Potential takeover targets in the resources sector (OZL, IGO, ORE, SYR, AWC, A2M)

**BIGPOND ISSUES; We aplogies however Bigpond users may not be receiving our daily emails, or may be receiving them intermitently. This is an issue we are working with Bigpond to fix. As an interim solution, please login to the website to view daily reports or alternatively, provide a different email address by calling 1300 301 868. Once again, we apologies for the inconvenience**

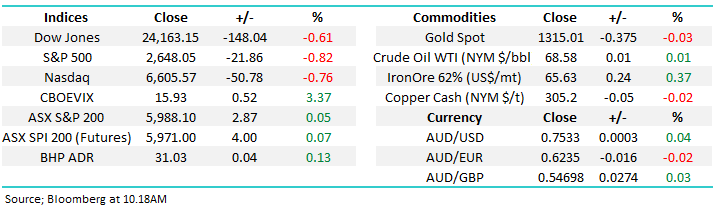

The ASX200 rallied strongly yesterday to close within 18-points of the psychological 6000 level – we basically rallied throughout April in an almost stealth like manner to close up an impressive 223-points / 3.9%. A pretty solid performance considering the massive fallout from the much publicised Hayne royal commission.

This morning the local market is likely to dip early following a -0.6% pullback by the Dow but we believe any short-term weakness is at this stage a buying opportunity. Our best guess for the next few trading days is some consolidation between 5950 and 6000 as investors consider whether “sell in May and go away” will again prove the correct mantra in 2018 plus importantly how well our banks report starting with ANZ this morning – first impression was ANZ’s reported an inline result, albeit a bit messy given a raft of recent asset sales.

- Market Matters remains bullish the ASX200 targeting the 6250 area, or 4.5% higher, assuming the 5850 area holds.

A new Direct From The Desk – AUDIO – segment we are trailing. This morning we cover ANZ result, CBA and our views around Independence Group (IGO)

Takeovers were in the press again last week as Healthscope (HSO) received a private equity bid. At MM we believe that 2018 will see an increase in M&A activity with the resources sector likely to lead the charge – the likes of BHP and RIO have become huge cash generating goliaths. Around 70% of the sector already enjoys net cash on their balance sheets while continuing to generate further free cash flow i.e. lots of cash for corporate activity for many miners both locally and overseas.

We’ve already seen M&A in the mineral sands space with Eramets bid for Mineral Deposits at an impressive 26% premium to the previous day’s closing price. We have no doubt that a number of companies are sharpening their pencils as I type.

Today we will look at 5 potential mainstream targets, excluding Gold stocks for now.

ASX200 Chart

Overnight US stocks slipped lower but they continue to oscillate in the triangular consolidation pattern which has now been evolving since February, our preference remains a “surprise” breakout to the upside which we believe could lead to significant short covering i.e. the markets in cash / negative and simply rattled after the sharp declines earlier in the year.

US NASDAQ Chart

Resource stocks that may be under the microscope

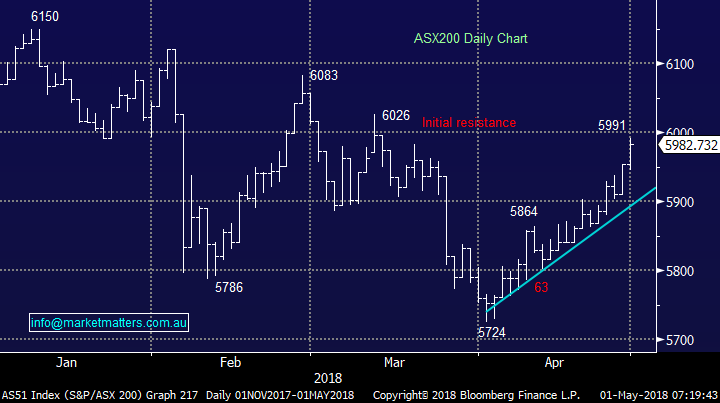

Yesterday we saw strong economic numbers out of China which helped our resources sector regain some of the days early losses, at MM we remain bullish the China story which should clearly assist the resources sector. However, recently MM has been taking some nice profits on our previously comprehensive resources holdings in anticipation of a 10% correction in base metal prices, primarily driven by an appreciating $US.

These macro moves have unfolded on cue and if we are correct base metals have another ~5% to fall to present some buying opportunities.

Today we are going to look at 5 potential takeover targets earmarking them as ideal opportunities for the MM Portfolios moving forward. Importantly, when considering a takeover target, we also need to have faith in the underlying business, and the below examples fit this bill nicely.

Bloomberg Base Metals Spot Index Chart

$US Index Chart

1 OZ Minerals (OZL) $9.25

Copper business OZL would be a an ideal target for a northern hemisphere producer. We took profit on our OZL holding last week but the volatile stock has held up pretty well so far as underlying commodities slips – a frustrating outcome to-date.

- We are a buyer of OZL into weakness with an ideal buy level below $8.50.

OZ Minerals (OZL) Chart

2 Independence Group (IGO) $5.17

IGO may interest people in the nickel space to get access to its Nova nickel operation plus a pretty good gold asset to sell on (Tropicana). IGO is a volatile stock that has already corrected ~70c four times since mid-2016. This morning they released Q3 production numbers that looked incredibly weak, setting up a big Q4 if they have any hope of meeting prior full year guidance. This may be an opportunity today depending prices this morning.

- We are a buyer of IGO into weakness below $5 leaving enough ammunition to average around $4.60.

Independence Group (IGO) Chart

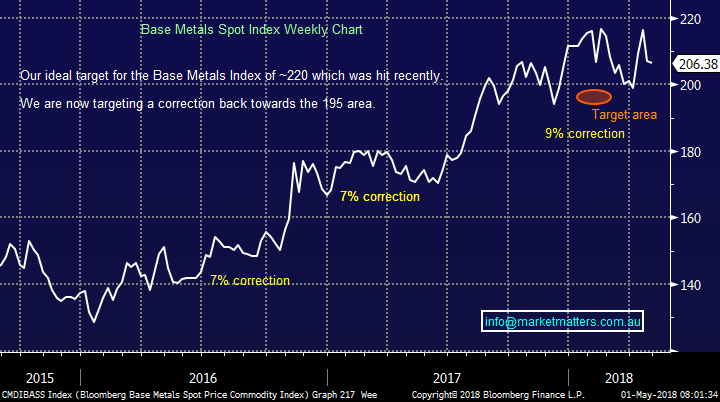

3 Orocobre (ORE) $5.65

ORE sits right in the centre of the “hot” battery / lithium space, one we have been focusing on very profitability over recent quarters. The highly speculative nature / price action of the sector has allowed us to both buy and sell in regions we perceive to be value or too euphoric respectively.

Toyota has already taken a significant stake in ORE almost $2 higher at a 35% premium to yesterdays close, we ask why they would not consider adding to this holding to lock in future supply for decades to come.

- We remain bullish and comfortably long ORE.

Orocobre (ORE) Chart

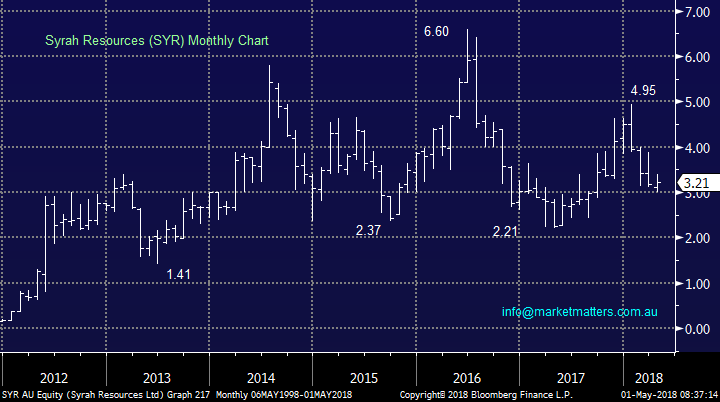

4 Syrah Resources (SYR) $3.21

Mineral exploration company SYR has been an “ugly duckling” of the sector over recent years failing to rally like most of its piers.

The companies projects provide exposure to graphite, vanadium, mineral sands, copper, coal and uranium. The coated spherical graphite is a high value, processed graphite product which is used to produce battery anode material (BAM) for anodes in lithium (Li) ion batteries – the battery story again.

- We like SYR as a speculative play around current levels.

Syrah Resources (SYR) Chart

5 Alumina (AWC) $2.64

We recently took a nice profit on AWC but unfortunately missed the final spike up towards $3 – the stock is now basically back to where we took profit. We like the stock moving forward and especially the yield of 6.5% fully franked so the question is where do we try and buy back in – let’s hope we haven’t been too clever!

With a new shareholder agreement with Alcoa signed (last year) the door is now open for either Alcoa or a major global alumina punter i.e. China Inc.

- MM likes AWC and is ideally looking to buy weakness back towards $2.35.

Alumina (AWC) Chart

Moving onto yesterday’s activity by MM.

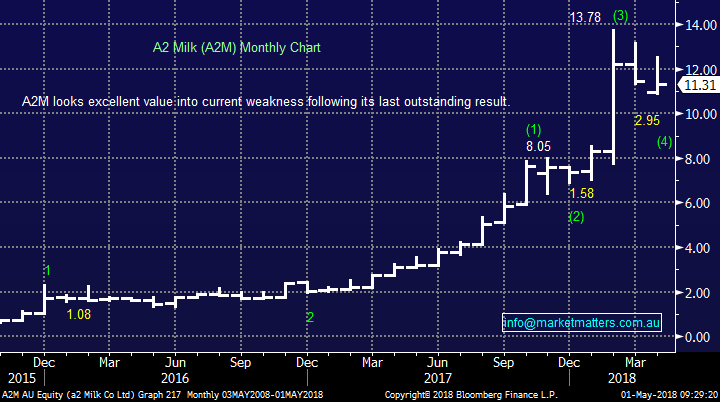

A2 Milk (A2M) $11.31

MM bought A2M yesterday around the $11.20 area following its strong rejection from early weakness – we were originally hoping to buy around $10.60.

Also, we especially liked the bullish article yesterday morning on Livewire by major shareholder Colonial First State. Back in November last year the stock dropped 20% on the news that they had trimmed their large holding – we successfully bought the pullback that week. It would be very hard to imagine them publishing bullish article’s just before selling again!

Our plan is simple:

- We will take our holding to 5% around the $10.50 area if we see another leg lower.

- Our current target is the $14 area, over 20% higher.

A2 Milk (A2M) Chart

Conclusion

We like the basket of OZL, IGO, ORE, SYR and AWC as potential takeover targets within the resources sector.

We could buy all but SYR on their own merits, ideally ~5% lower with SYR making up the speculative player in the team.

Watch for alerts.

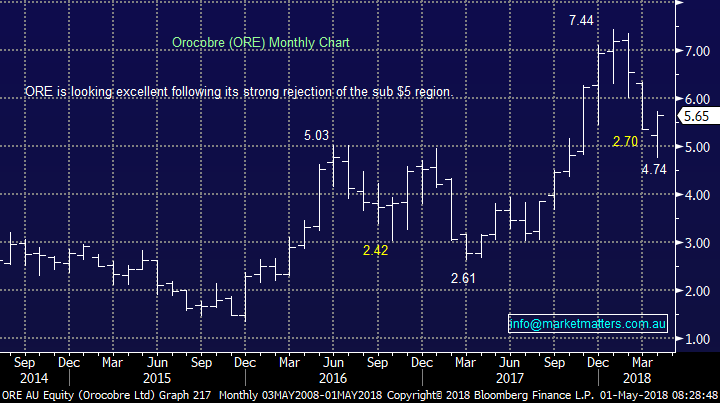

Overnight Market Matters Wrap

· The US equity markets had their last session on April in negative territory overnight led by the defensives, healthcare and telco sectors.

· More rate hikes look likely as inflation hit the Fed’s target as last year’s low readings dropped out of the measure. Personal income undershot analyst’s predictions.

· Oil rallied as geopolitical tensions are starting to heat up, this time Israeli President Netanyahu noting that he has proof that Iran lied about not pursuing nuclear weapons.

· The June SPI Futures is indicating the ASX 200 to open 12 points lower, towards the 5970 level as local investors wait for the RBA interest rate announcement – most expecting unchanged at 1.5% ahead of the Federal Budget.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 01/05/2018. 8.26AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here