Subscribers questions (AGL, PNI, JHG, NTC, ANO, FMG, TNE, CGC, IEL, CBA)

Major market news was thin on the ground over the weekend although I did notice auction clearance rates ticked higher albeit it on lower volumes, while I wouldn’t be getting too excited on housing prices just yet its clear nobody believes they can rally which is often the catalyst for such an event particularly if banks feel like they can now improve the availability of credit. Housing is important levels and we’ll continue to watch this data very closely - many stocks with earnings that are exposed the current downturn in the housing market have been simply smashed and will undoubtedly bounce hard at some stage.

Asia, and especially China, comes back to work this week following the “Year of the Pig” celebrations which is likely to change the recent dynamic of equities during our time zone, potentially giving buyers a greater selection of stocks at the buffet bar for both buying and selling.

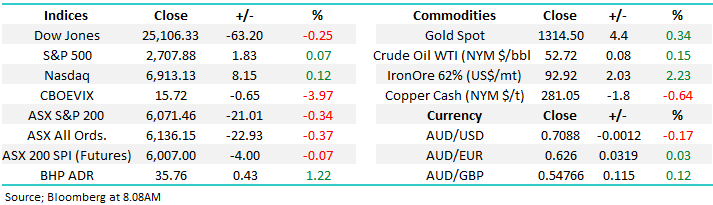

Following the late sharp and aggressive recovery by US equities on Saturday morning (AEST) the ASX200 is looking to open unchanged today while feels a touch pessimistic to me with BHP trading over 1% higher in the US but maybe we will see some profit taking in the banks this week.

MM remains in “ buy mode” with our elevated cash levels but we are currently not planning to chase strength.

Thanks for the excellent and very diverse bunch of questions, we haven’t included all however it highlights how engaged the subscriber base has become – thanks!

ASX200 Chart

The small cap Russell 2000 has led both the 2018 decline in stocks and the recent aggressive rebound hence we continue to watch this index very closely. Takeout’s at this stage:

1 – Medium-term we see the current bounce reaching the 1600 area, or over 5% higher from here.

2 – Short-term we anticipate a correction to the strong rally since late December, similarly ~5% lower.

US Russell 2000 Index Chart

Question 1

“Hi James, I'm struggling to understand the share price behaviour of AGL which has been on a steep upward trajectory since Nov 2018 following a massive decline from April 2017. I understand as a utility-type stock (bond proxy) it has been sensitive to interest rate sentiment and also been somewhat of a political football in relation to power generation. Still the volatility seems large in relation to the company's annuity style business leading to what should be a boring DCF-valuation. Thanks as always for your work.” - Rob J.

Hi Rob,

I think you’ve actually answered your own question on AGL, the chart below illustrates the very clear correlation between US 10-year notes and the AGL share price. As US-10 year Notes rally their yield (interest rate) declines making “bond proxies” like AGL far more attractive i.e. the relative yield from AGL shares becomes more attractive.

In terms of volatility I don’t think its that large when we put things into perspective:

1 – AGL has rallied 22% from its November low while the ASX200 has gained 12.2% i.e. major outperformance.

2 – However AGL had previously declined almost 40% due to fears of rising interest rates, a concern that has now diminished significantly.

AGL reported last week and we covered the stock at the time. Analysts agree with your views, the majority dislike the stock and more so now that a mooted buy-back is no longer going to happen, however I believe its current recovery is more about interest rates – if you want to forecast what next for AGL its about getting a handle on bond yields – US 10-years are what most market players watch.

AGL Energy Ltd (ASX: AGL) v US 10-year Notes Chart

AGL Energy Ltd (ASX: AGL) Chart

Question 2

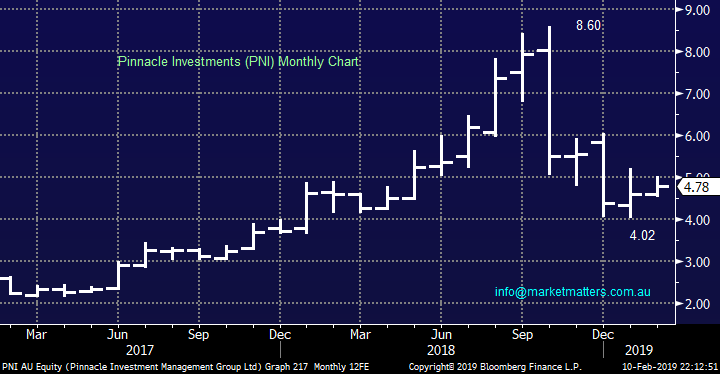

“Hi team, thanks for the latest report. One question that I do have refers to PNI. They have bounced around from $4.00 to $8.00. I know how they operate and I am familiar with the portfolio managers under their belt. I just thought that over a 12 month period that was a very big move. Would appreciate your thoughts.” - Cheers Greg C.

Hi Greg,

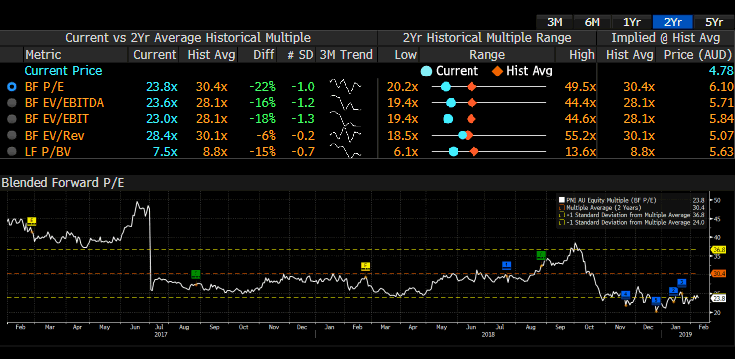

Pinnacle Investments (PNI) fell from $8 to $4, I assume your question was a typo? We’ve written a lot in the past about the leverage of fund managers to the market both in terms of performance and the rate of growth or decline in funds under management which both have an impact on fees.

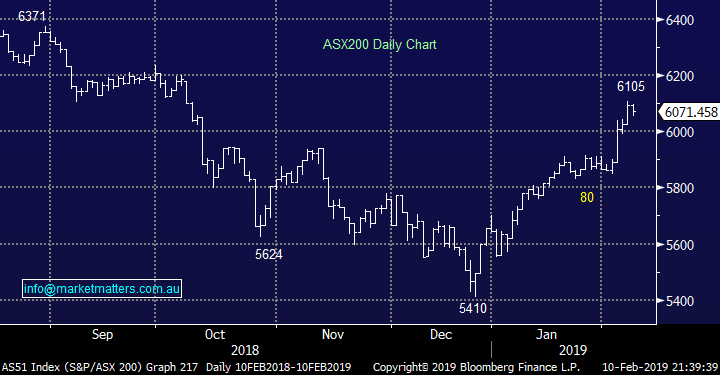

Pinnacle owns stakes in a host of funds and is therefore at the pointy end of this theme. When markets are going well, fund managers have strong earnings but more importantly, the market ‘pays up’ for higher earnings in the future, due to higher FUM and higher fees. Right now however, the funds management sector in Australia is trading at the cheapest it has in the last 14 years. While PNI has a reasonably short history, you can see from the chart below, the big variance in the multiple the market is prepared to pay for the stock. Average PE over the past 2 years is 30.4x and today it trades on 23.8x making it cheap versus itself but still expensive relative to other fund managers.

It’s also digested a capital raising and earnings have been more volatile.

P/E trends for PNI

Ultimately, this is a bull market stock - if the market rallies from here, PNI will do well, so will the other fund managers. We highlighted Perpetual (ASX:PPT) in the weekend report as a good looking technical trade.

We are neutral PNI at the moment.

Pinnacle Investments (ASX: PNI) Chart

Question 3

“HI there, I have recently joined MM and trying to mirror growth portfolio. what are your thoughts on JHG. with the price so low, is it a good buy at this point?” - thanks Dan A.

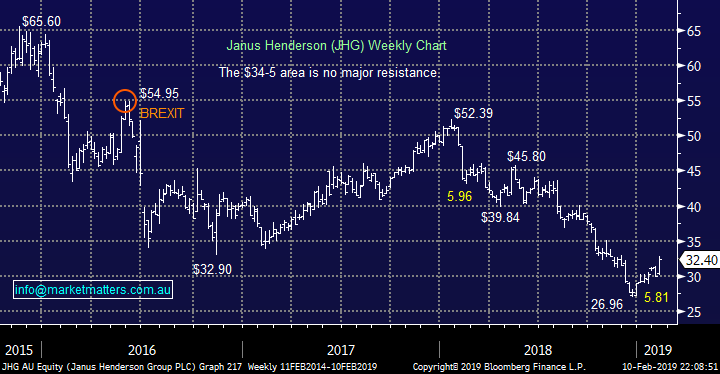

Hi Dan,

JHG has actually been one of the stock’s that has frustrated us the most over the last 12-months. Like much of the sector its cheap but has been for some time which to a degree makes sense considering its exposure to the UK and BREXIT, large fund outflows and weak performance – not a great combination.

At this stage we are closer to selling our JHG position into strength as opposed to increasing the holding - our ideal sell zone currently being the $34-35 area. Conversely JHG is likely to open down ~2% this morning following its weakness in the US which may be a better entry point.

Janus Henderson (ASX: JHG) Chart

Question 4

“Hi Guys, just wondering your thoughts on NTC chart?” – Thanks Peter S.

Hi Peter,

Thanks for the question on Netcomm Wireless (NTC) but unfortunately it’s not a particularly pretty picture.

For people who are looking to buy the current levels look ok with a stop under 69c but its not one for us.

Netcomm Wireless (ASX: NTC) Chart

Question 5

“Hi James, I was wondering if you would share your thoughts on Advance Nanotek Ltd (ANO)” - Kind regards Rom P.

Hi Rom,

I’m not familiar with the company other than to say that it manufactures advanced Nano materials and products. ANO is a very thin stock only trading 86,579 shares on Friday making it understandably very volatile and not a stock we can consider investing in.

Not sure what the stock will do and can only really provide a technical view as per below .

Technically ANO looks a buy with stops below $1.30.

Advance Nanotek (ASX: ANO) Chart

Question 6

“HI, we can expect a dividend announcement soon for FMG. After selling them just a few days ago, what is MM’s view regarding buying the stock back?” - Thank you, kind regards, Frank W.

Hi Frank,

In hindsight taking the +20% profit on our FMG position for our Income Portfolio in late January was premature but it was impossible to forecast the awful disaster in Brazil and the subsequent iron ore rally.

We intend now to watch FMG for a few weeks to let the dust settle – last weeks late 6% pullback showed us volatility and opportunity certainly remain.

RE dividend amounts – we’ve just seen consensus EPS upgrades in FMG by 33% to around 40cps so dividends should clearly rise. Using spot prices is not the thing to do, however if we amuse ourselves for a moment and think about the cash FMG is generating at “spot” and if we take out the net of dividends (65% payout) and buy back (A$500) we could see FMG move from a net debt position of ~US$3bn (current) to a net cash position of ~US$2bn by end 2021 – making it an extremely attractive income stock!

We clearly sold too early, and will revisit it again no doubt.

Fortescue Metals (ASX: FMG) Chart

Question 7

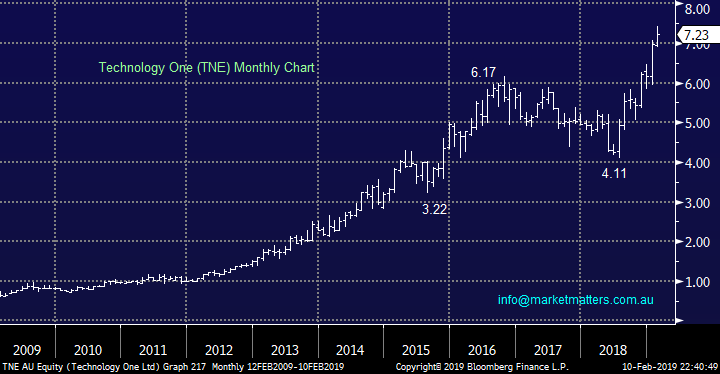

“A subscriber question for Mondays report. Hi James & MM Team. Can I have your thoughts on Technology One (TNE) please. It has run hard of late & is sitting above most of the broker target prices I have seen. Is it time to take some money off the table?” - Thank you, Ian

Hi Ian,

TNE looks great but I’m sure everyone can see that. The IT and Software companies shares continue to make fresh all-time highs following last year’s announcement of a $66.5m profit for last financial year. The stock trades on a rich valuation with an estimated P/E of 39x for 2019 while yielding under 2% - but this company has now paid a dividend for over 20-years making it a very reliable player in the tech space.

While TNE is likely to follow the NASDAQ sentiment along with the likes of Appen and Altium this business certainly has some excellent foundations.

If we were long we may consider reducing our position but certainly not closing out fully. From a technical perspective we would be running stops below $6.40 but I can see $8 this financial year.

Technology One (ASX: TNE) Chart

Question 8

“Hi James, would you mind having a fresh look at Costa Group (CGC) It got absolutely hammered on what didn’t appear to be such a bad report in January, rose again to what appeared to be a more reasonable level and now seems to be on a bearish trend. From what I can see the business is solid, it is in an almost dominant position with a lot of its produce and notwithstanding the “ smashed avocado economy” syndrome we all need to eat. Your take on the medium future?” – Peter H.

Hi Peter,

CGC is a stock we are watching closely for the reasons you mention above. The current momentum feels very poor but statistics tell us that companies who downgrade usually struggle to get off the canvas for a while i.e. they’ve lost the markets confidence.

Due to number of factors including lower demand for products like berries and avocados, earnings for 2018 are going to be lower than expected but more importantly if things don’t improve the business will show no growth for the current financial year. However shares are trading on an Est P/E for 2019 of 21x which is not a bargain for a company that’s downgraded and is showing no current growth.

At MM we are looking for an opportunity to buy CGC but a decline back towards $4 does not feel out of the question – we are being patient for now.

Costa Group (ASX: CGC) Chart

Question 9

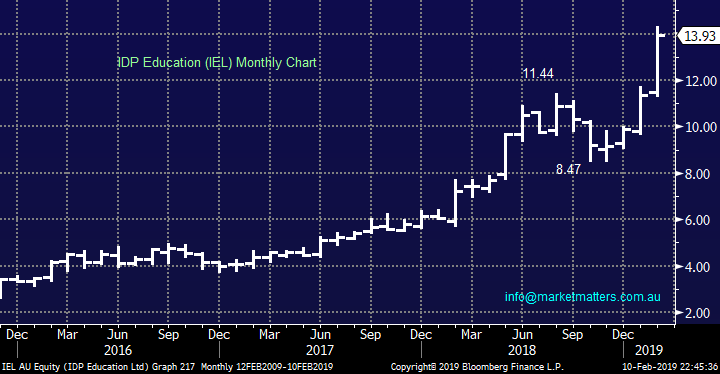

“Hi there, I have a holding in IEL since November last year. I was wondering about your thoughts on if to hold onto this or if it would be wise to take profit on this at this point?” - Thanks for all your advice. Cheers. Greg T.

Hi Greg,

IEL has soared this year following the release of its latest results which showed a 26% increase in revenue to over $300m plus a more impressive 34% increase in profits to over $40m.

The ongoing strong growth in Asia is exciting and if we were long we would be holding for now to see if the business can maintain its momentum.

IEL looks great and technical stops could now be placed under $11.70.

IDP Education (ASX: IEL) Chart

Question 10

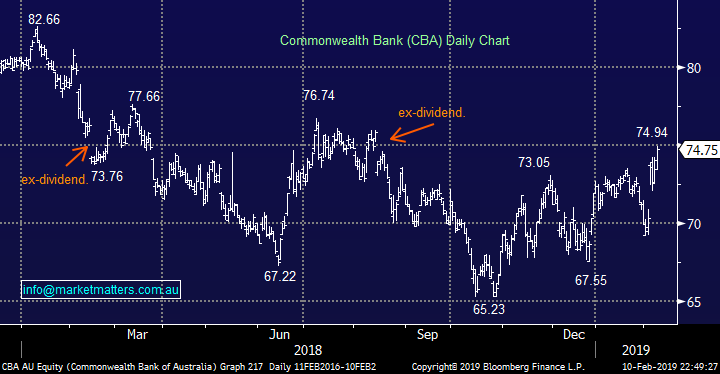

“Good morning. Thank you for your continuing quality advice and pragmatic and realistic approach to ‘investing’. Given the restrictions of the 45-day rule, can CBA shares be bought on Monday 11 February 2019 and the dividend payment still made. I understand one needs to have purchased the day before the 45 day period commences.” - Best wishes Brian E.

Hi Brian,

A nice easy one, CBA goes ex-dividend on Wednesday so shares purchased today and tomorrow will be entitled to the dividend later in the week, however to retain the franking credits, one needs to hold for 45 days not including day of purchase or sale, meaning it should really be called the 47 day rule. For a stock like CBA, there is also a cum dividend market created on the day the stock goes ex-dividend, so shares with the dividend can be bought under code CBACD on Wednesday.

Commonwealth Bank (ASX: CBA) Chart

Overnight Market Matters Wrap

· Overseas markets were mostly weaker on Friday night. European stocks and the Dow closed lower, while the S&P 500 and NASDAQ made small gains.

· Short term, risk is back on another possible US government shutdown, while US analysts are revising down their first quarter earnings expectations. They now expect a small fall vs 5.3% growth at the start of the year.

· US-China trade talks will also be the focus as high level talks begin this week in Beijing. Trading in mainland Chinese stocks resumes today after the Lunar New Year break. A lot of investors will be keenly watching how iron ore trades after iron ore futures rallied hard last week in Singapore.

· In other commodities news, metals on the LME were largely weaker, led lower by nickel which fell more than 3%. Oil is trading higher as is gold, now at $US1318/oz.

· The March SPI Futures is indicating the ASX 200 to open flat this morning .

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 11/02/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.