Reporting season takes over from North Korea.

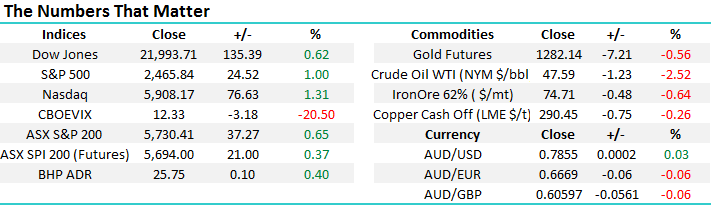

The ASX200 enjoyed a solid rebound yesterday leaving the index yet again almost exactly in the middle of its 13-week trading range between 5629 and 5836. The local equity market celebrated a weekend without any major news from Messrs Trump and Jong-un by rallying 37-points / 0.65% led by the banking sector which gained 2.3% following a strong result from Bendigo Bank (BEN). Today we are going to look at 4 stocks that are firmly in our universe following their respective results yesterday i.e. ANN, BEN, JBH and NCM.

The local market again picked the overnight move by global indices who all enjoyed a relief rally with the only notable negativity coming from the energy sector. Following yesterday’s disappointing data out of China plus a statement which was not as upbeat as we’ve been accustomed to a period of underperformance from our resources feels likely, and this of course would be amplified if we a short term bounce in the US currency.

Our preference remains for a pullback towards 5500 in the coming weeks / months, however a pullback to that level would see us allocate a large proportion of our 23.5% cash in the Growth Portfolio. In simple terms we believe any correction is likely to be very short-lived.

ASX200 Weekly Chart

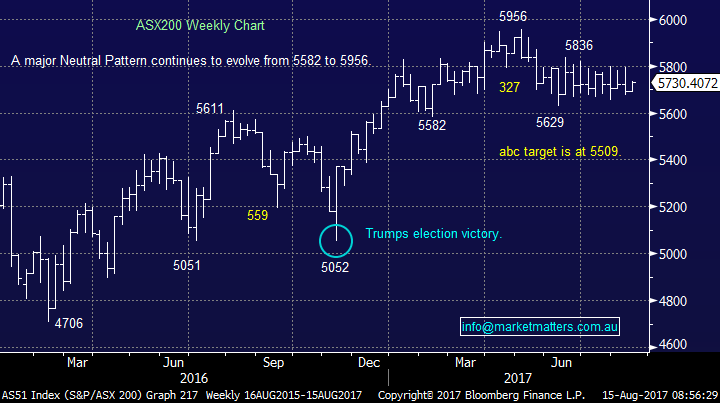

US Stocks

US equities bounced back solidly overnight as issues on home soil took over from geo-political concerns, today is “Liberation Day” in North Korea so more headlines from Kim Jung-un are a distinct possibility. However, with China pushing down the sanctions / diplomacy path with regards to issues on the Korean peninsula it appears a strong outburst, or worse, may be required for the issue to again become centre stage.

We remain bearish US stocks in the short term targeting a correction of ~5% and sell signals are now in place.

US S&P500 Weekly Chart

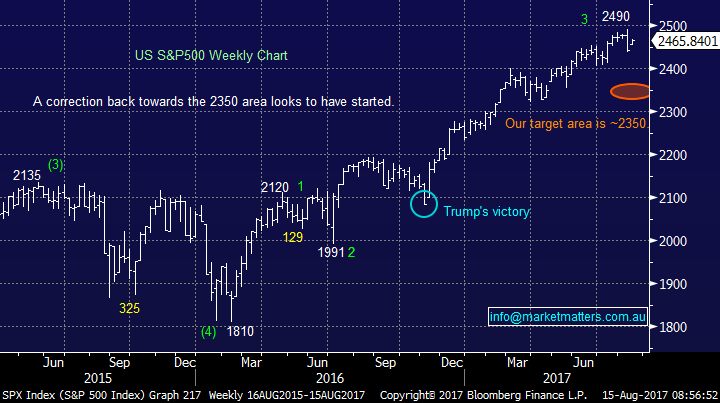

1 Ansell (ANN) $20.89

ANN reported a 7.2% drop in profits to $US147.7m while announcing its looking for acquisitions as it commences a 3-year transformation program. The optimism in the rhetoric was not enough for investors who sent the stock down 3.1% to a 13-month low, closing over 18% below its 2017 high.

While MM is currently not a huge fan of the healthcare and / or $US earning companies, we do see value in ANN around $20.50 for investors who like the sector. We would consider ourselves neutral ANN at present.

Ansell (ANN) Monthly Chart

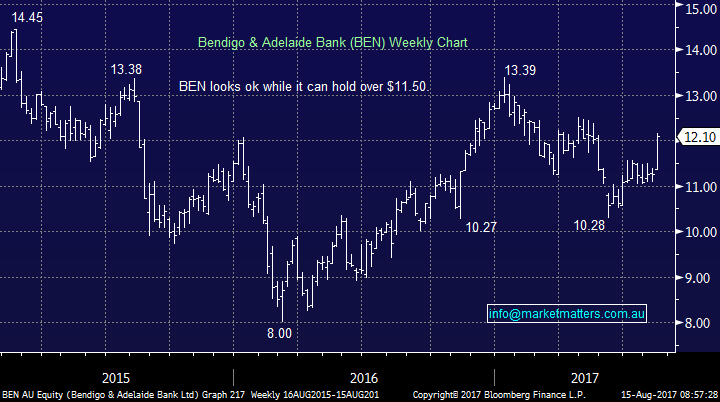

2 Bendigo Bank (BEN) $12.10

BEN showed a strong blue print yesterday for the broader banking sector, highlighting that effective re-pricing of a loan book will lead to strengthening margins and in an environment of lower bad debts, this creates a very strong combination for bank earnings! The result was taken extremely well and the stock closed up an impressive 7.5% - BEN has been heavily shorted recently which is likely to have assisted yesterday’s gains. The bank is paying a 34c fully franked dividend in the first week of September putting the stock on a yield of 5.62% fully franked plus providing some small steady growth which makes the story pretty compelling.

The result composition was also a positive read-through for BEN’s peer group with the banking sector remaining well bid through the day and finally closing up 2.3%. It’s hard to imagine the ASX200 falling too far if the banks are going to rally, or at least remain firm.

We are bullish BEN around $12 while it can hold above $11.50.

Bendigo Bank (BEN) Weekly Chart

3 JBH Hi-Fi (JBH) $24.41

JBH reported yesterday with all the metrics looking ok, the headline underlying profit of $207.7m was ahead of both market expectations and company guidance. However, the market appeared to focus on the cash flow being slightly weaker than expected.

The current market doesn’t need much of an excuse to sell retail stocks due to the ongoing consumer weakness and the ever-present threat of Amazon looming large. JBH finally closed down 3.8% and it remains hard to get excited about the stock in this environment.

Unfortunately, we have JBH in the too hard basket at present.

JBH Hi-Fi (JBH) Monthly Chart

4 Newcrest Mining (NCM) $21.62

NCM missed expectations but the stock only fell 1% on a day when most gold stocks also retreated as geo-political tensions appeared to calm e.g. Evolution (EVN) was actually down 1.3%.The company announced changes to the dividend policy which probably helped offset a negative knee-jerk reaction to the poor underlying earnings, they printed $349m vs $442m consensus expectations which is a significant miss. The stock has been a poor performer since March which also probably cushioned any fall with the market expectations not too rich.

We are long NCM from higher levels and have remained patient in pressing the buy button, which we’ve discussed for a while, to average our position. Medium term we like the NCM story and are looking for a short-term catalyst to increase our position.

Newcrest Mining (NCM) Weekly Chart

Conclusion (s)

We remain buyers of any major market weakness and although our ideal target for the ASX200 is ~5500 we may slowly deploy some of our 23.5% cash holding in the Growth Portfolio before this area.

We like BEN ~$12 and NCM ideally under $20 but may raise this level, conversely we are neutral ANN and JBH.

Also, we believe the banks are likely to outperform resources in the next few months following yesterday’s China data and statement.

We are considering a switch from our RIO, or BHP position.

*Watch for alerts*

Overnight Market Matters Wrap

· Investors diverted their attention from the Korean peninsula to continue the theme this year of buying any pull-backs, with the three US indices trading near all-time highs.

· New York Fed President Dudley said he is expecting another rate rise this year which saw US bonds retreat as investors switched to riskier assets.

· Copper, nickel and aluminium traded lower on the LME, oil fell nearly 3% and iron ore was 0.6% lower.

· The September SPI Futures is indicating the ASX 200 to open 21 points higher, towards the 5750 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/08/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here