Sifting through the debris

Yesterday was probably our toughest day since the inception of MM, as we saw one of our holdings Vocus (VOC) plummet over 20%, courtesy of a poor update. Simply another story of a local company failing to merge / takeover another business in a successful manner over the short-term. The trend of underestimating how hard the implementation becomes in reality, appears ingrained in companies within the ASX200 - a potential warning to Boral investors in recent days.

Vocus came out with an updated net profit forecast of $205-$215 million, coming from underlying EBITDA (earnings before interest, tax, depreciation and amortisation) which was 7% below forecast expectations. The stock has now collapsed ~50% in the last few months, as the Telco space is clearly out of favour and the market has no confidence in their guidance moving forward. It's hard to imagine that VOC raised $650m at $7.55 only a few months ago to buy Nextgen.

The big question remains, should we walk away from this nightmare or does it represent the best chance of improving by 10-20% from the current stocks we are watching. Unfortunately it's hard to imagine it rallying hard without news, so any bounce back over $5 will be considered an opportunity to reduce our exposure. Today we are going to look at 2 other potentially aggressive plays where this capital could be allocated – it’s common practice to have 10-15% of a portfolio in more aggressive plays and our money in VOC has by definition taken this role.

**We will have a video update to subscribers out today detailing, in more depth our views on Vocus**

Vocus Communications (VOC) Weekly

- Vita Group (VTG) $3.00

VTG is a telecommunications retailer, which currently runs 103 Telstra stores. VTG has had a poor year even after signing a new deal with Telstra, but there lies its risk - the dependency it has on Telstra. The stock is now trading on a P/E of ~12x and pays an attractive 4.66% fully franked dividend.

We are buyers of VTG around the $2.50-60 region, where we perceive the potential returns outweigh the risks.

Vita Group (VTG)_Daily Chart

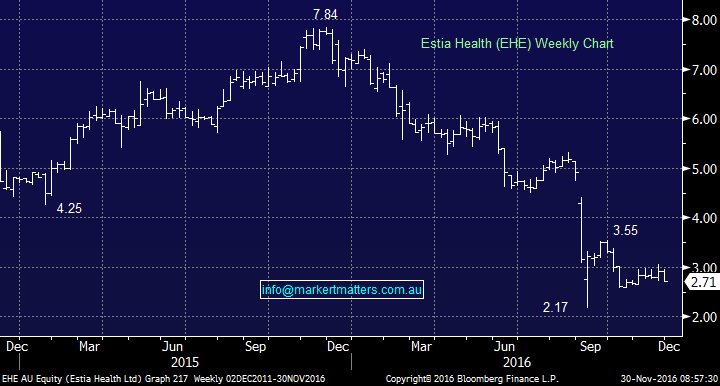

2.Estia Health (EHE) $2.71

We have been watching EHE for a few months now as the stock continues to struggle. The aged care operator is strained at present, with a debt mountain close to $300m and very importantly, it has a $330m debt ceiling. Why the company recently announced a dividend equating to $19.3m, we have no idea - perhaps the directors need some cash!

We still like aged care as a sector for obvious reasons, but to buy into EHE we want better entry given its current debt pile. This is a very volatile stock which fell 6.5% yesterday. We are buyers of EHE between $2 and $2.10.

Estia Health (EHE) Weekly Chart

Summary

- We are going to stick with our VOC position over coming days and constantly re-evaluate.

- We think the longer term picture for the company remains sound, and for those without a position, or a smaller allocation and a high risk tolerance can buy / average here

- If the two above mentioned stocks (EHE or VTG) come back into our identified buy zones, we may look to reduce our holding in Vocus by 50% allocating the capital into one of these stocks; EHE around $2.10 and VTG ~$2.50-2.60.

*Watch for alerts.

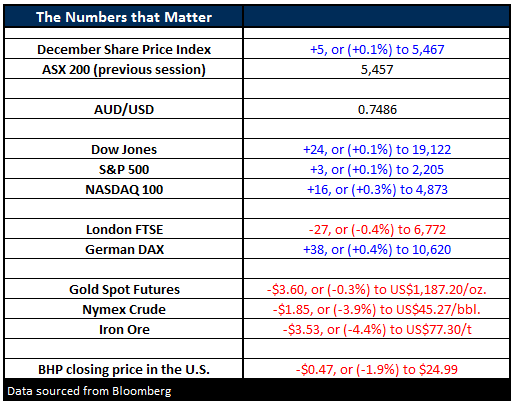

Overnight Market Matters Wrap

- The US share markets closed marginally higher overnight, with the bank and health care sector helping to deliver small gains.

- The Dow closed 24 points higher (+0.1%) at 19,122, while the S&P 500 edged 3 points higher (+0.1%) to 2,205.

- The US economy continues to reaffirm the likelihood of a rate rise, with its GDP higher than analysts’ expectations at 3.2%.

- The ASX 200 is expected to open marginally higher, testing the 5,460 level as indicated by the December SPI Futures. However, with the major miners expected to extend their recent weakness, the risk bias weighs to the downside.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/11/2016. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.