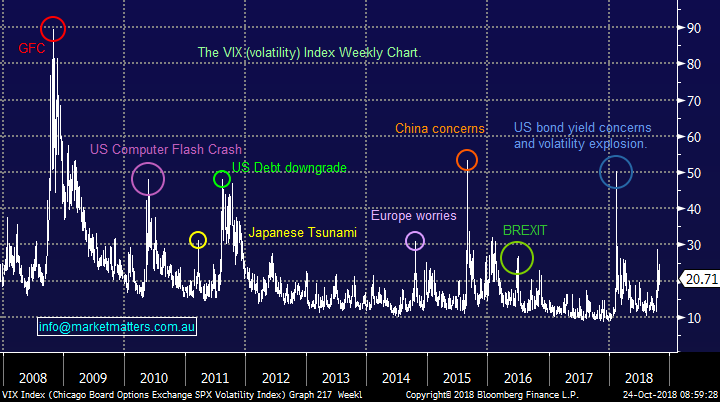

Potential implications from Caterpillar’s profit warning in the US (CAT, BHP, NCM, MMM)

The ASX200 came under pressure from the opening bell yesterday and didn’t receive any meaningful respite until the market closed on its lows, down over 1%. The sustained selling was futures led with global indices all coming under intense pressure, Asian indices fell between 2 & 3% while the US S&P futures were down ~0.8% at 4pm AEST.

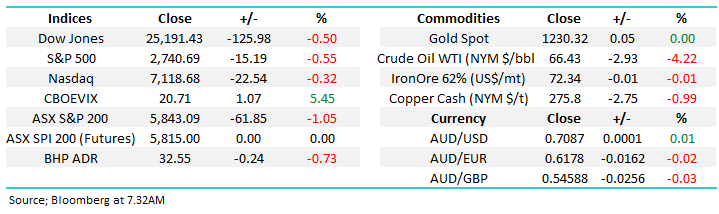

The local market continues to follow our expected short-term path, and after a strong sell off, a gradual, grinding recovery before another attempt at the lows yesterday. Our favoured range over the coming few weeks is 5750 to 5950 for the ASX 200 strongly implying that we’re nearer the lows. Let’s hope it doesn’t deviate too much so we can add some serious “Alpha” (value) over the weeks ahead.

I was thinking about this report last night when putting the kids to bed – my youngest is 4 and took an eternity to go to sleep last night so I had some time to contemplate. A volatile night felt inevitable with the S&P500 futures down -1.3%, noticeably lower than when our market closed. Selling can often perpetuate selling and there were plenty of reasons for that to play out overnight.

As I rode the Triumph over the Harbour Bridge around 6am this morning, markets had rallied from their lows and SPI futures are implying the ASX200 will open down around 10-points following an aggressive drop and recovery in the US – the S&P500 ended a rollercoaster session down only -0.55%, the Dow Jones rallied 423pts from the sessions low.

Today’s report is going to look at a few different topics in today’s volatile market, excuse the hotchpotch nature but its aligned to exactly what’s happening today.

ASX200 Chart

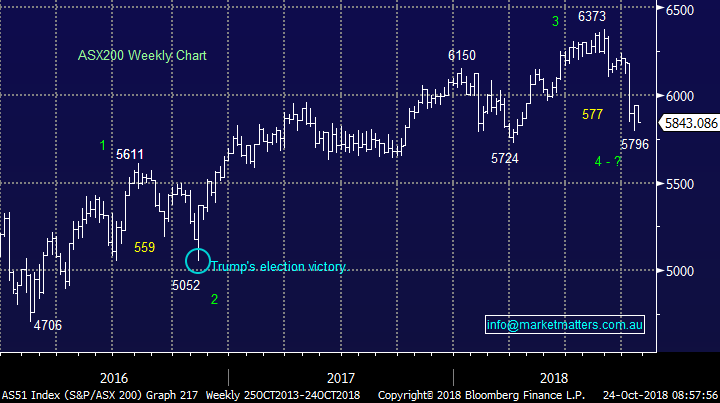

1 US stocks

Overnight US stocks followed our previously outlined script pretty well, they made fresh October lows but the weakness didn’t follow through and stocks recovered strongly. We are now bullish US stocks short-term targeting at the very minimum a break of last week’s high but we are open-minded to the possibility that we may have seen a more meaningful low, the way stocks evolve from here will refine this opinion.

More importantly MM will look to cover its short US stocks position via the BBUS ETF – frustrating the panic lows were when our market was closed but this was a risk we had outlined previously.

Watch for alerts.

US S&P500 Chart

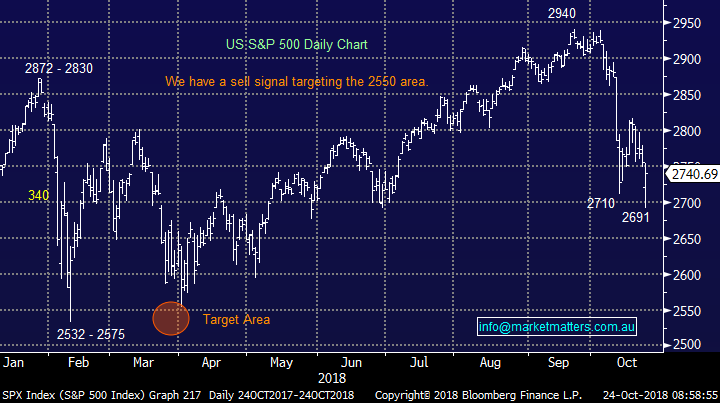

2 Volatility (VIX)

Interestingly overnight the VIX spiked higher as would be expected with the Dow tumbling over 500-points at one stage but it remained well below last week’s high, even though equities were making clear fresh October lows.

This divergence between the VIX and US stocks is usually a reliable bullish indicator.

Fear Index / Volatility Gauge (VIX) Chart

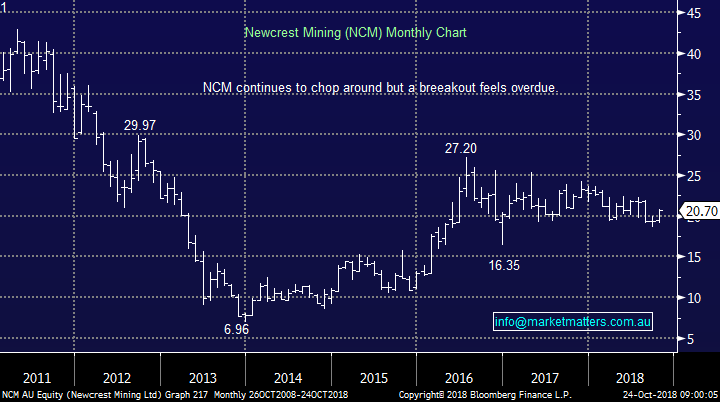

3 Newcrest Mining (NCM) $20.70

NCM has rallied over 11% from its early September low, the question is do we grab a small profit or is it time to chase gold as volatility increases and inflation is touted as one of the major market worries in 2019 /20. It’s a busy time for NCM with production numbers our today, an investor day on Friday and a site visit to their Cadia operation in Orange scheduled for Monday. Expect lots of analyst commentary coming from NCM over coming days.

Also, gold itself is rallying strongly in $A terms, currently sitting only 5% below its 20-year high, a breakout in the precious metal basis $A now feels a strong possibility – NCM may follow.

We remain keen on Gold in AUD and Newcrest at current levels

Newcrest Mining (NCM) Chart

Gold in $A Chart

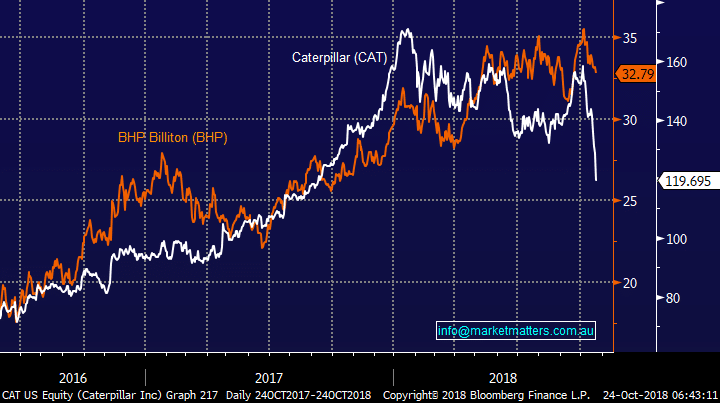

4 Caterpillar (CAT) $US 119.95

Overnight CAT shares tumbled around 10% at one stage before bouncing slightly, although they still closed well in the red – as we know an earnings outlook “miss” will do that.

To be precise CAT disappointed investors by not increasing its 2018 earnings forecast, promoting fears that the heavy-duty equipment maker may be signalling a slowdown despite posting better-than-expected / best ever quarterly profits.

This is an interesting outcome when the overall US market is priced richly for ongoing growth. CAT is the largest mining equipment manufacturer in the world and investors have turned cautious due to China’s economic growth slowing to its weakest pace since the global financial crisis plus the International Monetary Fund cutting the global economic growth forecasts for 2018 and 2019.

CAT has now corrected well over 30% since its March high and from a risk / reward perspective we could consider being a contrarian at current levels and buying the stock.

However just like the copper price CAT is often regarded as an economic bellwether so if the weakness does continue it will be a concerning indicator that all’s not well under the hood of the market.

The correlation between BHP, our key resources indicator, and CAT is fairly solid hence on this front we will remain patient with any BHP purchase, it may just slip in sympathy with CAT providing an opportunity closer to $31.

Plus for good measure comments from Saudi Arabia overnight sent oil tumbling 4%, not good news for BHP.

Caterpillar US (CAT) v BHP Billiton (BHP) Chart

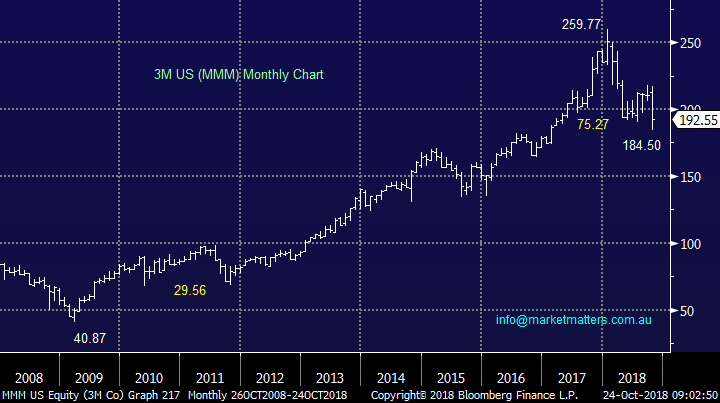

5 US high flyers – 3M (MMM) $US193.23

Overnight 3m joined CAT in the sin bin following a 4.4% miss on third quarter earnings estimates.

A number of subscribers have been asking for our thoughts on some leading US stocks so here is a snapshot of 5:

1 3M (MMM) – Short term we like it at current levels for at least a 10% rally.

2 Apple (AAPL) – a great company but not exciting risk / reward above $US220 although we remain bullish.

3 Google / Alphabet (GOOGL) – not exciting above US1,100, were keen around the $US1000 area.

4 Amazon (AMZN) – we are neutral at present.

5 Netflix (NFLX) - we are neutral at present.

An interesting takeout from the above 5 is the more traditional but recent underperformer 3M looks more attractive than the high-flying FANGS, at least for the next few months.

3M (MMM) Chart

Conclusion

We are now bullish US stocks, at least in the short-term.

Hence watch for the alert to sell our BBUS ETF i.e. bearish US stocks.

Overseas Indices

The US Russell 2000 like the S&P has now satisfied our downside bearish targets switching us to neutral / bullish.

US Russell 2000 Chart

European indices are now also neutral with the German DAX hitting our target area which has been in play since January.

German DAX Chart

Overnight Market Matters Wrap

· The broader US equity markets staged a solid recovery overnight, initially the Dow fell 2% before buying in consumer and blue chip tech stocks supported the index. The Dow closing -0.5% lower in a volatile night.

· Oil plummeted following comments by Saudi Arabia that they would produce as much oil as possible. Brent and crude both fell over 4%.

· The December SPI Futures is indicating the ASX 200 to open 10 points lower, testing the 5830 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/10/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.