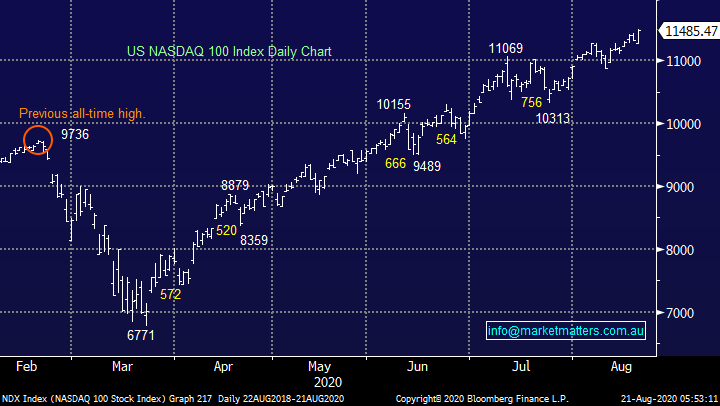

Should we keep chasing cloud based stocks? (CSL, MMS, APT, MSFT US, MP1, NXT, XRO)

LOCAL REPORTING CALENDAR: CLICK HERE **Please note, data sourced from Bloomberg, not all ASX companies are on this list and dates can vary**

Today we have a long list of results – best to click the link above. I have covered WES, PPT, SIQ, STO, A2M, DHG in the recording below.

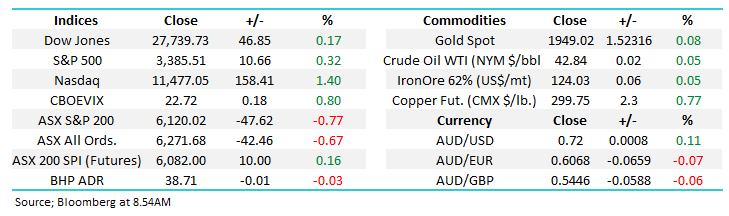

The ASX200 struggled yesterday following an average lead from Wall Street and a volatile session by S&P500 futures in their after-market but overall a -0.8% pullback with almost 40% of the index managing to close up is no big deal. Reporting season delivered a more balanced impact on Thursday with 5 stocks closing both up and down by 5% at the days end. However when heavyweights CSL, CBA and BHP are on the wrong side of the ledger the net impact on the market is almost inevitable.

The local coronavirus numbers are improving at a refreshing rate sending Scott Morrison into battle for companies in dire need of relaxed border controls across Australia e.g. Webjet (WEB) plunged 12.5% yesterday after reporting while QANTAS (QAN) is currently losing a staggering $40m per week. My “Gut Feel” is he may be successful although it’s probably still a coin toss whether it’s a good idea or not – most of us are keen to get Australia back to work but this has the potential to send us all back into lockdown sooner rather than later.

In yesterdays report we said “Short-term we think the euphoria in the tech sector is getting a little overheated and the likelihood of a pullback is increasing by the day.” perhaps our reach must be further than we realised as Asia endured its worst day for its tech stocks since March with likes of Samsung (005930 KS) falling by over 4%. We’re a tad nervous towards the tech sector short-term but great bull markets contain many pullbacks, what sorts the “winners from the losers” is knowing when to avoid chasing strength while identifying levels to buy the inevitable corrections.

MM remains bullish the ASX200 medium-term.

ASX200 Index Chart

CSL Ltd (CSL) fell over $12 yesterday, giving back about half of Wednesdays rally following the companies report – we felt the reception to the disappointing FY21 guidance was surprising / impressive. The market had been concerned about plasma collections during lockdown but the company allayed market fears on their post result conference call saying collections were down only 20-30%, not the 60-70% as some were expecting, plus they talked up higher inventory levels. With collections continuing to improve rapidly and expectations that CSL will produce the locally manufactured COVID-19 vaccine (when it comes) there was some clear initial cheer but yesterday felt like a reality check.

At MM we still feel the issue for this quality company is valuation on an Est. P/E for next year of well over 40x plus its “well owned”, we’re happy being patient on the buy side for now.

MM is neutral CSL around $300.

CSL Ltd (CSL) Chart

Salary packaging, fleet management & leasing business McMillan Shakespeare Ltd (MMS) fell over -6% after it reported on Wednesday but it came out of the blocks firing yesterday closing up almost +15%. Their report showed a 10% fall in revenue which dropped down to a 25% drop in EBITDA, coming in just under $100m. The company also suspended its dividend until 2021, we feel a prudent move in the current uncertain environment.

I believe that once investors digested the result plus the company saying that Q1 of FY21 had been encouraging they decided the stock had become cheap and an excellent risk / reward recovery story – plus for good measure MMS’s digital expansion is looking very promising in today’s new remote working norm.

MM is bullish MMS initially looking for 10-15% upside.

McMillan Shakespeare Ltd (MMS) Chart

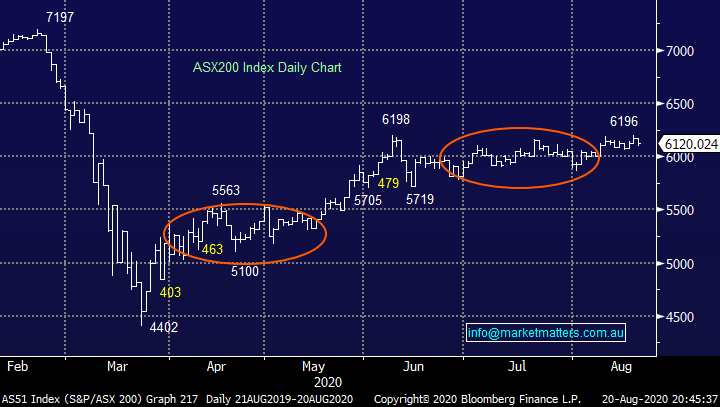

Afterpay (APT) was the markets 3rd best performer yesterday rallying almost 7% after delivering the exciting news that earnings for the fully year would be almost double their forecast in July i.e. $44m compared to the flagged $20-25m plus the important core measure of profitability transaction margin was coming in 0.25% higher than expected. The stock will be fascinating over the coming days, will it be a case of “buy on rumour sell on fact” or is it performing so well it remains a great buy – we believe its time to stay long the BNPL (buy now play later) space into their full year results but without becoming complacent.

MM can see APT testing well above $85 on current momentum – a positive read through for Z1P who reports on the 27th August

Afterpay Ltd (APT) Chart

Overseas Indices & markets

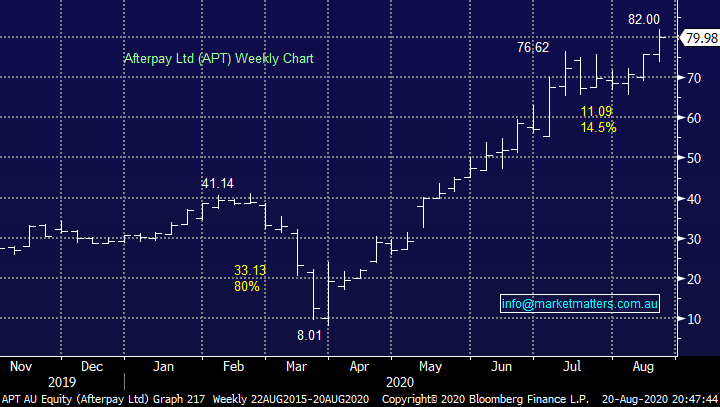

Overnight US stocks recovered from midnight wobbles (AEST) to close up on the day with another stellar performance by the tech heavyweights driving the NASDAQ to yet another all-time high. As we mentioned earlier this is a bull market where the most prudent action over the last 5-months has been to buy pullbacks, its averaged one a month since March and MM sees no reason this rhythm won’t continue into Christmas.

MM remains bullish US stocks medium-term.

US NASDAQ 100 Index Chart

Overnight markets went into slow reverse as bond yields fell, the $US followed suit sending many commodities to recover from their intraday lows with silver the noticeable standout closing up ~2.5%. Further consolidation from the likes of gold is our expected path, MM plans to increase our position around $US1850/oz and take profits above $US2100/oz – we’ve seen plenty of choppy rotation by the ASX perhaps its time for gold and silver, were happy to let other play the noise between our 2 respective buy / sell levels.

MM remains bullish precious metals.

Gold ($US/oz) Chart.

Cloud stocks are “hot” should we still chasing?

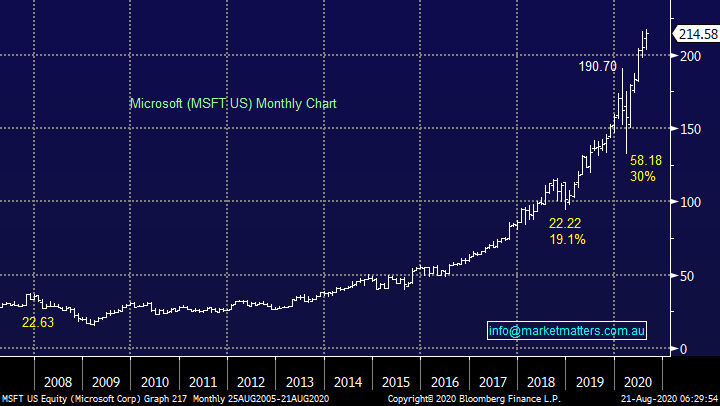

Overnight we saw the tech based NASDAQ rally +1.4% to fresh all-time highs with the cloud based stocks continuing to offer huge support to the group e.g. Amazon (AMZN US), Alphabet (GOOGL US), Microsoft (MSFT US) and Alibaba (BABA US). Cloud computing offers investors a wide selection of opportunities from business services to basic internet infrastructure. For subscribers struggling to visualise this relatively new concept simply consider a warehouse full of data centres packed with computer servers and data storage systems.

Quickly the picture and opportunities become clear from Intel (INTC US) selling chips for the servers to Cisco Systems (CSCO US) selling switches / routers to make the cloud superfast. The cloud has provided phenomenal returns to many investors over recent years whether from storage servers, CPU servers, GPU servers or the many applications of the hardware – to put things in perspective the cloud computing market has grown well above $US250bn with the “big boys” like AMZN and MSFT still competing in the infrastructure services area. Clearly all the names mentioned above are US goliaths but today I have focused on 3 Australian stocks in an effort to identify some good risk /reward opportunities into this huge growth area.

MM remains positive towards the overall cloud industry.

Microsoft ((MSFT US) Chart

1 Megaport Ltd (MP1) $15.81.

MP1 is a provider of elasticity connectivity and network services to over 300 centres globally. On Wednesday the company followed up with another great result, the “network as a service” provider delivered a 66% increase in revenue to $58m while recurring revenue increased ~10%. We believe the company is well positioned for ongoing strong growth as demand for its services increases in-line with the cloud computing boom.

This is a great company /story with the hardest facet being the risk / reward, considering the stocks broken out to new highs we would simply advocate buying now with stops under $15 – a 5% loss is always manageable and blue sky does beckon.

MM likes MP1 moving forward.

Megaport (MP1) Chart

2 NEXTDC (NXT) $11.74

NXT is an excellent innovative data centre operator with a number of impressive operations across Australia. Demand continues to grow for its off-site storage & security as can be seen from the performance of its share price which by definition has enjoyed strong earnings growth – this cycle looks likely to continue. With Australia transitioning to a semi-work from home culture the picture is rosy for NXT as more businesses will need their services.

On the risk / reward front, we would be buyers here leaving $$ to average into the next ~10% pullback.

MM is bullish NXT.

NEXTDC (NXT) Chart

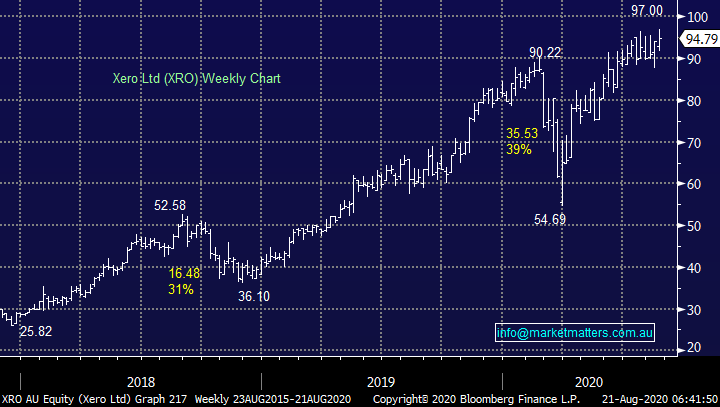

3 Xero Ltd (XRO) $94.79.

New Zealand cloud based accounting platform provider XRO is expanding rapidly into the likes of the US, UK and South East Asia. We like XRO over the medium-term seeing upside in their expansion while excellent client retention is both encouraging and vital. Competition remains in the form of MYOB but XRO appears to have the number on its rival. The huge traditional valuation has kept many investors on the sidelines, our Growth Portfolio went long in April and were already enjoying a 36% paper profit with our dichotomy now do we look to switch to another stock in the sector showing more potential upside into Christmas.

MM likes XRO medium-term but we feel its unlikely to stock will move too far before it reports in November.

MM likes XRO but it feels likely to consolidate.

Xero Ltd (XRO) Chart

Conclusion

MM likes all of these 3 cloud orientated companies as long as investors remain cognisant of the risk / reward.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.