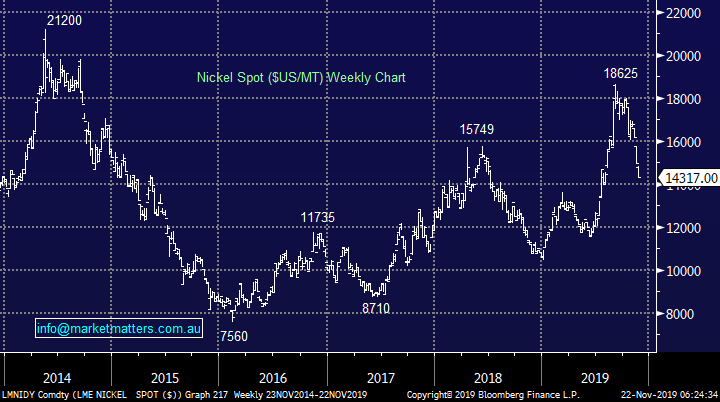

Reviewing Hamish Douglass (Magellan’s) 5 largest holdings (WSA, IGO, WBC, GOOGL US, MSFT US, FB US, SBUX US, BABA US)

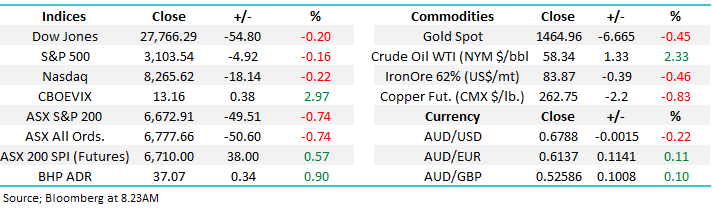

Thursday proved to be another bad day for Australian stocks as the ASX200 finally closed down another 50-points, although it was much worse at lunchtime down around 85-points. Again well under 30% of the index closed positive in the weak session while the major index damage was inflicted by the heavyweight Financial, Healthcare and Resource sectors but on a day when all 11 of the ASX200’s sectors closed down it was more a case who fared the worst as opposed to who offered some support.

Australian stocks have suffered over $40bn being wiped from their value in just 2-days of solid selling, after starting the week with so much optimism the markets basically lost all of its gains for November although in today’s choppy environment we might get all of it back in the next few sessions!

Yesterday’s weakness reverberated throughout most of Asia with Hong Kong dropping -1.6%, China -0.3% and Japan -0.5%, markets have clearly been well and truly rattled by increasing concerns around the US - China trade talks. Perhaps we’ve all heard just one tweet too many and when the US Senate voted to support Hong Kong’s anti-government protestors it felt like markets had decided that a positive outcome from the talks between the world’s largest 2 economic super powers was no longer a foregone conclusion i.e. they built some risk into the equation.

MM remains neutral the ASX200 with a slight bullish bias.

Overnight US stocks were marginally weaker at allowing the SPI futures to point to 38-point bounce locally as the heavy weakness from the Asian region did not spread throughout global markets i.e. a relief rally looks likely to see out this choppy week.

Today we’ve followed up our look at Warren Buffett’s 5 largest holdings on Wednesday with a similar exercise focused on Hamish Douglas from Magellan. Hamish is actually presenting today at the Hearts and Minds conference at the Opera House, this year’s event being headlined by Ray Dalio from Bridgwater & Howard Marks from Oaktree, two superstars from the investment world.

ASX200 Chart

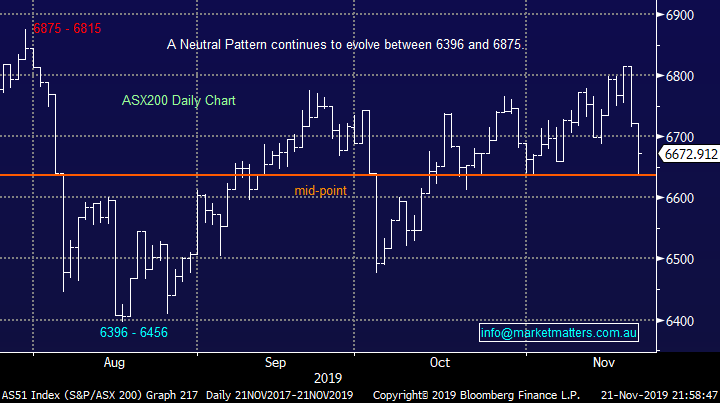

The Westpac news gets worse.

Westpac’s money laundering numerous breaches have surprised many including ourselves, the companies recent capital raise at $25.32 now feels almost opportunistic to many market sceptics. CBA were fined $700m for similar offences but on a smaller scale, WBC look likely to be hit with a number expressed in billions! The financial crimes regulator AUSTRAC has accused WBC of an astonishing 23 million breaches, a number that’s hard to comprehend, the story gets worse as ASIC is considering involvement around the issue of breached company law i.e. potentially more legal cost and fines!

MM is long WBC in both of our Platinum and Income Portfolios hence the last 2-days more than 5% plunge hurts and requires some assessment. Obviously the trouble is we are dealing with a number of unknowns at this stage leaving us almost forced to adopt a wait and see approach, sorry not ideal.

MM would only add to our WBC / banking exposure below $23, or another 8% lower.

Westpac (WBC) Chart

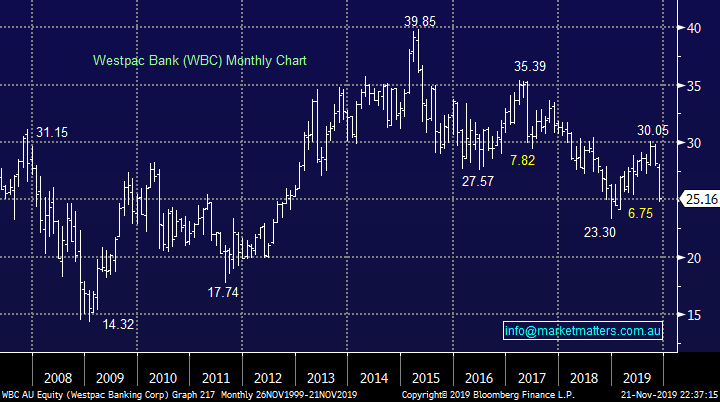

Nickel stocks are under pressure

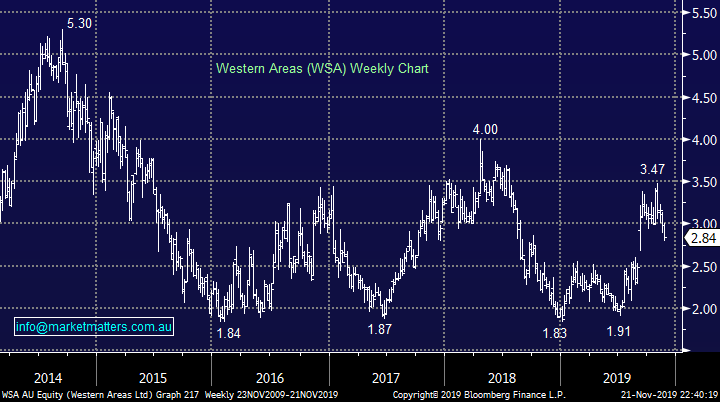

The nickel price has plunged 23% from its early September high, MM felt the metal was vulnerable to a pullback but it’s been harder and faster than we anticipated. The question we ask ourselves is where should we put our hand up to increase our relatively small 4% exposure via Western Areas (WSA).

Nickel ($US/MT) Chart

There are 2 options within the ASX for nickel exposure, one of which we already own:

1 – Western Areas (WSA) $2.84 – MM is considering averaging this pure nickel play around ~5% lower.

2 – Independent Group (IGO) $5.97 – IGO is a nickel and gold producer making this a least preferred option to MM, we already have enough gold in our Growth Portfolio. Technically MM likes the stock 3-4% lower, similar to WSA.

Western Areas (WSA) Chart

Independence Group (IGO) Chart

Reviewing Hamish Douglass’ 5 largest holdings

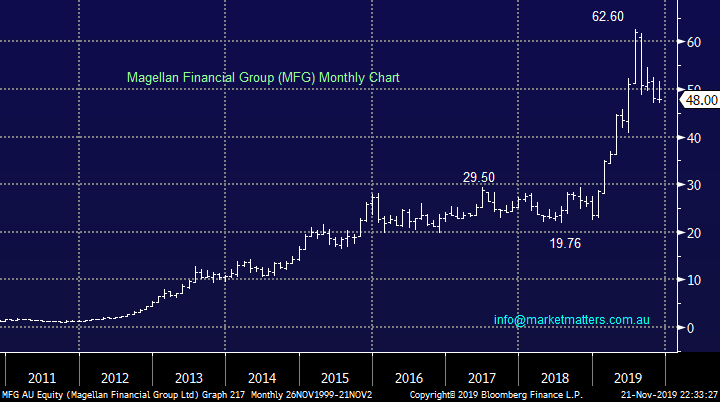

Billionaire Hamish Douglass has enjoyed huge success as the co-founder of Magellan Financial Group (MFG), even after recently correcting 25% the stock is up an extremely impressive ~250% from the lows of last year.

Common sense should tell investors to look at what successful investors are holding, it might become the catalyst of an idea for our own portfolio but remember as with Warren Buffett and his investment in Heinz they are still human and do get things wrong. Also what they are holding today might be one keystroke away from being an ex-holding, hence look with a very open-mind.

Interestingly, there was no overlap between the 2 groups with Mr Buffett being a more traditional value investor while I would describe Hamish Douglass as more of a visionary hence his holdings are more skewed towards tech and China – a country where he believes investors should have exposure.

Magellan Financial Group (MFG) Chart

Moving onto Magellan’s 5 largest holdings in its flagship portfolio at the end of October – again this could now be out of date. One of my favourite sayings is “invest / trade to sleep” and none of his positions would prevent me getting some deep rest, a good start in my opinion.

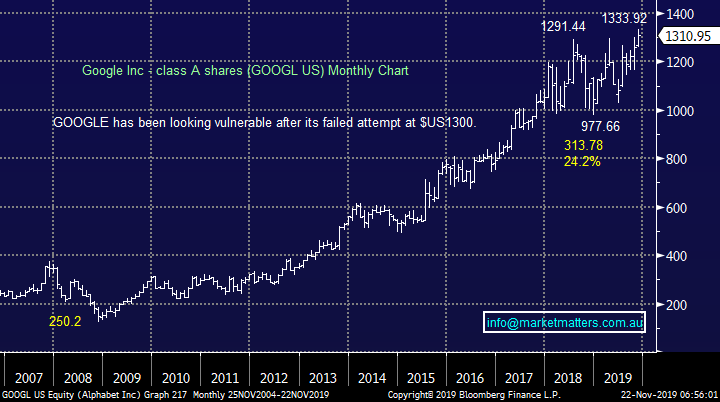

1 Google Alphabet Inc (GOOGL US) $US1,310.95

Google needs no introduction, most of us use it every day. The goliath of the internet has an advertising based business model which is rapidly expanding in a number of different directions. In its latest report 84% of the company’s revenue came from selling adds while 16% came from “other revenue” category i.e. mainly cloud and hardware.

We see nothing not to like in the business it simply comes down to what price to pay for this company which was over 20% lower for much of the last few years. It’s clearly been in the group of stocks that investors have almost chased higher as fund managers appear afraid to go outside of the top quality safe stocks i.e. its valuation has been pushed to levels where by definition risks increase. This is a company we would be keen to buy into a decent market correction, statistically likely in the year (s) ahead our ideal entry is ~$US1000 but we could buy here in a small way with stops below $US1260.

MM is bullish Google with 4% stops.

Google Alphabet Inc (GOOGL US) Chart

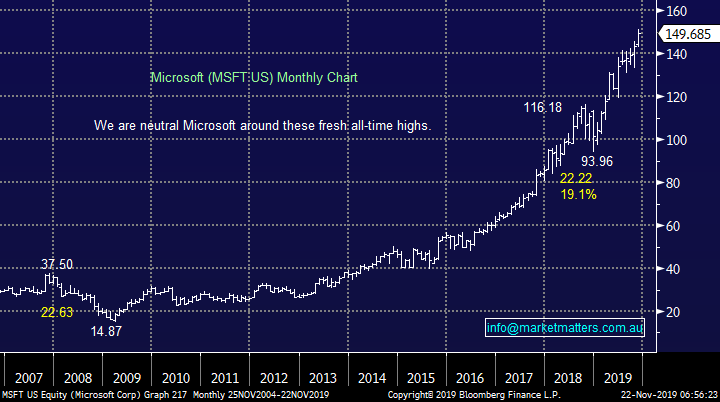

2 Microsoft (MSFT US) $US149.68

Microsoft is a similar story to Google in many ways, a quality company kicking huge goals but the risk / reward around $US150 is not too exciting. The business has been a huge beneficiary of the worlds move to the cloud a phenomenon which we feel has much further to unfold.

This is another stock we like but MM has been hoping to buy lower, we are starting to change our thought process towards accumulation leaving some ammunition in case a correction does unfold for equities – our concern remains that looking at fund manages cash levels too many people are hoping for such a pullback.

MM likes MSFT, ideal ~$US130.

Microsoft (MSFT US) Chart

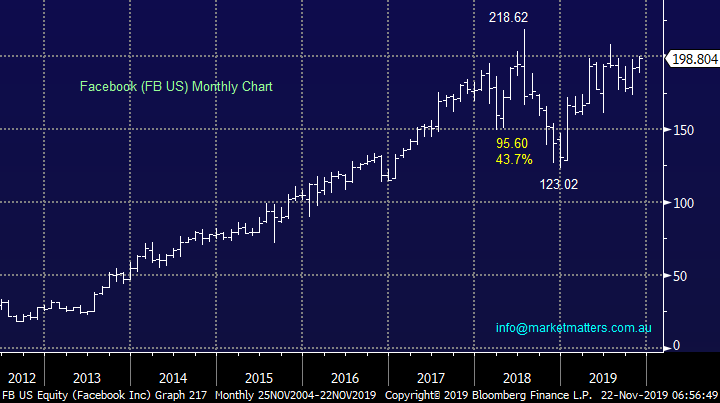

3 Facebook (FB US) $US198.80

Facebook has experienced a few issues in 2018/9 primarily around privacy and data issues. Like Google, FB is an advertising based business model which only went public about 5-years ago, on top of its namesake platform it also owns WhatsApp, Messenger and Instagram creating some revenue diversification but a whopping 98% of its revenue still comes from digital advertising.

One of my concerns with FB has been the fickle nature of the “youth of today” - it’s no longer cool to be on the same platform as your Mum. That said, FB has the cash / capacity to simply buy the next big thing, similar to what they did with Instagram meaning they stay at the forefront of social trends.

MM is neutral / bullish FB.

Facebook (FB US) Chart

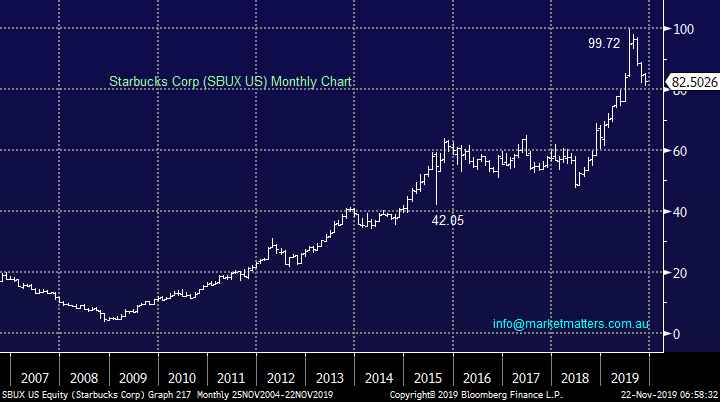

4 Starbucks Corp (SBUX US) $US82.50

Starbucks is a strange one for me, I would never drink their coffee in Australia but once you land in the US or China it’s the best of a bad bunch and we all know which are the bigger markets. Technically the stock looks ok after a recent +15% correction and after its latest solid quarter, which showed 7% growth in the US and 6% in China, value appears to have been restored to the coffee business. Technically we could buy here with stops under $US75 for the true believer.

MM is neutral / bullish SBUX.

Starbucks Corp (SBUX US) Chart

5 Alibaba (BABA US) $US

Alibaba is a stock MM has been stalking over recent months and it’s held up impressively well even while the likes of Hong Kong and China have corrected – watch for alerts.

MM is bullish BABA with stops below $US180.

Alibaba (BABA US) Chart

Conclusion (s)

MM likes Magellan’s top 5 holdings with our order of preference at today’s prices Alibaba (BABA US), Microsoft (MSFT US), Google (GOOGL US), Facebook (FB US) and Starbucks (SBUX US). However into a market led pullback we would be particularly keen on Microsoft and Google.

Overnight Market Matters Wrap

- The US equities closed marginally lower overnight, as investors continue to assess inconsistent reports on the trade deal with China.

- If it’s any indication however, risk is currently on with crude oil up another 2.33% overnight, while the ‘safe haven asset’ gold lost 0.45%.

- BHP is expected to outperform the broader market today, after ending its US session up an equivalent of 0.90% from Australia’s previous close.

- Locally, AGM’s to end the week is light with Kathmandu (KMD), Mayne Pharma (MYX) and Orocobre (ORE) to present today.

- The December SPI Futures is indicating the ASX 200 to open 35 points higher, back above the 6700 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.