Reporting season rattles a few cages! (TCL, CZZ, NVT, IFL, Z1P)

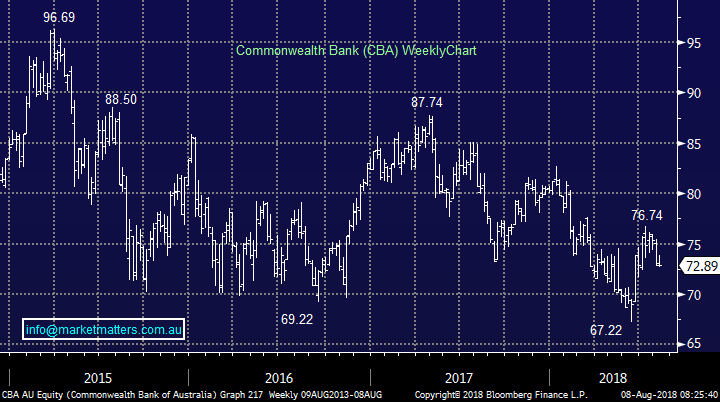

The market was surprisingly weak yesterday falling -0.3% led lower by Commonwealth Bank (CBA) which fell close to 1% as investors were clearly nervous ahead of today’s report, although the overall banking sector still managed to close in the black. General weakness was experienced in the diversified financials, healthcare, telco and retail sectors although volumes remained subdued.

As expected reporting season and stock news flow continues to dominate both headlines and the market with plenty of “fun” still looking likely moving forward. Interestingly most of Asia was very strong with Japan +0.7% and Hong Kong +1.5%, perhaps we will play some catch up when the local heavyweights have revealed all.

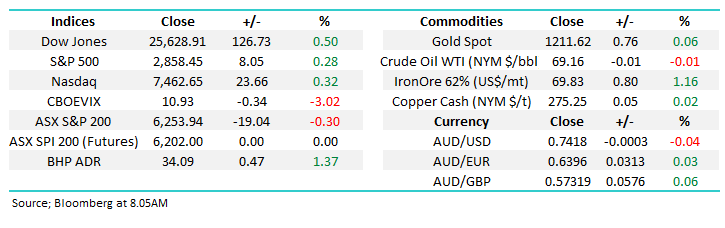

- We are neutral the ASX200 while the index holds above 6140 but we remain in “sell mode” albeit in a patient manner.

Overnight stocks were strong in both Europe and the US taking the lead from a positive Asia, the broad based US S&P500 is now less than 0.5% from its all-time high. The major news overnight came through Twitter and for a change it wasn’t Mr Trump using the platform as his mouth piece, this time it was Tesla Founder and CEO Elon Musk tweeting that he may well privatise the company. It sounded like a flippant comment to rattle short sellers (which it did), however further tweets suggested he had finance in place and it will happen pending shareholder approval.

Locally, SPI futures are indicating that the ASX200 will open unchanged with the interpretation of today’s result by CBA likely to change everything pretty quickly.

Today’s report is going to look at stocks in the crosshairs of news / reporting season with volatility on the increase on the stock level as “misses” are not being tolerated by investors.

ASX200 Chart

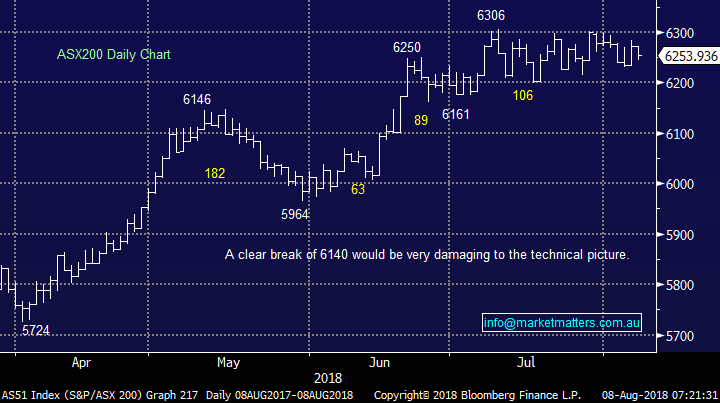

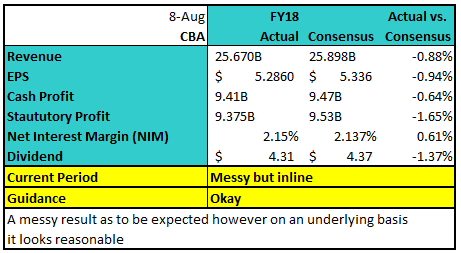

Commonwealth Bank result (CBA) $72.89

The CBA result is just out and its messy, however that was to be expected amid charges from the money-laundering settlement, margin pressure in the 2nd half from short-term funding costs (CBA have not repriced the majority of their loans higher as yet) and financial cost of ongoing regulatory issues. There was always going to be very little incentive for CBA to deliver a strong result today, however the result announced this morning looks reasonable on an underlying basis.

The headlines will highlight that CBA have booked the first drop in profit since 2009 thanks to weak revenue growth and higher costs while short term funding pressures also had an impact on the second half.

In terms of the numbers v expectations;

Clearly the market was expecting a messy result and that’s what has been delivered, however the trends in the underlying business actually seem to be tracking along reasonably well. Furthermore, the market was negative about the result leading into it, so some relief may play out in the market today.

- This is a tough call however I wouldn’t be surprised to see a sell-off early followed by a decent recovery.

Commonwealth Bank (CBA) Chart

Amcor (AMC) $14.39

Amcor (AMC) resumed trading yesterday morning following its announced huge $7bn all scrip acquisition of US-based Bemis Corporation which would make AMC the world’s largest maker of flexible plastic packaging products – interesting as we all try and move away from plastic. The good news is that while AMC was trading on P/E of 22x when the offer was made Bemis was only on 15x hence it certainly appears they aren’t paying a silly price (smart using more highly valued scrip to buy lower valued scrip). Also, AMC may be considering an eventual move from the ASX to the US with only a small % of its revenue now generated locally.

NB the deal didn’t come out of the blue. Amcor had approached Bemis about a year ago on a possible merger but the two parties couldn’t reach an agreement on the price.

- Technically we are neutral / negative AMC and would need the stock around $12 to have interest.

Amcor (AMC) Chart

Now moving onto 5 companies that provided earnings announcements to the market although none had the impact of the Eclipx Group (ECX) -40.8% discussed in yesterday’s afternoon report.

Winners

1 Transurban (TCL) $12.02

TCL reported a 8.7% increase in revenue for the year ending June 2018. Undoubtedly a solid result, plus a dividend increase, but the landscape of rising bond yields led to a muted response by the market of up only 12c. Very simply rising bond yields / interest rates diminish the attraction of infrastructure stocks like Transurban and Sydney Airports unless of course they can grow their earnings faster.

Australia surpassed the 25 million population mark yesterday and this is of coursed good news for TCL who want more users of its toll roads but of course they have limitations as we so often witness in Sydney. TCL is on a huge PE while now yielding 4.66% part franked. They also confirmed dividend guidance for 59cps for FY19 irrespective of whether or not they are successful in the WestConnex deal. This would imply the debt will increase and/or a large equity raise will happen.

- MM intends to avoid infrastructure stocks as bond yields rise, the headwind may easily become too strong.

Transurban (TCL) Chart

2 Capilano Honey (CZZ) $15.95

CZZ released its results and it was a very ho-hum affair with the stock closing up 15c. CZZ is now trading on an Est. P/E of 16x while yielding 2.63% fully franked.

- We remain neutral CZZ.

Capilano Honey (CZZ) Chart

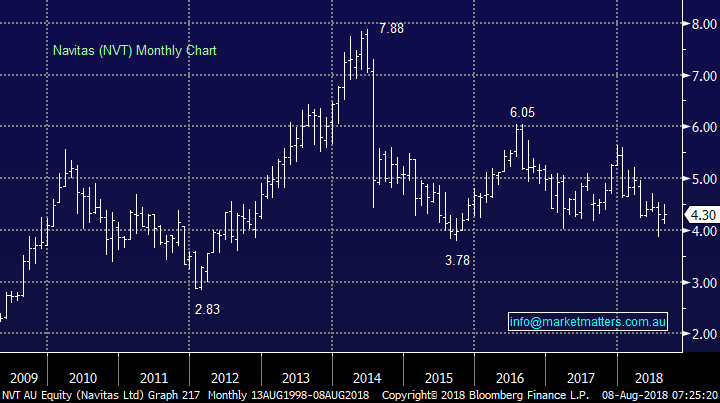

3 Navitas (NVT) $4.30

Education services provider Navitas (NVT) shares rallied 2.6% yesterday following the announcement of an after tax FY18 loss of $553m. We didn’t like to see revenue down 2.5% to $931m.

It appears to be the rhetoric from the CEO David Buckingham that supported the stock – “meeting the majority of our 2020 KPI targets”,

- MM is neutral NVT at current prices.

Navitas (NVT) Chart

Losers

1 IOOF Holdings (IFL) $8.84

IFL fell 1.9% following its result and the stock is now down over 17% for the year. The company’s profit was down 24% to $88m although organic growth was solid.

They announced a dividend of 27c, a scary 98% payout ratio, certainly risks here. The company clearly bought the ANZ business at / near the top and are paying the price.

While the business should benefit from a growing population and subsequent superannuation we do believe it’ s going to get harder before it turns the corner.

- MM is bearish IFL short-term targeting at least ~$8.

IOOF Holdings (IFL) Chart

2 ZIP Money (Z1P) 88c

Z1P latest market update contained little new information and the stock closed the day down 2c. The headline numbers look good with revenue up 138% and costs down, the stock does feel cheap compared to sector success Afterpay (APT).

- MM likes Z1P as an aggressive play although technically we could see ongoing weakness towards 70c i.e. leave some ammunition to average.

ZIP Money (Z1P) Chart

Conclusion

Not an exciting group of results yesterday, our views are:

- Neutral / bearish TCL.

- Neutral CZZ and NVT.

- Outright bearish IFL.

- Mildly bullish Z1P as a trade but preferred entry ~70c.

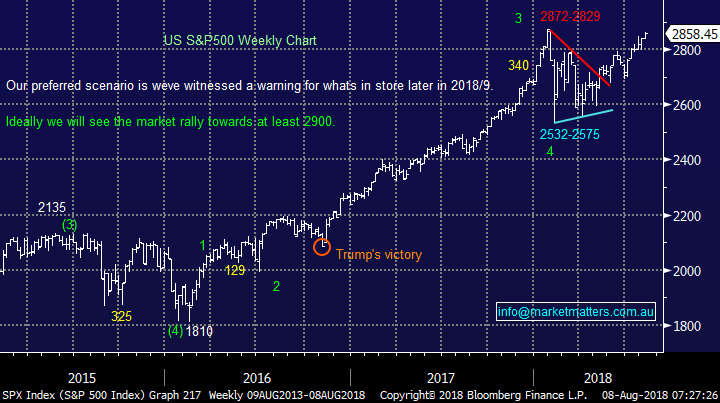

Overseas Indices

The S&P500 looks destined to make fresh all-time highs in the next few weeks, this has been our preferred scenario for months with the big question “will it fail around 2900?”, again as we have also been expecting. We are on alert for a decent market correction and are still looking to increase our cash position into strength.

European indices continue to trade sideways in a relatively similar manner to the ASX200.

US S&P500 Chart

UK FTSE Chart

Overnight Market Matters Wrap

· The Australian market is expected to open flat today according to the SPI as US markets again closed higher. The DJIA closed 0.5% in the black, while the S&P 500 and NSADAQ put on ~0.3%.

· It was a quiet night on the news and economic front. US earnings season is coming to a close with 85% now having reported. Earnings remain in focus after strong growth in the quarter.

· Tesla shares rose sharply after the Saudi Sovereign Fund built a stake and comments from Elon Musk that he may take the company private at US$420/share.

· Metals on the LME were mostly better, while iron ore and oil rose. The Chinese intention to stop the yuan falling any further after a potential trade war with the US has seen some short covering in the commodities space.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 08/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here