Subscriber Questions (CGF, AAD)

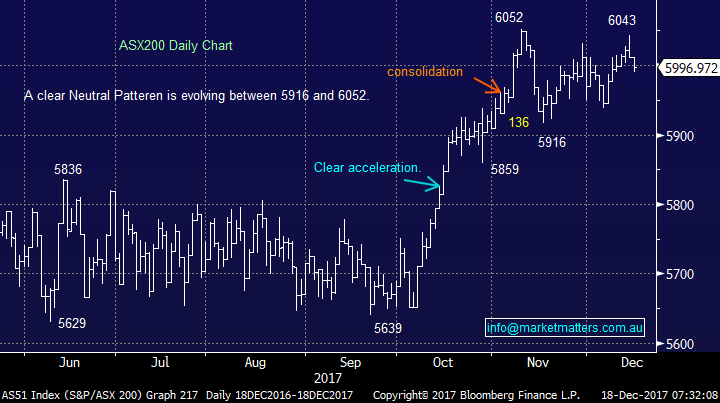

The ASX200 remains in its seasonally strongest period of the year but this December we are only up 27-points / 0.45% to-date. We’ve received some positive leads from overseas markets on Friday night plus the Liberals victory in the Bennelong by-election should help the local market this morning with the futures market pointing to a 35-point rally on the open – it feels like now or never to us for this Christmas / window-dressing rally.

Assuming we simply see an average December to see out 2017 then the ASX200 should reach 6125 in the coming 2-weeks i.e. a gain of +2.5% in December. Our “Gut Feel” at MM is still the ASX200 will say goodbye to 2017 around the 6150 level i.e. this would be an impressive +8.6% gain for the year.

This week we have again received an excellent group of questions and we’ve covered 4 in this morning’s report, as always please keep them coming!

ASX200 Daily Chart

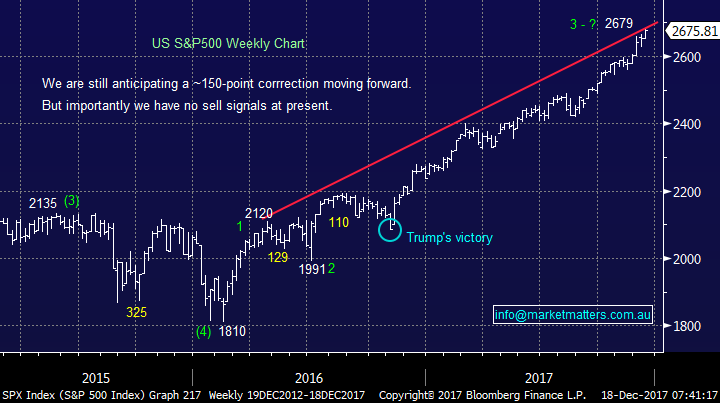

No change, we still believe the US S&P500 is “looking for a top” but following a number of failed attempts on the downside further “choppy” strength into Christmas now feels likely to complete an impressive multi-month rally with a 5-7% correction likely to follow.

On balance if we were specifically looking at US stocks we would continue to increase our cash levels in anticipation of a reasonable correction.

US S&P500 Weekly Chart

Question 1

“Morning James & Co., I see you are having over a 2-week break from Friday which I thinks a great idea as we all need to recharge the batteries but there are a number of market trading days between 22/12 and the 8/1/18, what happens if a sell / buying opportunity arises then? Especially as you are considering increasing cash levels!” – Thanks Matt H.

Morning Matt, thanks a timely question and one I was going to answer towards the end of this week. Firstly, you are 100% correct, we are wearing our “sellers hat” looking to increase our cash levels into 2018 for both the Platinum and Income Portfolio’s.As we have said over recent weeks the ideal topside level for the AX200 is around 6150, or 2.5% higher, this is very achievable considering the seasonal characteristics of December. Today I will answer your question in simple bullet form:

- During the Christmas period (22nd Dec - 8th Jan) MM will still send out alerts if / when we transact for either of our portfolios.

- We will still send out short reports if market movements deem it necessary.

- We will send out our annual forecast / best ideas report to start of the exciting new year – we’ve had some corkers over recent years!

Importantly, we will have an eye on our Bloomberg’s over the break and will continue to update you should the need arise. I’ll touch on this again later in the week.

ASX200 Weekly Chart

US S&P500 Quarterly Chart

Question 2

“Hello, as I have just joined MM, this is my first question. MM recently exited Challenger, to me it looks like it is getting to the 262% level of Elliott wave 3/5 at $14.38. is this one of the reasons MM exited recently??or were your other rules met.it has had a good run from it’s low $11.51 on 16/8/17, just wondering your thoughts on CGF” – thanks Tim C.

Morning Tim, thanks for the question, selling such a popular stock as Challenger (CGF) always raises a few eyebrows but remember things always do look the best around a top.

Firstly, when we sold CGF for a nice quick 15% profit it was simply following our plan at the very beginning i.e. we started “stalking” the purchase of CGF during the 16% pullback from $13.82. The initial plan was to buy around $11.50 but we finally had to pay up for it, the second part of the plan was to take profit close to all-time highs ~$14.

Secondly, the reasons why! We like CGF as a business with the global population ageing which increases the demand for certain cash income such as annuities during retirement, good growth, good recent ‘tweaking’ of their business towards higher margin products and of course overseas expansion were all things we liked – and of course, the technical picture as you mentioned was supportive. CGF has been in a clear uptrend since 2012/3 and we were looking for one final pop over $14 to complete this advance. Whichever wave count you apply to CGF, a subjective method of interpreting charts, we feel the strong likelihood is that MM will again be able to re-enter CGF close to $11.50 – this coincides with our view that global stocks will have a 5-7% correction in 2018.

Challenger (CGF) Monthly Chart

Question 3

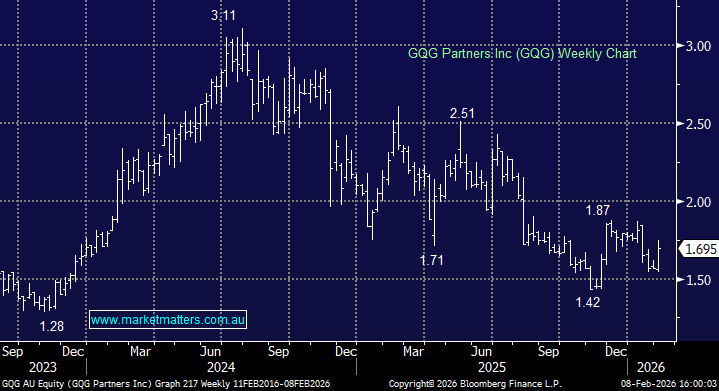

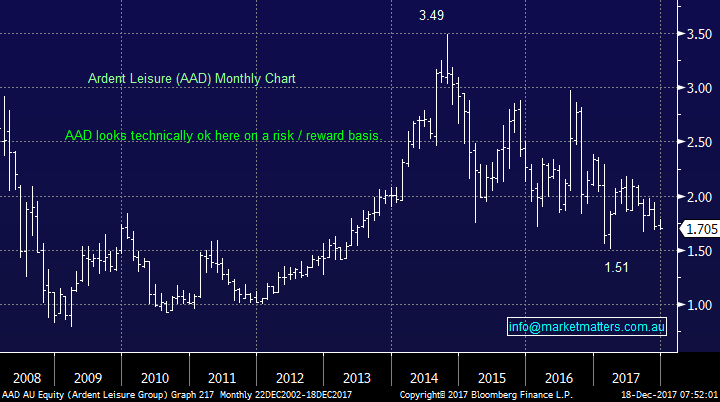

“Hi guys, just a question about AAD. you have recommended AAD a while ago under $2.00 I have bought them at $1.75 are they still a hold or should I get rid of them, seems like there struggling a little bit.” - Thanks Bill B.

Hi Bill, thanks for the question which raises a couple of interesting points.

Ardent Leisure (AAD) shares have certainly not recovered from the damage of the Dreamworld disaster which has seen the demise of 2 CEO’s. However, With tourism in Australia improving, the Queensland Commonwealth Games approaching and the Dreamworld disaster over a year behind us the future is looking better for AAD. We don’t mind AAD as a speculative buy at current levels however it’s unlikely that we would put in either of our portfolios.

Ardent Leisure (AAD) Monthly Chart

Question 4

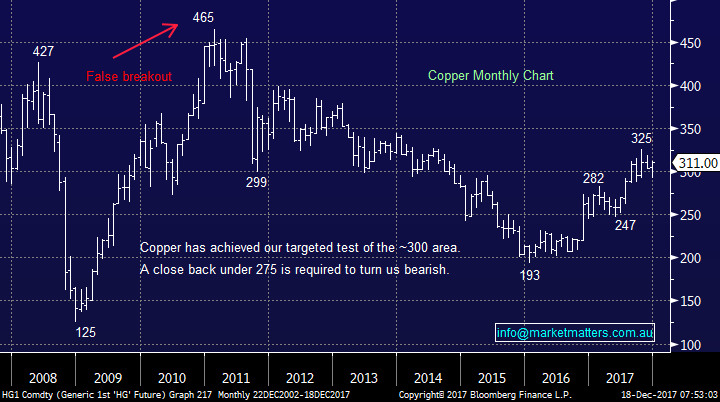

“Morning James, I think copper looks headed towards $US330/lb, I assume this fits with your bullish outlook on resources over coming weeks?.” - Thanks Nick W.

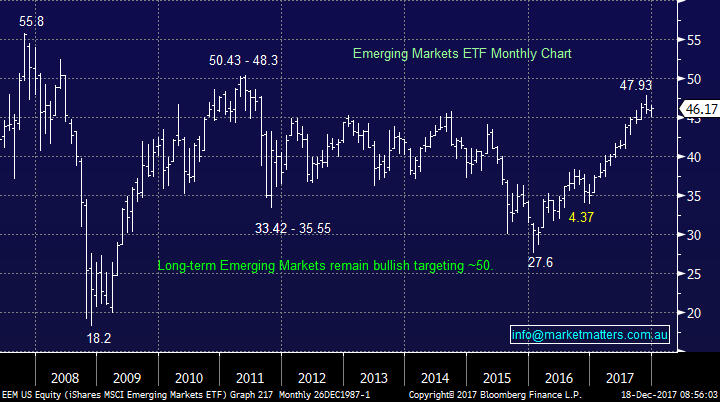

Morning Ian, absolutely! Our current short-term bullish view also coincides with how we see the highly correlated Emerging Markets trading over the coming weeks. We are targeting resource stocks to rally strongly over coming weeks to provide excellent selling opportunities into 2018.

NB If resource markets do rally we do expect to pull the trigger on our planned selling.

Copper Monthly Chart

Emerging Markets ETF Monthly Chart

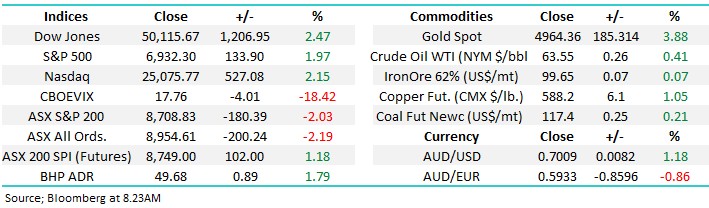

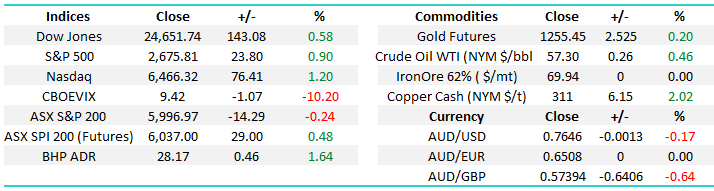

Overnight Market Matters Wrap

· The US share markets ended last Friday in positive territory, as investors gain further confidence of the benefits with the anticipated tax cut plan.

· The iron ore names are expected to outperform the broader market, with BHP in the US ending its session up an equivalent of 1.54% from Australia’s previous close. The M&A activity continues to grow before the year wraps up, with Oracle agreeing to buy Aconnex (ACX) at $7.80/ share, a whopping 47% premium of its last close of $5.29.

· The Christmas Rally is expected to begin with the December SPI Futures is indicating the ASX 200 to start the week up 40 points towards the 6035 level this morning with a quiet and lower volume trading expected to commence this week.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/12/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here