Subscriber Questions (PPT, NCM, Z1P, MYR, FOZ, ADB, S32, WSA, SCG, SCP)

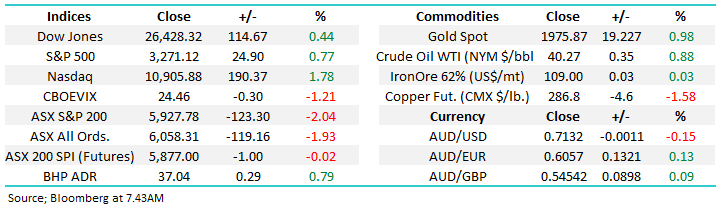

The ASX200 SPI Futures closed unchanged on Saturday morning disappointingly ignoring a strong night for US stocks, and especially heavyweight Apple which rallied over10% in the session. This week should be all about reporting season and while it probably will be on the stock level it’s the coronavirus cases in NSW and QLD which will garner the most attention on the index level. We all know that Victoria has moved into the unprecedented Stage 4 lockdown - the picture below illustrates that the situation is already are much worse than in March / April.

The economic damage to Australia is escalating at a disconcerting rate, if the massive monetary & fiscal stimulus can hold financial markets together through the next few weeks then I have to agree with the colloquial phrase “shorts are for the beach”, the bears will surely reach the end of their tether and retreat to the sidelines. However, when I also look at this accelerating number of infections in Japan it’s hard to see how countries can successfully go back to work without a vaccine for such a virulent enemy.

MM is nervous about the next few sessions after Fridays 2% plunge.

Confirmed COVID-19 cases in Australia Chart

Confirmed COVID-19 cases in Japan Chart

The SPI Futures may be calling the local market to open unchanged this morning it does feel a touch optimistic after virus news over the weekend, the world simply needs a vaccine soon. Hopefully reporting can surprise many and create a tailwind for some stocks, at least expectations aren’t particularly high with consensus expectations for FY20 earnings to fall by 15.5% at the index level, with no growth in FY21.

One thing we should remain mindful of is market bottoms are formed when things look their worst, at the moment everyone’s talking about Victoria’s Stage 4 lockdown and international travel being off the menu for the foreseeable futures but if we suddenly get a vaccine stocks should rise sharply led by the multiple laggards who are being battered by COVID-19 – never say never!

MM remains bullish Australian stocks medium-term but short-term a test ~3% lower would not surprise.

ASX200 Index Chart

Apples (AAPL US) impressive result has set an excellent platform for the relatively immune tech sector into reporting season, while Fridays low’s hold the technical picture and subsequent risk / reward looks excellent targeting fresh all-time highs in the weeks ahead.

MM likes the US tech space, targeting fresh all-time highs.

NYSE FANG+ Index Chart

Thanks as always for an excellent number of questions, they’re always appreciated as the Australian lifestyle we all love and cherish continues to be threatened by COVID-19, keep safe & be happy.

Question 1

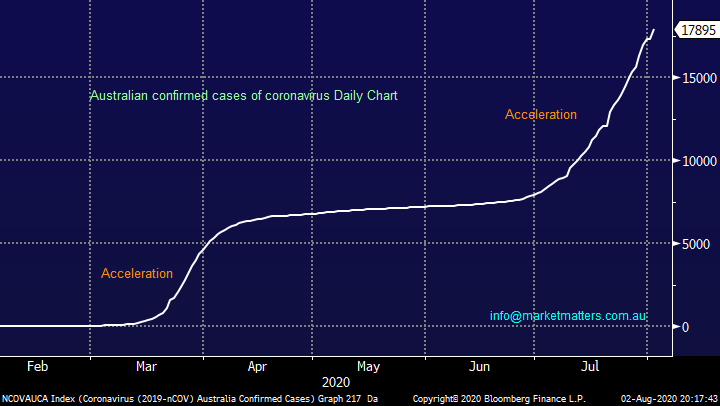

“Hi James, I like your reports but wonder why you agree the take up the Perpetual SPP at $30.30 with a likely reduction when you could ( on Friday ) buy all you wanted for less than $30. Maybe still not too late. Similar opportunities seem to occur with other SPP's and if you get set early you get all you want/need.” - Cheers Graham A.

“HI James & Team, PPT is having a share purchase plan closing 26th August 2020 at $30.30, I don’t own PPT presently. What are the chances of being able to buy the shares at the SPP price? What generally happens to the share price after the institutions and had their fill at the trough” – Gracias Indran R.

Morning All,

Investors need to read the “fine print” on the SPP, Perpetual will be offering eligible shareholders the opportunity to participate in a non-underwritten SPP up to A$30,000 each, free of any brokerage or transaction costs, targeting to raise up to A$40 million2. The issue price of shares under the SPP will be the lower of A$30.30 per SPP Share, being the Offer Price; and the 5 day VWAP of Perpetual shares up to and including the closing date of the SPP (currently scheduled for Wednesday, 26 August 2020) less a 2% discount, rounded to the nearest cent.

Approaching $30bn has been raised since March obviously primarily to support companies after COVID-19, so far investors have been supportive of raises illustrating the large volume of cash on the sidelines. For those tempted by PPT the statistic quoted in the AFR this morning should add a degree of confidence – the return on raisings in May / June is almost 60% but we should caution that the equity market was rallying during the time.

MM likes PPT around $30 following their acquisition.

Perpetual (PPT) Chart.

Question 2

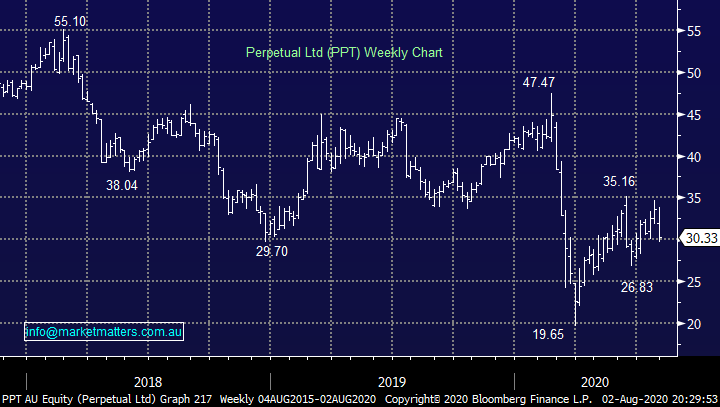

“Hi, I am wanting to purchase USD (not cash) when it reaches my entry point, hold it, and then sell in the future when it falls below my purchase price. Can you suggest the best way to do this please.” - Cheers Peter W.

“Some weeks ago, you gave good advice on buying ETFs that benefit from a declining USD vs a rising AUD. I have mislaid that information and would be grateful if you could reprint it Monday. Thanks also for the Retail Report. Excellent stuff.” - Thanks Chris G.

Morning Guys,

I’m not sure the wording of the first question is correct as it implies you will lose money hence I have just focused on how to “play” the weakening $US - its already declined ~10% from the high of 2020, certainly no safe haven bid tone at this stage. There are a number of ways to implement a position looking to benefit from a declining $US, or rising $A. The 3 obvious ones are:

1 – A futures contract which is generally used by the more sophisticated/ professional investor.

2 – An FX position which is also generally used by the more sophisticated/ professional investor.

3 – An ETF which can traded / invested in a very similar manner to a stock but like the above 2 certainly requires a degree of understanding. Two we like at MM are the Invesco $A Trust (FAX US) which has a market cap of $US143m and is traded in the US and the smaller BetaShares Strong $A (AUDS) which is traded locally which makes it easier to transact, but note it is leveraged by around 2.4x.

MM remains bearish the $US.

$US Index Chart

Question 3

“Hi James Love your service and analysis, particularly enjoy reading your macro views. It's keeping me on the right side of the trade at the moment. Just wondering if you have ever considered adding an Options portfolio to your service? Not necessarily complex strategies, but just simple cash secured puts on stocks you would be happy to own, or covered calls to reduce cost basis. I think of NCM as classic case in point. I bought some stock at $33 but will recent spike up in last few days I wish I had bought more. So, rather than chase I just sold cash secured puts at $34.50 strike. If i get put the stock, my effective entry is below $33. If i don't get put the stock, then at least i get to keep the options premium and will continue to sell more as the stock rises. I appreciate that not many of your subscribers would be options traders, particularly on the ASX where liquidity is not very good, but I think this would make an excellent additional to your already fine service. Just wondered if is something that could be on your future roadmap? Many thanks Alex P.

Hi Alex,

Through Shaw, I use options regularly in portfolios however its unlikely to be something that we focus on at MM in the next 12 month or so, but never say never. We are in the midst of a major upgrade to the MM service and as part of that we are launching a new portfolio focussing on Emerging Companies, smaller and mid-cap companies with a growth mindset. They’ll also be some slight tweaks around how we communicate our portfolio views with a specific portfolio report each week, plus we hope they’ll be more clarity around our specific stock views through dedicated stock pages on the website. Theoretically, subscribers could extend those into trading whatever vehicle they choose, Options, CFDs, Stocks, Warrants etc.

As always we are interested to hear from subscribers areas that would be of interest to them.

Newcrest Mining (NCM) Chart

Question 4

“Hi James, Question 3 last week: Hold until the company is wound up and the shares are worthless. The value of longs = zero and the value of shorts = zero. If that is the case, what is the incentive for a buyer of the shorts when the value falls to zero?” – Thanks Sidney H.

Morning Sydney,

As we mentioned before the “shorters” have be definition borrowed and need to give it back to the actual holder with one obvious incentive being the ability to crystallise / reconcile the profit in a timely way. Holding for a wind up can take an extended period of time.

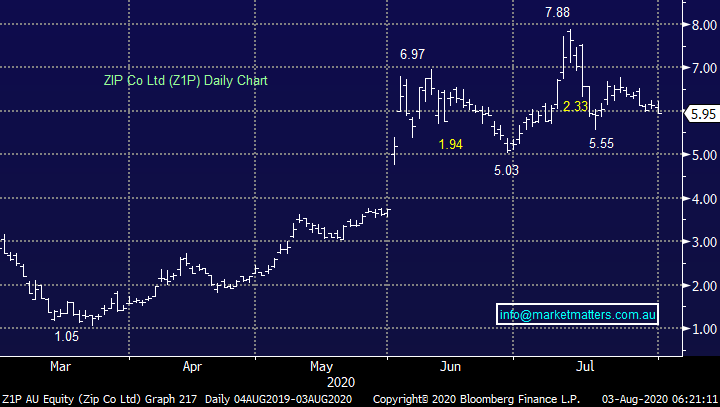

We hold Zip Co (Z1P) in our Growth Portfolio which one of the most shorted stock on the ASX, we are hoping this is an example where the traders have it wrong.

Zip Co Ltd (Z1P) Chart

Question 5

“Hi, I’m a new member (joined as a regular today ). Very impressed with MMs knowledge & approach to the stock market. I have one question regarding the above. Many big Chinese Tech stocks are migrating to the HKSE & a new tech index has just been formed. Is there any way we can invest in that index via an ETF or has one been created yet?” - Thanks & keep up the good work. Regards Clifford L.

Hi Clifford,

Welcome on board! We actually like the Chinese tech space and believe it will help contribute to outperformance of the Shenzhen CSI 300 Index which we have talked about recently. In the Weekend Report we identified the unleveraged iShares MSCI China ETF (MCHI US) as a good vehicle to play a bullish outlook for Chinese stocks.

In the US the Invesco China Technology ETF (CQQQ US) is a great product with a market cap of $US892m – Tencent Holdings (700 HK) makes up over 10% of this ETF.

In terms of the new tech index you mention, I haven’t yet seen an ETF that directly tracks this (yet).

MM is bullish the Chinese market.

China’s Shenzhen CSI 300 Index Chart

Question 6

“MYR is as much Australian as BHP. And yet whilst BHP pushes ahead powerfully, MYR has been in the doldrums for a no of years. What is the future for MYR (& indirectly high end retail in Aust)?” – Peter P.

Morning Peter,

We covered Myer and the broader retail space in a Webinar last week – for those subscribers that may have missed it, you can see a recorded version here.

Myer unfortunately may have very little in the way of future as its share price illustrates. The company has clearly missed the boat in terms of a game changing e-commerce platform while COVID-19 is challenging the very existence of the average shopping centre – our view is the quality destinations will survive and probably thrive but how Myer (MYR) can improve its footprint is questionable. Sorry this may be another household Australian name to follow companies like Qintex, Gowings and Bond Corp into the history books.

MM has no interest in Myer.

Myer Holdings (MYR) Chart

Question 7

“FZO Quarterly Update - FYI James… good qtrly costs coming down. Always a lag in cash receipts with new signs ups…” - Kind regards, Mark B.

Hi Mark,

Family Zone Cyber Safety Ltd (FZO) is an Australian cloud based parental control business – certainly a hot topic in today’s environment.

The latest announcement simply just rounded-out the quarter with an update on cash flows. This better-than-expected result was driven by impressive management of expenses, with cash overheads +20% YoY against receipt growth of 65% - staff costs + admin of $2m were particularly impressive vs our forecasts of $2.6m. We feel this result finally demonstrated the operating leverage in FZO's business is starting to come through.

MM likes FZO with stops below 29c.

Family Zone Cyber Safety Ltd (FZO) Chart

Question 8

“Hi Team, Thanks for all the great insights during this crazy period. A question for Monday. Hoping you might be able to offer a view of Audinate (AD8) at current levels and whether their SPP @ $5.15 is good value? They were well tipped at the start of the year from much higher levels.” – Cheers Steven M.

Hi Steven,

Audinate Group (AD8) is a leading software business which offers audio visual solutions, we listed AD8 through an IPO at Shaw and Partners back in 2017 and have their products throughout our office. As you mentioned, they recently raised capital for growth however one aspect that struck me about this was the higher cash burn that is occurring at the moment. We think the backdrop for AD8 gets harder from here and while it’s a quality business with quality products, we think we’ll be able to buy it cheaper than the $5.15 raise price.

MM is neutral / negative AD8 at current levels.

Audinate Group (AD8) Chart

Question 9

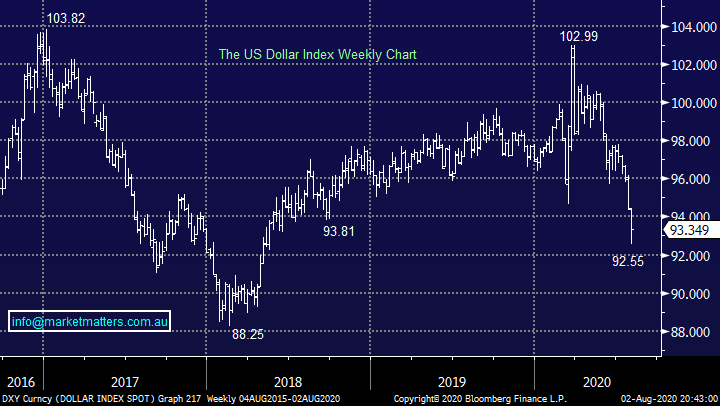

“Please advise where your DOW result of close at 26539.57 in this morning’s MM Morning Report.” - Thanks...Geoff S.

Morning Geoff,

We get all our prices from Bloomberg, the chart of which is shown below.

MM is bullish the Dow medium-term.

US Dow Jones Daily Chart) Chart

Question 10

“Dear MM, just writing to get your take on where S32 sits in the parking lot? I know it has been one you have been watching over the course of the year.” – Cheers Paul A

Hi Paul,

South32 (32) continues to underperform the market and the resources sector and until the coal price at least stabilises S32 looks destined to struggle compared to its peers – at present S32 doesn’t feel “cheap” enough to attract our money but we will continue to monitor closely. Its important to remember that with the huge movement away from fossil fuels there remains plenty of sellers around.

MM is still “watching” S32.

South32 (S32) Chart

Question 11

“Hi James, Thanks for your ongoing contribution to our investment needs. Just wanted to know if there was any particular reason for WSA dramatic dip today.” - Regards Errol K.

Hi Errol,

Western Areas (WSA) is a high beta resource stock therefore it can move more than the market. Friday was a ‘risk off’ day and growth-related sectors were hit hardest. They released a quarterly update on the 24th July and there were some very mixed reactions to it from brokers, the most highly rated analyst on the stock in Bloomberg is Hayden Bairstow from Macquarie who cut his price target on the back of the update by 7% to $2.80.

MM remains bullish Western Areas (WSA) & Resources Sector.

Western Areas (WSA) Chart

Question 12

“Message: Thank you for the commentary. What is the relative outlook for SCG (Scentre Group) and SCP (Shopping Centres Australasia Property Group) over the next 6-12 months? Regards Ram H.

Hi Ram,

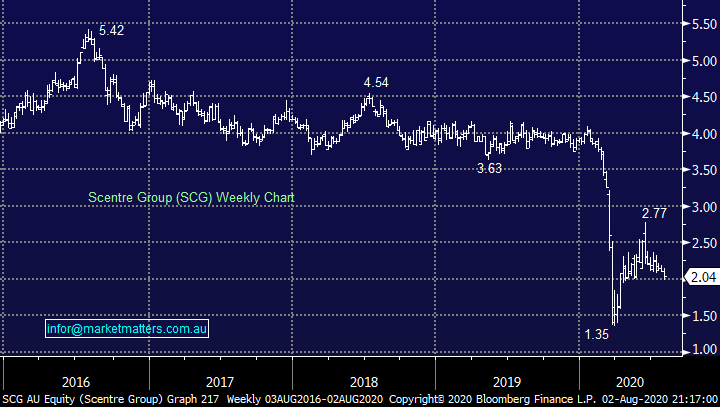

Scentre Group (SCG) and Shopping Centres Australasia Property Group (SCP) are in the eye of both the e-commerce revolution and COVID-19 pandemic, we’ve been very cautious on both over the year but things can get too pessimistic when the news is at its worst. Another aggressive spike lower in either stock will put them on our radar, especially for our Income Portfolio. I think SCG in particular may need to raise capital, and we’d suggest caution until that occurred.

MM is watching them both closely.

Scentre Group (SCG) Chart

Shopping Centres Australasia (SCP) Chart

Question 13

“You mention that Friday's market was a sea of red and that shareholders had fled to defensive assets. What are these defensive assets? Hard to imagine where all the cash would have gone to.” – Sandy B.

Hi Sandy,

Sorry the comment was a touch of a throw away line but gold and government bonds do remain firm, some investors have clearly been moving down the risk curve – MM even increased cash levels earlier in the week.

MM is cautious equities short-term.

Gold $US/oz Chart

Question 14

“I am new and looking for some help on what company's I should start investing in” – Alex N.

Hi Alex,

Obviously, there are many considerations to take into account and at MM, we simply write about the market and our own portfolio’s in general terms i.e. not specific to anyone’s individual circumstances. From our own perspective, we like to hold a mix of positions and manage our exposures from a portfolio perspective, rather than just targeting one or two stocks.

The MM Portfolios – here – are a good place to start. Importantly, I would always advocate starting slowly and maintaining cash levels which afford flexibility as opposed to leaving ones self-open to fear when stocks do inevitably endure pullbacks.

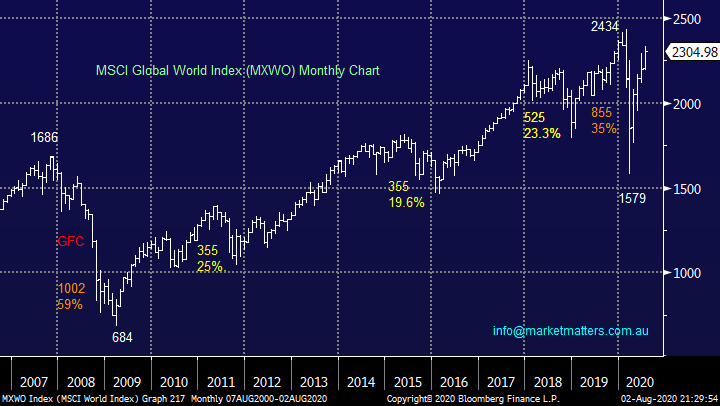

MM is a long-term believer in equities as an investment vehicle.

MSCI World Index) Chart

Have a great day & week!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.