Subscribers questions (ANN, FLT, TLS, BIN, BBOZ, BBUS, CNU, HACK, A2M, RHC)

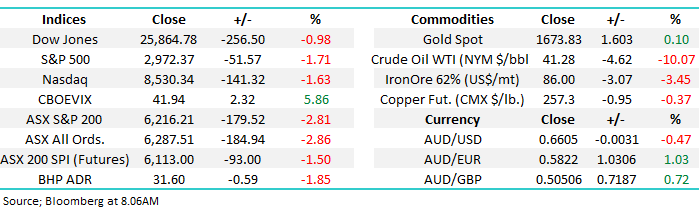

The ASX200 is bracing for another tough start to the week this morning following a volatile Friday night on Wall Street and a -1.5% decline by the SPI Futures implying we are likely to see a test of 6100 sooner rather than later - S&P Futures in the US have opened down ~3.5% this morning implying more pain – while the barrage of news flow is clearly negative, markets are now very oversold in the short term hence our more positive stance in our Weekend Note – click here

The virus is threatening to end the longest bull market in history, our opinion is it will fail but it’s certainly having an extremely good attempt and the situation is highly fluid.

Over the weekend the news, both good and bad, continued to flow with below salient points catching our attention:

1 – The huge Chinese economic engine is starting to come back to life and although it may take a while to have it firing on all cylinders we must remember it’s only been around 2-months since the COVID-19 outbreak really began in Wuhan i.e. our core view is things will improve in FY20-21 but expect numerous countries / regions to go into lockdown first. i.e. the headlines will continue to be very negative.

2 – The Australian property market continues to run hot after the latest interest rate cut down to 0.5%, suggesting buyers only believe COVID-19 will have a temporary impact on the local economy, Sydney led the charge with an impressive ~80% clearance rate over the weekend although Melbourne did slip back to just under 70%.

3 – Italy is now “locking down” its famous Milan region although I ponder how efficiently it will be implemented on the supposed 16 million residents – organisation is not the countries historical strength.

4 – There are now over 109,500 Coronavirus cases worldwide with 3800 deaths plus the likes of San Francisco and New York are in a state of emergency – more panic is likely before calm but China & South Korea have illustrated markets look through the “now”.

5 – Saudi Arabia looks about to set off a global oil price war, good for users and bad for suppliers. On Friday night the oil price plunged almost 10% taking the US S&P500’s Energy Sector down -5.6%, this bodes poorly for the local sector.

On a lighter note a great example of simply rubbish / sensationalism media came out this week with a claim that 38% of Americans wont drink Corona beer because of the COVID-19, funnily sales grew by 5% between mid-Jan and mid-Feb, social media at its finest.

On balance MM believes the ASX200 is oversold and expects the market to rally after early weakness this morning .

On Friday night US stocks bounced strongly into the close but the SPI wasn’t a believer with the ASX200 bracing for a test of at least the 6100 this morning, the only current certainty appears to be volatility will persist.

Thanks as always for the questions today, we appreciate both them and the positive feedback in these difficult times.

ASX200 Index Chart

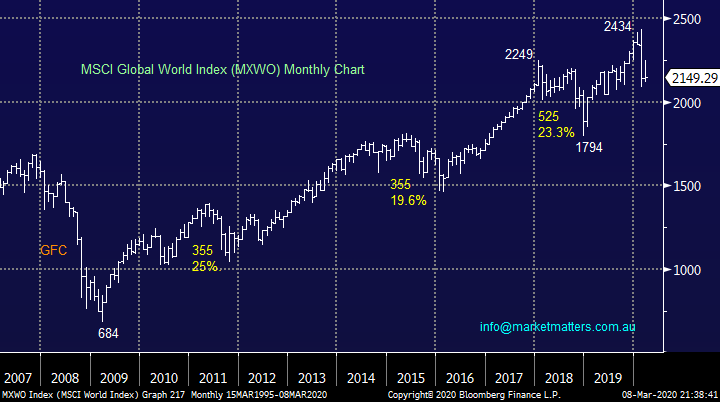

No change with global equites, technically they look awful, if it wasn’t for the underlying issue being the total panic around the unprecedented Covid-19 issue MM would be extremely concerned for the health of equities but recent events make us more open minded to news flow.

Technically speaking global equities look potentially capable of declining another 15%, but would likely bounce first - scary stuff.

MSCI Global World Index (MXWO) Chart

The decline by Australian bond yields has been almost pedestrian compared to the US where they’ve positively plunged on concerns for the global economy as COVID-19 spreads its wings. We stick with our view that this is likely to be a major blow-off top in bonds / low in yields but clearly more virus panic could push our 10-year down towards 0.5%. Following on from recent events the contraction of the bond yield differential between the US and Europe is of major concern to the perceived relative strength of the world’s largest economy – a situation we intend to watch carefully moving forward.

MM believes global bonds are very close to an inflexion point implying the panic in financial markets is set to ease.

Australian 10-year Bond Yield Chart

Question 1

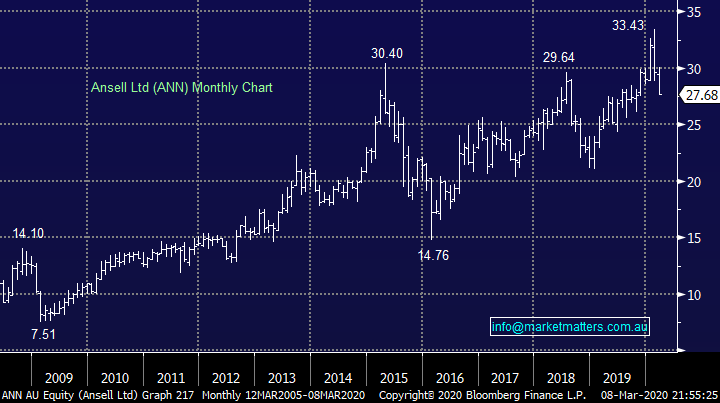

“ANN: Hi Keep up the good work. Being a subscriber to MM pays for itself especially in the present environment. I've been searching around for companies that may benefit this coronavirus thing. Have you a view on ANSELL Limited?” - Take care Danny.

Hi Danny,

Thanks for the appreciation in these unpredictable times, I cannot remember such volatility both intra-day and day to day since the GFC e.g. in one day last week the S&P500 experienced 15 intra-day +/- 1.75% swings, certainly crazy GFC style price action.

Ansell (ANN) has two parts to their business, healthcare and industrial. Their healthcare division does sell examination gloves which will be in high demand however it’s only a small proportion of revenue / profit. The more influential impact would be from delays in elective surgery where ANN supplies surgeons with sterile gloves. Non-urgent procedures could be put on ice. In their industrial business, they sell protective equipment in the manufacturing sector which could also see reduced demand as manufacturing slows globally.

ANN has delivered strong earnings as a result of a major business overhaul, and impressive / successful cost cutting led transformation. With an Est P/E of sub 16 for 2020 it’s not as expensive as many would think or assume as the virus panic continues to unfold.

While it has already corrected 17%, we view the potential impact from the virus on ANN as overall neutral / negative leaving us neutral the stock.

MM’s is neutral ANN.

Ansell (ANN) Chart

More broadly in healthcare, the potential impacts could be as follows.

Positive impacts

Fisher & Paykel Health (FPH) sell humidification systems and interfaces like masks and tubing etc that are used to help ventilation. COVID-19 hits respiratory systems in severe cases and this type of support will be needed

Resmed (RMD) also has a small part of their sales attached to masks and tubing, a positive for them

Healius (HLS) operates pathology and imaging services used in diagnosis while its medical centres could also see an uptick, although that’s harder to know, we might actually see people avoid Dr’s for other ailments that would usually take them to their GP

Sonic Healthcare (SHL) is similar to Healius in providing pathology, imaging and medical centres

Invocare (IVC) & Propel Funerals (PFP) for (unfortunately) obvious reasons

Negative impacts

Cochlear (COH) has already announced a COVID-19 downgrade on delays in implant surgery in China. Other markets could follow given this is non-urgent elective surgery

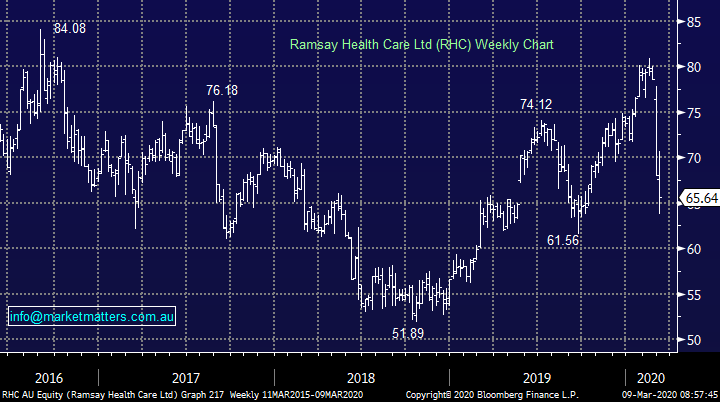

Ramsay Healthcare (RHC) could be impacted by a similar trend, the deferral of non-urgent elective surgery. They operate in Australia, have a big operation in France along with the UK and the Nordics

Question 2

“I note that you state you are avoiding FLT (Flight centre). What's your reason for this position. I see FLT having strong financial health giving them an ability to ride out this period of volatility.” - Kind regards Kristian H.

Hi Kristian,

You are correct about FLT’s strong balance sheet however the business was under pressure before Covid-19 became prevalent. At their AGM in November they downgraded guidance given challenging conditions, Hong Kong riots, BREXIT, softness in their domestic retail network plus wage growth pressures, Covid-19 is just another major headwind.

The bright spot in the FLT operations in more recent times been their corporate business, however as corporates ‘lock down’ any travel plans this area will also be hit hard.

We previously held FLT in the income portfolio having sold out above $47, back towards the $25 I can see value in the stock when we consider a post-virus landscape or the potential for some corporate activity, perhaps MD & 15% shareholders Graham Turner could privatise the company?

MM feels FLT is an accumulate between $20 and $25.

Flight Centre (FLT) Chart

Question 3

“G’Day James, I have been baffled by the movement of TLS during the recent run to the door. I can’t find any logic in what has happened with it. Given what Telstra actually does and where it does it, I would have thought it to be a bit of a safe haven when people are scared of such as the Banks and Industrials profitability in a downturn. Is it not somewhat recession proof? I must be missing something.” - Best regards, Ron O.

Hi Ron,

I actually think Telstra (TLS) has held up relatively well last week closing up +3%, in a sector which was impressively 80% in the green. The week before it was hit hard, perhaps on rumours the ACCC was not going to appeal the TPG – Vodafone merger which will create a solid No 3 in the sector. Also important to note, TLS has lost some of its safe haven appeal as it re-invests more into future growth, rather than simply acting as a ‘bond like’ equity passing through most of its earnings in dividends.

MM likes TLS at current levels.

Telstra (TLS) Chart

Question 4

“Hi James, I know you are super busy but can you please republish your list of stocks that are likely to benefit from a government fiscal package. Keep up the great work.” – Cheers Tim N.

Thanks Tim,

Initially I would simply refer to our list of buys in the Weekend Report:

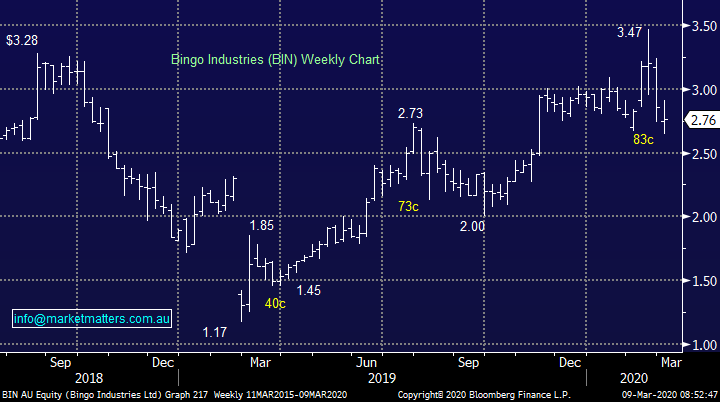

Buying : Bingo (BIN), Healius (HLS), South32 (S32), Xero (XRO), ASX Ltd (ASX), Macquarie Bank (MQG) and Altium (ALU).

Plus I would keep an eye on the medium-term opportunities which we believe are slowly emerging, like FLT discussed in the previous question while Ramsay Healthcare (RHC) is also on our radar. With regards to pure beneficiaries of fiscal stimulus, both locally and overseas, I would look no further than the quality end of the resources, except oil and gold, plus some building stocks e.g. RIO Tinto (RIO) and well established infrastructure focused businesses like Lendlease (LLC) and Transurban (TCL).

Bingo (BIN) Chart

Question 5

“Hi MM, What kind of short vehicles, we can use to protect our long positions, I know BBOZ, but I missed the order at $8, how about put options of ASX200? I don’t know much about options, can u please explain put options on ASX200?” – Cheers Steve Y.

Hi Steve,

Options is a very specialised and often dangerous area and one that can ‘cut both ways’ in periods like this. We remain keen on incorporating the BBOZ and / or the BBUS, however we would be buyers of that into strength as opposed to weakness. As suggested above, while this is a very fluid situation below the market is oversold and a bounce feels close at hand.

BetaShares Leveraged Bearish ASX200 ETF (BBOZ) Chart

Question 6

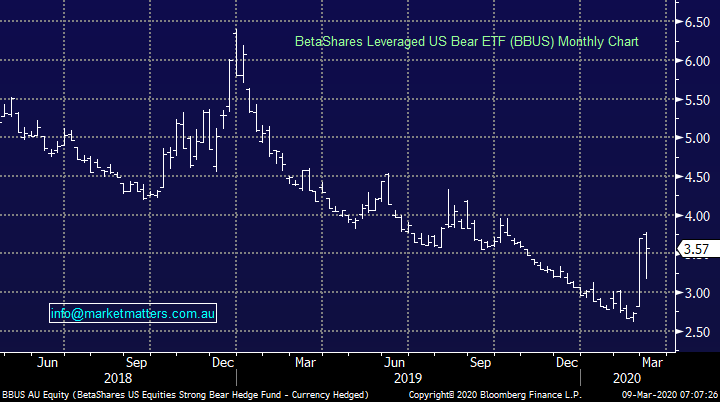

“Why are you not considering or recommending buying BBUS and BBOZ if there is a short term bounce?” - Sadhana P.

Morning Sadhana,

We will consider buying the BBOZ / BBUS after a decent short-term bounce but obviously not now as we feel the market is oversold.

BetaShares Leveraged US Bear ETF (BBUS) Chart

Question 7

“Hi James Friday (March 6) was a sea of red on the ASX. That said Chorus powered on, Nufarm was up and so too was IDX. During these across the board sell offs are these dots of green a very good sign for these and others companies that have achieved this?” - Cheers Tim R.

Hi Tim,

In general it’s a great sign when investors are happy to chase / support stocks into weakness, it means for example that the weight of selling that might be unfolding due to arbitrage is more than offset by the appetite of buyers. The only thing I would be aware of is if stocks have significantly underperformed bounce / hold up well its not always a sign of a bottom, it may simply mean investors are focusing elsewhere.

Integral Diagnostics (IDX) provides diagnostic services so is a beneficiary of growing demand.

Fixed line communications infrastructure NZ based business Chorus (CNU) increased guidance in late February by around 3% which was enough to put a rocket up the stock in this pessimistic world we currently live.

MM likes CNU but the risk / reward is tough.

Chorus (CNU) Chart

Question 8

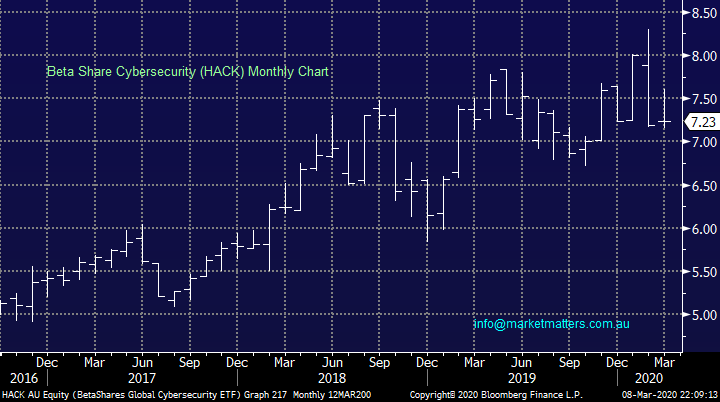

“Hi James Any thoughts on the ETF HACK?” - Cheers Tim R.

Hi Tim,

I’ve looked at it but not traded it before – cybersecurity is not really my area of expertise although clearly it’s a growing issue globally. In terms of the ETF itself, it is a cost-effective way of gaining exposure to a basket of global companies that operate in this space.

More information can be found here: https://www.betashares.com.au/fund/global-cybersecurity-etf/

I can see the fundamental attraction of accumulating this ETF into weakness but some of its high valuation components have struggled of late hence I wouldn’t be chasing strength.

BetaShares Cyber Security ETF (HACK) Monthly Chart

Question 9

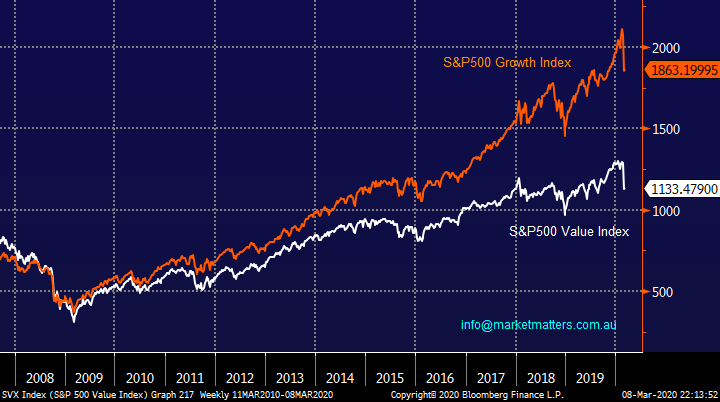

“Hi, When you say "the current bear trend for yields could easily have further to unfold i.e. a supportive backdrop for “Value” stocks compared to “Growth”. which Value stocks in particular?” – Thanks Carol G.

Morning Carol,

A great question in todays volatile times but I may have confused our message. We believe that Value stocks will outperform Growth as bond yields look for an inflection point i.e. reverse some of the performance differential illustrated below. At this stage I would be focusing on the high quality miners while avoiding the Energy Sector. Once bond yields have bottomed the Banking sector should come back into favour.

MM prefers Value over Growth through the next year.

US S&P500 Value v Growth Chart

Question 10

“Monday Questions. During this market hysteria, MM has provided me with logical calming advice. Thanks guys. Sooner or later the hysteria in the market will dissipate as it understands Covid-19 is "just" another version of the Flu, we need to live with. Hopefully, when this happens, we can start rebuilding. I did not sell anything once the carnage got underway. I have picked up some small positions in CSL, COH and MQG, maybe more later. Fortunately, over the last year I had withdrawn 30% funds from winning positions and trades for a war chest. This 'correction' may be a good time to buy into some high priced (quality?)stocks. Three questions. 1. What stocks held up best through this last few weeks, as these maybe good long term holds for the future? 2. Because a stock fell the most, does not mean it will bounce back the most. Which stocks do you think will 'bounce' the strongest? 3. Do you consider ROE and ROA as a good measurement tool for a held stock? My view being why hold a dividend stock paying 5% when I can hold a stock with a 40% ROE, and a 7% ROA. I will have to sell some stocks for income.” – Geoff B.

Hi Geoff,

1 – The best performing stocks / sectors over the last 5-days are Food & beverage, Real Estate and Telco’s. Our preference at current levels is the Food and Telco sectors which both look good.

2 – This depends on your timeframe but I can see the IT sector bouncing hard early but ultimately we are happier in the strong yielding Resources Sector.

3 – I 100% agree with your thoughts on ROE and ROA but in today’s environment I don’t see the need to totally turn ones back on yield, it’s more a case of where to search for it.

A2 Milk Co (A2M) Chart

Question 11

“Hi Team, Enjoy your commentary - always insightful. I know there is little cash in the funds for purchases but for your readers with cash you could also highlight what you consider excellent buys. You do it from time to time but dedicated piece at least while this correction is unfolding. A good omen for buying now - I can remember what I was doing on 9 March 2009 which was also a Monday and a public holiday in Canberra. As it turned out Friday, March 6 was the lowest point for the Dow and the ASX during the GFC. What I bought on 9 March did very well. Now is the time to buy during this correction. CBA bottomed at 27 but had you got in too soon say at 35 you would be kicking yourself that you purchase had dropped another 23% but your $35 purchase would have doubled in 4 years without taking into account the excellent dividends - a fantastic purchase. So Monday might not be the bottom but I will be buying and I am sure over the next few years I will be glad I did.” – Selwyn.

Hi Selwyn,

I agree with your comments, we like slowly accumulating at todays levels. With our “shopping list” from the Weekend Report a great starting point:

Buying : Bingo (BIN), Healius (HLS), South32 (S32), Xero (XRO), ASX Ltd (ASX), Macquarie Bank (MQG) and Altium (ALU). We also like Ramsay Healthcare (RHC) into weakness.

MM believes this is a great opportunity to be accumulating stocks on the back foot.

Ramsay Healthcare (RHC) Chart

Have a great day!

James & the Market Matters Team

Overnight Market Matters Wrap

- Global sell off continued last Friday as economists are forecasting a fall in world growth to 2% this year, leading the European markets off ~4% while the US key indices traded lower as well!

- On the commodities front, crude oil slid 10.07% following Russia resisting OPEC’s ambition to cut its output. In response, Saudi Arabia plans to increase production, possibly at a record as high as 12m bbl./ day.

- BHP is expected to further underperform the broader market after ending its US session off an equivalent of -1.85% from Australia’s previous close.

- The March SPI Futures is indicating the ASX 200 to continue its recent weakness and open 100 points lower, testing the 6120 level this morning, although S&P Futures suggest we’ll open lower than that

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.