Should we wait for IOOF, or look elsewhere in the sector? (RIO, NWH, VOC, AMZN US, IFL, JHG, MFG, PTM)

It doesn’t particularly feel like it because most of us so often compare ourselves to US stocks but the ASX200 has actually just enjoyed the best August in 11-years, courtesy of a solid reporting season preceded by the low expectations due to the coronavirus. Local stocks unfortunately signed off with a whimper on Monday with some standout selling in the Diversified Financials and Healthcare Sectors, our reasoning for the weakness in these 2 areas is fairly straightforward:

1 – A number of Fund managers would have needed to raise some cash from other names in the Financial Sector to pay for their looming allocation in IOOF (IFL) at what is a significant discount to its last trade – more on his later.

2 - The Healthcare Sector is largely exposed to an appreciating $A which at the time of typing has rallied ~35% from its March low, its our view that many investors have sat long some of these big names expecting the FX tailwind to continue almost indefinitely. Also, just for good measure the worlds feeling more relaxed around the pandemic which has taken the herd attraction out of the Healthcare Sector.

This morning following a reversal of fortunes on most US indices the ASX is set to open down ~1%, as mentioned a few days ago we haven’t soared with the American markets but unfortunately we are likely to be caught in its downdraft when it does pullback.

MM remains bullish the ASX200 medium term.

ASX200 Index Chart

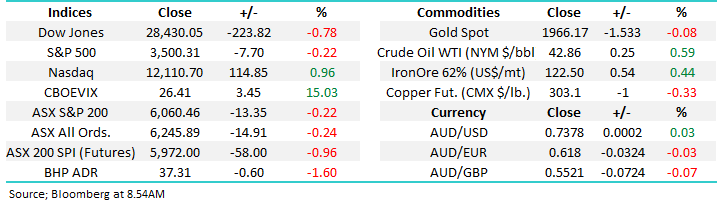

Just under 2-weeeks ago MM switched our RIO Tinto (RIO) position to a mixture of NRW Holdings (NWH) and Monadelphous (MND), we felt it was time to evolve part of our Growth Portfolio from the traditional Miners up the curve to the Mining Services sector, so far so good as can be seen below but obviously were looking for more than just a few weeks of glory!

Switching like the example above is one way that MM as Active Investors endeavours to achieve better returns than the simple classic “buy and hold” approach, obviously both concepts have their day in the sun but in today’s environment things are evolving very quickly creating opportunities under the hood almost weekly. In the Weekend Report we identified the Fund Managers as a group of stocks that might be steadying themselves for a “pop” higher and IOOF (IFL) moving into a trading halt ahead of its much anticipated ~$1bn capital raise might be providing some excellent entry levels in the sector, we will be considering whether to switch or simply buy in the coming sessions.

MM is considering a switch to a fund manager, or outright buying.

RIO Tinto (RIO) v NRW Holdings (NWH) Chart

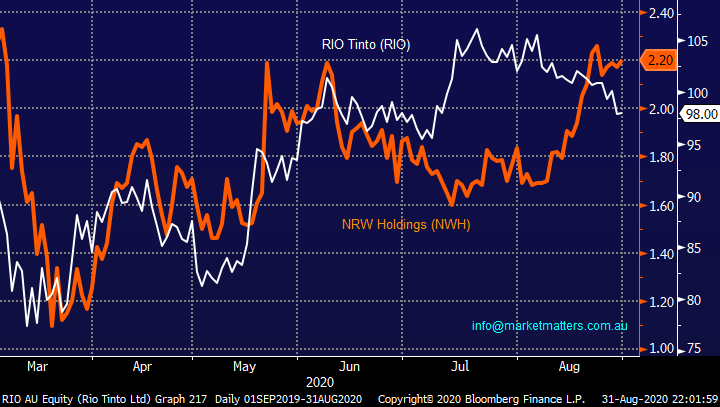

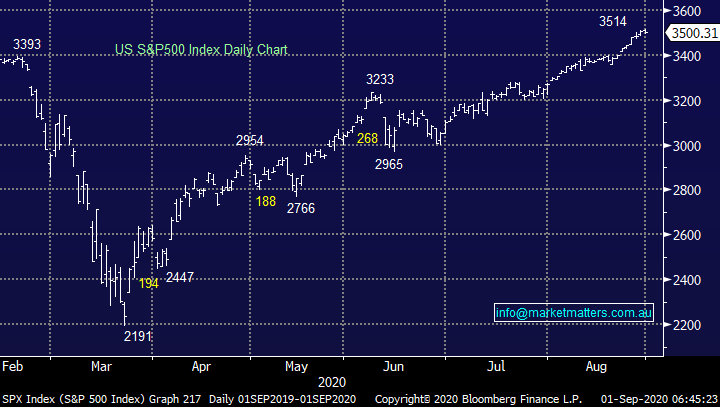

In Mondays questions we often get asked around our decision making and entry / exit thought process, our answer usually includes one of the following market clichés “if the reason for the trade has gone get out” and “plan your trade / trade your plan”, this may prove apt with regard to our recent purchase of Vocus (VOC). The telco had broken out of its recent trading range after an initial positive interpretation of its FY20 numbers where we saw reoccurring revenue in excess of $1.75bn while retail struggled fibre / network improved. We particularly liked the strong network services business which grew 10% over the year plus we feel the company has a great position in a number of key high margin areas, including NZ – like the CEO we feel that VOC is on track with its 3-year business turnaround.

Our target remains 30-40% higher, for those understandably concerned that the stock will return to its old ways we initially flagged a technical stop at $3.25, we’ve since tweaked this down 6c hence if VOC cannot regain some love soon we may be exiting in September.

MM remains bullish VOC with stops under $3.19

Vocus (VOC) Chart

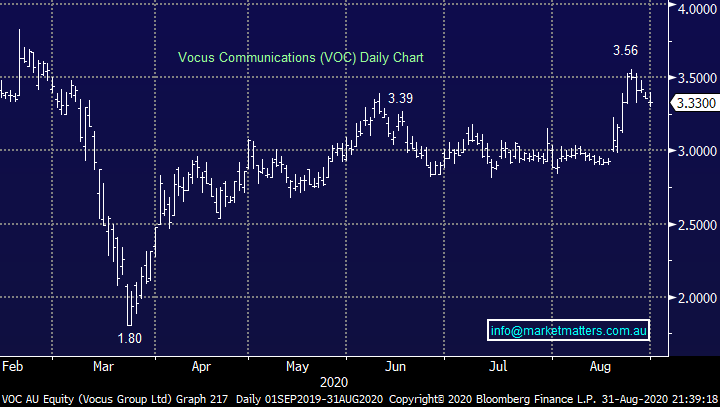

Overseas Indices & markets

Overnight US stocks gave back early gains with strong performances by heavyweights Apple (AAPL US) and Amazon (AMZN US) minimising the damage. The S&P is feeling very stretched around the 3500 area and a pullback feels likely but we’ve thought that before, the trends up and it remains a more lucrative exercise to be looking to identify where to buy such corrections as opposed to swing highs to sell – at least for now.

MM remains bullish US stocks medium-term.

US S&P500 Index Chart

The above-mentioned Amazon (AMZN US) has soared in 2020 making Jeff Bezos the world’s richest man in the process. We believe in the bigger picture this rally has further to go but from a risk / reward we would be keen buyers of its next $US500-600 pullback, as we approach an election and the infamous October never say never to a period of volatility.

MM is a buyer of a $US500-600 pullback in Amazon.

Amazon (AMZN US) Chart

Should we wait for IOOF (IFL) or look elsewhere in the sector?

Within 48-hours of our Weekend Report we’ve seen IFL look to raise ~$1bn to buy NAB’s wealth business MLC, this is a major deal especially for IFL who arguably will sink or swim depending on the implementation / integration of the acquisition. The total purchase price is $1.44bn which the board of IFL believes will give the business a sound footing to compete on scale in the Australian Super industry where big is beautiful has been the mantra. The deal will give IFL over $500bn in funds under management (FUM) as the business expands from its unpopular financial advice model with only AMP left in the space where regulations have made the cost of doing business both prohibitive and downright scary to many.

With potential big returns by definition comes big risk, the deal is flagged to be a huge 20% earnings accretive to IFL and the synergies flagged at $150m just a few years in but history tells us this will take some skilful integration to be successful. The $1.04bn raise at $3.50 is a huge 24.4% discount to the stocks close last week, dilution is significant with the new stock making up a phenomenal 85% of the current business. I’m glad were looking at the deal now as opposed to being an existing shareholder.

We like the deal but the risks are very real hence the price MM will consider paying needs to be discounted accordingly. The stock movement is likely to happen in 2 phases, initially we will see the market decide upon a new fair value after the dust settles and then it will be a wait and see game as integration runs its course, we like the stock around $3.80, a 10% premium to the placement.

MM is very interested in IFL around $3.80.

IOOF Holdings (IFL) Chart

Today I have also had a quick look at 3 other contenders for our hard earnings in the fund manager sector i.e. the IFL placement is likely to cause some further kneejerk selling in the sector which could be more appealing than IFL where the future is certainly full of risk. We might look at a few others later in the week.

1 Janus Henderson (JHG) $28.63

The most recent 2nd quarter update by JHG showed assets under management of $US336.7bn up 14% on the quarter helped by market moves. However net outflows persisted hitting $US8.2bn for the quarter causing the stock to remain cheap compared to its peers. Through 2020 the share price has reflected bond yields almost as closely as the local banking sector hence at this stage the logic which MM is applying to the sector is flimsy at best with JHG, we’re neutral the stock around the $30 area.

MM is now neutral JHG.

Janus Henderson (JHG) Chart

2 Magellan Financial Group (MFG) $59.25

Hamish Douglass has stirred the Magellan ship admirably over the years and this was reflected by inflows in July - the company’s overall funds under management (FUM) sat at $98.5bn on July 31st. Overall this is a quality manager who has called the transition to the US / Global tech stocks extremely well but its weakness is its run hard and some profit taking would not surprise, we will be on alert ~6-8% lower – the stocks valued at a premium to most of the sector but we believe it deserves this status.

MM likes MFG in the mid $50 region.

Magellan Financial Group (MFG) Chart

3 Platinum Asset Mgt (PTM) $3.71

PTM endured a tough 2020 with FUM, revenue and profit all falling. At the end of the last financial year the company had FUM of $21.4bn, down 13.7%. Across the companies financials its been tough but this is reflected in the stocks valuation with an Est P/E for 2021 of 17.3x, basically the middle ground of todays 2 stocks.

MM is neutral PTM.

Platinum Asset Mgt (PTM) Chart

Conclusion

MM likes MFG out of the 3-stock considered today believing it’s not time to fight the trend of paying up for quality. Also, IFL will be interesting if it recommences trading around $3.80.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.