Subscribers questions

Morning All,

As Christmas rapidly approaches its easy to sit back and relax but historically December is an important month for the average annual investors returns. Recent questions have not surprisingly been based around our thoughts for the coming weeks / months and years. People have been reading doom and gloom for many months from a multitude of other sources but the market has remained strong creating significant investor confusion.

We are staying with our roadmap of the last 18-months, which has led us to be aggressive buyers both times the S&P500 pulled back sharply to the 1800 area:

- US stocks are now in the final "Phase 5" of the bull market advance from March 2009.

- Ideally we will see a further ~8% upside from US stocks.

- If we get a "Santa Claus" rally we at least expect a 5-10% correction in early 2017.

- When this "Phase 5" rally is complete we anticipate a significant correction of ~25%. Identifying this point in time is the million dollar question moving forward.

We used have the US stock market for our road map because it is overall clearer than the local index and the correlation with the ASX200 is extremely high – although not perfect!

US S&P500 Monthly Chart

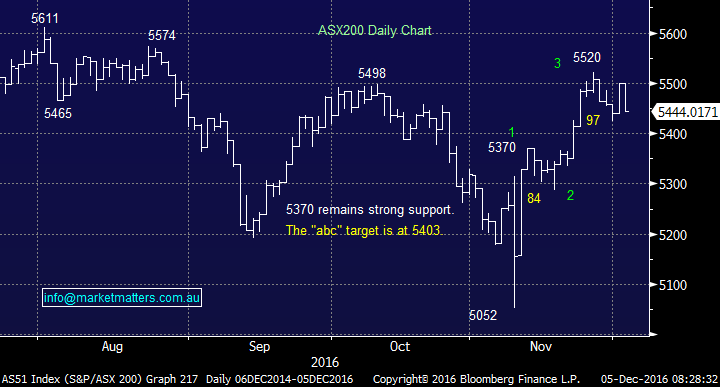

Our current preferred scenario for the ASX200 is an ongoing correction to test 5400 before a strong Christmas rally to test the 5611 high of 2016. We plan to be sellers into this advance if it unfolds.

ASX200 Daily Chart

Question 1

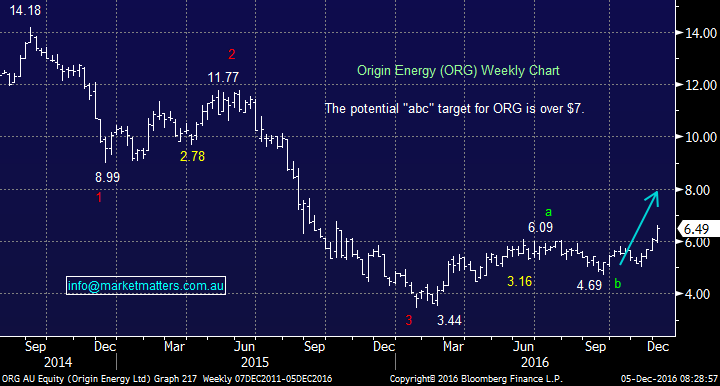

"Now the oil price has finally rallied and more importantly my Origin positioning is up, are you tempted to take profit now?" - Stephen.

Morning Stephen, the ORG ride has certainly been an interesting one as the stock rallied strongly over $6 quickly after purchase only to then correct over 20% making us question our bullish stance on oil and its related sector.

Our most recent purchase of ORG was in mid-May and the position is now up ~18% so taking profit is easy but is it wise? We still are targeting oil to test $US60/barrel and ORG $7 hence staying long makes sense here.

We are now operating stops on the ORG position under $6.09.

Origin Energy (ORG) Weekly Chart

Question 2

"Market Matters, You have discussed moving to higher cash levels anticipating a 20% decline in 2017. Are there different types of “Cash” investments that you would recommend that would return more than the paltry bank deposit interest rate?" Thanks Peter.

That's a great question Peter and one we will cover in more detail over coming weeks / months. Firstly receiving around 3% from a term deposit if the share market corrects over 20% is a very solid relative performance – so not all bad however it’s harder to put Diesel in the boat, new the tyres on the 4wd, spoil the grandkids when you need around $3.3m in cash to give you an income of 100k pa!

At MM, we provide general advice only so we’re not here to tell you what you should do, we merely provide the pro’s / cons with specific investments and present our view of them (& the market overall). If you do want some more personal advice, we’re happy to point you in the right direction.

Below we’ll look at a few areas that we’ll no doubt explore in coming reports / video updates – however it’s important to note that risk and return are very much linked. Cash is your lowest risk investment and anything that pays a higher rate has more risk.

1.Options - selling calls over a portfolio to increase yield and cover some of the downside is a good strategy when volatility picks up. This is generally known as a Covered Call Strategy and is a way for investors to monetise the perceived upside from their shares. For instance, if CBA is trading at $80, and we are happy to sell at $82, we can sell call options expiring in January and receive ~45c now. If CBA finishes in January below $82, we keep the full 45c per share and sell more options receiving another lot of premiums. If CBA closes above $82 on the 24th January (options expiry), we miss the upside on any movement above that level (although we still retain the 45c).

2. Hybrids – are listed securities which combine components of debt and equity and typically pay a floating rate yield ~6%. These are not Term Deposits however they are useful as income generating securities and in most instances will not be as volatile as shares – but it’s important to understand them first. We like some hybrid investments for income and capital stability but some have varying conditions around convertibility while others sit at different levels in a company’s capital structure. Some are perpetual (no end date) while others have a convertibility trigger at maturity. They’re somewhat complicated however they’re useful – and we like them as an asset class. For those that would like more information on the Hybrids we like, please drop us a line and we will look to provide a more in depth analysis of the sector.

3. A short Exchange Traded Fund (ETF) which benefits from a falling market. For instance the BEAR Fund by Betashares will move inversely to the ASX 200 – this is one of the simplest ways to benefit from a falling market. There are a huge range of ETFs that will track all sorts of themes. Simply put, when we have a specific view on the market there is generally a way to play it. This will no doubt feature in reports / MM positions if / when applicable over coming months / years.

4. Long - short funds, these are neutral the market but investors are backing the fund manager (s). For instance, there is a new fund currently being promoted called the Watermark Global Leaders Fund and this is market neutral where they will be short relative weakness and long relative strength, but their overall market bias will be neutral. These funds are interesting however they are typically higher cost, and are prone to periods of underperformance given a wrong call can be amplified on both the long and short side. In terms of the Watermark IPO, we covered this last week however the fees eaten up from listing and the mandate to invest the $$ in a set amount of time means we are not keen on participating in the IPO, even though a free option is on offer!

Question 3

"If you feel stocks are approaching some rocky times surely gold stocks are worth considering?" - Peter.

Our initial answer is probably but be patient! The inverse correlation between gold and global stocks is ok currently with gold stocks falling aggressively for the last 5 months while US stocks have hit fresh all-time highs.

However gold has fallen sharply, more in line with a weak bond market (interest rates rising) - this correlation is far better than with stocks. Our view is bonds fall and rates rise in the coming years hence we believe there are better places to be than the gold sector. There is likely to be bounces with gold if / when stocks do panic on the downside but if it’s because the underlying reason is around interest rates rising, any bounce may be short-lived.

Market Vectors Gold ETF Monthly Chart

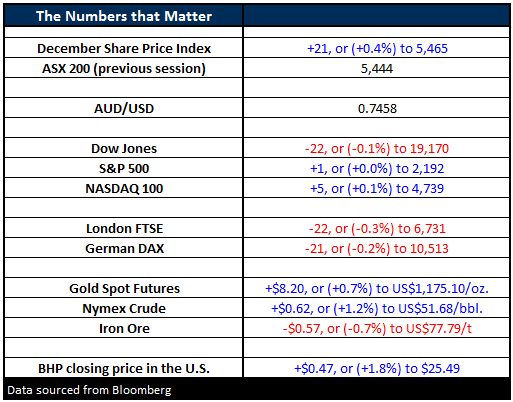

Overnight Market Matters Wrap

- A quiet session experienced in the US share markets on Friday, with the indices ending mixed. US non-farm payrolls were good, the unemployment rate fell yet so did wages. Wages are typically more volatile month to month so don’t read too much into that. US remains on track to hike rates in Dec.

- The Dow closed 22 points lower (-0.1%) at 19,170, while the S&P 500 closed 1 points higher at 2,192. For the week, the DOW was only 0.1% higher and the broader S&P 500 down 1%.

- The resource sector is likely to outperform the broader market, with crude oil climbing further to the upside, and BHP in the US up an equivalent of 1.8% higher to $25.49 from Australia’s previous close.

- The banking sector will likely be consolidated and quiet, as we wait for the RBA meeting tomorrow – no change expected

- The December SPI Futures is indicating the ASX 200 to open 18 points higher, testing the 5,460 level this morning.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 05/12/2016. 8.30AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here