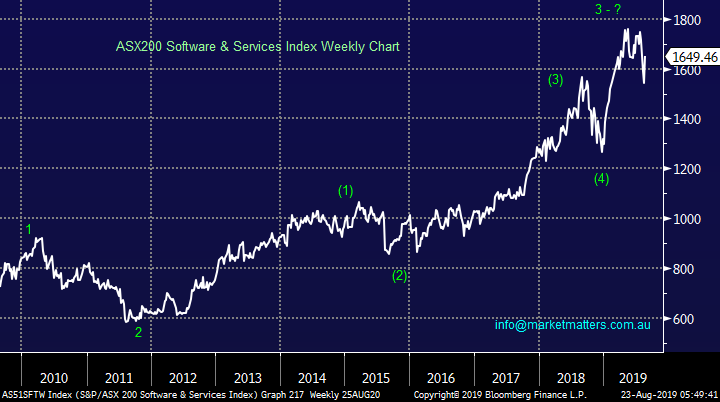

Reviewing the Australian IT sector as the NASDAQ struggles – (CGC, NAB, GDX, WTC, XRO, APT, APX, ALU)

The ASX200 finally experienced a relatively quiet day on lower turnover, stocks closed 18-points firmer surprisingly up almost 100-points for the week with only Friday to go – it hasn’t felt that strong! The market drifted into the close as iron stocks gave up early gains and investors appeared reticent to chase early market strength – no great surprise to MM. Under the hood the volatility remained elevated with 10 stocks in the ASX200 rallying by over 5% while 4 fell by the same degree, nothing unusual for reporting season. Today more companies face the music including Alumina (AWC), Goodman Group (GMG) and Costa Group (CGC) which MM will be watching very closely.

I get the feeling that fund managers simply cannot decide how to position their portfolios into the last quarter of 2019 as stocks, sectors and the index itself continue to chop around with an apparent lack of clear direction. There are so many macro balls in the air that I can understand the confusion i.e. interest rates / bond yields are at their lowest in history plus central banks are threatening yet more QE but a global recession looks imminent to many economists, especially as the US – China trade war continues to find no satisfactory resolution. Both the Australian Dollar ($A) and Copper hovering around fresh multi-year lows is a solid indicator that investors are very concerned with the health of the global economy.

MM remains comfortable adopting a conservative stance towards equities, especially around the 6600 area.

I reiterate that MM intends to adopt a more conservative stance if / when the ASX200 reaches the 6600-area through a combination of increased cash levels, re-entering the gold sector and considering the leveraged bearish ETF (BBOZ) i.e. less than 2% higher.

Overnight US stocks were mixed with the Dow rallying 50-points while the NASDAQ fell over 0.3%, the SPI futures are pointing to the ASX200 opening down around 10-points.

Today we are going to look at the IT sector, which so often leads the market, following last night’s underperformance.

NB This Weekend Report will come out late on Sunday as I’m heading down to the snow for a few days.

ASX200 Chart

I’m writing (typing) this before Costa Group’s (CGC) reveal their report this morning but I had mixed emotions yesterday as I saw the stock squeeze up almost 8%. While the gains were nice it reminded me of Emeco Holdings (EHL) on Tuesday prior to its result after which the stock was smacked, fingers crossed history doesn’t repeat in this instance.

CGC is carrying a fairly large 8% short position, MM would certainly be happy if these guys felt some pain.

We have been patient with CGC with today’s report likely to dictate if we’ve been correct into Christmas.

Costa Group (CGC) Chart

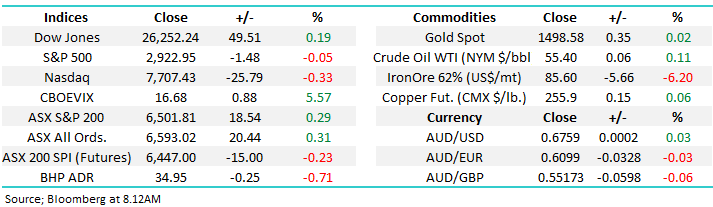

We regularly quote “the market won't go up without the banks”, not always true but a great guide considering the Big Four alone make up over 21% of the ASX200. Currently MM is overweight the sector but we are looking for an ideal area to take some money from the table and reduce our holding.

If National Australia Bank (NAB) squeezed back above $28 we would be tempted although at this stage Bank of Queensland (BOQ) is the most likely position to be cut.

MM is looking to reduce our banking exposure into further strength.

National Australia Bank (NAB) Chart

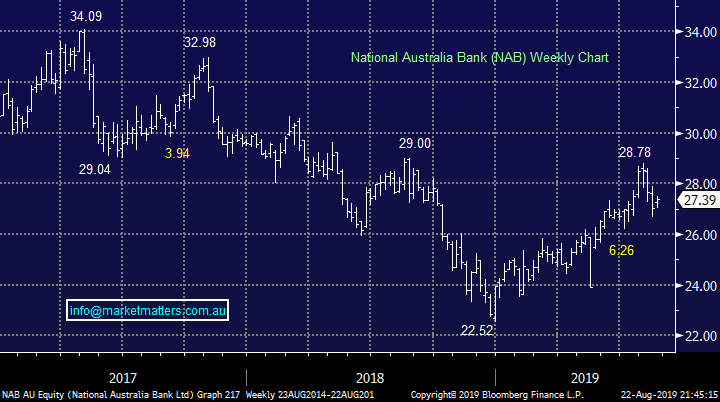

The Australian gold sector continues to drift lower, it feels like it’s in need of a classic capitulation style day to enable MM to start accumulating at attractive levels.

MM still likes gold stocks into weakness, ideally on a dip by the precious metal towards $US1450 /oz, only 2-3% lower.

VanEck Gold Miners ETF (GDX US) Chart

It’s been a relatively quiet fortnight on the important bond yield front but as the chart below shows it feels more like a rest before they continue their journey lower.

MM still expects the RBA to cut interest rates at least once in 2019.

Australian 3-year Bond yield Chart

No change in our opinion for US stocks: “MM believes we have entered a new short-term cycle for US stocks where bounces should be sold for the active trader”.

Our medium-term target for this market correction is around 6% lower, we feel it remains an ideal time to be an active investor, after a bull market lasting over a decade simply buying and holding carries some risks from purely a statistical perspective.

Our initial target for this down leg by US stocks is ~6% lower.

US S&P500 Chart

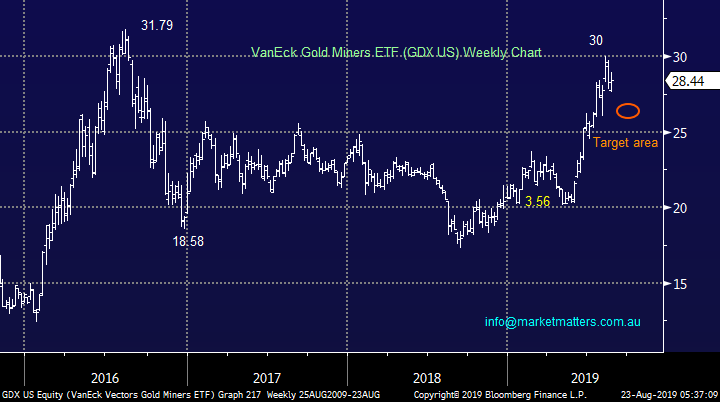

Reviewing the Australian IT sector

The ASX200 IT Sector, represented by the Software & Services Index, led the markets descent in Q4 of 2018 as investors ran scarred on concerns that interest rates were set to rise and push the US into a recession. One year later the recession talk is still around but this time interest rates are tumbling which has helped the sector record impressive gains in 2019.

Overnight we saw the NASDAQ struggle as Federal Reserve Officials cast doubt on further US interest rate cuts, not a significant decline but still noticeable on a night when the Dow rallied by 50-points. MM believes this trend will continue into 2020 and when the market decides central banks have finished with their sugar hits for risk assets this “well owned” group of stocks can easily fall over 10% i.e. The Australian “WAAAX” stocks WiseTech Global (WTU), Altium (ALU), Altium (APX), Afterpay Touch (APT) and Xero (XRO) have enjoyed huge success in 2019 as they’ve become momentum traders vehicles of choice BUT we should all remember Q4 of 2018, when the sector turns it can be savage.

MM believes the IT sector is a sell medium-term but short-term it's more 50-50.

ASX200 Software & Services Index Chart

Today we have briefly looked at 5 IT stocks as we look for both opportunities and clues to the path for equities in Q4 of 2019.

1 WiseTech Global Ltd (WTC) $32.89

Logistic business WTC shares rallied 10% following the release of their FY19 results – 57% revenue growth to almost $350m and a 33% increase in net profit after tax (NPAT) to $54m.

An overhaul impressive performance form this business which services 86% of the top global 3rd party logistics providers and all 25 of the top global freight forwarders.

However our concern is not surprisingly the valuation as the stock trades on a whopping Est. P/E for 2020 of 124x, no typo and zero room for error. We cannot justify the current price from purely a risk / reward basis. Considering the huge volatility in both the stock and sector MM believes there is strong possibility of another 20% correction in the months ahead i.e. be patient.

MM is neutral / bearish WTC at present.

WiseTech Global Ltd (WTC) Chart

2 Xero Ltd (XRO) $62.43

XRO has been on our radar for many weeks but the stocks actually been quiet which is unusual for any stocks in the sector. We are a fan of this on-line accounting business but the risk / reward is not exciting at current levels.

We can see XRO trading in an expanded range between the mid-high $50’s and $70 as it looks for direction hence we are happy sitting on our hands for now.

MM is neutral XRO at current prices.

Xero Ltd (XRO) Chart

3 Afterpay Touch (APT) $24.69

Buy now, pay later, payment Services provide APT has been in the news a lot over the last 12-months creating enormous short-term volatility but interestingly the stock is actually unchanged for the last 6-months.

APT sales are obviously linked to discretionary spending which is under general economic pressure but with most of the businesses growth focused into the US hence they are relatively well insulated from the highly indebted average Australian household. Competition is likely to increase significantly in the years to come which does scare us from a purely valuation perspective but APT has got the first off the rank advantage.

Into Christmas APT is likely to be driven by the overall performance of high risk growth assets, not a space we like after their strong run up in 2019, for us an easy one to simply leave alone.

MM is neutral APT short-term.

Afterpay Touch (APT) Chart

4 Appen Ltd (APX) $24.66.

Artificial Intelligence (AI) & machine learning business APX has been one of the market darlings over recent years but suddenly it finds itself correcting almost 30% in a relatively strong market. It appears the market is concerned around its revenue streams as the US-China trade war shows no signs of being resolved.

Our concern with APX, like most of the sector, is not the quality of the business but the stocks valuation as it trades on an Est P/E for 2019 of 50x, clearly way above the market average. We like the business but believe the shares have now become an active investors (traders) vehicle with so much good news built into their price. Short-term we can see a bounce but it's unlikely that MM will step up to the buyers plate until US stocks have satisfied our downside objective as APX often trades like a leveraged play to the NASDAQ.

MM is neutral / slightly positive APX short-term.

Appen Ltd (APX) Chart

5 Altium Ltd (ALU) $36.10.

This developer of printed circuit boards (PCB) for Microsoft delivered an excellent result this month showing an almost 23% increase in revenue to $US172m and a subsequent 41% increase in NPAT to $US53m, this growth business even declared an annual 34c unfranked dividend.

Another business that MM likes and its Est P/E for 2019 of 50x is almost cheap compared to some of its sector peers. Following its strong result we can see ALU testing $40 in 2019 and its currently our preferred stock in the sector.

MM is short-term bullish ALU.

Altium Ltd (ALU) Chart

Conclusion (s)

The Australian IT sector is not exciting as a group at present but we feel like it will be in a few months’ time, potentially similar to last year.

Our favourite stock at current levels is Altium (ALU) while WiseTech (WTC) looks likely to experience some profit taking – a good pair's position for the active trader.

Global Indices

We believe US stocks are now bearish short-term as we touched on earlier, the tech based NASDAQ’s initial resistance is currently being tested.

US stocks have generated technical sell signals.

US NASDAQ Index Chart

No change again with European indices, while we remain cautious European stocks as their tone has become more bearish over the last few months, however we had been targeting a correction of at least 5% for the broad European indices, this has now been achieved.

The long-term trend is up hence any “short squeezes” might be harder and longer than many anticipate.

Euro Stoxx 50 Chart

Overnight Market Matters Wrap

• The US equity markets closed with little change overnight, as investors await a speech by the Chair of the Federal Reserve, Jerome Powell, at the annual central banking symposium in Jackson Hole, Wyoming tonight which should give some insight into the pace of further rate cuts.

• The European markets closed lower on continuing recession concerns. There also remain mixed signals about whether a deal can be done for the UK to leave the EU in an orderly fashion at the end of October, after UK Prime Minister Boris Johnson met with French President Macron overnight and it appeared that little further was resolved.

• A lighter day on corporate earnings, with AD8, AHG, AWC, BWX, CGC, GMG, IRE, MYX and SGM expected to report.

• The September SPI Futures is indicating the ASX 200 to open marginally lower below the 6500 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.