Subscribers questions (CBAPF, TLS, COL, MVP, COH, QBE, NXT, MFG)

The variance in how different countries have dealt with COVID-19 is simply astounding but I remain proud to say that Australia is sitting at the top of the tree if such a thing can exist during this humanitarian catastrophe. Out of 165,000 global deaths we have 71, a number which belies our population and previous access to the world. The war against this invisible enemy is not going to be fully over until a vaccine has been found but we’re certainly winning the battle.

My major concern from an economic post COVID-19 perspective is how the developed world deals with China, undoubtedly the communication from the world’s second largest economy has been poor at best and potentially very misleading, people in China don’t even believe the rhetoric! However, for the global economy to recover in H2 of 2020 and 2021 we cannot afford any semblance of a Trade War, let’s hope President Trump shelves his self-interest at some stage during the run in to November’s election.

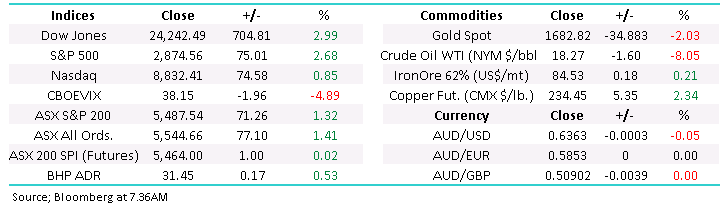

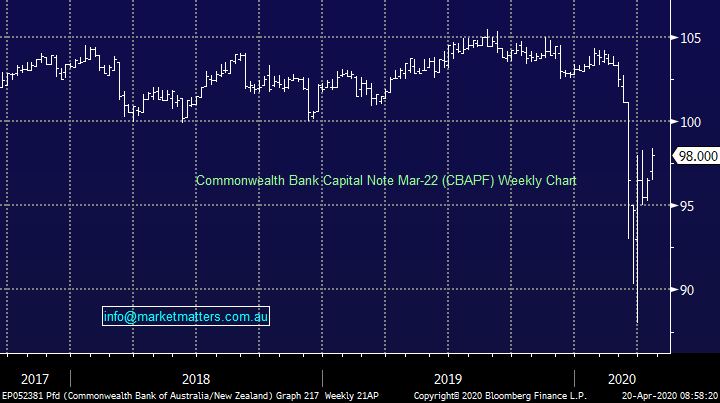

The chart below illustrates that Italy is finally “flattening the curve” but the US is not, especially as the virus rolls through the country from New York, thankfully the Big Apple is slowly improving. President Trump is “Opening up America again “, a catchphrase he’s proud of although a bit like with the originally named “The Facebook” my initial thought was what’s with the “again” bit. Anyway, onto more serious matters the concern is are they moving too fast? Improvements in a couple of major hotspots doesn’t necessarily mean the whole country is off to the races, I deeply hope they think the exit through better than the entry – specifically I hope decisions over the next few months are not just determined by Novembers election.

MM remains optimistic that Australia will be “on top of” COVID-19 by early June.

Italian & US Coronavirus confirmed deaths Chart

As we discussed in the Weekend Report our preferred scenario for stocks at least for a few weeks is a pullback / some consolidation. The risk / reward after the 26% rally is not particularly compelling in these uncertain times.

MM is in “buy mode” but short-term we expect a ~5% pullback.

ASX200 Index Chart

Over the weekend I read Optus are evolving their business to make work at home measures a more permanent fixture of its call centres . The Singaporean company have arrived at the rapid conclusion that the coronavirus inspired changes have been so successful that it’s simply the future and as they said “businesses will continue to avail themselves of the cost saving opportunities the crisis has allowed for”. MM has discussed our belief that WFH will increase exponentially post COVID-19, the virus has accelerated what was already an evolving trend.

Hence MM has no interest in Real Estate businesses that will suffer from diminishing demand for office space.

NB The acronym “Work from home” is WFH.

ASX200 Real Estate Index Chart

Thanks for the questions over the Easter Break and shortened trading week, a few less than usual but no surprise as many of us binged on chocolate eggs and Netflix, personally I loved and needed the family walks to get some exercise over the last few days.

Question 1

“I have the distinct impression that once this economic down-turn has subsided, the Government will raise the GST by at least 2.5% to help pay for the massive spending - although I can't understand why they don't mention it at least as a possibility now while they are spending to put it in the back of people's minds - but politicians never were the brightest cards in the deck. Would you like to give your views on which Sectors/Stocks would be the most affected up down and neutral should this play out?” - Michael B.

Hi Michael,

I agree with you that the incumbent government, whoever that may be in the coming years, will need to raise the GST to pay for the huge coronavirus stimulus, however this will be some years away, economic policy for the next couple of years at least will need to be pro-growth.

As to what stocks / sectors that are most impacted by a rising GST its likely to be those who don’t have enough pricing power to pass on the increased cost to their consumer. The likes of the Telco’s for example should not be affected but parts of the retail sector who continue to require heavily discounted sales to survive and maintain cashflow look likely to feel the pinch, especially when compared to the likes of Prada and Louis Vuitton who don’t undermine their brand with sales.

Basically, if companies have been able to increase charges over recent years they shouldn’t be impacted but those with contracting margins are likely to be a concern.

MM believes the move up the quality curve will be in play until clarity emerges economically post COVID-19.

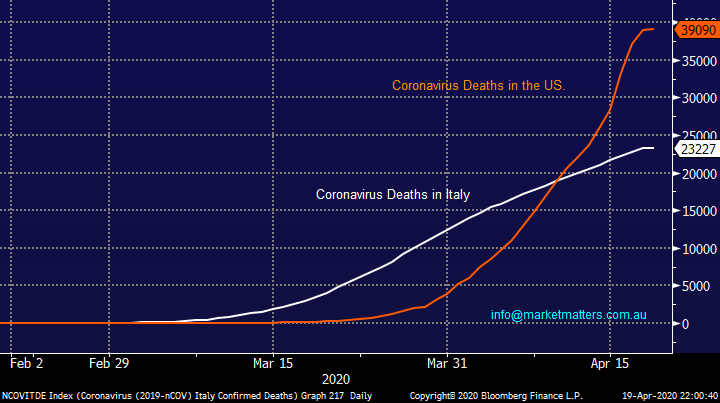

ASX200 Retail Index Chart

Question 2

“Question re MM Wednesday:

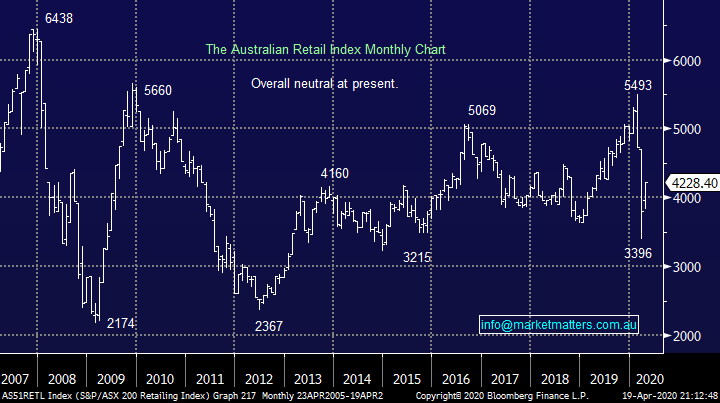

“CBAPF: 2 years to run paying a yield to first call of 6.74%

“CBAPI: 7 years to run paying a yield to first call of 5.90%

Could you clarify paying a yield to first call. Is that each year to first call or a total for the remaining years. i.e. for CBAPI 5.90 pa or 5.90 total at end of 7 years.” – cg

Morning,

Yes, it’s the per annum yield plus it also includes the small capital gain between the current price and the $100 face value of the security (divided by the number of years to run).

Commonwealth Bank Capital Note (CBAPF) Chart

Question 3

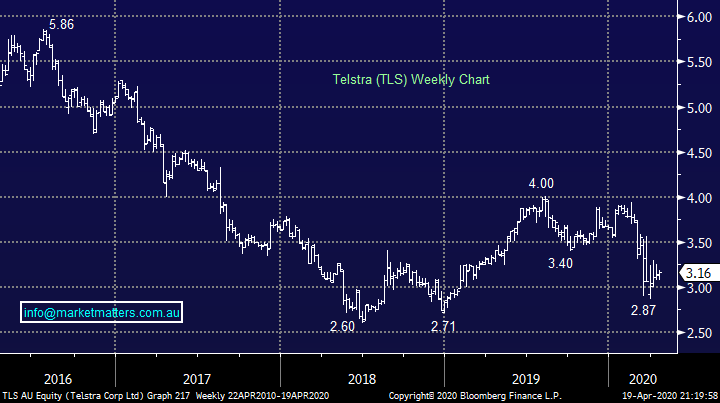

“Hi MM Team, Can I get your views both technical and fundamental on Telstra and Coles?? Also Medical Developments (MVP)” - thanks Tim C.

Hi Tim,

A quiet day on the question front so I can briefly look at all 3 - Telstra (TLS) we see future upside from the current position for TLS from both the NBN and 5G. Conversely Februarys go-ahead from the Federal Court for the TPG Telecom (TPM) and Vodafone merger is a slight headwind to the stock which is illustrated by the chart below. We can see value in the stock below $3 but MM is not considering chasing any strength.

MM sees value in TLS below $3.

Telstra (TLS) Chart

Coles Group (COL) has been a rare benefactor of COVID-19 as people flocked to the supermarkets to stock up, largely unnecessarily as its now shows but “there’s nothing as strange as folk”. At current levels we believe the stocks at a fair price but nothing exciting however on a comparative basis we prefer other pockets of value, especially if we do see another market pullback.

MM is neutral COL at current levels.

Coles Group (COL) Chart

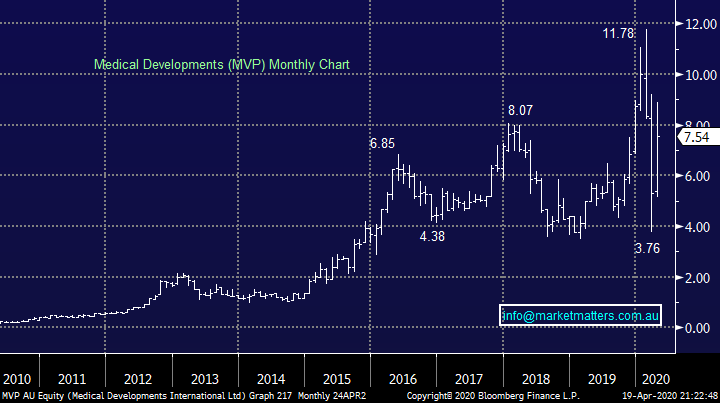

Medical Developments (MVP) specialises in respiratory products, very topical and hence the surge as the coronavirus panic hit a crescendo. The panic like spike towards $12 proved to be an excellent selling opportunity just when the market bottomed, it’s a little trickier now. The stocks growth is positive but there’s nothing cheap about this almost $500m business however after COVID-19 the companies likely to remain in a growth sector for years to come – MM likes MVP below $7 with stops under $5.50 for the believers.

MM is neutral MVP around $8.

Medical Developments (MVP) Chart

Question 4

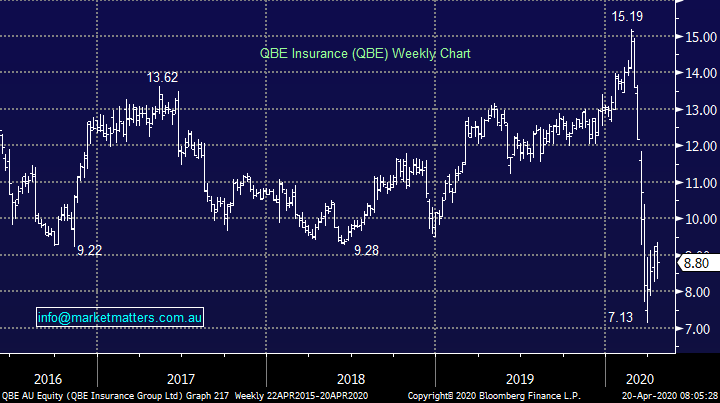

“Hi MM team, Subscriber question for you... Fully agree with your strategy that now is the time to move up the quality curve. Pursuant to this, I'd be interested to hear your take on seven or eight stocks that fit into your quality business narrative, which you think may be likely to or have to raise capital in the next six months. I own QBE, my take on this is that they are moving early to secure additional funds before the raising space becomes overheated, but are not desperate for this money (similar to COH, contrasted with OSH, FLT and WEB where the capital raising is vital for long term survival). On this basis and again comparing to COH, QBE are offering a discount of 9.4% at time of announcement compared to COH of 16.7%. I feel a little six of one half a dozen of another, what is your view on this? Continue the good work in a challenging environment, the only disappointing thing about the MM reports is that we only get 2 per day.” - cheers, Shannon.

Hi Shannon,

I really appreciate the thumbs up in these challenging times on. You have identified the major difference between current capital raisings i.e. are they raising to turn the company’s balance sheet into a fortress or to survive with the later clearly far less appealing at this stage of the recovery from COVID-19. I would be judging each individual company raise on its merits e.g. did you like Cochlear (COH) before they knocked on the door of the capital markets.

COH’s $50m SPP was a no brainer with the shares trading well above the highest possible price of $140 but appetite has been largely unsatisfied.

MM likes COH ideally closer to $180.

Cochlear (COH) Chart

In our opinion QBE is a not a company of the same quality as COH, the $US825m raise certainly has tightened its balance sheet and put is capital levels above the boards highest target level, but also of course diluted existing shareholders in the process. The raise at $8.25 still looks attractive with the stock at a 6% premium. I’ve often bought QBE after a successful capital raise and its proven to be a good time.

MM sees value in QBE below $8.50 especially as the business was performing strongly in Q1, before COVID-19, a good sign for the medium-term.

MM likes QBE below $8.50.

QBE Insurance (QBE) Chart

Question 5

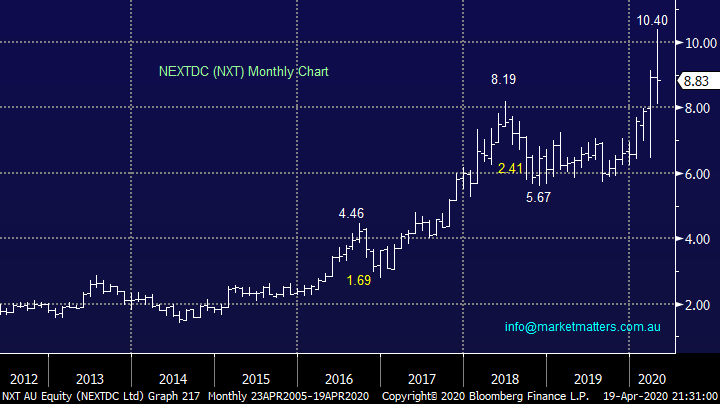

“Hi MM Team. A question for Monday if I may. What is the MM view on subscribing to the NXT and COH SPPs. Apologies in advance if you have covered this - but I don't recall seeing your view.” - Many thanks David M.

Morning David,

Firstly, NXT which has raised $672m to meet increasing call centre demand, a good reason in our opinion. They raised is at $7.80, which is showing a 13% profit compared to Fridays close hence we like the SPP on price alone.

However, this is a growth company which remains on track to meet its 2020 guidance with revenue set to come in just over $200m, we see any weakness as providing solid risk / reward.

MM likes NXT with stops below $7.80.

NEXTDC (NXT) Chart

Secondly COH we have discussed earlier. We would be very comfortable taking up the raise.

MM likes COH ideally closer to $180.

Cochlear (COH) Chart

Question 6

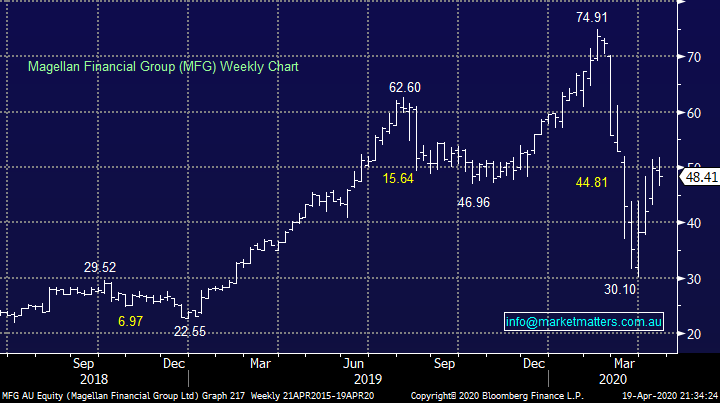

“James this is what I’m talking about when you say MM is considering taking a 30% profit on Magellan. That’s great but you need to be transparent and disclose the loss when it goes the other way. No-one expects MM to always make a profit and we all understand the risks… just report it in a more balanced view please.” - Anthony B.

Hi Anthony,

I understand that like many subscribers you have some underwater positions plus have probably crystallised some painful losses but I can assure you MM always tries to present a balanced opinion in all we do, we actually pride ourselves on being the most transparent offering in the space.

We provide all buy/ sell prices, gains and losses listed on the website under Recent Activity. However as a long-term member I take your comments on board and will endeavour to specifically clarify any losses moving forward – hopefully they will be few and far between!

Magellan (MGF) Chart

Overnight Market Matters Wrap

- The US rallied last Friday, as hopes of its economy reopening gathered momentum ahead of an expected volatile period of US corporate earnings.

- On the energy front, crude oil slid 8% towards US$18.27/bbl.

- This morning, NZ reports its quarterly CPI, while tomorrow we digest the RBA minutes of April and the depth of the current economic destruction coronavirus has done to Australia.

- The June SPI Futures is indicating the ASX 200 to open with little change, testing the 5490 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.