Should we cut and run from our healthcare exposure? (HSO, RHC, CSL, COH)

Local stocks enjoyed a decent recovery yesterday led by the resources while there was a notable lack of aggressive selling across our time zone, even after the S&P500 had closed down -0.6% the prior session. The market still feels jittery, which is normal after such a savage sell off – the obvious questions is whether or not that’s the end of it, or a pause before another leg lower. Given the aggression of the initial selling we do think another attempt on the downside remains likely. One standout undertone is that interest rate sensitive and high valuation / growth stocks are being met by sellers.

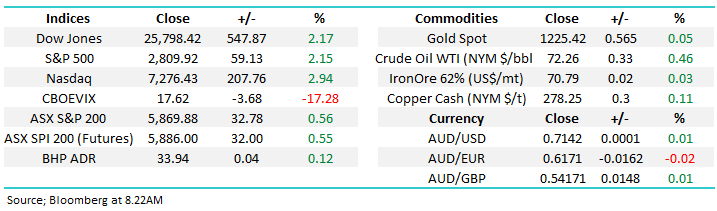

The ASX200 continues to trade in the 5775 – 5900 range we highlighted on the weekend as we commence the traditional “hump” day for the week. MM continues to anticipate tweaking our Growth Portfolio over the coming weeks the old cliché “buy strength & sell weakness” our current mantra.

MM remains marginally negative the ASX200 short-term, with an initial target ~5700, now around -3% lower.

Overnight stocks bounced strongly with the US S&P500 gaining +2.1%, all sectors closed in the green but the largest gains were seen by the technology and healthcare sectors which is coincidental with today’s report. Europe was also strong gaining +1.5% while the emerging markets outpaced US stocks gaining +2.5%.

The SPI futures are pointing to a gain of around 40-points, just above the psychological 5900 area.

Today’s report is going follow on from yesterday’s initial discussion on late cycle investing, looking at our exposure to the healthcare sector.

ASX200 Chart

We have been bullish Kidman Resources (KDR) below 90c over recent weeks targeting a strong countertrend rally towards $1.30. We believe the move started yesterday but it’s not too late to jump on board for the very active subscribers.

Technically we are bullish KDR below $1.20 targeting a 25% rally minimum.

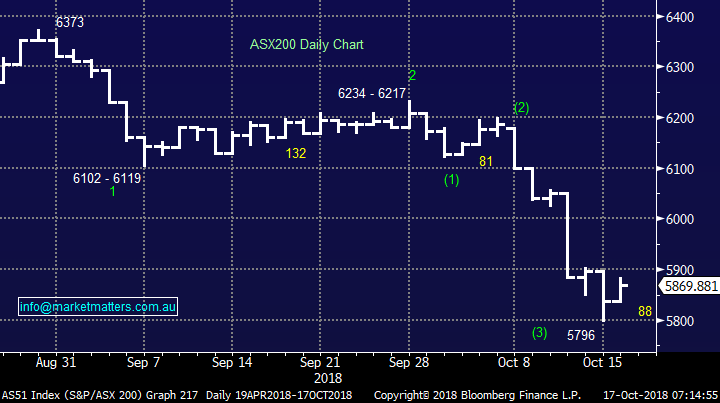

We will not be adding KDR to the Growth Portfolio because we are already holding some lithium exposure via Mineral Resources (MIN) which also rallied 4% yesterday – we expect to re-evaluate the MIN position ~$17.50.

Kidman Resources (KDR) Chart

Mineral Resources (MIN) Chart

We believe it’s prudent overall to increase our short exposure to US stocks as a hedge, and this morning appears to be a reasonable opportunity following last night strength.

MM is looking to increase its BBUS (bearish US stocks) ETF into the current bounce.

US S&P500 Chart

The Healthcare Sector

Historically more defensive sectors like Healthcare and Consumer Staples (essentials like food & drink such as Woolworths / Wesfarmers) outperform “late cycle” i.e. when economic growth is peaking / falling. This makes sense because people need to eat and look after their health whatever the economic backdrop.

Similarly, during aggressive corrections healthcare fares ok from a relative perspective e.g. in 2011 when the US S&P500 fell over 18% the healthcare sector was the 4th best performer, only beaten by Telcos, Consumer Staples and Utilities – note this correction was not fuelled by rising interest rates. Hence the next decent pullback may not be so kind to utilities.

Private equity currently has a significant taste for the sector with BGH / Australian Super recently having a failed tilt at Healthscope (HSO) while in July KKR announced the bid for Envision Healthcare for $US9.9bn.

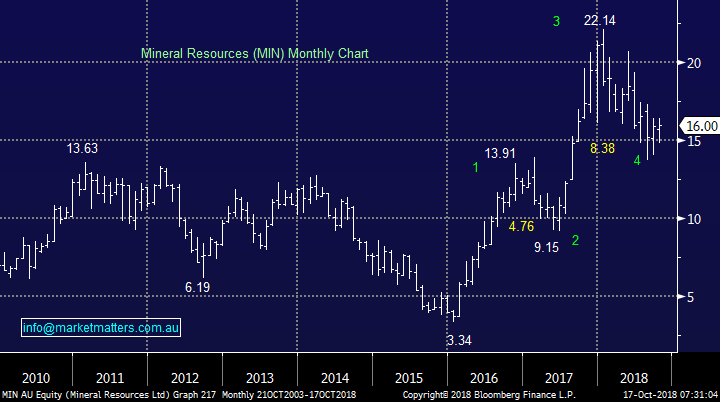

Conversely many Australian healthcare stocks had become regarded as “safe” and hence crowded investments causing their valuations to become stretched and outing them into the GAAP basket – growth at any price. This has led to aggressive market corrections by market favourites CSL and COH of 21.3% / 17.3% respectively, along with the hospital operators Ramsay and Heathscope

We recently bought CSL and Cochlear into their sell-offs but as part of our investment process we must question was it too soon.

ASX200 Healthcare Sector Chart

1 Healthscope (HSO) $2.09

We have 3% of the MM Growth Portfolio in HSO at $2.25 which currently looks poor today.

Australian Super still holds a 13.9% stake and were keen to take over the business in late April, which the board subsequently rejected, along with the higher bid by Canada’s Brookfield Asset Management at $2.50 – I wonder this morning with the stock sitting over 23% below the higher bid there is some concern by the board about the decision taken! We understandably ponder if a 3rd attempt will come out of the woodwork into the current market weakness. Two intelligent parties performed their due diligence on the business this year and clearly saw plenty of financial upside when the stock was 20% higher hence raising the question is the stock cheap under $2.

Private hospitals are currently struggling on a few levels including:

1 Cash strapped Aussies are foregoing private healthcare as rising premiums (around 6% p.a.) put pressure on household balance sheets

2 Reduced demand for private health insurance means the insurers are putting pressure on their service providers, like hospitals

2 A large proportion of private patients are going through the upgraded public system reducing the occupancy at private hospitals.

Obviously there will be an “uncle point” when the public system cannot cope and this will be one for the politicians.

We like HSO as a business and it clearly has some very attractive assets like the new Northern Beaches hospital in Sydney. The partnership model used here with Government making a public / private hybrid facility is clearly an interesting one.

MM is likely to stick with this position and will consider averaging below $1.80

Healthscope (HSO) Chart

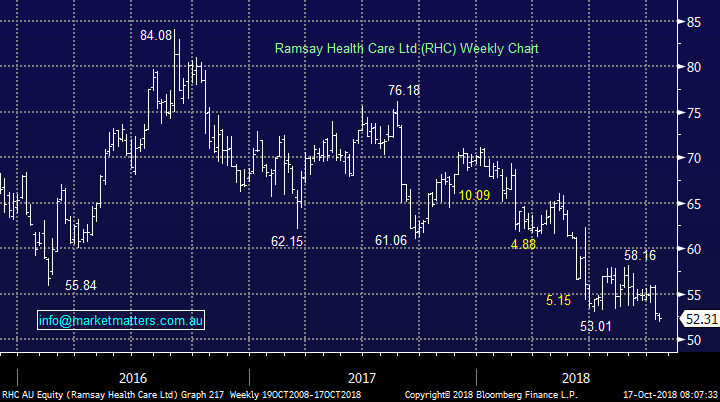

2 Ramsay Healthcare (RHC) $52.31

RHC is another private hospital operator that we hold 3% of the MM Growth Portfolio in after buying the recent weakness – were currently find ourselves down a few percent.

Many of the points raised above for HSO are relevant to RHC on the domestic front plus of course RHC has been on acquisition trail with its bid for Capio having been recommended by the board creating expansion into Germany and Scandinavia plus likely synergy with its French operations, however the main benefit here for the boarder group is around technology advancements in the delivery of healthcare – something Capio is strong in.

We like the way RHC is evolving overseas but the shares remain under pressure primarily due to domestic issues – the stock has now almost corrected 40%.

Our current plan is to average below $50 and sell around $58 – very much inline with our current mantra.

Ramsay Healthcare (RHC) Chart

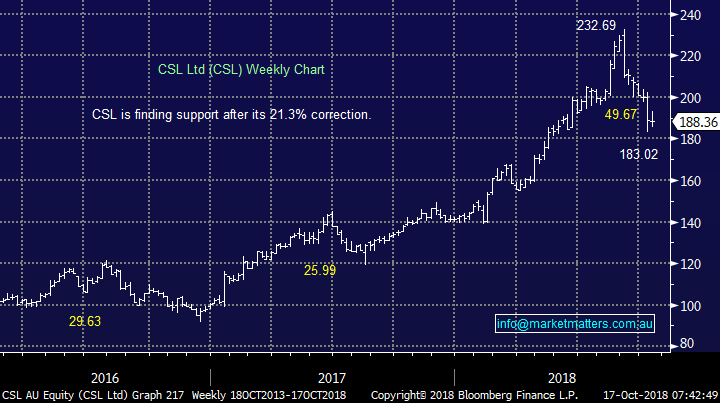

3 CSL Ltd (CSL) $188.36

We bought CSL into its recent panic sell off and the position is showing a very small profit.

This is a high quality business with strong earnings that are growing. Growth businesses actually perform well late cycle if those earnings can be sustained. Businesses on a growth multiple that are yet to monetise their product / platform / service is the area that should be of concern. CSL, COH and even A2M for that matter have real businesses, with real earnings.

We continue to like CSL however appreciate that if markets fall, CSL could be targeted simply because of its high multiple and strong performance over the past year.

MM will consider exiting CSL if it cannot hold current levels

CSL Ltd (CSL) Chart

4 Cochlear (COH) $185.85

As we often mention stocks / markets regularly swing between unbridled bouts of pessimism and optimism, and COH has both rallied and fallen ~20% in just 3-months.

COH like CSL is a wonderful example of Australian business at its best.

Yesterday, they had their AGM and re-confirmed earnings guidance forecasting a profit of ~$250m, up between 8-12% on the year.

As businesses we love both CSL and COH but the question to ourselves is are we a touch too exposed owning both considering the markets current position?

MM will consider exiting COH if it cannot hold current levels

Cochlear (COH) Chart

Conclusion

We like the Healthcare Sector for “late cycle” investing and during market corrections.

MM is monitoring CSL and COH closely, and will cut either / both positions if they cannot hold current levels – theoretically, they should bounce from current levels

KDR looks a good technical buy

Overseas Indices

The US Russell 2000 remains bearish, targeting ~1450 or 9% lower.

US Russell 2000 Chart

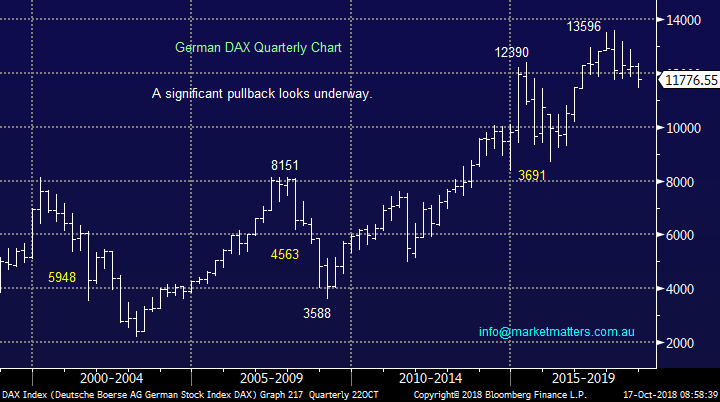

European indices are a touch tricky just here – technically the shorter timeframe is bullish / supportive having hit our targeted retracement areas but the longer term picture looks very concerning.

German DAX Chart

German DAX Chart

Overnight Market Matters Wrap

· The SPI is up 32 points as European and US markets surged overnight. The Dow and S&P 500 closed up nearly 2.2%, while the NASDAQ was the best performer, +2.9%.

· Strong results from investment banks Morgan Stanley and Goldman Sachs, as well as health care stocks, led the market. US job vacancies rose to 7.14m – the highest since this data started being collated in 2000.

· Tech stocks including the FANGs were strong and Netflix shares were trading 13% higher after market as they reported profit that soundly beat consensus.

· LME metals were mostly weaker as traders held on to concerns around Chinese inflation and global growth. Oil inched ahead and gold fell as investors moved out of safe havens. Iron ore was marginally lower.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/10/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.