growth Portfolio and at this stage remain bullish the stock. Worth noting that we’re not really focussed on breakeven levels on stocks – more about assessing a stocks prospects at a point in time irrespective of buy price.

We are currently bullish ALL with a current initial target ~$29.

Aristocrat Leisure (ASX: ALL) Chart

Question 2

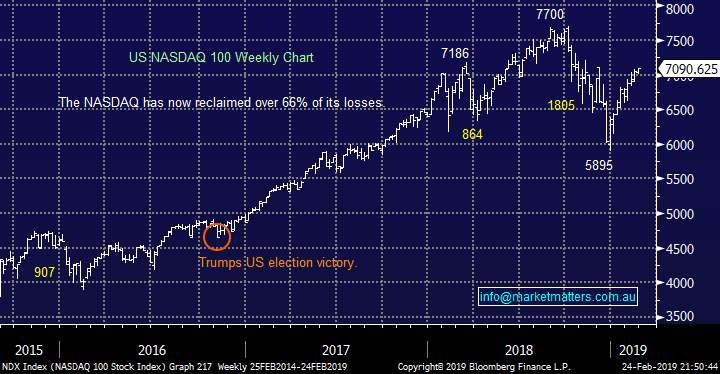

“Hi MM Your Report on 14/2/19 1 Emeco Holdings (EHL) $2.87 MM likes EHL at current levels but would implement stops below $2.60 – just under 10% risk. Conclusion MM is considering the following stocks as potential buys in the weeks to come: Bullish today – Emeco (ASX:EHL) Emeco have reported today and have been hammered down to as low as $2.13 - 68 (down 24%) Has the sell been overdone and this is an opportunity to buy ? or is this stock best left alone for now?” - regards Debbie G.

Hi Debbie,

Earthmoving equipment hire business Emeco (EHL) dived following the release of its interim results which showed a slight miss on the profit line however the market got concerned about increased debt from higher expenditure (for growth), and the potential for a capital raise. The rhetoric from the MD was solid and he’s got plenty of skin in the game however the market certainly did not embrace his comments on the day: Here’s what we wrote on Wednesday morning.

Yesterday earth moving equipment hire company Emeco Holdings (EHL) was clobbered over -24% and as I wrote in the afternoon, I wasn’t sure why such a significant hit occurred. After digging into the result which was a complicated one it seems to me the market saw a miss on pretty much every metric and sold first before digging deeper.

As is usual with many mining services companies, the standard litany of one-offs that makes performance of the underlying (core) business really hard to decipher – in this case, asset impairments, redundancy and restructuring costs, acquisition accounting, currency impact and the like had an impact. Dumbing it down, revenue was a 3% miss, adjusted EPS was a 3% miss, they had poor operating cash flow and total debt didn’t drop as much as the market had hoped for.

That said, top line growth was good, margins are expanding and they have better utilisation of their fleet, all things that look good for the future.

MM believes EHL is starting to present value and we will be watching carefully – potentially another 2% “dog” for the Growth Portfolio.

We are now neutral EHL around $2.40 its not yet cheap enough to take on the downtrend that’s been in play since early 2018.

Emeco Holdings (ASX: EHL) Chart

Question 3

“MM Team, Is there any way for retail investors to get access to "the numbers" that institutions are looking at companies meeting? It would be handy to know at the time of market announcement what numbers companies are required / expected to meet (based on the collective wisdom of fund managers). In the case of Emeco (only a slight miss and a 24% sell-off) it highlights that perhaps the market is focusing on "something else" e.g. forward looking statements. For Emeco, potentially said statement(s) are alluding to a capital raising and the market didn't like that. Although the market loves selling this stock off for no real apparent reason. Maybe they didn't like the shirt that the CEO wore today! Read a while back that this company would be better suited to private equity holders, rather than being listed. No doubt management would agree with this today!” – Regards Scott T.

Hi Scott,

An interesting and very timely question considering the enormous volatility we have witnessed over the last few weeks. Recently its felt like a 50-50 punt whether buying excessive result driven weakness is the smart way to go.

Through Bloomberg we look at consensus data and that provides an aggregate number for earnings and other metrics based on all contributing analysts, however, the half year numbers generally have less substance to them so bigger swings tend to happen at the half year versus full year. We also dig deeper into analyst reports which provides a better feel for how they get to their numbers. These are known as sell side analysts reports. The buy side analysts that work for a fund don’t generally publish their research..

However the real issue is very often the “markets” interpretation of what the MD / CEO says when announcing the result, just as you mentioned with EHL above. Soon after they delivered the result they realised they did a poor job of giving context to the numbers they presented and what it means for the broader business, so they gave another update the following day and the stock rallied.

Hence we believe the most important part of investing during reporting season is preparation and planning i.e. do we like the business / sector and importantly what price would I pay during a sell off assuming the news didn’t move the proverbial goalposts too far.

Question 4

“Hi, when do you expect the International portfolio and the ETF portfolios to come on stream?” - Regards Richard R.

Hi Richard,

We’re currently looking at a tech re-build within Market Matters and as a consequence we haven’t yet launched the portfolio’s, although we are working on them in the background. Without giving a firm date, in the next few months I would envisage.

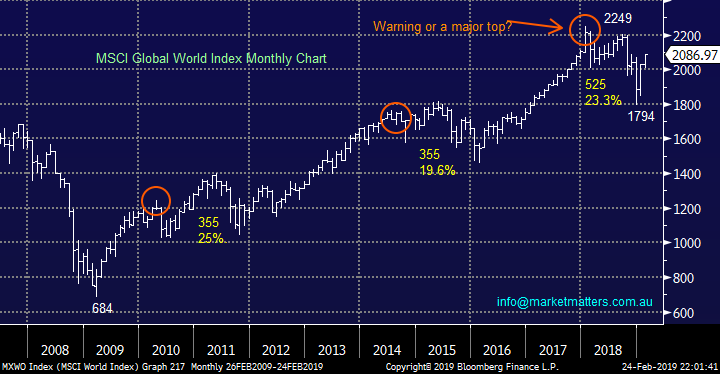

MSCI Global world Index Chart

Question 5

“Hi James, SIQ (SmartGroup) reported this week. The report showed strong performance but the stock was dumped. What have I missed?” - Thanks. Alek J.

Hi Alek,

Another reporting stock which was sold off when they missed expectations although as you correctly say the performance was still okay. The trouble is the market often gets ahead of itself leading to a decent fall on only the smallest of misses.

In the case of SIQ revenue for example came in up 18% but it was still over 3% below analyst expectations which led to a ~10% drop on the day – top line growth in a growth stock is very important. Similar to EHL earlier SIQ has been falling steadily, this time since mid-2018, hence the miss albeit small just gave the stock a push in the current direction of least resistance.

MM is neutral SIQ but would be watching it closely below $8 if the opportunity presents itself.

SmartGroup (ASX: SIQ) Chart

Question 6

“Hello, I am a subscriber to MM and would like to have your opinion on Wisetech (WTC), its value and time to buy?” - Thanks, Cheng G.

Hi Cheng,

We have mentioned WTC in a few reports recently and MM is now neutral at current levels but for fans of the stock we can see reasonable risk / reward buying around $19 with stops below $17.60 i.e. under 8% risk after the recent 20% correction.

MM is neutral WTC at present preferring growth stocks APX / ALU into any weakness.

Wisetech Global Ltd (ASX: WTC) Chart

Question 7

“Hi James, Just wondering if you can shed some light on the aggressive moves down in Afterpay (APT) yesterday and again this morning in the opening trades? What are consensus expectations for their half year report?” - Cheers Craig.

Hi Craig,,

Interesting question Craig as ASIC announced last week they intended to investigate the Aterpay (APT) share plunge on Wednesday morning, 2 days before a Senate inquiry into the buy-now-pay later sector was due to hand down its final report. From what I hear APT contacted a few analysts booking meetings for that day to discuss the outcome and without knowing for sure, it seemed like there was one large seller on the back of that i.e. simply getting out to avoid the news driven risk. APT is a momentum stock, and we saw some big lines through early that day which prompted more momentum money to exit.

The buy now pay later business is thriving with millennials as we saw a few months ago when the business announced that sales for the first half of FY19 were $2.2 billion, up 140% in comparison to last year’s result of $916 million, they processed around $2 billion in Australia, with an additional $260 million coming from the USA. The shares are priced for growth but have clearly been delivering.

The outcome of the Senate Enquiry was released on Friday afternoon and while there still seems more to play out here, the outcome for APT and others seems very manageable. I’ll include more information on this in the afternoon note today.

Currently we like APT from a risk / reward perspective around the $16.50 area.

Afterpay (ASX: APT) Chart

Question 8

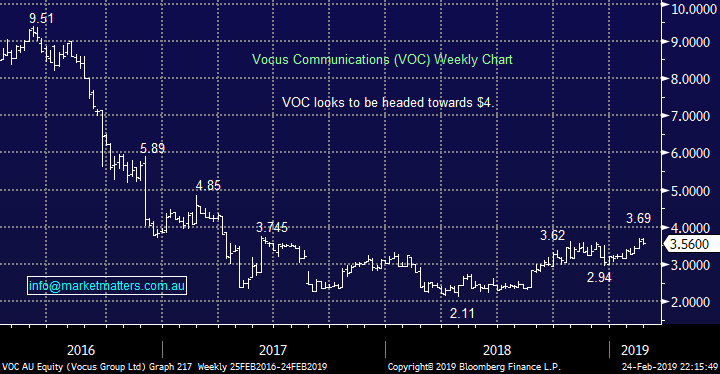

“Hi, really keen to get your view on Vocus (VOC). Has run up to $3.65 but now bouncing around above $3.50. Earnings next week, market liked last earnings result and recently upgraded with price targets $3.80 to $4.Would you sell or hold?” - David H.

Hi David,

We have talked about Vocus (VOC) a few times over recent months and our target was the $4 area, similar to the targets you mention above.

I still think this a realistic objective for the stock although the “easy money” if such a thing exists has already been made.

Vocus (ASX: VOC) Chart

Question 9

“Hi I have kept ALU and doing nicely. I’m wondering if you have had held on this when you would sell? Or would you keep this on a longer term?” – Thanks, Best Regards Kenneth C.

Hi Kenneth,

Congratulations, Altium (ALU) enjoyed an amazing week and now looks great while it holds above $30.

At this point in time this stock looks like an excellent long term play and we will consider buying the next reasonable correction – similar to our view on APX.

Altium (ASX: ALU) Chart

Question 10

“Hi James and M&M, I currently hold STO and have been watching it rising at a steady pace for the last 3 months. Its full year profits were good so do you believe it is worth or not worth taking a position on this one, if so what percentage amount and what would be M&M's entry and exit targets?” - Thank you "Love your work" Tony K.

Hi Tony,

Thanks for the thumbs up!

Santos (STO) is now tricky for us, we are bullish targeting over 10% higher but the risk / reward is not exciting.

We would be keen buyers of STO ~$6.50 with a target of $7.75-$8.

Santos (ASX: STO) Chart

Overnight Market Matters Wrap

· The US equity markets rallied last Friday on an investor fuelled prospect of a US-China trade agreement, following further constrictive talks and US President Trump noting a “very good chance of a trade deal.” This led the major indices to post their 9th week of gains, hitting their highest levels since early November.

· The tech and cyclical stocks led the way, following the trade update, with suggestions that as part of any trade deal China had committed to buying US$1.2 trillion of US goods. Presidents Trump and Xi are also reported to be discussing plans to meet again in late March for a trade summit.

· Commodities continued to benefit from the optimism, with copper at an 8 month high over US$2.995/lb. and crude oil around US$57/bbl. Both BHP and RIO traded stronger in US trading and expect these names to outperform the broader market, while the A$ is back above US71.3c.

· The March SPI Futures is indicating the ASX 200 to open 10 points higher, towards the 6180 level this morning as Australian reporting season enters its last week, with Appen, BluesScope, Boral, Caltex, Lendlease and QBE among those with profit results today.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 25/02/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.