Should we chase Australian Travel stocks? (WEB, FLT, QAN, SYD)

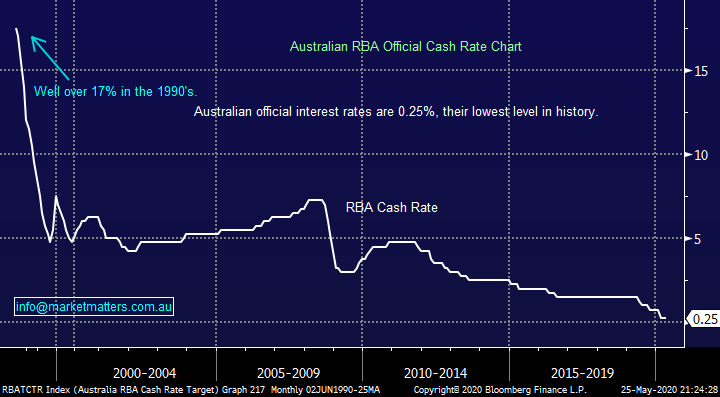

The ASX200 started the last week of May with a bang, rallying +118-points / 2.16% to its highest close since mid-March. The winners circle was full to the brim with 90% of the index up on the day, 26 names surged over 5% making it a strong day from all perspectives. The IT Sector was the strongest advancing +3.6% while the Materials were at the back of the field and they still gained +1.3%, the euphoria accompanying the easing of lockdown restrictions has continued unabated to-date taking stocks to a fresh 11-week high. The icing on the cake was talk that the government may use part of their new found $60bn to further stimulate the tourism, travel and hospitality industries – wish I could find a $60bn positive error in my tax return!

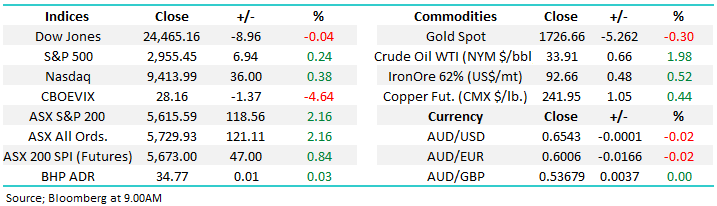

The Australian IT Sector rallied hard as we touched on above, in the process outperforming the other major top performer of recent years Healthcare, pretty much as we forecast in the Weekend Report although of course 1-day does not make a summer! In very broad terms we see another 20% upside from the likes of Afterpay (APT), Wisetech (WTC) and Xero (XRO), perhaps that’s when we will say it’s time to disembark the bus and rotate aggressively to the value stocks. Hence if we do see a 10% pullback in stocks this financial year MM will be looking to increase our exposure to these IT high flyers, at least for one last final hurrah.

ASX200 IT & Healthcare Indices Chart

The ASX200 made a fresh 11-week high yesterday but it was still only ~1% above levels touched in mid-April, one of our best calls in 2020 has undoubtedly been to “sell volatility” since early April i.e. sell strength and buy weakness. It will be interesting to see if the elastic band will again become too stretched and pull the local index back under 5500, our preferred scenario but we’re not married to it primarily because MM remains bullish over the next 12-18 months.

The market is clearly very rich based on currently depressed earnings although it’s obviously forward looking as we again saw yesterday fund managers appear to have turned their attention to some of the more beaten up pockets of stocks / sectors which is propelling stocks north. We’re continuing to see mean reversion across some sectors as markets price in a good economic recovery from the pandemic, assisted by central banks unlimited support, as the saying goes “don’t fight the Fed”.

The US markets forward P/E correlation to asset value has gone from +0.9 to -0.9 which tells you the market 100% believes the Fed will maintain elevated valuations for stocks -i.e. investors are pricing in a bullish price reversion although new economic structural trends are also clearly evolving.

Importantly there remains a distinct absence of sellers which could dramatically unravel the bearish thesis still carried by many pundits. The latest Bank of America Survey released just a week ago was extremely supportive of stocks into any pullbacks, especially those created by “news flash” events:

1 – Only 10% of fund managers believe we will enjoy a “V-shaped” economic recovery i.e. the path of least resistance / surprise / most pain is up.

2 – Over 2/3rd of fund managers still regard the current stock market advance as a bear market rally with the same implications as point 1.

3 – The most “crowded” positions were in growth and tech stocks which is very evident but leaves room for a rotation to value at some stage in 2020.

4 – Defensive positioning in cash did slip from 5.9% to 5.7% but it remains significantly above the 10-year 4.7% average.

Overall this sentiment remains around “extreme bearishness” which is actually a bullish indicator simply because ‘whose left to sell’ hence reinforcing our view that pullbacks will be met with solid buying. Professionals are concerned that stocks are being artificially supported by central bank liquidity but during these unprecedented times this environment could last for the foreseeable future.

MM remains bullish equities medium-term but were now adopting a more neutral stance short-term.

ASX200 Index Chart

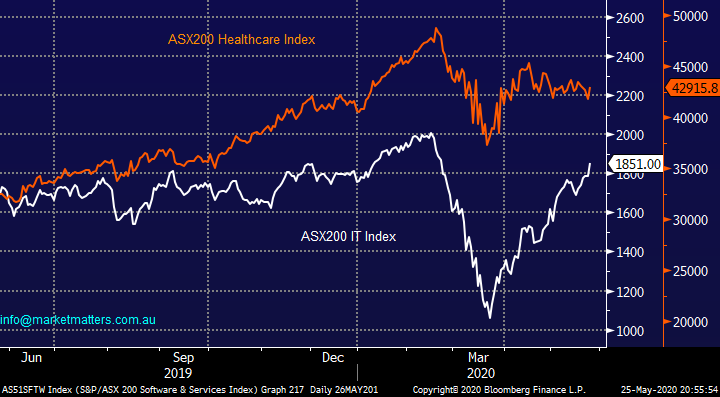

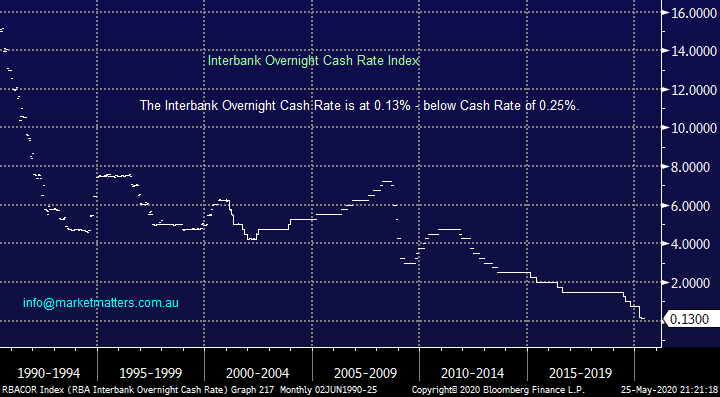

MM has been banging the liquidity drum for weeks and perhaps one of the best ways to illustrate this point is with the Interbank Overnight Cash rate which has fallen to 0.13%, almost half of the Official RBA Cash Rate. Cheap central bank funding has sent the overnight cost of money for the banks down to an unprecedented level leaving these same institutions basically awash with cash, not bad when the “Big 4” are still getting ~3.5% for their standard variable rate mortgages. We had a call with Westpac yesterday who confirmed that the funding environment was indeed very positive for them at both a wholesale and depositor level.

If we do see a pick up in the domestic economy and household / business bad debts don’t spiral out of control as many anticipate we could see underweight fund managers flock to these out of favour financial institutions – now that would send the ASX20 back towards 6000 in a hurry!

Interbank Overnight Cash Rate Chart

RBA Official Cash Rate Chart

Another great illustration of liquidity or more importantly of when its faltering is often provided by the junk / corporate bond market and especially its advance / decline line. – while A-D lines remain strong the markets internals are regarded as solid because buying is broad based as opposed to being focused in just a few large names. As we can see below the A-D line for US junk bonds remains strong implying strong liquidity which helps explain why we’re seeing stocks ignoring increasing US – China tensions. As MM often says, “a market that ignores bad news is bullish”.

S&P500 Index v Junk Bond Advance / Decline Line Chart

Overseas markets

US stocks were closed overnight for Memorial Day, but European markets were very strong in their absence, Europe took the mantle and followed the ASX to fresh multi-week highs.

MM remains bullish global stocks medium-term but short-term they are starting to feel “rich” or vulnerable to a pullback.

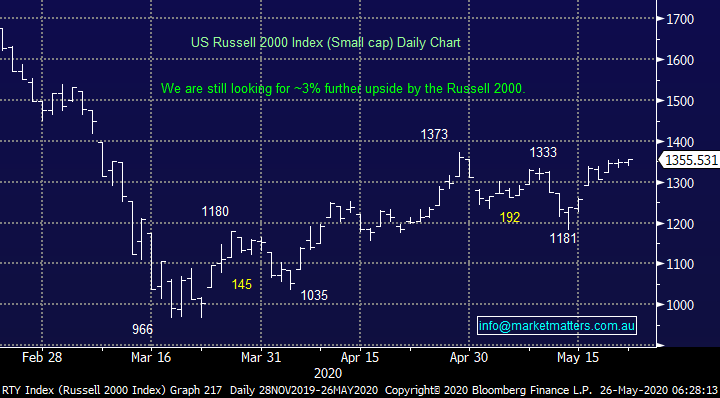

US Russell 2000 (small cap) Index Chart

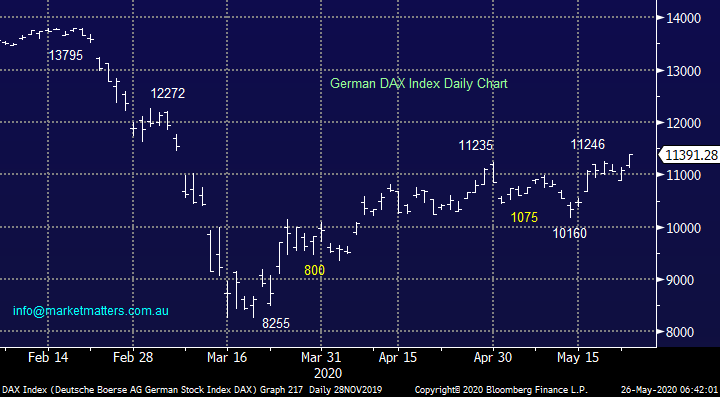

The German DAX surged almost 3% last night as global stocks enjoyed ongoing “recovery bets”. Stocks have reached our targets flagged over the last 6-weeks and we’re now open-minded to a pullback, the DAX will generate technical sell signals on a break & close below 11,200 but at this stage the trend is your friend and things look bullish basis last nights close.

MM now believes the German DAX is vulnerable to a 10% correction.

German DAX Index Chart

Should we chase Australian travel shares?

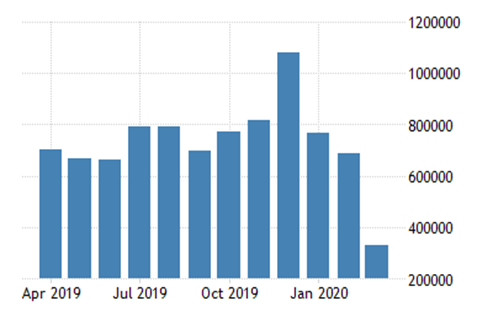

The Australian travel and tourism stocks surged higher yesterday as lockdown laws continue to be relaxed and markets became optimistic the Liberal government would dish out part of their newfound $60bn in the sectors direction. This morning Scott Morrison is expected to announce a new “JobMaker” initiative which may take the limelight away from some of yesterday’s optimism towards the sector but investors are still on the hunt for value as they look 6-12 months ahead, as opposed to today’s frustrating social landscape. The press have been full of graphical representations of the grinding halt to our economy with tourism clearly front and centre - it’s certainly been a hard space when you basically can’t fly overseas or even drive between some of our own states.

Today we have looked at whether MM should consider chasing any of these stocks after they’ve recently enjoyed strong bounces, the key from a risk / reward perspective is determining what will be the new norm in the years ahead e.g. we already know Australians are likely to be holidaying at home as opposed to abroad for the next 12-18 months.

Australia Tourist Arrivals Chart

Chart from Trading Economics.

The jump in travel stocks yesterday was dramatic with both Webjet (WEB) and Flight Centre (FLT) putting on over 15% to be the local indexes best 2 performers while QANTAS (QAN) and Sydney Airports (SYD) also enjoyed strong days. These 4 stocks are the focus of our attention this morning as they sit well below their respective recent highs hence begging the question, are they still cheap? Travel stocks certainly standout as some that would benefit from a very rapid return to normality, although I think some fund managers might just be buying these stocks as an insurance against a faster “V-shaped” recovery, with downside perceived to be small after their savage declines.

1 Webjet (WEB) $4.16

On-line travel business WEB raised $346m back in April at $1.70 – buying when there’s blood on the streets is definitely looking good at this stage although some profit taking might emerge into further strength. MM likes the on-line business model of WEB although the feedback has been mixed as to how well the company and brand has emerged from the pandemic but I do believe many companies will / should be given some grace in these tough times.

WEB is undoubtedly a play on our economic recovery both locally and internationally, with traditional valuations almost irrelevant in today’s rapidly evolving economic environment. While this stock is cheap if we all start flying as before, Iit is not as cheap as the current price would imply. They have an additional 203m shares now on issue, up from 136m before the equity raise. This means if earnings bounce back to what they were previously the stock should trade at about 40% of its previous price. Being generous as using $12.48, a new high for WEB would be at $5.00 per share.

Ultimately I can see the stock rotating between $3.50 and $5.00 for the remainder of the FY as we see a few more twists in the virus road but it still feels like a long way to go until the world will be flying around as it was in 2019.

MM is neutral WEB – too many new shares on issue

Webjet (WEB) Chart

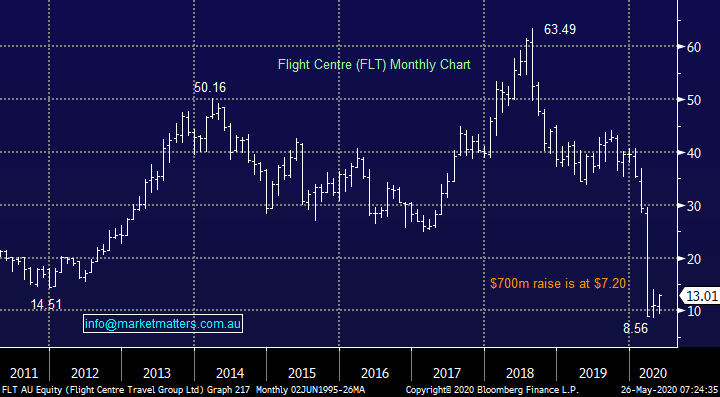

2 Flight Centre (FLT) $13.01

Travel business FLT raised $700m back in April at $7.20 to secure its future - a scary phrase! Buyers in this raise haven’t fared as well as with WEB which makes sense to us on the simple bricks and mortar v on-line level. Similar to WEB, the share count of FLT exploded from 101m shares on issue pre-crisis to 198m post crisis, that’s an increase of 97m shares or almost a doubling of share count.

Similar to the whole sector FLT is undoubtedly a play on our economic recovery but overall, I’m a little uncomfortable with FLT post the raise. I would rather buy a company that has managed through without dramatically expanding its share count.

MM is neutral FLT.

Flight Centre (FLT) Chart

3 QANTAS (QAN) $3.86

QAN didn’t need to raise equity / issue new shares which is strong positive while it was performing strongly before the world was blindsided by the pandemic, overall a characteristic we like at this point of the recovery. We wouldn’t be going “all-in” but QAN does look poised to challenge the $4.50 area in 2020, cheap fuel and Virgin in strife should help this iconic carrier dominate the domestic routes until international travel returns to everyday life.

MM likes QAN short /medium-term.

QANTAS (QAN) Chart

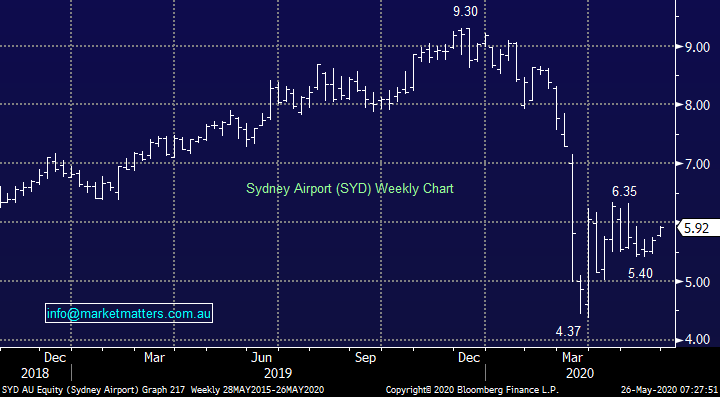

4 Sydney Airports (SYD) $5.92

SYD is another travel related company that didn’t need to raise fresh equity and they have recently said it’s unlikely in the future. MM bought SYD for our Income Portfolio a few weeks ago and it’s nice to see an early “paper profit” on the table. The more action at the airport the better for SYD making it another recovery play, with both domestic and international passenger traffic down over 96% in the first 2-weeks of April one could certainly argue the only way is up! We shouldn’t forget that cargo is still being shipped meaning revenue has some support in these tough times.

With interest rates extremely low and Australian and NZ leading the COVID-19 fight SYD looks good value at current levels.

MM likes SYD short /medium-term.

Sydney Airport (SYD) Chart

Conclusion

MM can see further upside from the 4 stocks looked at today, but we are cautious of both WEB & FLT that have expanded their share count substantially.

We are reluctant to chase current strength considering our mantra of the last few months – “sell strength and buy weakness”.

Overnight Market Matters Wrap

- A quiet session was experienced around the globe with both US and UK markets closed, however business sentiment data in Germany bolstered investors’ minds to turn risk back on in hopes of a faster global economic recovery.

- Crude oil gained on the back of this hope while gold eased slightly.

- Locally, Prime Minister Scott Morrison will speak at 12.30pm outlining the next major steps to get Australia back on track

- The June SPI Futures is indicating the ASX 200 to open 60 points higher, testing the 5675 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.