Subscribers questions (A2M, CGC, EHL, ASL, BIN, AWC, WSA, MFG, AHG, RIO, CBA)

I was sitting at my desk last night at 8pm starting this morning’s report wondering why we don’t write the MM reports 5-minutes before the market opens! At around 6pm last night President Trump decided that he’s had “second thoughts on his China trade war moves” or in simple English, it appeared he’d reconsidered his actions with at least one eye, if not both, on next year’s election. At that stage I wouldn’t have been surprised to see the US futures regain half of Fridays losses this morning implying the ASX200 would only open down 40-50 points.

However this morning we woke up to see England had won an extremely improbable game of cricket and the Whitehouse proclaiming that Trump had been misinterpreted and he actually regretted not raising tariffs higher! While I guess nothing should surprise us from President Trump it does still leave me amazed what’s coming out of that previously iconic white building in Washington DC. It now appears we will be smashed early this morning or at least until the Presidents next comment / tweet. However as we saw with the cricket you can never 100% know and that’s certainly true in today’s political environment – I wonder what the heads of the G7 are all thinking at present, are they walking on eggshells with Trump?

Moving on from crazy macro tweet driven index movement, the volatility “under the hood” should have its last major week of report driven volatility this week as we see the likes of Fortescue Metals (FMG), Wesfarmers (WES), OZ Minerals (OZL), Appen Ltd (APX) and Woolworths (WOW) reporting their performance to the market. For a reporting season calendar, click here

Following on from President Trump’s double about-face I feel like many investors may throw the towel in and say its too hard until we receive clarity from the US – what I can say with confidence is stocks are very lucky we have interest rates at an all-time low and investors are already largely cashed up. The US futures have opened down another 1.2% this morning courtesy of Trump, an initial fall of 100-points might be optimistic for the ASX200.

Ideally we will still bounce short-term towards 6600 for the ASX200 to become more defensive, at least for a few months.

Thanks as always for the questions, an excellent mixture today although I would imagine most subscribers would be wondering what on earth should we be doing as Trump starts to confirm many investors greatest fears i.e. he’s a loose cannon at best.

ASX200 Index Chart

US stocks are currently in an extremely volatile period on a day to day basis for all the reasons discussed in the Weekend Report and above, the key is to know what your plans are and how to implement i.e. “plan your trade and trade your plan”.

1 – MM will look to increase our defensive stance if US stocks rally around 3.5% higher.

2 – MM will look to increase our market exposure around 4.5% lower for US stocks.

Most importantly to recognise there’s a 8% band where we believe from an index perspective stocks are too hard i.e. simply random noise.

US Dow Jones Index Chart

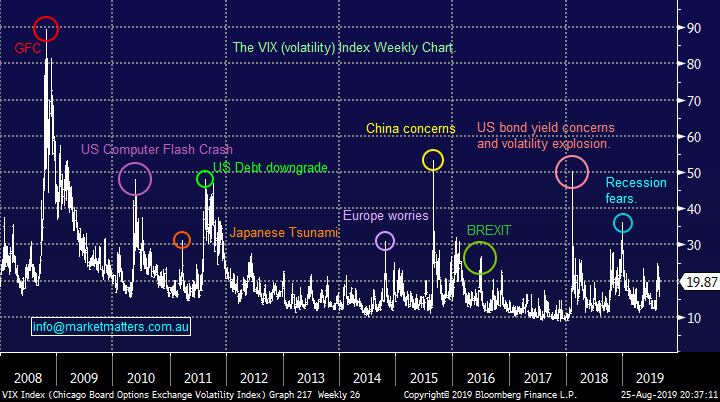

Interestingly even as the Dow plummeted over 600-points and a full scale trade war looked imminent the VIX couldn’t close above 20, in other words the VIX is saying don’t panic things aren’t that bad. That’s 24% below the panic highs earlier in August, we ponder whose more on the money – stocks or the VIX.

MM believes the VIX will ultimately rally above 30 in 2019 but when might not be as obvious.

The US VIX / Fear Gauge Index (VIX) Chart

Question 1

“Hi, What price we should buy A2M?” – Sanjay S.

“Hi, A2M drop is it an overreaction?” - Cheers Nici B.

Morning Guys,

a2 Milk Co. Ltd (A2M) is clearly exposed to China which is not ideal in today’s current US – China trade war environment. Also, last weeks result did not excite the market as the company’s shares proceeded to make fresh multi-week lows. A classic case of expectations simply being too optimistic when an increase in revenue of over 40% and a net profit up 47% is not good enough! It was more the outlook that concerned the market with expectations of 20% growth now watered down to nearer 10% and that has made the stock to look more expensive in outer years.

My concerns short-term are 3-fold:

1 – The simple fact that 2 subscribers are asking a similar question implies investors might be caught long this quality and top performing business.

2 – The stocks exposure to China in today’s environment should not be underestimated, its already corrected over 20% in 2019 but this could be repeated with the stock still trading on an Est. P/E of 31x for 2020, with lower growth now likely.

3 – What we wrote earlier in the month holds firm “From company boss Jayne Hrdlicka “the easy revenue gains made in Australia and via Daigou shoppers are a thing of the past and the milk and baby formula maker is building capacity for the long haul in China”. Sounds to us like lower growth moving forward”.

In the current environment I could see a panic selloff towards the psychological $10 area hence we intend to be patient for now.

MM is neutral / bearish at current levels.

A2 Milk Co. Ltd (A2M) Chart

Question 2

“Guys, I have followed your advice closely on the swag of 'dog stocks', PGH, EHL, ASL,CGC and BIN. If bought at their lows there was much to be made from the gradual climb back ... until reporting season that is. I got spooked and sold out of all a few weeks ago, and am now seeing them back in our former buying territory.

1 - CGC seems to stumble from one bad quarter to another. Considering droughts are likely to become more prevalent than less, is there something wrong with the business? Is this just too high a risk.

2 – EHL looks to have been sold down for no reason. What price do we buy back in? Similarly ASL?

3 – Rubbish and domestic recycling looks to be a growth industry to me. Is BIN in order and cheap enough to buy at the moment?

4 - Also, a couple of former favourites, AWC, which is back to where I originally bought in, and WSA, which finally had a gallop, but has come back again? Is Nickel as hot as BHP are indicating?

I am aware that is lot of stocks in 1 email, but only because I want to know if the moves down in the past fortnight present a buying opportunity on stocks I am familiar with?

Thanks” – Charlie N.

Hi Charlie,

That certainly is a long list of stocks but the vast majority are very important to MM at this point in time. I have given our summary of this volatile bunch below.

1 – Costa Group (CGC) $3.01 – Arguably our worst looking position today following last week’s downbeat commentary from the company. The risks are clearly high but people must eat although the likes of berries and mushrooms are definitely not essentials. However the stock is trading on an P/E of only 15.9x for 2019. We would be looking to slowly accumulate if we had no position hence we are reticent to “dump” our position into current weakness, we are considering reducing our holding to aid flexibility.

2 – Emeco Holdings (EHL) $1.94 – we feel EHL has been very harshly treated by the market and we would be again be accumulating into current weakness below $1.90.

3 – Ausdrill (ASL) $1.735 – ASL is drifting lower with the oil price, courtesy of Trump et al. We see better stocks to buy for a trade war resolution which looks required for ASL to rally.

4 – Bingo (BIN) $2.33 – I agree on the sectors outlook especially as its historically relatively recession proof. However BIN is in a tough transition year, we now like BIN closer to $2.

5 – Alumina (AWC) $2.16 – we can see further downgrades flowing through for AWC hence there’s no hurry to commence “bottom picking”, we can easily see another ~15% downside.

6 – Western Areas (WSA) $2.36 – WSA has enjoyed the strong tailwind of rising nickel prices but the stocks significantly below its 2018 high, not a great sign to us. We intend to be patient here for now.

Nickel Price ($US/MT) Chart

Question 3

“Hi Not sure if this is the right place to ask this question, but .... What are your thoughts on the opportunity to participate in the new Magellan High Conviction Trust, particularly as I’m entitled to an additional “free” 7.5% extra units under the offer? Thanks Chris F.

Morning Chris,

Magellan Financial Group (MFG) have launched is High Conviction Trust which will invest in a concentrated portfolio of high quality companies, weighted towards the companies best ideas – their words not mine. However the track record of MFG over the years is clearly one to be admired as Hamish Douglass steers a top quality ship.

We had the Magellan team in last week running through the deal. While we can make general rather than personal comments only, the 7.5% loyalty bonus for current holders of any Magellan listed fund or the headstock (MFG) is a good deal. For those that do not currently own stock in MFG or any of their listed funds there is a priority offer available through brokers, including Shaw and Partners that will entitle those participating to a 2.5% loyalty bonus of shares. Through Shaw & Partners we can assist in applying through the priority offer. if interested, please email me on [email protected]

In terms of the loyalty offer, to receive either 7.5% or 2.5% worth of additional units in the trust, unit holders need to be on the register on the 31st December 2019. This means that unit holder can actually sell after listing at any stage, however they need to be back on the register by the 31st December to receive the bonus. While the bonus issue of units is clearly a positive and it provides a buffer from a performance perspective, I wouldn’t be surprised if there were some unintended consequences of it. For example, subscribe for units through the loyalty offer, sell after allotment - before buying back in December to be on the register by the 31st to receive bonus shares. This could potentially put some pressure on the unit price of the trust on open.

Magellan Financial Group (MFG) Chart

Question 4

“Hello Team, I was reading an article on https://www.vowfood.com/, which is into cellular agriculture. Do you have any thoughts on how to create investment exposure to cellular agriculture? Best regards Nick R.

Hi Nick,

A first for MM and one that’s going to be tough to add any great value I’m afraid. Basically cellular agriculture is food produced from the laboratory with most efforts being focused on animal products to avoid the raising and slaughtering of animals. For more background information read: https://www.cell.ag/cellular-agriculture-future-of-food/

This is a relatively new industry and the more progress which is made scientifically the greater the number of opportunities will become for investors – you may be ahead of the curve for now.

Unfortunately MM is not aware of any stocks / opportunities which offer exposure to cellular agriculture.

Question 5

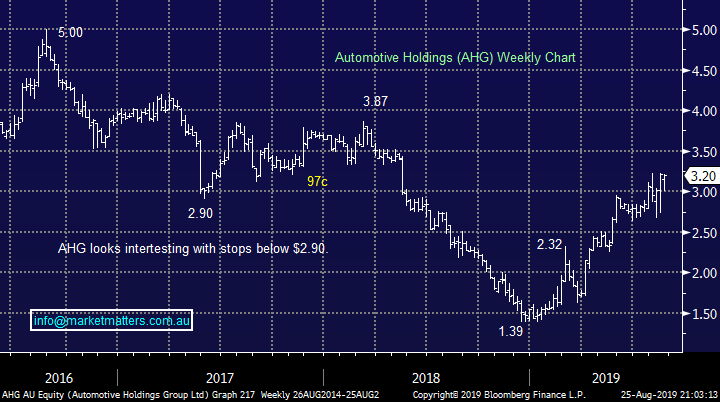

“Hi MM Team, hopefully your perpetually superior analysis will give some hints on what to do with AHG. As an AHG shareholder, every few months I get an offer to swap my AHG shares for a lesser number of APE shares. Usually taking up the offer would see me in a worse position, but this week’s latest offer of 1 APE share for every 3.6 AHG shares is closer than ever before to providing a break-even situation (given current prices). What is actually going on, and are AHG shareholders best to take up the APE offer, or just hold on to their AHG shares and take no notice of these regular offers?” - Regards, Gil

Morning Gil,

Again, making general comments only there is nothing sinister here, its simply an offer basis the $800m takeover of AHG by APE. The offer is one of APE shares for 3.6 shares in AHG. AHG shareholders are essentially swapping $11.52 worth of shares (3.6*$3.20) to get $11.57 worth of APE Shares which gives exposure to the combined / larger group.

Holders of AHG basically have 2 alternatives, either sell shares in AHG in the market at the current price in the usual manner or exchange them for shares in APE in the offer outlined.

Automotive Holdings Group (AHG) Chart

AP Eagers (APE) Chart

Question 6

“What are your thoughts on RIO shall it climb back up, and CBA?” – Tim W.

Morning Tim,

These are 2 high beta stocks which often move in the direction of the market although external factors like the iron ore price determines to what degree. I have briefly looked at them individually:

RIO Tinto Ltd (RIO) $85.

Following its 22.8% correction, which did include a $3.076 fully franked dividend, we believe RIO and the iron ore sector are positioned strongly to outperform the ASX200.

Obviously if the US-China trade war continues to escalate then any recovery will be later rather than sooner but we believe the current levels are presenting solid value.

MM likes RIO below $85.

RIO Tinto (RIO) Ltd Chart

Commonwealth Bank (CBA) $77.40

Following its 11.5% correction, which did include a $2.31 fully franked dividend, we believe CBA and the “Big Four” banks still are positioned strongly to outperform the ASX200.

Again if the US-China trade war continues to escalate then any recovery will be later rather than sooner but we believe below $76 represents solid value.

MM likes CBA below $76.

Commonwealth Bank (CBA) Chart

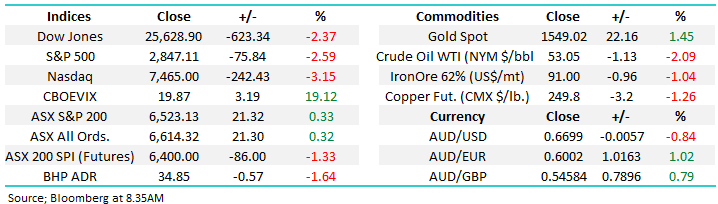

Overnight Market Matters Wrap

· Global equity markets sold off aggressively last Friday with the US Futures off over 1% as I write this morning with the US-China trade war escalating to a new level, sparking further concerns on global slowdown on economic growth.

· Metals on the LME were mixed, iron ore rose and gold is trading higher this morning atUS$1549.02/oz. Crude oil is currently sliding further, while US 10 year bonds are yielding 1.54%.

· BHP is expected to underperform the broader market after ending its US session off an equivalent of 1.64% from Australia’s previous close.

· The September SPI Futures is indicating the ASX 200 to gap 80 points lower, testing the 6445 level this morning with global macro conditions to dominate investors eyes rather than the current earnings season.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.