Subscriber Questions (SUN, RHC, A2M, PGF, PDN)

The ASX200 is set to open up around 20-points this morning following a solid session in the US including a nice bounce by BHP which closed up almost 2% in the overseas ADR market which would regain around 2/3’s of last week’s losses. With iron ore strong on Friday night both RIO and Fortescue can also be expected to follow BHP higher.

At this stage there’s no reason to anticipate our market will break out of its entrenched 6200-6306 trading range but you never know with the slew of company reports on the horizon, CBA’s the highest profile of next week’s “show and tell time”.

- We are neutral the ASX200 while the index holds above 6140 but we remain in “sell mode” albeit in a patient manner.

Thanks again for some excellent questions this week.

ASX200 Chart

Question 1

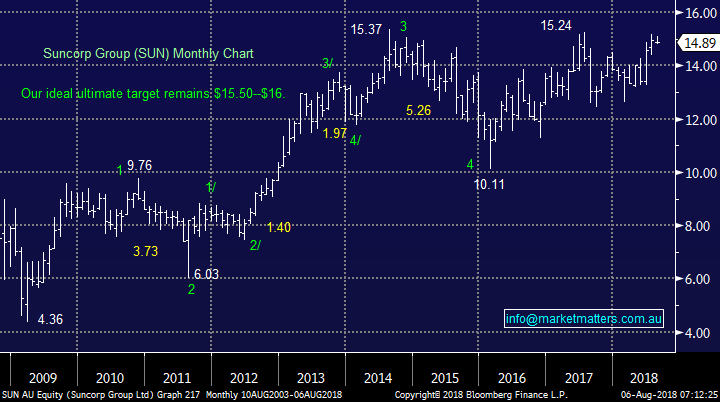

“Hi You have said you are looking to "sell Suncorp (SUN) between $15.30-$15.80 but we may reduce this large position into initial strength above $15." Are you considering the Platinum holding or both portfolios and by what percentage would you be looking at?” - Regards Bryan H.

Hi Bryan,

A very topical question with SUN reporting later in the week (Thursday – full year results)

Growth Portfolio: we intend to sell our entire 10% position between $15.30 and $15.80 assuming there are no game changing surprises in their result.

Income Portfolio: we are likely to sell at least half of our 6% position between $15.30 and $15.80 again assuming there are no game changing surprises in their result.

Remember we are in “sell mode” looking to reduce our equities exposure into market strength for both portfolios.

Suncorp (SUN) Chart

Question 2

“With MM positive on RHC I am contemplating adding it to my portfolio (once again). With RHC at $56.37 was hearted to see Morningstar gives it a 5-star rating and a fair value of $82. Was then nonplussed to see Goldman’s rate it as a sell with a target price of $49. Does MM think the large discrepancy between these two valuations is based on different attitudes to the French acquisition or does MM think there is more to it?” - Chris G.

Hi Chris,

I have not delved into both sets of analysis too deeply but it will be down to a combination of differing assumptions and timings of when the reports were out. Morningstar are the most bullish in the market however their last analysis on Bloomberg was back in January, so fairly outdated. Goldman’s is the most bearish in the market by far. Looking more widely, there are 7 buys, 4 holds and 2 sells in RHC with a consensus price target of $63.20

The risks in RHC at the moment largely centre around the Government putting pressure on private health insurers which in turn are applying pressures to the care providers such as RHC. We’re also seeing some issues in their French business which has put pressure on margins and to cap things off they are sniffing around an acquisition at the moment, which I think is actually a positive but it adds another layer of complexity. All these are shorter term factors and in our view are now in the price.

We like RHC as the largest Australian private hospital operator who enjoys the tailwinds of an ageing population and a government keen to push off some of the huge financial burden of our public health system. While there are risks from political policy week to week, especially into elections, by necessity for the government’s coffers it should be net positive to RHC over time.

RHC is trading on an est. P/E of 20.1x for 2018, well below the 23.2x of Healthscope (HSO) which has some corporate appeal in the price.

We are comfortable with our holding for now but will be watching developments carefully starting with its French acquisition which we like if they remain disciplined on price

Ramsay Healthcare (RHC) Chart

Question 3

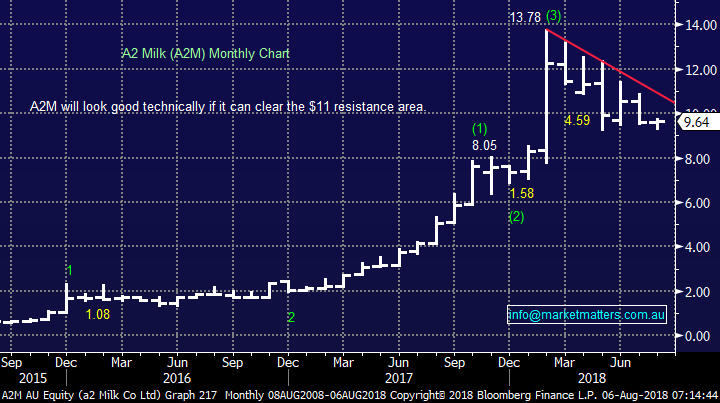

“G'Day, I have been watching A2M for a while and I see they down around $9:45, Is this a good buy right now do you think??” – Warren D.

Hi Warren,

An interesting question after our Weekend Report explaining MM’s current dislike for high growth / valuation stocks at this stage of the economic / market cycle.

We sold 50% of our position in A2M on June 21st around $11.40, the stock’s since fallen over 15%, and previously we had been considering doubling up below $9 however this has now been put on ice as we look to move away from the “growth stories”.

The stock now feels like it’s got a wall of sellers into strength as opposed to a queue of buyers into weakness – we feel it needs to report solid earnings next time up to avoid a further weakness. (Worth noting, it does have a very strong pedigree of upside surprises at earnings time overall however its volatile, having moved at least 2.5% each time its reported since 2015)

A2M is trading on a high est. 2018 P/E of 41.3x showing that a further rerating is likely if it fails to continue with its growth, primarily into China.

- We are ok with our A2M holding at present but now have no plans to increase.

A2 Milk (A2M) Chart

Question 4

“Question for Monday: PM Capital offering an LIC variant PTrackERS with guaranteed buy-back at NTA in 2025. Is that a useful innovation or prefer the vanilla version of the LIC, asx code PGF.” – Paul T.

Hi Paul,

It’s a very interesting innovation in terms of the sector generally and more specifically to those LICs trading at a discount to their assets. NTA refers to the net tangible assets of the listed investment company, or in other worlds the value of their portfolio. As it stands, PGF trades at $1.285 however as at 31st July they had a $1.4384 – pre-tax NTA value and a $1.3127 – post –tax (approx.) NTA. The post-tax NTA is the applicable one here as that is what a buy-back would occur at. So, assume in 7 years time the portfolio is valued on a post-tax basis at $1.50 per share, yet the share is only trading at $1.40, the holders would have the capacity to sell at the $1.50 mark.

This is a big topic and one we could cover in more depth, however the short answer is, the deal should ensure PTrackERS trade closer to NTA for the next 7 years, however they are unlikely (in my view) to now trade at a premium, like WAM and other well marketed LICs do. It’s a good innovation.

Question 5

“Team, firstly great comment as always. Quick question. Do you guys have any view on the Uranium sector? It seems to be getting more interest, as Tribeca is setting up a new $100m fund dedicated just to Uranium (run by Commodity specialist Guy Keller, ex Macquarie), and Paradice now has 9.9% in PDN (run by well-respected and very successful small cap manager Adam Harvey). Reason for question - China is building 208 new reactors, 10% all energy in US energy is Nuclear and Japan has just started 9 new reactors and bringing back online Tepco after 2011 disaster.” - All the best Rodney F.

Hi Rodney,

The uranium sector has been a graveyard of investment returns over the last decade. I still remember the Fukushima Daiichi nuclear disaster back on 11th March 2011, Paladin was trading then around $4.50 compared to Fridays 21c. We actually have been looking into the sector and PDN over recent weeks for a number of reasons including those you mentioned above as we scour the landscape for stocks that can rally in a struggling market PDN has collapsed in a rising market so it fits the bill.

- We like PDN around 20c and can see it at least doubling in 2018/9 BUT this is at the speculative end of town and in very high risk

Paladin Energy (PDN) Chart

Global Uranium ETF (URA) Chart

Question 6

“Dear James, this is not directly associated with financial markets, but is very much indirectly associated. The state government has announced the impending sale of its share in the Snowy Mountains Hydro Scheme. As I understand it, this represents the sale of a state-owned asset, an asset which presumably is generating income for the government, and has strong implications for almost every resident of NSW. If (when) this asset is sold, the shortfall in income will have to be made up by other means. On the other side of the equation, the purchaser is going to want to make a profit on its investment, so it is likely upwards pressure will be put on electricity prices in the state. However, the state government is not disclosing the downside but trumpeting only the anticipated benefits. Is there something I am missing? Are we being conned? I don’t know anywhere else I can get a fair and balanced analysis of the planned transaction.” - Kind Regards, John W.

Morning John,

You are taking us out of our market comfort zone and into the political arena here, not our favourite location, however you mention that the state government is not disclosing the downside but trumpeting only the anticipated benefits – sounds pretty standard on the political front I would have thought!

The idea is to sell a piece of infrastructure to someone who can run it better (more efficiently) than the Government can, and the buyer can strip out costs to generate a good return. This frees up capital for the government to spend on Schools / roads etc – other critical infrastructure. It’s called asset recycling. In terms of electricity (and in the short term) I think its unlikely electricity prices will rise much further, that would be a political hot potato.

So, the validity of the approach relies on how well they sell it, and how well they spend the proceeds.

AGL Energy Ltd (AGL) Chart

Overnight Market Matters Wrap

· The US had a breather from its recent selloff overnight, ending the session with little change across the major indices.

· Crude oil however jumped above US$70/bbl. helping the assisting the energy sector to outperform the broader market, up 1.4%. This will likely assist BHP to claw back most of its losses overnight, as the US session ended up an equivalent of 1.2% from Australia’s previous close.

· The September SPI Futures is indicating the ASX 200 to open

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 06/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here