Searching for “3 ideas” to create outperformance into Christmas (CBA, APT, CAT US, BHP, NWH, SVW, BOQ, BAC, BPT)

LOCAL REPORTING CALENDAR: CLICK HERE **Please note, data sourced from Bloomberg, not all ASX companies are on this list and dates can vary**

Today we have results from CGF, FBU, SCP & SYD + Equity Raise, I cover all of them in the recording below.

The ASX200 started of the week with a huge bang yesterday rallying over 100-points to post its highest close in 3-weeks, the heavyweight Banking Sector lead the charge as it followed in the footsteps of its US peers on Friday night. The gains were not surprisingly broad based with over 80% of the market closing in positive territory but it was the rampant “Big 4 Banks” who added the bulk of the days gains, the average advance of the 4 was an impressive +3.1% - as we often say at MM the market struggles to go up without the banks, well on Monday they certainly joined the party!

We’ve remained particularly bullish Commonwealth Bank (CBA) since March with our initial target above $75, suddenly its only one good day away! However, were not saying sell at this level, rapid acceleration to $80 and above would not surprise for a couple of reasons:

1 – The market is too negative and underweight the Australian Banking Sector easy to comprehend with COVID-19 and its implications on many Australians financial position but when too many people are positioned for the same view surprises often unfold in the opposite direction.

2 – MM remains bullish the “reflation trade” over the next 12-18 months, a macro backdrop that is theoretically bullish for the Banking sector.

3 – CBA is still estimated to pay a ~5% fully franked for investors who buy today and hold for the next 13-months i.e. theoretically capturing 3 dividends in the process. Clearly very attractive in today’s interest rate environment.

4 – CBA remains almost 20% below its pre-coronavirus levels implying a significant amount of economic damage is built into its share price, a faster than anticipated vaccine & / or economic recovery could easily see a rapid degree of catch-up.

MM remains bullish & long the Australian Banks.

Commonwealth Bank (CBA) Chart

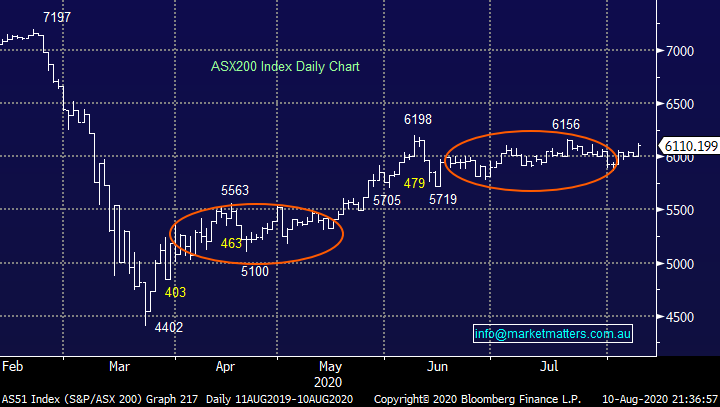

Yesterday’s surge took the ASX200 clear of its recent very tight trading range, for the traders amongst our subscribers we could now comfortably be long at today’s level with a stop under 6050 with an initial upside target in excess of 6250 i.e. almost 3:1 risk / reward with the 4-month trend. However, we all know the 6000 area has remained a huge magnet for the index, but after many weeks at least an attempt at a fresh level of equilibrium does feel overdue, again! However now the banks are threatening a decent move a break to the upside has more foundation, either way at MM we remain bullish local equities with the only question in our minds being “when” will stocks pop higher.

MM remains bullish the ASX200 medium-term.

ASX200 Index Chart

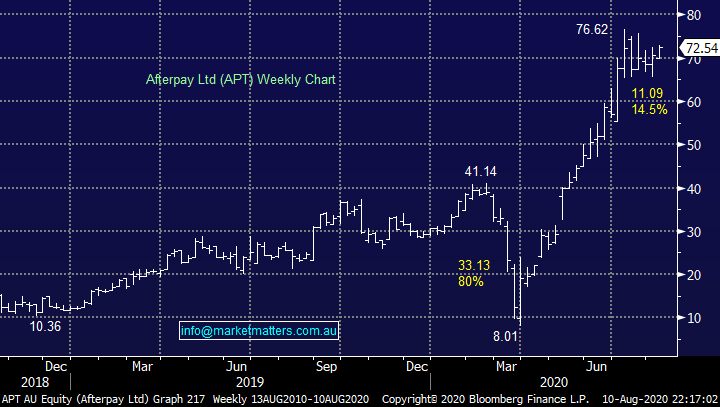

Afterpay Ltd (APT) continues to follow our anticipated path even after the news around Tencent’s ban by President Trump – remember the Chinese tech goliath took a 5% stake in APT back in May potentially affording APT the head start into the Chinese market plus the added bonus of huge tech support. The ban by the US is a clear headwind to these expansion plans but the share price has shrugged off the news, there’s clearly more water to go under this particular bridge as talk of APT challenging Visa and Mastercard gathers momentum. Bull markets have a habit of extending further than many people expect and while we’ve been looking for another 10% upside it could easily surprise many and become nearer 20%, either way it provides a solid outlook / backdrop for the Australian IT sector – even if it is a market group we feel may underperform into Christmas.

MM remains bullish APT initially targeting the $80 area at least.

Afterpay Ltd (APT) Chart

Overseas Indices & markets

US stocks enjoyed another strong night on Wall Street with the S&P500 poised only 1% away from making a fresh all-time high. There’s no change in the MM camp, we’re bullish medium-term but a short-term initial pullback from the 3400 area would not surprise, importantly though we remain a buyer of dips until further notice.

MM remains bullish US stocks medium-term.

US S&P500 Index Chart

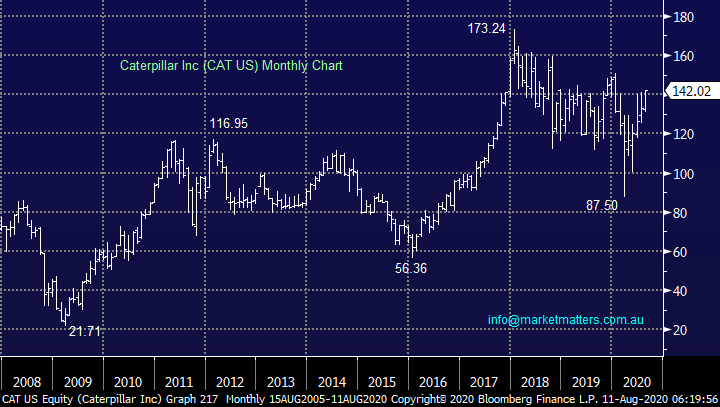

Caterpillar (CAT US) is a major US mining machinery manufacturer, it has a market cap of over $100bn, significantly larger than our own Fortescue (FMG) to put its size into perspective. Overnight CAT rallied strongly gaining over +5% closing at its highest level since late January, in other words its recovered all of its virus losses as Chinese & global stimulus has helped the resources stocks rally strongly in recent months.

MM is a bullish CAT targeting gains of ~30%.

Caterpillar (CAT US) Chart.

European stocks continue to run their own race which has pretty much followed MM’s roadmap illustrated below, if this proves correct one more look lower should provide the springboard to regain their upside momentum, potentially the ASX has pre-empted this turnaround after yesterday’s strong performance.

MM is a buyer of Europe ~5% lower.

EUROSTOXX Index Chart.

Searching for outperformance into Christmas.

Yesterday I had a conversation with a colleague of mine around a few ASX200 stocks and it crystallised my thoughts that following a ~50% rally in global equities identifying the next pocket (s) / stock (s) for portfolio outperformance has become a tough proposition, we’ve had the “High Beta” IT sector carry the torch in admirable fashion since March but now it feels like it’s running out of steam, last night’s -0.3% decline by the IT Sector while Energy Stocks rallied over 3% offers some insight into what could happen next. I feel like some of the best returns into Christmas will be enjoyed by the underperformers where investors are underweight or perhaps even short – we mentioned this scenario earlier with sighting banks as the example, however we feel this theme will extend into other beaten up areas.

Today I have looked at 3 ideas / stocks / sectors which MM likes into Christmas.

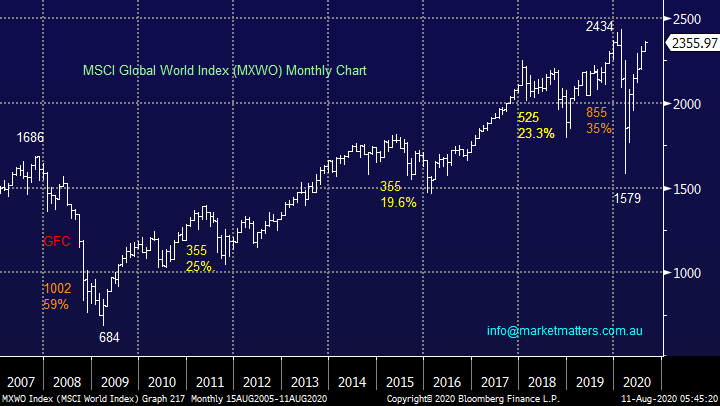

MM remains bullish global equities over the next 12-18 months.

MSCI World Index Chart

1 Mining Services.

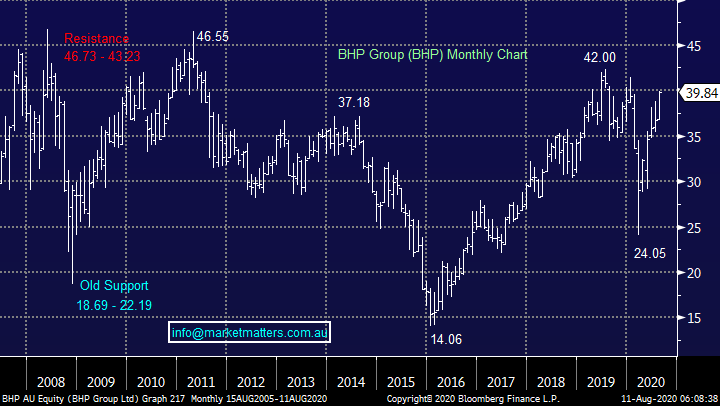

As we mentioned earlier Caterpillar soared over +5% last night helping the Dow rally over +350-pints / 1.3%, even while the large cap IT based NASDAQ dipped -0.5%. MM has made no secret of our penchant for the Australian Resources Sector and its view that has paid dividends since March’s market plunge with BHP Group (BHP) recovering 65% and in our opinion remaining on-track to test its decade old all-time highs.

MM is bullish the Resources Sector.

BHP Group (BHP) Chart

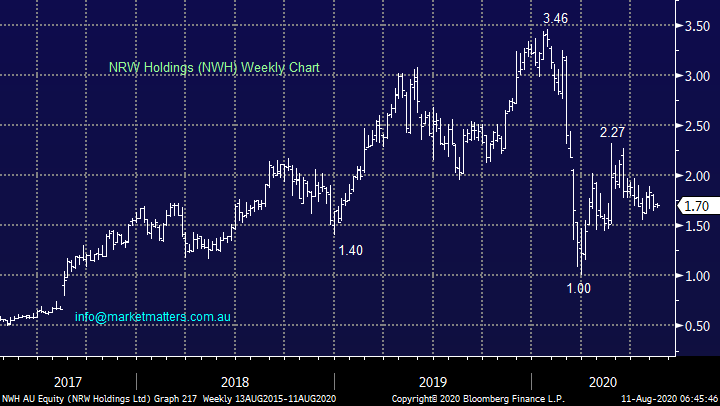

The miners have been relatively tight with their capex spending in recent years after seeing the folly of their ways previously i.e. commodities are like the economy very cyclical in nature and many resource companies have in the past cranked up the infrastructure spend just as the underlying commodities have rolled over and headed down. We believe they are likely to dust off the cobwebs and open their wallets as the world presses stimulus buttons like never before, the question for us is which local mining services stock offers the best risk / reward - MM already owns NRW Holdings (NWH) in this space which has been a fairly tough ride but we remain comfortable with the stock believing the BGC Contracting acquisition provides an excellent opportunity for both scale and diversification of earnings into 2021.

MM remains positive NRW Holdings (NWH).

NRW Holdings (NWH) Chart

However, one stock that jumps out at me this morning is Seven Group Holdings (SVW) which has exposure to resources capex, infrastructure spend plus gas – we like all 3! The company operates the Caterpillar franchise in Australian and holds a 29% stake in Beach Petroleum (BPT) which we own hence caution would be required with regard to position sizing, but we do like this stock both fundamentally and technically.

MM is bullish SVW both short and medium-term.

Seven Group Holdings (SVW) Chart

2 Global Banking Recovery

Yesterday we witnessed how the path of least resistance for the banks is slowly skewing back to the upside however its been a tough few years of huge underperformance hence we must remain on guard that this is not just another false dawn – we don’t believe so but investors must remain open-minded.

Locally the much maligned Bank of Queensland (BOQ) is catching my eye from a risk / reward perspective - we are initially looking for 15-20% upside while the stock can hold above last weeks $5.68 low – this is definitely a case of “bottom picking” hence we wouldn’t advocate throwing the kitchen sink at the stock.

MM likes BOQ with stops under $5.68 as a trade

Bank of Queensland (BOQ) Chart

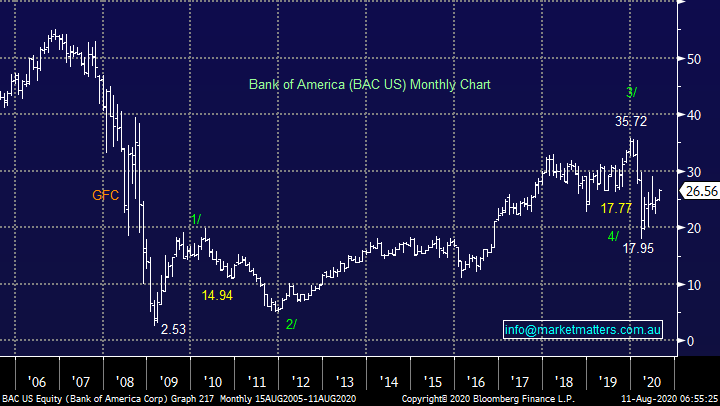

In the US as we’ve mentioned recently we agree with Warren Buffett and believe the Bank of America (BAC US) represents great value at current levels, we are looking to average our position in the International Portfolio.

MM is bullish BAC medium-term.

Bank of America (BAC) Chart

3 Natural Gas.

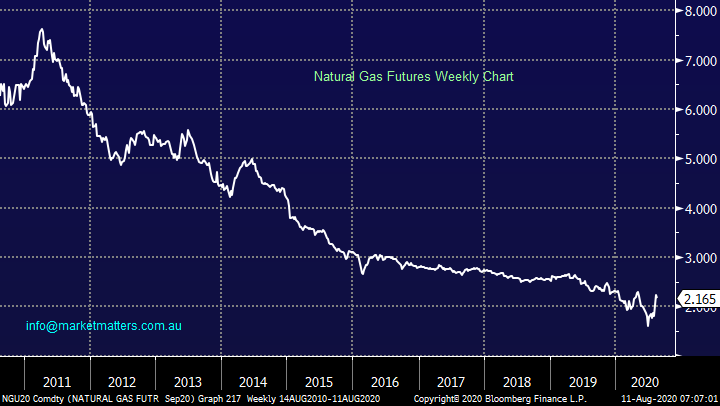

Natural gas has remained one of the most consistent bear markets over the last decade with prices falling by ~75%, a big ouch for local producers like Woodside (WPL) & Santos (STO). However, a big call for today’s reports – we believe that as Natural Gas moves into its seasonally bullish period it’s become a huge breakout candidate. The technical rally above $2.00 has broken its short-term bear trend and a rally into at least mid-2021 is our preference BUT this is a very volatile market and towards $4.00 to $5.00 would not surprise – another classic component of our reflation view.

MM likes natural gas from a risk / reward perspective.

NB This is one of the reasons that MM has held our WPL position to-date and will continue to hold in our Growth Portfolio, however as suggested last week (click here) we are looking to close this out in the Income Portfolio given the outlook for dividends.

Natural Gas Chart

If our bullish outlook for natural gas plays out our existing position in Beach Petroleum (BPT) which has been struggling of late should benefit significantly – we are considering increasing our position from 3% to 5% but note this would be a fairly aggressive play considering our holdings in Woodside (WPL) and BHP Group (BHP) alternatively as mentioned earlier we could consider Seven Group (SVW), watch this space! The

MM likes Beach Petroleum (BPT) medium-term.

Beach Petroleum (BPT) Chart

Conclusion

We like SVW, BAC / BOQ and the Gas sector which were all covered today.

Watch for alerts.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.