Subscribers questions (ALG, TGF, BIN, HSO, RFX, WOR, CGF)

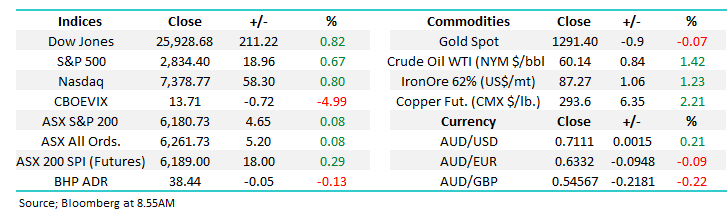

The ASX200 is set to kick off both April and Q2 2019 on a positive note following a strong night on Wall Street which rounded off its own strongest quarter in almost 10-years by gaining ~+0.8%. The SPI futures are pointing to another test of the psychological 6200 area by local stocks. With China’s economy showing signs of recovery over the weekend as its Manufacturing soared the most in 7 years everything points to a strong open today.

Local news over the weekend was relatively thin on the ground as we got a welcome break from NSW politics before the Federal election starts dominating the press in probably only a few days’ time. The next election must be held by the 18th of May, around 6-weeks’, and it’s still widely tipped that Bill Shorten is to become the new Prime Minister of Australia – Sportsbet has Labor at 1.18 favourites compared to Liberals at 4.5, that’s almost a one horse race if you believe the bookmakers.

Moving into a new month we should be aware that while April has seen an average gain of 1% over the last decade May & June are the standout weakest period for stocks with an average drop of almost 4.6% - this actually coincides reasonably well with our anticipated 6000 – 6300 trading range for the new quarter, notably quieter than the rampant advance stocks have just enjoyed.

MM remains in “ buy mode” primarily due to our elevated cash levels and we will be relishing any reasonable short-term correction.

Thanks for the questions again this week, obviously from a volume perspective last week was simply a little rest, similar to that experienced by the ASX200!

ASX200 Index Chart

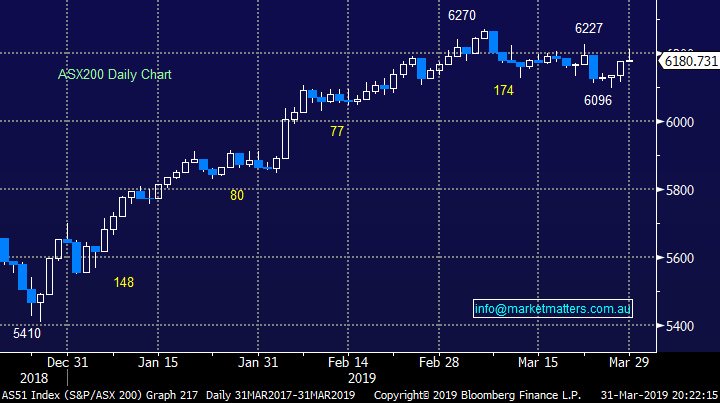

MM has stuck to our bullish call for the $A into 2019 / 2002 initially targeting the 80c area – an opinion we understand not all subscribers agree with but as we often say “that’s what makes a market”.

The below chart should be a touch sobering for the “Aussie Bears”, the likes of Fortescue (FMG) and RIO Tinto (RIO) have fully embraced the strong rally by iron ore in 2019 but the highly correlated $A has ignored the bulk commodity – so far.

Australian Dollar ($A) v Iron Ore Chart

Question 1

“Any insight / comments in regards to Ardent Leisure (ALG)?” – Michael C.

Hi Michael,

We last mentioned ALG in 2018, after a colleague took his family to Dreamworld on the Gold Coast and reported it felt like a tired ghost town with literally zero queues on even the major attractions.

The stock actually rallied over 5% in late February following its half-year results which showed a loss of almost $22m, expectations were clearly low but since the stock has recommenced its painful decent and technically this is one falling knife that has no appeal to MM. The business is losing money, has growing debt and zero yield – not a compelling combination.

MM still has no interest in ALG at this point in time.

Ardent Leisure Group (ALG) Chart

Question 2

“Hi, just a thought worth considering. For active investors in pension phase, the loss of franking credits means the 45-day holding rule doesn’t apply. This may present some opportunity to roll over some short term trades in a volatile market into cash or a new investment.” - David H.

Hi David,

That’s certainly true if the fund in pension phase is paying zero tax - some funds in pension phase would be paying tax and could therefore use the franking credits. However overall yes, you are correct in theory – we recommend subscribers discuss thoroughly with their accountants any potential investing decisions around the looming Federal election, or any tax mattes for that matter.

Question 3

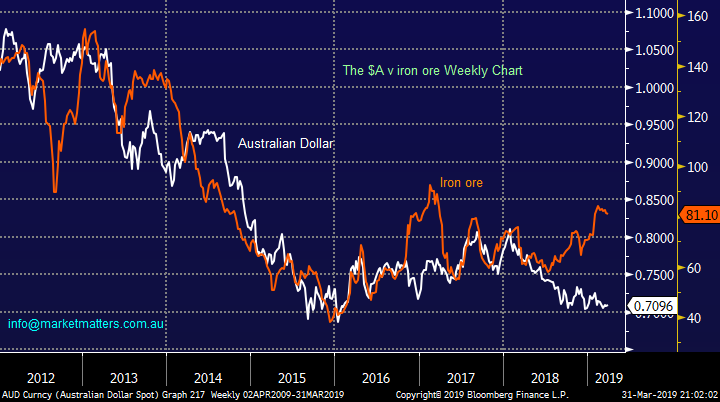

“Hi James, on the subject of discount to NAV, I note that Tribeca Global Resources Fund is trading at 2.22 when its NAV is 2.47. Also the directors have been buying up shares. Is this just a lack of promotion of the fund by Tribeca and/or sentiment driven? - regards, Rob J.

Hi Rob,

One of the biggest issues for The Tribeca Global Natural Resources Fund (TGF) is turnover which was well under $15k on Friday, extremely small for a company with a market cap above $140m – certainly impossible for MM to consider.

The Listed Investment Company can actively manage both long and short positions in the natural resources sector, credit positions and commodities themselves as such investors are backing the portfolio managers. I had dinner with the Tribecca team prior to this listing and although I looked good, I was of the opinion that assessing post listing was the way to go, and for now, I don’t think the runs are on the board. While it’s great to see the team buying their own shares it’s not reason alone to be accumulating in our opinion. The NAV at $2.47 v last close at $2.22 is interesting, that NAV figure was at the end of February, and a new NAV figure will be released on or around the 13th of April.

MM would like to see some company performance before jumping into TGF.

The Tribeca Global Natural Resources (TGF) Chart

Question 4

“Hello, I like the information on how new government would potentially impact on LIC. I am interested in investing some large ETF that have shareholdings in UK or USA or Asian. Are you able to recommend some in your next report?” - Many thanks Esther.

Hi Ester,

Here’s the link to the report for those that missed it: https://www.marketmatters.com.au/blog/post/income-report-how-could-a-change-of-government-impact-listed-investment-companies-lics-wle-cdm/

If you are considering ETF’s with exposure to global equities the list is almost endless. Below is a list of the Australian based ETF’s with a decent number covering your needs mentioned above. We would be keeping an eye on costs to administrator and liquidity but this has become a highly competitive space making it generally very user friendly.

Vanguard, iShares and Betashares are a god place to start or for a general list: https://en.wikipedia.org/wiki/List_of_Australian_exchange-traded_funds

Question 5

“BIN has already announced acquisition of Dial-a-Dump yesterday on 25Mar. What more they are expected to announce next week?” – Regards Sanjay S.

Hi Sanjay,

Bingo Industries (BIN) rallied nicely following the announcement that the waste management company has completed the acquisition of Dial a Dump Industries – almost old news now.

At the end of last month global powerhouse Goldman Sachs added BIN to its “strong buy list” with a price target of $2.40, a touch more optimistic than our $2.20 target. We are not expecting any fresh news from BIN this week and the company doesn’t now report until August – we believe that BIN is a strong turnaround story in a sector we like.

MM remains bullish BIN targeting the $2.20 area.

Bingo Industries (BIN) Chart

Question 6

“Hi James, I have read the blog www.michaelwest.com.au/saving-the-deal-cover-up-over-northern-beaches-hospital regarding the use of tax havens by Healthscope (HSO) and Brookfield. Even if it is legal under current tax law, for me and it should for all tax paying Australians, present a moral dilemma. Could you advise or comment on:

1. How may one find out which listed companies and to what extent are these companies are using tax havens?

2. What happens to this money, is it refunded at some time back to the company and shareholders or it just lost/stolen and diverted to others?

3. Are you aware of any attempts by government to limit transfer payments such as external management charges, license and franchise fees, debt etc by having such items treated as investment capital and thus not be tax deductible expenses ?

regards Alan M.

Hi Alan,

That’s a comprehensive question with a tough and an almost frustrating answer. At this stage obviously the books are opening up for both Healthscope (HSO) and Brookfield as the potential takeover runs its course – on the 29th of last month Brookfield asked ASIC for more time to make formal its Healthscope (HSO) offer.

However businesses will do whatever they can to minimise tax in a legal manner – the largest company in the world Apple instantly comes to mind. A quote by the late Kerry Packer also pops into my head:

“I'm not evading tax in any way shape or form. Of course I'm minimising my tax. If anybody in this country doesn't minimise their tax they want their head read. As a government I can tell you you're not spending it that well that we should be paying extra." – Kerry Packer.

However back to more serious question I’m afraid the answer to your question is literally hours of digging, you are looking for what others don’t want you to read. I am not aware of any similar situations you have described above.

Healthscope (HSO) Chart

Question 7

“Hi MM Team, with Friday being the last trading day of the quarter, could you please advise the best 3 performing and the 3 worst performing stocks in the ASX200 for the first quarter of 2019.” – Thanks Neil W

Hi Neil,

We touched on this in the weekend report but the precise best and worst 3 are listed below, certainly not a good time for shares to be falling when the ASX200 Accumulation Index was making fresh all-time highs:

Winners – Afterpay (APT) +69%, Fortescue Metals (FMG) +73% and Appen Ltd (APX) +74%.

Losers – Syrah (SYR) -29%, Costa Group (CGC) -31% and Eclipx (ECX) -74%

ASX200 Accumulation Index Chart

Question 8

“Hi & good morning, I would like to ask I would like to get more details of 'Forever Battery' from ASX listed stock?” - Kind Regards, Tony C.

Hi Tony,

Ossia’s Forever Battery is certainly a fascinating concept that would revolutionise batteries as we know them but the company is a private venture hence not a business we follow too closely. Their design suggests that AA-style batteries may be able to maintain their power without ever requiring charging.

However we did take a quick look at listed Redflow Ltd (RFX) the Brisbane based battery manufacturer – its shares are currently demonstrating no signs of interest to MM.

Redflow Ltd (RFX) Chart

Question 9

“Thanks, James for a very insightful MM report this morning. Are there any other correlations that support the firm market as of now? Or are the ones you used today all the markers?” – Thanks Bruce B.

Hi Bruce,

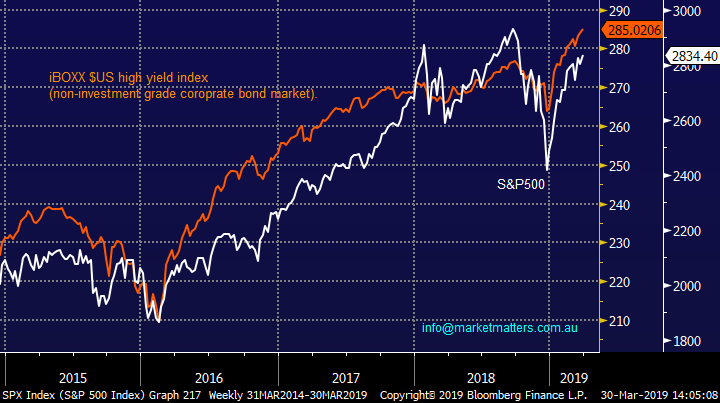

We added a few in the weekend report in our opinion the below chart is the key to stocks at this point in time.

While liquidity remains plentiful in the corporate / junk bond market stocks are likely to remain firm.

US S&P500 v iBOXX high yield index Chart

Question 10

“Hi MM Team, Just like to get your thoughts on Worley Parsons (WOR) thanks. Also, on Challenger (CGF) on a monthly chart my opinion is it is about to commence a wave 5 after last month forming a closing price reversal pattern. “ – Thanks Tim C.

Hi Tim,

1 – Mining services business Worley Parsons (WOR) is messy technically and fundamentally after their almost $3bn capital raise back in late 2018. A stock worth watching at this stage for MM.

2 – Popular stock Challenger (CGF) has had a tough 18-months falling by over 50% although last week’s +10% pop on the news of that it had further progressed its strategic relationship with Japanese partner Mitsui Sumitomo certainly helped, the Japanese business will hold more than 15% of CGF and subsequently wants a seat on its board.

We are now neutral CGF although declining margins across their book remain a concern.

Worley Parson (WOR) Chart

Challenger (CGF) Chart

Overnight Market Matters Wrap

· The US equity markets ended its first quarter of 2019 on a high with the major indices rallying between 0.7% and 0.8% on Friday, to cap off one of the strongest starts to a year for quite some time. This followed reports that China had made further concessions on trade as the protracted US-China trade discussions resumed.

· European markets also had a strong end to the week, despite continuing uncertainty around the UK’s withdrawal from Europe. The UK Parliament once again defeated yet another attempt by PM Theresa May to get her Brexit proposal accepted.

· The March SPI Futures is indicating the ASX 200 to open 24 points higher, testing the 6200 level again.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 01/04/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.