Reviewing our 4 worst performing positions (ORE, KDR, BBUS, TLS, JHG, CCP, RRL)

The ASX200 closed out July with the lowest monthly range in over 10-years which can interpreted in a number of different ways but considering its closed only 0.4% below the years high making it hard to be bearish at this point in time.

The energy and telco sectors stood out in the winner’s corner yesterday on a quiet yet choppy day while the healthcare sector remained under pressure slipping another -0.9%. At the very early stage of what feels destined to be a volatile reporting season companies have already been warned “miss expectations at your peril” e.g. Regis Resources (RRL) -10.8% thanks to weak production yesterday.

We noticed that on Bloomberg last night Morgan Stanley are now saying “a correction worse than February is looming” – shame, we often have our best results from unpopular views. However, in this case we will agree with the US investment bank.

· We remain mildly short-term bullish the ASX200 while the index holds above 6250, neutral between 6250 & 6140 and bearish on a break of 6140.

Overnight stocks were firm with the US S&P500 rallying 0.5% and Europe up 0.4%. A solid report by APPLE after their close should see the ASX200 open up at least the 15-points that the SPI futures are implying however continued discussions around trade between the US and China may have a influence here.

Today’s report is going to focus on our 4 worst performing positions as we kick off August – “the winners will look after themselves”.

Also, we will look at the best & worst performer of yesterday as opportunities maybe close at hand as reporting season kicks off sending individual stock volatility well and truly north.

ASX200 Chart

Winner: Credit Corp. (CCP) $20.58 / +8.54%

CCP initially fell to $18.35 yesterday largely because of their weaker than expected guidance for FY 19 however they did a good job of talking up their US opportunity which is now making money. The stock quickly turned around from early weakness and closed up more than 10% above the low of the day, for its largest gain in 2-years.

With earnings per share (EPS) and dividends both growing 16% CCP over the past year and growth expected to be around 5% in FY19, CCP looks well positioned moving forward + it’s a defensive business that can do well in an economic downturn when more debt requires collection (as long as their balance remains strong). Also, CCP sees the US a great “debt buying market” which spreads their risks across two economies while having some exposure to a potentially strong $US.

· We like CCP technically and fundamentally while it can hold above $19 and the risk / reward is ok considering its with the trend.

Credit Corp (CCP) Chart

Loser: Regis Resources (RRL) $4.46 / -10.8%

RRL closed down over 10% yesterday following its 4th quarter report and guidance for 2019, with production costs rising over 9% appearing to be the main concern to investors over the day but the board also has indicated costs will rise again next year.

· Technically the stock will look more interesting closer to $4 which fits the recent profile of stocks that disappoint falling for more than just a day.

We prefer our exposure to Newcrest within the gold sector.

Regis Resources (RRL) Chart

Now it’s time to take a deep breath and look at our 4 worst positions (on paper) in the Growth Portfolio. Do we “hold, fold or average?”.

1 Orocobre (ORE) $4.62

We’ve been watching / mentioning ORE over recent weeks on 2 levels, firstly for an optimum exit area and secondly a potential switch to fellow lithium stock Kidman Resources (KDR). Obviously we wish we had exited ORE for a profit above $6 but we were mindful at the time that our long-term view has been to hold either ORE or KDR, plus technically we thought $7 was a realistic target.

Yesterday ORE released some a record sales results which helped the stock close well off its lows on the day i.e. ORE was – 0.4% compared to KDR -8.2%. Also they realised record prices and costs fell 13%, an impressive combination. We believe this result justifies giving ORE further room for now.

Technically we will get an excellent buy signal for ORE on a close back above $5 where we may consider increasing our holding.

Finally even though KDR has now corrected far more than ORE from its 2018 highs we are putting our switch idea on ice for now.

Orocobre (ORE) Chart

Kidman Resources (KDR) Chart

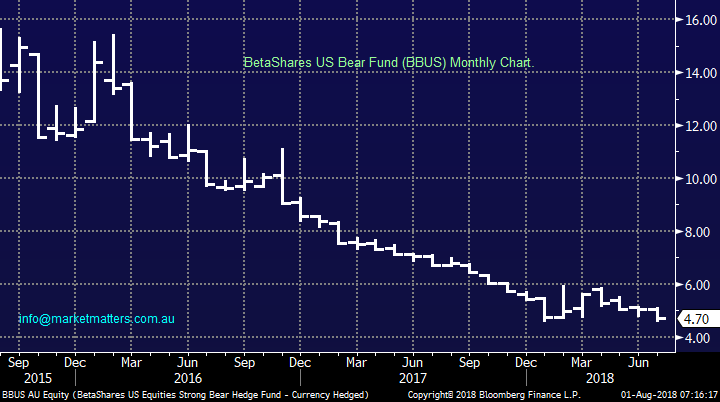

2 BetaShares US Strong Bear (BBUS) $4.70

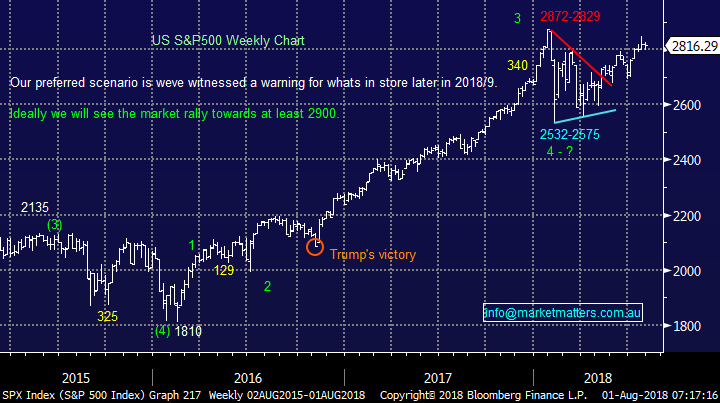

Our position in the negative facing US equities BetaShares ETF (BBUS) continues to suffer because US stocks remain resilient. However this is no real surprise and we still believe there’s a strong chance the S&P500 maKes fresh highs for 2018, as discussed at length since the January / February correction – note that’s now only ~2% away hence no big call.

Considering the US market has unfolded largely as expected both since 2015/6 and this January / February we see no reason to lose faith with our view moving forward i.e. we expect the US S&P500 to at least test its 2018 lows which should help the BBUS rally by ~30%.

· We plan to slowly add to this position in the BBUS, especially if we buy the European (HEUR) ETF or more local stocks.

BetaShares Strong Bear (BBUS) Chart

US S&P500 Chart

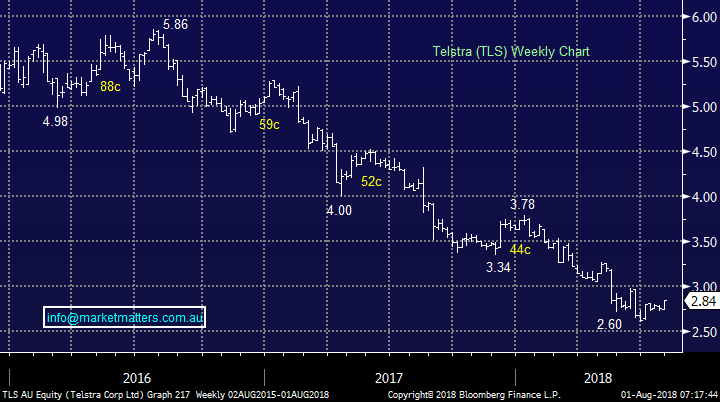

3 Telstra (TLS) $2.84

We find the recent actions by Andy Penn at TLS very encouraging and reminiscent of Alan Joyce before he turned around QANTAS. Also this week we read an article in Livewire basically calling TLS down up to ~25%, great stuff for our bullish view, we like the contrarian corner.

After slowly rallying almost 10% TLS looks well positioned technically to initially move back above $3 with our target closer to $3.50.

· We remain bullish TLS both individually and on a relative basis.

Telstra (TLS) Chart

4 Janus Henderson (JHG) $43.65

JHG has finally found some backbone with yesterdays +3.3% advance making it one of the best performing stocks in the ASX200 just of there earnings release overnight.

The stock is trading at the cheaper end of the scale compared to its peers on a P/E of 11.23x, we believe its cheap considering diversification, US earnings and potential cost saving from the Janus-Henderson Group merger but the market is not yet in our corner. The 2Q results released from JHG overnight were okay with earnings pretty much inline with expectations, outflows fairly high, however they did launch a $100m share buy-back which should be supportive – perhaps that part of the story was leaked yesterday!!

We remain bullish JHG short-term targeting the ~$45/6 area where we will reconsider our holding.

Janus Henderson (JHG) Chart

Conclusion

We are unlikely to act on any of the above 4 positions in the following week apart from potentially increasing our BBUS position if / when we increase our net market exposure.

Overseas Indices

The tech-based NASDAQ closed 3.7% below its al-time high set in July, a good effort considering the Facebook and Twitter stories.

European stocks look well positioned to make further gains to all-time highs.

US NASDAQ Chart

EuroStoxx Chart

Market Matters Overnight Wrap

- A solid rebound in technology shares following the recent selloff, helped Wall St close out another strong month with both the Dow and S&P 500 notching their strongest runs since January, up 4.7% and 3.6% respectively. The Nasdaq, which had been hit by this week’s tech selloff, also recovered and ended the month 2% ahead.

- After market, Apple reported better than expected 3rd QTR earnings, with revenue up 17% at US$53.3bn (consensus US$52.3bn) and a 40% rise in eps to US$2.34 vs consensus of US$2.18, despite lower iPhone sales of 41.3m (cons 41.8m). The stock is trading 2% higher in after-market trading.

- The market mood was helped by continuing stronger than forecast quarterly earnings as well as reports that the US and China were prepared to talk to avert a further escalation in the trade wars between both countries. About 60% of companies have reported so far, with over 80% beating expectations.

- The local market is expected to be buoyed by the overnight moves not only on Wall St but by a solid recovery in base metal prices, led by copper and aluminium. Oil prices however retreated, with Brent down about 1%. Both RIO and BHP were 1.9% and 1.2% stronger in overnight trading. The A$ is trading firmer this morning at US74.3c and the futures are pointing to a lift of 19pts on the opening on the ASX.

Have a great day

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 01/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here