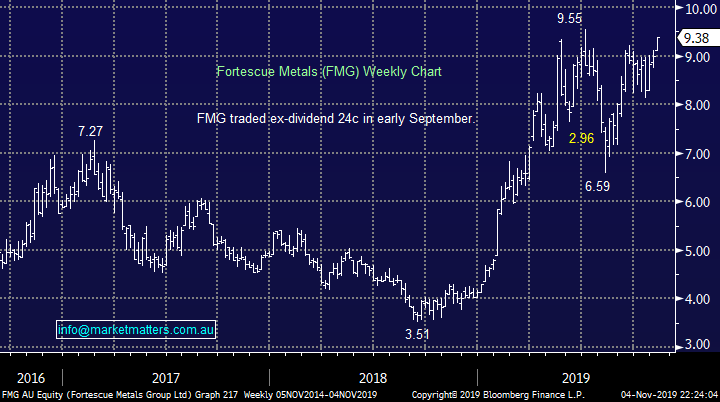

Should we take the $$ or buy yet more resources? (NAB, NWH, BSL, FMG, S32, WHC, SFR)

The ASX200 finally closed up a modest 17-points as November kicked into gear but the action under the hood was anything but quiet as the resources soared while the heavyweight banks slumped. As most subscribers know Westpac (WBC) surprised the market by the magnitude of its dividend cut - almost 15% to 80c fully franked while also raising $2.5bn at $25.32, a 9.2% discount to Fridays close. The insto placement was covered in about 4 minutes which is no surprise to MM considering at the placement price now puts the stock on a 6.3% fully franked yield with a new 80c dividend ongoing, very attractive after a “classic clearing the decks” report.

While WBC and banks generally have a number or challenges, top line earnings growth is hard to come by, interest rates are low which puts pressure on margins, regulators are forcing them to hold more capital which reduces returns and regulatory costs have risen post the Royal Commission. It all sounds fairly dire however we’d caution against taking such a negative view. While earnings growth will be hard to come by the other factors listed above seem to be at or close to their nadir.

MM is intending to take up our allotment in the Westpac (WBC) Share purchase plan (SPP).

Moving on to the standout sector moves on Monday which we touched on above:

Banks – National Australia Bank (NAB) -2.5%, Commonwealth Bank (CBA) -1.5% and ANZ Bank (ANZ) -0.9%.

Resources – Fortescue Metals (FMG) +4.2%, RIO Tinto (RIO) +3.5%, BHP Group (BHP) +2.2% and South32 Ltd (S32) +3.2%.

We have recently moved fairly aggressively long the resources stocks with a 24% direct holding not including gold, hence the obvious question after moves like yesterday, should we buy more or take profit? Yesterday I had a chat with my favourite resource analyst Peter O’Connor – a good time to get his views. The video covers calls in BHP, RIO, FMG, WSA, IGO, OZL, SFR, S32, WHC, AWC & Golds. Click here or on the image to view

Recently we stated that “our view at MM is the RBA wont cut rates again until at least a few months into 2020, we remain comfortable with this opinion and believe market players can enjoy todays Melbourne Cup without fear of being dragged back to their screens, but never say never! I’m actually out of the city for Melbourne Cup day this year, heading back over to Manly for lunch with the bride and some friends after spending last year stuck on the desk! I’ll get onto some Melbourne Cup picks later on.

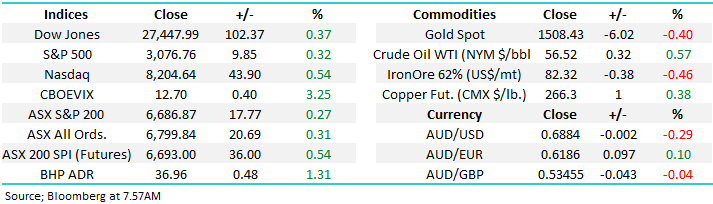

Short-term MM remains neutral the ASX200 with an upside bias.

Overnight global stocks were firm with the main US indices again making fresh all-time highs, optimism that China and the U.S. are moving closer to signing phase one of a trade deal sent the Dow Jones to an all-time closing high. The SPI futures are calling the market to open up around 40-points with the resources likely to be the main drivers this morning, BHP set to open up a further 1.3% this morning following a strong session yesterday. Westpac will be in focus as it resumes trading after completing its $2bn institutional placement.

This morning we’ve taken another look at the resources sector following the interview (above) I did with Shaw & Partners highly regarded Resources Analyst Peter O’Connor- as always a highly recommended view.

ASX200 Chart

Westpac (WBC) was in suspense yesterday while institutions were “tapped” for $2bn leading to the other banks taking the brunt of the markets angst & selling towards the sector, some of the weakness was likely down to funding of WBC purchases. National Australia Bank (NAB) was not surprisingly very much in the cross hairs as it reports on Thursday and after ANZ and WBC investors are understandably nervous.

A potential short-term drop in the banks is no great surprise technically but a few percent lower and we again see value emerging e.g. NAB below $27, or 2.5% lower for those looking to buy into this weakness

MM will take up its entitlement to WBC

National Australia Bank (NAB) Chart

Yesterday it was pleasing for MM to see our recent purchase NRW Holdings (NRH) soar over 13% as it was announced as the preferred bidder for Perth based BGC Contracting, a large privately held mining services business – the CEO of NRW Jules Pemberton has stated that he will only proceed if its earnings accretive, a nice view for a deal that can comfortably be funded by NWH in a number of different ways.

At MM we remain bullish NRH but if it roars above $3 we may take our profit.

MM remains bullish NWH targeting fresh 2019 highs.

NRW Holdings (NWH) Chart

Another Resources Update

Ideally subscribers will have listened to my interview above with “Rocky” before reading this section of todays report. Happily like ourselves he remains bullish resources. The chart below illustrates perfectly that base metals are poised to rally strongly assuming we see a reasonable resolution from the US – China trade talks – the 20% correction over the last 18-months clearly shows the concerns that the trade disagreements between Presidents Trump and Xi Jinping have caused investors with regard to a potential global economic slowdown.

MM believes that the US and China will nut out a deal of sorts leading to at least a 8-10% pop higher in base metals, its simply in both of their interests.

MM remains bullish the industrial metals.

Bloomberg Base Metals Index Chart

Copper is often tagged with the catchy name of “Doctor Copper” because it is a great representation of the health of the global economy i.e. when things are booming we use more copper driving up the price. However while the world has been concerned around a looming global recession , with much of the blame being laid at the door of the escalating trade war, this primary industrial metal has fallen over 25%. We believe the risk / reward has now clearly swung in favour of the upside for copper hence our recent purchase of OZ Minerals (OZL).

MM is bullish copper initially targeting the $US300/lb area.

Copper ($UUS/lb) Chart

So as we remain bullish base metals the question is we do we increase our market exposure, sit back and enjoy the ride or tweak our existing positions for better leverage to our view.

Firstly lets consider a couple of our existing holdings with one eye on potential sell prospects to “fund” allocations elsewhere which might have greater upside potential. MM has 2 obvious candidates at current levels that we’ve discussed in recent reports:

1 – BlueScope Steel (BSL) $13.54 - steel maker BSL has rallied towards fresh 6-month highs over recent weeks but while our target is still ~5% higher this is not a stock that’s likely to pop higher if / when base metals break to the upside.

BSL is a candidate to switch into a more leveraged industrial metals play.

BlueScope Steel (BSL) Chart

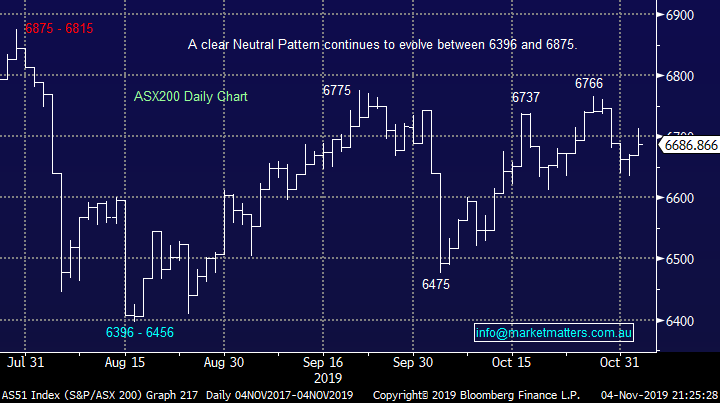

2 – Fortescue Metals (FMG) $9.38 - This huge iron ore success story has followed our technical script perfectly, Twiggy Forrest’s company is only 1% below its all-time high even after paying some attractive dividends of late and the bulk commodity languishing almost 25% below the years high. This has become a phenomenal cash cow that could easily go on to challenge its $13 pre-GFC all-time high. Hence although FMG has now basically achieved our target we are likely to give this position a little room to really perform,.

MM is bullish FMG while it can hold above $9.

Fortescue Metals (FMG) Chart

Iron Ore Chart

Three “cheap” targets

MM has already almost “filled our boots” with resources but if the sector is set to really pop higher a little more, or greater leverage, would never hurt. This morning we have taken a brief look at 3 stocks that are now interesting according to Rocky and potentially in the accumulation areas for MM.

1 South32 Ltd (S32) $2.61

MM has been bearish diversified miner S32 for most of the year but now the miner has corrected over 40% the picture has not surprisingly improved, but like most of the sector its relatively cheap and although many regard its 5.2% fully franked yield as a potential trap we don’t believe that’s the case just yet.

MM is bullish S32 from current levels with an initial target 15-20% higher.

South32 (S32) Chart

2 Whitehaven Coal (WHC) $3.32

WHC remains in a clear downtrend but it’s clearly offering far more value than a year ago. We are not convinced its yet time to jump on board but the current rhythm of buying new lows is working extremely well, another break under $3 and MM will be very interested.

MM has WHC on “close watch” at this stage.

Whitehaven Coal (WHC) Chart

3 Sandfire Resources (SFR) $5.97

Major copper and gold producer SFR has been an out of favour resource stock in recent times but by definition it’s the one who can probably pop the hardest if / when copper rallies back towards $US300/lb i.e. it feels under owned.

MM is watching SFR for a potential break up but there’s no trigger in place just yet.

Sandfire Resources (SFR) Chart

Now, in terms of Melbourne Cup form, the Macquarie Equities team put together a quant model for the cup, although in fairness, they haven’t had much success in recent times in a race that is notoriously hard to pick from 24 starters.

Their top quant picks are:

I’m actually having a swing at the Irish horse, Raymond Tusk, now sure to come in at the back of the field!

Conclusion (s)

MM is bullish the resources space and we are considering further exposure moving towards Christmas with S32, SFR and HC all on close watch, this is also our order of preference to the 3.

Conversely BSL is a potential funding vehicle within our Growth Portfolio.

Global Indices

No change, we had given the benefit of the doubt to the post GFC bull market and fresh all-time highs have been achieved as anticipated but major resistance is now being tested reverting us to a neutral stance. However a break back under 3000 is required to switch us to a bearish short-term stance, still over 1% away.

MM is now neutral US stocks.

US S&P500 Index Chart

European indices continue to “climb a wall of worry” at this point in time MM is neutral but we maintain our slight positive bias.

Euro Stoxx50 Chart

Overnight Market Matters Wrap

- The US equity markets continued to hit all-time highs overnight, while the 10-year treasury yield rose as investors continue to shift their risk back on.

- The resource sector is looking to outperform the broader market yet again as the emerging markets heat up again and BHP in the US ending its session up an equivalent of 1.31% from Australia’s previous close.

- All eyes today are on the Melbourne Cup Race RBA meet this afternoon, where analysts expect no change at 0.75%.

- The December SPI Futures is indicating the ASX 200 to open 31 points higher, testing the 6715 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.