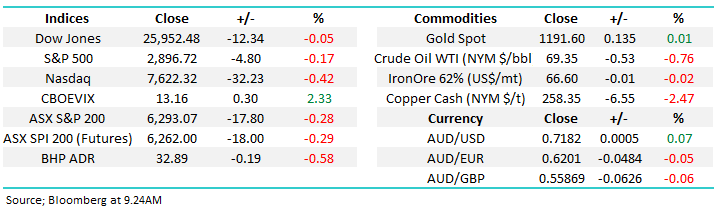

Reviewing the stocks on the move (ASX, SGM, EVN, SDA, WHC)

The ASX200 again retreated yesterday and is now feeling distinctly heavy, after 4 disappointing days we find ourselves back below the psychological 6300 area. The recent characteristic of heavy selling via the SPI futures early in the day followed by range trading from around 11.30am in my experience has often been how overseas fund managers sell our market.

Yesterday’s decline was led by the banking and energy sectors, while a few recently weak stocks enjoyed some selling reprieve but the market tone was very poor. At MM we have been eyeing a few stocks to buy into weakness but we are comfortable at this point in time with our relatively conservative stance in the MM Growth Portfolio i.e. we are currently holding:

- 18% cash, 3% in $US via an ETF, 10% bearish equity ETF’s (with half being leveraged) and only 69% in equities.

At 2.30pm the RBA left the cash rate glued to the 1.5% level, Australians holding debt have now enjoyed this lowest rate in history for an astonishing 25-months. Money markets are now looking towards the next decade before the RBA will consider raising rates with the $A suffering accordingly. We actually felt the RBA attempting to “talk up” our economy felt a touch desperate, or at least very optimistic – perhaps they have some “insight” into today’s growth (GDP) figures.

· We remain neutral the ASX200 but still in very cautious “sell mode”.

Overnight stocks were weak but they bounced fairly well from their lows, as we mentioned in the Weekend Report the US market feels to us like its enjoying an almost bond like “safety bid”. The SPI futures are calling our market down around 10-points early on with the damage likely to be experienced in the resources sector following falls in base metals led by copper -2.7% as it tests 14-month lows – the “Dr Copper” followers will be banging the looming recession drum hard this morning.

Today’s report is going to look at the 5 stocks on the ASX200 who moved by over 5% yesterday in case buy / sell opportunities are presenting themselves.

ASX200 Chart

Emerging Markets woes

The emerging markets continue to rattle investors with some poor economic news helping both the declines & negative sentiment in the groups currencies:

· South Africa’s economy has slipped into a recession sending the Rand down 2%.

· The Turkish Lira fell over 1% in a move that shows little confidence in their central bank.

· The Indonesian Rupiah fell to fresh decade lows.

MSCI Emerging Markets Currency Basket Chart

The 5 stocks on the move yesterday

In a weak market yesterday we saw 4 stocks rally by over 5% while one fell by -7.6%, we like to look at stocks who rally when markets fall hence the following look at these 5 movers.

1 Ausdrill Ltd (ASL) $1.72

Mining Services business ASL was the best performer yesterday rallying over +9% following news that the board have recommended shareholders vote to approve the Barminco acquisition which is apparently going to be earnings positive by around 30%.

However, the company has endured an awful year following some troubles earlier in the year at a few of its operations.

- MM is neutral ASL but wouldn’t be surprised to see an ongoing bounce towards $2 – one for the trader.

Ausdrill Ltd (ASL) Chart

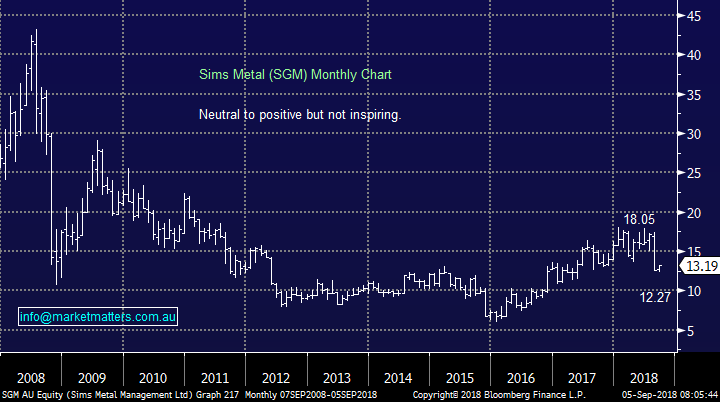

2 Sims Metal (SGM) $13.19

Scrap metal business SGM rallied almost 7% yesterday although it’s a drop in the ocean compared the recent weakness.

Recently the shorts have been covering but it wasn’t a major position and today sits ~3% of shares on issue.

- MM is neutral SGM at present, albeit with a slightly positive bias.

Sims Metal (SGM) Chart

3 Evolution Mining (EVN) $2.84

EVN rallied +5.2% yesterday but it was a from a low base, we actually flagged the potential bounce in the chart pack recently.

- We are neutral EVN but further strength towards $3 would not surprise.

Evolution Mining (EVN) Chart

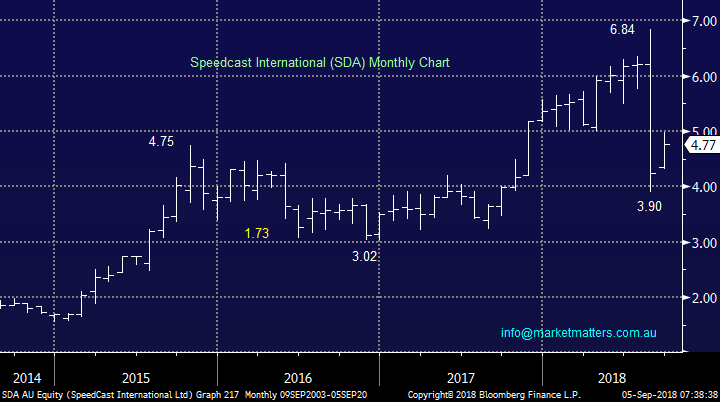

4 Speedcast International (SDA) $4.77

SDA rallied over 5% yesterday but its not been a fun time for SDA with the stock down 30% from last month’s high – a downgrade will do that to growth stocks.

We did find it encouraging to see a number of SDA directors buy their own shares into the weakness although most got set between $4 and $4.50. and are hence now nicely in the money.

- We are neutral SDA but another one to watch for the traders.

Speedcast International (SDA) Chart

5 Whitehaven Coal (WHC) $2.83

WHC tumbled -7.6% yesterday but two thirds of this fall was due to the company trading ex-dividend 27c i.e. including a 13c special dividend.

Technically we are neutral / negative WHC targeting under $4.20.

- MM is neutral WHC at best and have no interest at current levels.

Whitehaven Coal (WHC) Chart

Conclusion

Interestingly all 4 stocks who rallied by over 5% yesterday have corrected noticeably in recent months and are showing no meaningful reason for MM to consider purchases – a couple may be interesting for the traders.

WHC coal which fell yesterday technically looks poor and we have no interest at current levels.

Unfortunately this morning was one of those days when you look at a few things but the result is far from exciting.

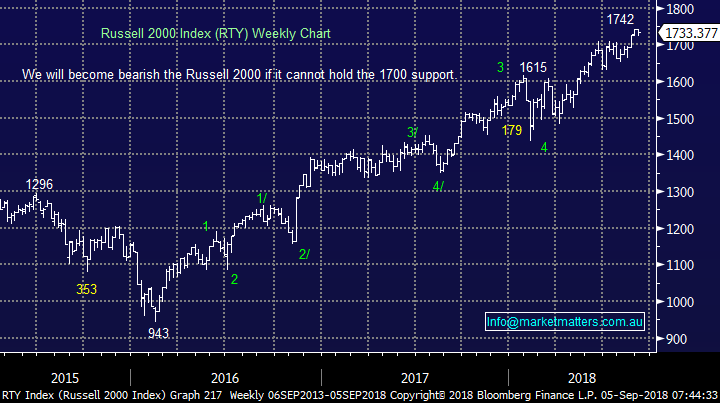

Overseas Indices

US stocks remain firm with the Russell 2000 needing to break under 1700 to generate technical sell signals i.e. around 2% lower.

US Russell 2000 Chart

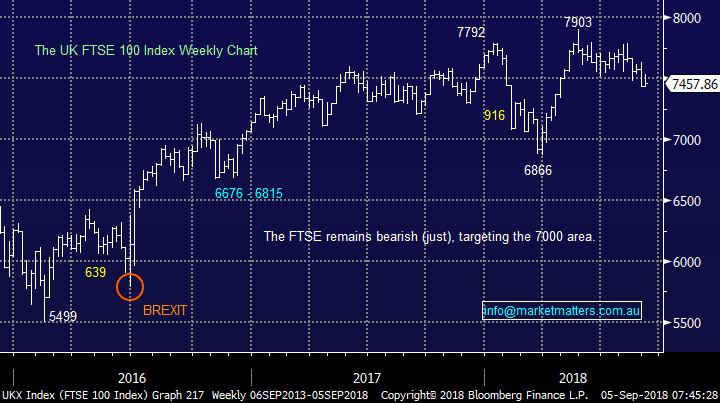

The UK’s FTSE remains bearish targeting a further 5% decline unless it can close back above 7550.

UK FTSE Chart

Overnight Market Matters Wrap

· The US equity markets resumed their trading week to end marginally lower overnight.

· US President Trump’s threat to keep Canada out of any NAFTA agreement kept markets restrained. Talks will resume Wednesday US time. Meanwhile US manufacturing activity rose to a near 15 year high and the economy grew at 4.7% pa in the third quarter.

· Emerging markets are gaining more attention for all the wrong reasons. The Indonesian, Turkish and Argentinian currencies are being hammered and South Africa has entered recession territory. Metals on the LME were weak with most falling ~2%. Iron ore rose nearly 1%, while oil fell a touch.

· The September SPI Futures is indicating the ASX 200 to open 9 points lower towards the 6280 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 05/09/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.