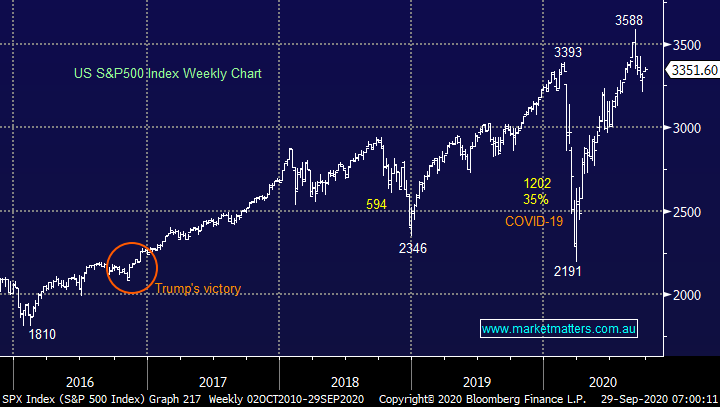

Stocks / sectors to consider for a Trump, or Biden victory (A2M, CTD, ASB, LLC, SGR)

On Monday the ASX200 failed to follow through on Fridays gains even with ~60% of the index closing up on the day, plus other Asian indices rallying - the local issue was more a case of lethargy as opposed to noticeable selling. Overall considering the last 3-months we shouldn’t be too surprised as chasing the index through the psychological 6000 area has proven unprofitable on a number of occasions. Only the IT Sector made any noticeable headway on the day led by EML Payments (EML), Afterpay Ltd (APT) and Nearmap Ltd (NEA) who averaged a gain of almost 6%.

The rotation we’ve been anticipating from Resources to Tech continues to unfold on cue, at this rate we’ll be switching back after just 7-10 days as opposed to the 3-4 weeks we originally envisaged. However, at this stage patience remains a virtue, on the stock level we’re still looking for at least another ~10% from the likes of Z1P Co (Z1P) and Megaport (MP1). The strong gains in the US overnight were across the board but it was encouraging from a local index perspective to also see the Energy & Banking Sectors advance by well over 2%, another test of 6000 looks likely this morning.

Elsewhere the Building Sector enjoyed a great start to the week with Boral (BLD) surging almost 6%, which makes it a gain of +15.5% for the month. This is one sector MM would like more exposure but we’re very conscious of being sucked into the “Fear of Missing Out” (FOMO). Basically, our Growth Portfolio is fully committed to the market hence any further purchases will only be through stock / sector rotation, another potential option if / when the tech stocks reach our target areas.

MM remains bullish the ASX200 short-term.

ASX200 Index Chart

Previous highflyer a2 Milk (A2M) was the worst performing stock on the main bourse yesterday falling over 11% following a market update for FY21. The rhetoric while not surprising in many areas did reiterate the mounting headwinds ahead for the business, primarily from COVID-19 disruptions to the daigou resellers channel which has become a huge 30% of the company’s annual revenue. Its important for investors to remember this NZ business is still priced for growth, albeit at more reasonable levels following its 25% correction.

Disconcertingly 3 major insiders sold stock in August, at much higher levels than todays close – human nature of “Fear & Greed” makes it rare that directors “dump” large parcels of shares if they see a great 12-months ahead. Technically A2M also looks vulnerable to further weakness back towards $12.

MM is neutral / bearish A2M at current levels.

A2 Milk (A2M) Chart

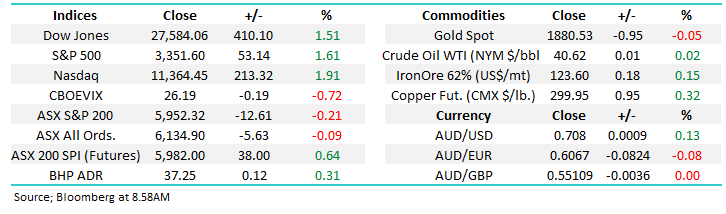

Elsewhere on the stock level Corporate Travel (CTD) entered a trading halt yesterday as it prepares to raise $375m to buy Omaha based Travel & Transport, my initial feeling is what a great time to be acquiring businesses in this sector. The synergy in the takeover on the surface is also solid as the US company provides business customers with travel management services – how refreshing to see an Australian company buying as opposed to being bought. Any dip following the raise might provide an opportunity into this recovery stock – watch this space.

MM likes CTD at current levels.

Corporate Travel (CTD) Chart

Overseas Indices & markets

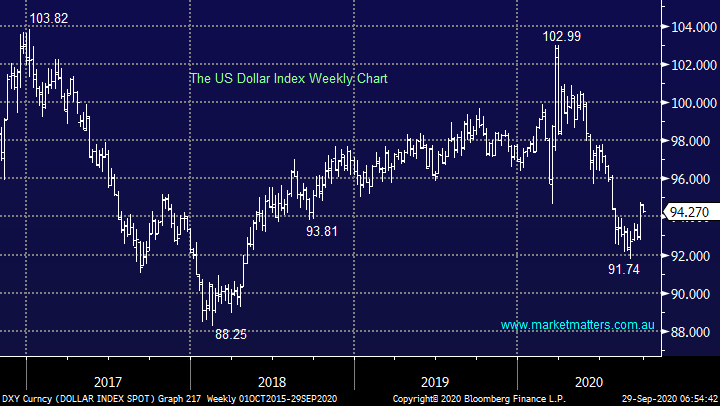

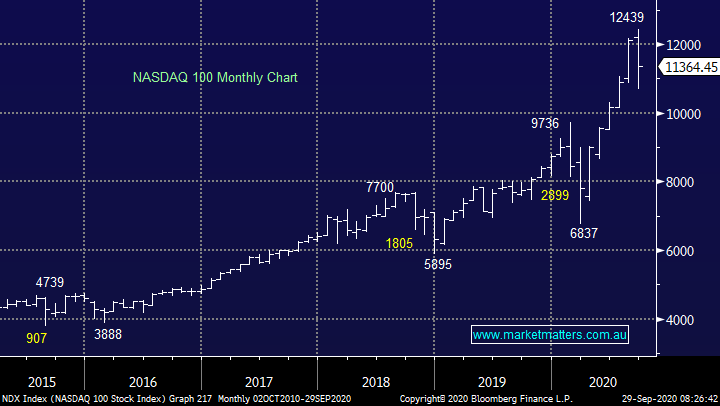

Overnight US stocks enjoyed strong gains which should provide an excellent lead for the ASX, especially as the Banking Sector was best on ground although on the index level the tech based NASDAQ stood out gaining almost 2% with heavyweight Apple Inc (AAPL US) up another +2.4%. Investors should at the very least remain mindful as markets head into October that seasonally this is the strongest month of the year.

MM now believes that US stocks have found a low.

US NASDAQ Index Chart

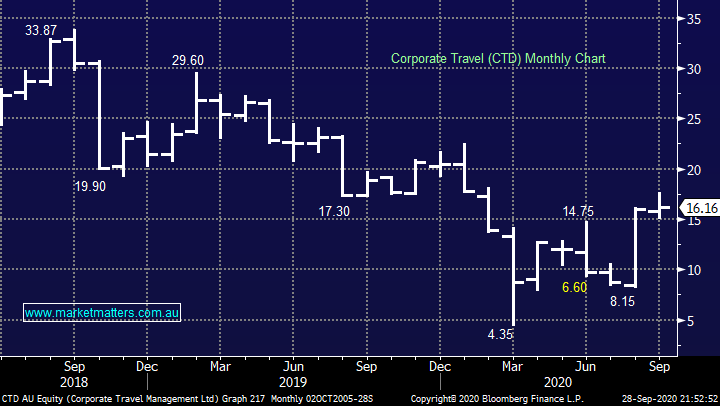

Recent comments from the Fed have given the $US a leg up into its targeted 94-94.5 resistance area, if we are correct this advance will fail and gains will be reversed, last night’s reversal may have been the start of the decline. The implications to MM of such a move played out last night exactly as we expect:

1 – Precious metals and other commodities rallied – last week MM averaged our Silver position via the (ETPMAG) which should bounce strongly this morning.

2 – A weak $US has largely been supportive of US equities which coincides with our bullish outlook into October – the Dow popped over 400-points to kick off their week.

MM remains bearish the $US into Christmas looking for a further ~5% downside.

$US Index Chart

What stocks / sectors will benefit from a Trump or Biden victory.

Personal politics aside we have a US election early next month which the bookies are telling us is very close as Trump attempts to narrow the gap – this morning Sportsbet has Joe Biden favourite at $1.75 followed by Trump at $2.1 as we head into the debates. There are a number of different potential outcomes and by definition interpretations of such results, unfortunately the only certainty is the winner will have to deal with a country struggling with ~200,000 deaths from COVID-19 plus an economy having witnessed a record drop in GDP plus soaring unemployment.

Today’s report is deliberately kept simple and concise so subscribers will comprehend our logic over the coming weeks as November 3rd looms fast. Remember after Trumps first victory and BREXIT polls / betting odds should definitely not be regarded as set in stone.

We believe the stock market will primarily react to who controls the Senate, not necessarily the headline the press will focus on:

1 – If Trump wins, the Republicans hold the Senate and Democrats remain in control of the House we expect a small rally as uncertainty is removed – investors will expect the pro-business environment to be maintained but China relations may deteriorate further.

2 – If Biden wins, the Democrats take the Senate and hold the House we envisage at least an initial ~5% spike lower, a move echoed in history from this outcome however importantly the market usually recovers extremely well after a tough November i.e. buy the weakness.

3 – Biden winning but the Republicans holding the Senate is regarded as many as the most likely and best for equities as it would hinder the new president’s ability to implement his new policies such as undo Trumps cut to corporate tax and general deregulation but relations with China might improve.

4 - The wildcard of a delayed / disputed result is comparable to 2000 when the S&P500 fell 10% by the end of November – NOT good for stocks.

Not surprisingly MM expects volatility to increase in the months ahead but by definition with this comes opportunity for the prepared investor. Simple mathematics tells me if we see a strong rally in October increase cash levels in case, we see either scenarios 2 or 4 unfolding makes sense as it would afford investors the flexibility to buy a likely pullback in stocks.

MM is anticipating elevated volatility in Q4 of 2020.

US S&P500 Index Chart

Scenario 1 – no change.

If Donald Trump can again surprise the polls and win re-election MM expects markets to embrace the result, at least short-term. The current consensus is the outcome will favour Tech, Financials & Defence but not Retail. However, we just believe it’s likely to be largely more of the same but an important eye should be cast towards US – China relations, another potential concern for companies like A2M we mentioned earlier.

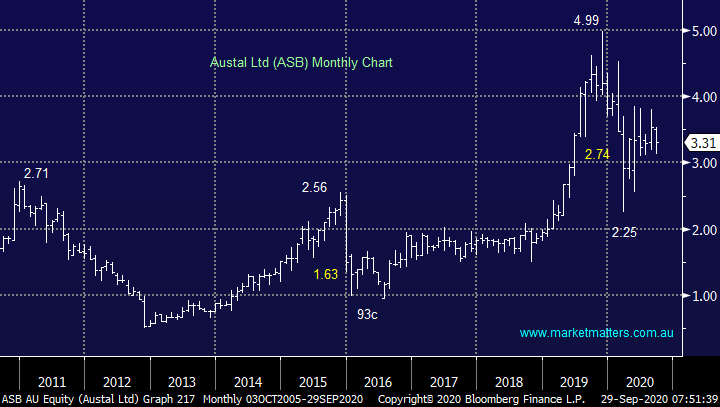

One stock which is interesting MM if Trump wins is emerging defence contractor Austal (ASB) which delivered solid results in August including a 13% increase in revenue for the full year to over $2bn.

MM likes the risk / reward on ASB around $3.

Austal Ltd (ASB) Chart

Scenario 2 – A Biden & Democrats clean sweep

An interesting scenario where stock markets worry about a Democrat President, but the historical performance of stocks says they should be dancing in the streets after an initial knee jerk lower. If this scenario eventuates, we like Infrastructure and renewable energy at the expense of Tech and Healthcare which are likely to come under increased regulatory scrutiny. MM is long construction goliath LLC looking for an increase in local and international infrastructure spending but a $310m loss in FY20 is currently weighing on the share price, a few new contracts and a general global economic turnaround is what the company obviously requires.

MM likes LLC below $12.

Lend Lease (LLC) Chart

Scenario 3, Biden wins & Republicans hold Senate.

A split congress might surprise many to know is historically the best outcome for stocks as it maintains balance ensuring one party cannot become too extreme, historically a dividend congress usually leads to ~4% outperformance. From a local market perspective I would be looking for opportunities / value in stocks who have been sold off around fears of global- US relations with China e.g. exporters like A2M and Treasury Wines (TWE) plus the Education and Tourism Sectors.

Our current preferred pick is currently casino operator Star Entertainment (SGR) where we see 20-30% upside.

MM is bullish & long SGR.

Star Entertainment (SGR) Chart

Scenario 4, disputed result

The “yuk” scenario and while its been over 20-years since this occurred there are plenty of noises around that it could happen again, in November of 2000 the NASDAQ plunged ~20% as the result went to the Supreme Court for a decision. Simply never say never and as we said earlier this is one of two scenarios that’s likely to see a knee-jerk lower in November – note a comparable drop in tech today as 20-years ago still only tests NASDAQ’s pre-COVID highs.

MM is keen on flexibility in November.

US NASDAQ Index Chart

Conclusion

MM hasn’t unfortunately got a crystal ball hence we believe the best course of action into the election is to carry both a degree of flexibility and a well thought out plan – above is our bare bones version at this stage.

It’s also worth remembering that politics are not the main driver of markets over time, markets have rallied with many different combinations

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.