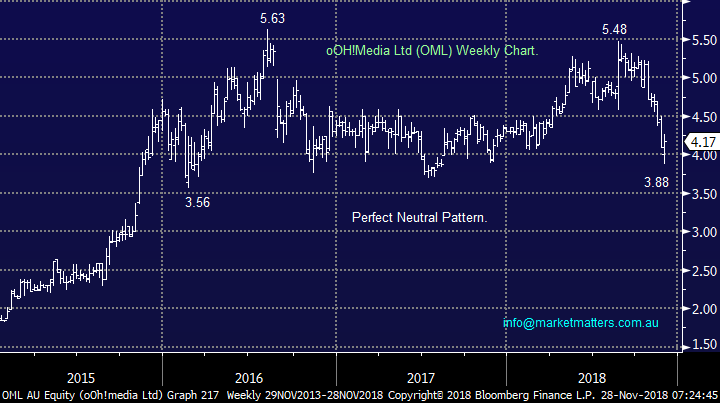

Should we be watching the Media & Entertainment Sector? (NWS, CAR, NEC, REA, OML)

Good morning from a crazy day in Sydney where we are being lashed by a month’s worth of rain in just a few hours. Is it a sign I’m getting old when I think rain = good for garden?

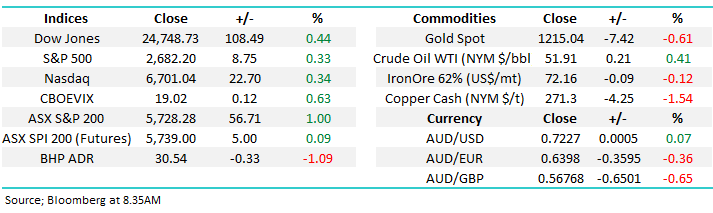

The ASX200 enjoyed another strong day closing up +1%, again rallying after lunch, making it a quick fire 134-point / 2.4% recovery from last Wednesdays low. The banks again led from the front with all of the “big 4” outperforming the index while excellent support was offered by the Diversified Financials, Healthcare and Telco sectors to name a few.

The resource stocks we covered in yesterday’s report fell short of our ideal buying levels making it easy for us to sit on our hands. While most of the sector did recover some of the previous sessions losses not at any stage did I feel like we were “missing out” having not tweaked our exposure over recent days – this feels on the money this morning with BHP again falling well over 1% in the US overnight.

MM remains bullish the ASX200 short-term targeting a “Christmas rally” towards the 5900-6000 area.

Overnight US stocks finally closed higher after a choppy session with the Dow gaining 108-points however the SPI is indicating the ASX200 will open only marginally higher with the weakness in BHP implying the resources will again be a drag on the index.

Today’s report is going to cast our eyes over 5 Media and Entertainment stocks which as a group have been major underperformers over the last 3-months, we ask the obvious question - are there any bargains around?

ASX200 Chart

A week ago today MM made a relatively bold move allocating a collective 9% of the Growth Portfolio into Appen (ASX: APX), Altium (ASX: ALU) and Xero (ASX: XRO) i.e. we caught the proverbial falling knife, in this case the growth sector. We also spent the last of our bullets in the Growth Portfolio, and are now fully invested for a Christmas rally.

This morning all 3 positions are showing a paper profit but complacency is a dangerous state of mind hence we’ve taken this opportunity to update how we see the 3 positions into Christmas.

Appen (ASX: APX) $13.34 – we remain bullish with an ideal target around $15, or well over 10% higher.

Altium (ASX: ALU) $21.40 – we remain bullish with an eventual target above $24, or over 10% higher.

Xero (ASX: XRO) $37.50 – we remain bullish with an eventual target close to $45, or close to 20% higher.

Xero Ltd (ASX: XRO) Chart

5 Media & Entertainment stocks

The average decline of this sector over the last 3-months is a whopping -23.6%, especially compared to the ASX200 which has corrected ‘only’ -9.5%. The particularly disconcerting fact is that all 9 stocks are lower with the best 2 performers still falling -5.4% and -16.2% respectively i.e. there’s been no gold in these hills of late.

MM has given the whole sector a wide berth in 2018 which has proven correct but with 6 of the sector recently falling by 25% or more it’s worth a quick look.

It should also be noted that this is a messy group of stocks with cross ownership / deals unfolding – similar to what we currently see in the property sector right now.

1 Newscorp (ASX: NWS) $18.56

Market stalwart NWS has been the best of the bad bunch over recent months and has actually outperformed the index over the last 5-days. The stock spiked up towards $20 earlier this month following the release its quarterly earnings. The analysts reaction was mixed which has been reflected in the stocks choppy price action.

NWS owns ~61% of REA Group (ASX:REA) which we will look at later, and speculation has been circulating that they may enter into a minor commercial advertising agreement with SWM in part response to Nine’s takeover of Fairfax which gained approval in the Federal Court yesterday i.e. the corporate wheel in this sector keeps turning. Fairfax will go off the boards at the close this afternoon.

MM is neutral NWS but a bounce over $19 would not surprise.

Newscorp (ASX: NWS) Chart

2 Carsales.com (ASX: CAR) $12.25

CAR has clearly found some support around $11 but technically we can still see sub $10 – MM has been bearish CAR for most of 2018. The second hand car market has been weakening alongside the local housing market, although not to the same degree at this stage. We covered the sector in an income report a few weeks ago (click here). Automotive Holdings (ASX: AHG) has been a standout casualty with the stock halving in 2018.

We like the Carsales business and its model / site but the underlying economic fundamentals suggest a better entry is likely in 2019 / 2020.

MM remains bearish CAR, eventually targeting sub $10.

Carsales.com (ASX: CAR) Chart

3 Nine Entertainment (ASX: NEC) $1.73

NEC has tumbled 41% in 2018 being pulled lower by its proposed takeover / merger partner Fairfax which has witnessed a collapse to a 52-week low. Thinking about the Nine (post Fairfax takeover) their main growth assets are Stan and Domain Holdings (ASX: DHG), which Fairfax holds nearly 60% of after spinning out the rest on late 2017.

Unfortunately for NEC, Domain’s performance has been disappointing since listing, with the shares hitting a record low of $2.29 earlier this month. They closed on their first day of trading at $3.69

Technically NEC looks average at best and a test below $1.50 in 2019 would not surprise.

MM is currently neutral NEC.

Nine Entertainment (ASX: NEC) Chart

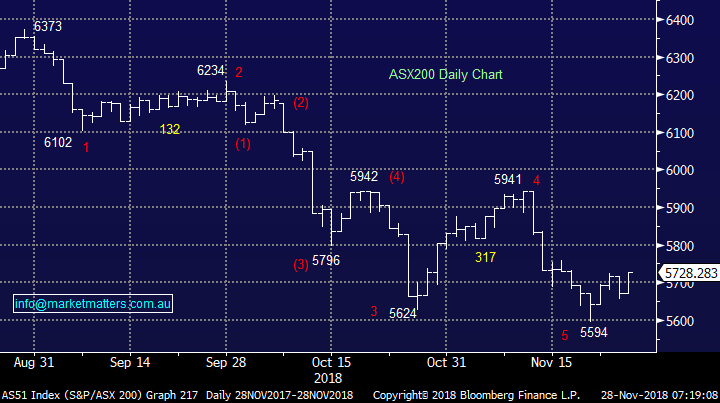

4 REA Group (ASX: REA) $75

REA Group which is better known as realestate.com.au to most of us recently posted 17% revenue growth for Q1 of this financial year.

Considering that REA is a growth stock its relative small pullback is an excellent indication of the strength on the underlying business. The bull case for REA is that as house prices fall houses take longer to sell and require a greater marketing effort which increases revenue.

Technically we are neutral / positive REA with accumulation into weakness looking to have some foundation.

MM is neutral REA at present but it’s the best of a bad bunch in our opinion.

REA Group (ASX: REA) Chart

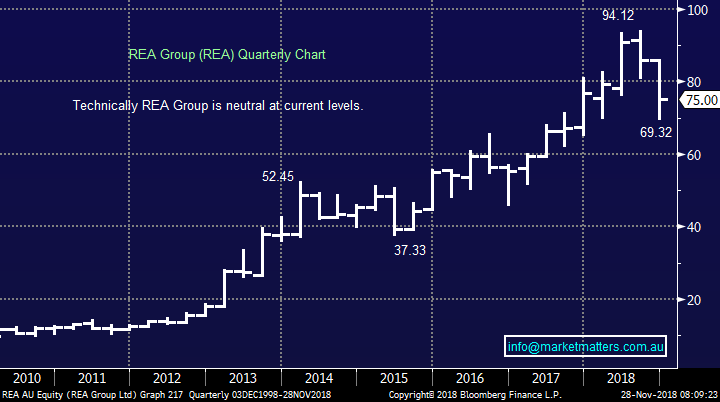

5 oOH! Media Ltd (ASX: OML) $4.17

OML is a fairly new kid on the block and it’s another growth stock that’s endured a tough 2018. The company is becoming a marketing and media conglomerate which could in the years to come help Sydney and Melbourne resemble other international cities with huge neon advertising adorning buildings.

Last financial year oOhMedia reported a net profit of $9.2 million on revenue of almost $200 million, while yielding 3.25% fully franked.

Also in the current financial year OML has completed the $570 million acquisition of outdoor advertising rival Adshel.

Considering the P/E has now fallen to sub 19x the stock is clearly looking far more attractive to the believers.

MM is neutral OML but we could consider buying below $3.75

oOH! Media Ltd (ASX: OML) Chart

Conclusion

MM sees no opportunity in the Media and Entertainment stocks and would rather be patient in anticipation of lower levels in our resources sector.

Overseas Indices

The US S&P500 now looks poised for a rally into 2019 with an initial target ~2850, or 6% higher – most certainly the path of most pain in our opinion.

US S&P500 Chart

European indices are now also neutral with the German DAX hitting our target area which has been in play since January, we need a close above 11,800 to switch us bullish.

German DAX Chart

Overnight Market Matters Wrap

- The Australian market is poised to open slightly higher this morning after Wall St recovered from early weakness to close slightly ahead, after the Dow at one stage had dropped over 200 pts. The rally came after investor hopes were raised of a US-China trade agreement following a more conciliatory tone from the White House ahead of talks between President Trump and President Xi scheduled at this weekend’s G20.

- Stocks were also boosted by comments from Federal Reserve vice chairman, Richard Clarida that the Central Bank was much closer to a neutral interest rate, and the pace of future rate hikes will be data dependent. A further rate hike is still expected in December, but the expectations for further rate hikes in 2019 have eased, with only another one or two hikes now priced in. US ten year bonds were steady at around 3.06%.

- Commodities were mixed with gold and base metals a little weaker, oil recovering from early weakness, and iron ore bouncing about 1.5% to around US$65.20/tonne following yesterday’s heavy selloff. Both BHP and Rio are about 1% and 1.6% weaker respectively in US.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 28/11/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence