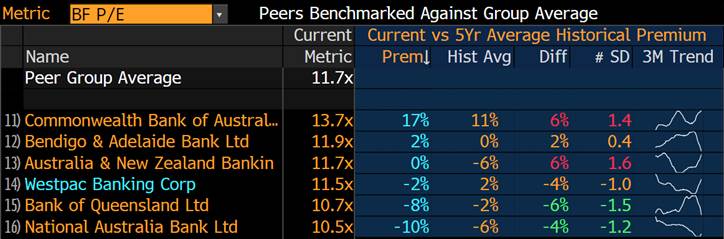

Reporting season is maturing fast & remains volatile!

The ASX200 surprised many on the upside yesterday (including us) as it appeared to become excited by 1. Westpac economist Bills Evans’ forecast that the RBA would cut interest rates twice this year & 2. Details emerging of a potential trade deal.

Mr Evans thinks our GDP growth will now be closer to 2.2%, compared to the previously anticipated 2.6%, and unemployment will rise to 5.5% by late this year, when combined with our weak property market it seriously feels Australia is intent on talking itself into its first recession in 27-years. It appears to be a very fine line that equity markets are walking between enjoying more financial engineering (lower interest rates & / or stimulus) and overlooking the usual very negative impact that a meaningful downturn in the economy exerts on stocks – only last December stocks plunged when investors became nervous of a looming slowdown.

The afternoons surge by the ASX200 was well and truly led by the banks with the “big 4” rallying an average of +1.5%, investors are clearly believing in their sustainable yield as opposed to potential bad debts moving forward - we will briefly look at the sector later. More stocks did rise than fall on this active Thursday but sector performance was mixed with gains in banks, financials being partly offset by losses in resources and especially golds.

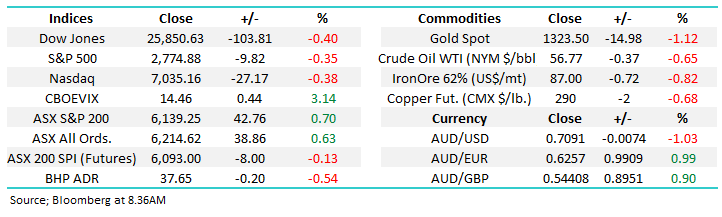

MM’s ideal scenario remains a pullback of around 175-points from the current area and we will be looking to buy this move, at least short-term.

MM remains in a patient “buy mode” with relatively elevated cash levels.

Overnight US markets were weaker with the Dow down 103-points while European stocks were mixed – the ASX200 looks set to receive more pressure from the resources with BHP down ~0.7% in the US. Today we are again going to evaluate 3 of the best and worst stocks from yesterday as reporting season now cools down slightly.

ASX200 March SPI Futures Chart

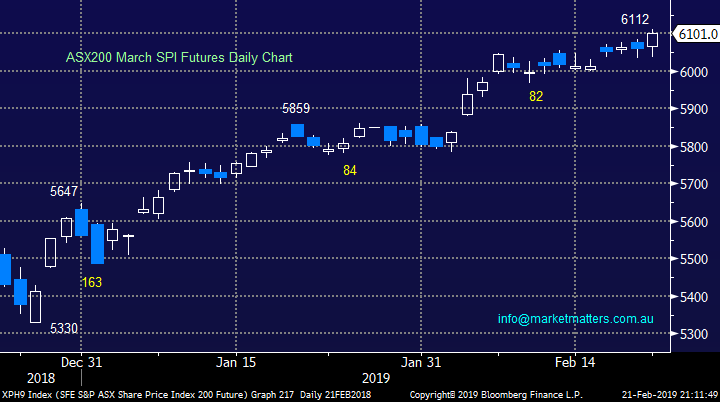

Star Entertainment (SGR) $4.65

Star Entertainment (SGR) met expectations yesterday and bounced back from the Crown led selloff the day before. The 1H was strong and importantly, they’re seeing top line revenue growth which is good. That led to a solid +5.7% pop in the stock compared to rival Crown (CWN) which continued to drift lower.

It looked to me there was clear selling of CWN to buy SGR i.e. a switch within the casino sector. Over the last month CWN is down 4% while SGR has rallied +9.2%, I think this outperformance by the Sydney operator SGR will continue and that perhaps a turnaround is now on the cards. Good volume into yesterday’s buying implies we’re not the only ones sniffing around here.

While we’re looking to buy SGR, for now we’ll remain patient ideally targeting the low end of the range around $4.20, however we may pay up.

Star Entertainment (ASX: SGR) v Crown Resorts (ASX: CWN) Chart

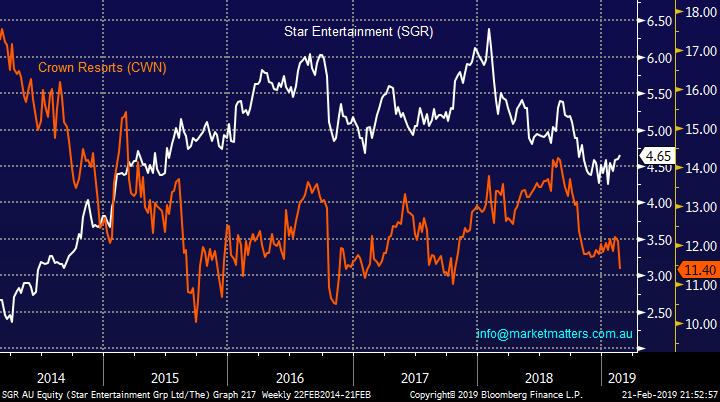

The banks “feel” firm.

MM has been overweight banks for a while and on days like Thursday it feels a good call, interestingly one that still appears a touch contrarian – MM is holding 30% of the Growth Portfolio in the “big 4” banks compared to their index weight of 20% i.e. we are 50% overweight.

When we look at Westpac (WBC) it may be 15% above its recent multi-year lows, however trading on a forward PE of 11.5x and yielding 7% versus a broader market that is now expensive remains appealing to us, even though I appreciate that growth is hard to come by in the sector.

In the case of WBC, it generally trades on a 2% premium to the sector, however currently its trading on a 2% discount. NAB remains the cheapest bank across the board and arguably has the most upside if they ‘self-help’ from here. CBA has regained its sector premium and then some which implies this should be the first bank on the chopping block if we lighten the load.

Source; Bloomberg

At this stage we feel banks look good and fundies remain underweight, hence most pain could be up.

Westpac Bank (ASX: WBC) Chart

Overseas indices

No change with European indices who have reached more resistance and our target area following their 12% bounce, we are now neutral to bearish from a simple risk / reward basis.

This reaffirms our believe that patience is likely to be rewarded with buying of the market in general – clearly not necessarily on a stock by stock basis.

Euro Stoxx 50 Chart

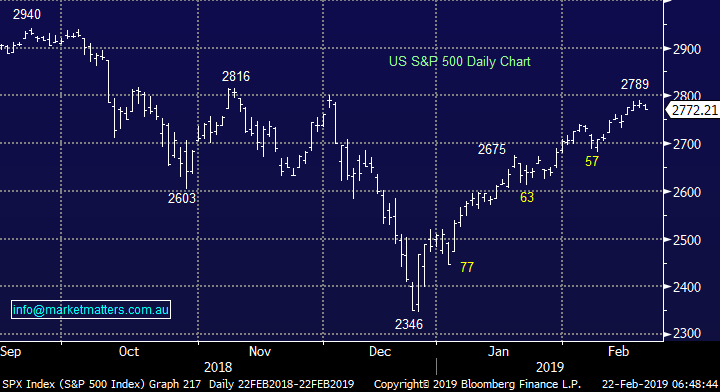

No change with US markets, we still believe they have a strong risk to the downside with our target ~5-6% lower. The upside momentum is wanning and a lot of good news has been baked into the recent index appreciation.

US S&P500 Chart

3 of the best performing stocks.

Yesterday we saw the 10 stocks rally by over 5% making it a tough call to pick just 3 to evaluate this morning but after mentioning SGR earlier we have focused on stocks that may be worth buying.

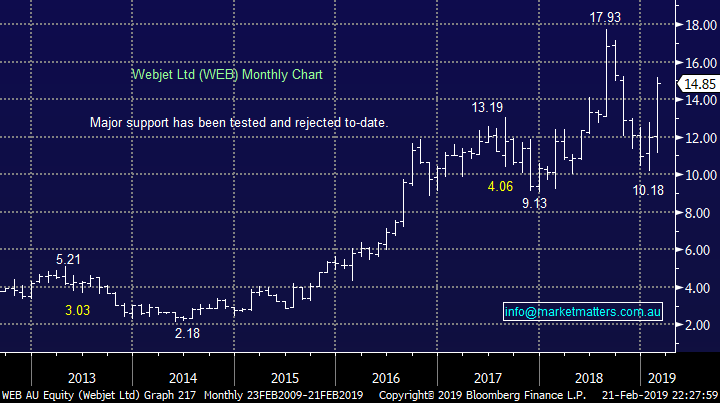

1 Webjet (ASX: WEB) $14.85

Yesterday WEB rallied a huge +30.6%, an advance we simply could not ignore. MM realised an almost 40% profit by selling WEB in June last year which looked a great call as the stock fell almost 30% to test the $10 area but in one quick move its now above our exit level.

WEB’s result was clearly strong yesterday and the market jumped on it aggressively. The company grew earnings 37% for the half, and gave a better than expected outlook which. Webjet had been under a cloud over the past few months following the disappointing European summer for their partner Thomas Cook which saw lower bookings during a hot UK period, plus Brexit impacting many peoples travel plans. Yesterday that cloud was lifted as the company reaffirmed full year guidance of at least $120m EBITDA with WebBeds continuing to power growth for the company. Despite the somewhat subdued leisure travel market, business travel continues to boom helping profits grow substantially for the business. Acquisitions have also bolstered Webjet, with the purchase of JacTravel and Destinations of the World lifting the company to a record result. However the 30% jump felt simply too much and we will not be chasing the stock higher.

While we like WEB as a trading vehicle, we’re not long term believers in their model. Attracting bookings online is all about optimising search capability, Airbnb is good at this and their recent hire of former Virgin America CEO Fred Reid could indicate that they’re looking to target the air travel market on top of accommodation. Not an immediate threat to WEB earnings but a potential sign of things to come. The disruptor could become the disrupted.

We are neutral WEB at current levels.

Webjet (ASX: WEB) Chart

2 Nine Entertainment (NEC) $1.57

Yesterday NEC rallied well over 7% following the release of its half year results, a result with no negative surprises can often be welcomed by a market entrenched in negativity. They also upgraded FY19 guidance for growth of at least 10% (at the EBITDA line)

While profit is flat, this is a stock priced for no growth. The shares are enjoying a relief rally that looks to have another 10% on the cards. While we view this stock as cheap with a strong yield (and we were considering for the income portfolio), the headwinds faced by a number of their operations over the next 12 months and beyond will likely remain

MM does not see value in NEC from a risk / reward perspective.

Nine Entertainment (ASX: NEC) Chart

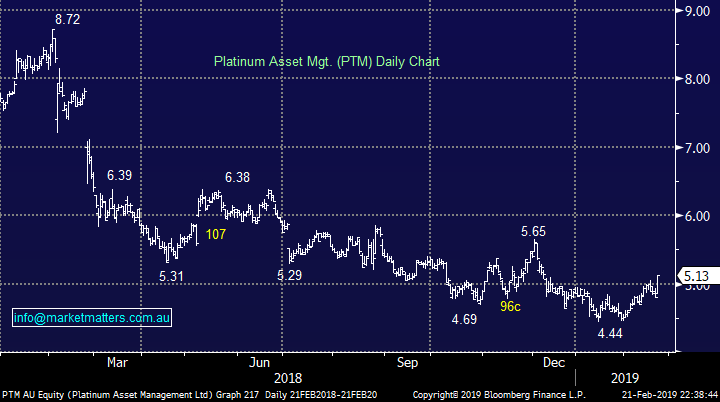

3 Platinum (PTM) $5.13

Yesterday PTM rallied almost 7% after declaring net income for the first half of almost $75m on revenue of $133m plus a 13c dividend putting the stock on a yield of around 6.2%. Most of the performance in markets had already been flagged and Funds Under Management (FUM) of $24.1bn, a decline of 6.1%, was clearly regarded as ok by the market - the growth in new products from Platinum should attract FUM in the future. .

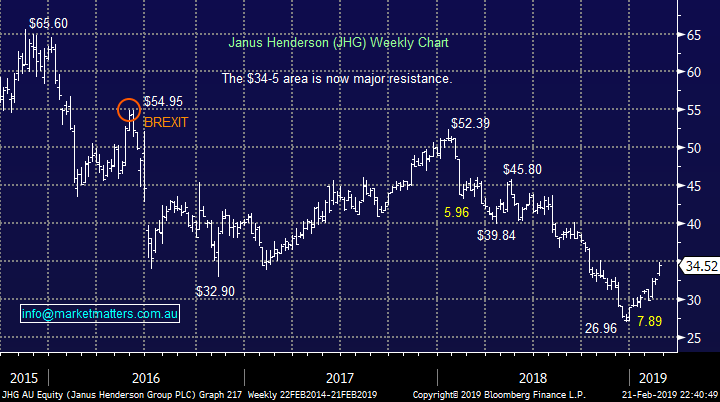

PTM is not cheap trading on 19x forward compared to say Janus Henderson (ASX: JHG) on just 10x that we own in the Growth Portfolio and Perpetual (ASX:PPT) trading on 14x we hold in the Income Portfolio, however like both of those stocks, PTM looks technically bullish.

In terms of PTM, we are bullish at current levels initially targeting 15% upside, conversely JHG has now achieved our 30% bounce target and has clear resistance around $34.50, however this could easily bounce further given relative valuation versus the sector (i.e. traders search for cheap ‘market orientated exposures’)

Platinum Asset Mgt (ASX: PTM) Chart

Janus Henderson (ASX: JHG) Chart

3 of the worst performing stocks.

The losers were a smaller group with only 4 stocks falling by over 5% and one of them was Wisetech (WTC) which we said to avoid in yesterday report – we’ll take them when we can!

1 St Barbara (SBM) $4.82

Yesterday SBM fell over 8% following a combination of broker downgrades plus the whole gold sector copped some selling.

We are looking to build some gold exposure in 2019 but not yet.

MM is neutral / bearish SBM with technically 20% downside looking a strong possibility.

St Barbara (ASX: SBM) Chart

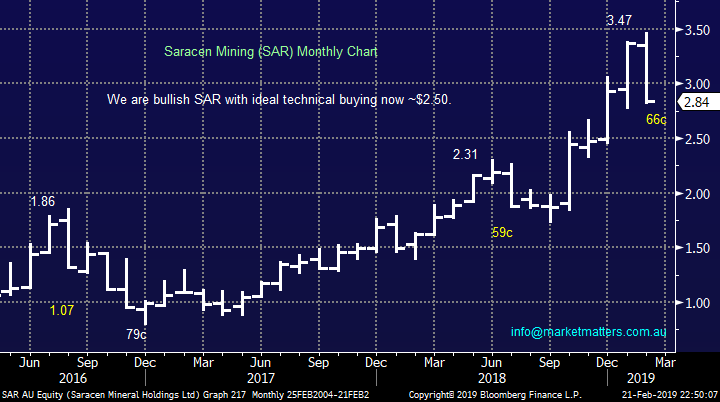

2 Saracen Mining (SAR) $2.84

Yesterday SAR continued its decline following average results earlier in the week.

MM may now consider SAR around $2.50 but not yet as the downside momentum increases.

Saracen Mining (ASX: SAR) Chart

3 Mineral Resources (MIN) $16.84

Yesterday MIN fell by over -5% yesterday although they remain on track to achieve the FY19 EBITDA guidance of $280m to $320m. Expenditure of almost $400m has been reported for the construction of lithium mine / processing facilities.

Investors who want to gain exposure to the volatile lithium space could consider MIN with a stop below $15.

MM has no interest in MIN at this point in time.

Mineral Resources (ASX: MIN) Chart

Conclusion

Technically PTM looks more appealing than JHG at current levels following the latter’s strong bounce.

Overnight Market Matters Wrap

· The SPI is down 8 points as US equities fell overnight. The Dow, NASDAQ and S&P 500 all closed down 0.4% weaker.

· US economic growth was revised down and orders for US made capital goods fell in December. Meanwhile one of the Fed presidents said rate normalisation is coming to an end, while another said there are no signs of inflation despite low unemployment.

· The $A fell to US$0.7081 after reports that a large Chinese port operator has banned the shipment of Australian coal. The $A wasn’t helped by comments from a Westpac economist predicting two RBA interest rate cuts this year.

· Nickel and copper fell and aluminium rose on the LME. Iron ore is 1.5% lower, while oil and gold are also trading in the red.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 22/02/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.