Perhaps all that glitters is not gold? (SSM, NCM, S32, SVL, SLVP US, SLV US, ETPMAG)

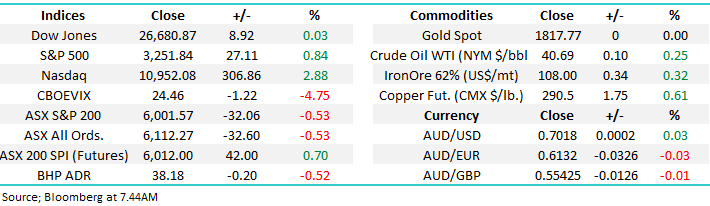

The ASX200 is slowly but surely lulling us all into a false sense of security, the index has now been oscillating around the 6000 area for over month, while history does tell us money is generally lost fighting a trend, sideways in this case, a break in one direction is clearly overdue. Yesterday’s -0.5% decline was fairly muted with over 30% of the market closing up on the day but when the “Big 4” banks fall by ~1% and the Energy Sectors tumbles by -2.6% it’s an uphill battle for the underlying index. The market had a knee jerk move lower at 11am when we saw Victoria & NSW in particular declare their latest COVID-19 statistics plus accompanying rhetoric, there’s no doubt what’s driving sentiment in stocks short-term.

Personally I find the emotions around the virus both fascinating and scary – when we moved out of lockdown just a few weeks ago politicians and scientists warned us that clusters would inevitably occur yet here we are today with less than 300 cases in Australia but there’s a sense of foreboding / inevitability washing over most of us that most of the country will be following Victoria back into lockdown, just as the kids go back to school this morning! For a change I truly I feel sorry for both the State and Federal leaders, I wouldn’t want their jobs for quids!

The world continues to be awash with bad news around the pandemic, not just the US with its 65,000 cases daily, but Hong Kong & Japan who performed admirably during the initial outbreak are also starting to struggle with another wave of infections. However as the news worsens and investors would usually expect increased volatility we’re witnessing the opposite, stocks are holding firm with a slight upside bias, as I have said previously it would frustrate me if I was bearish /short.

MM still remains bullish equities medium-term.

ASX200 Index Chart

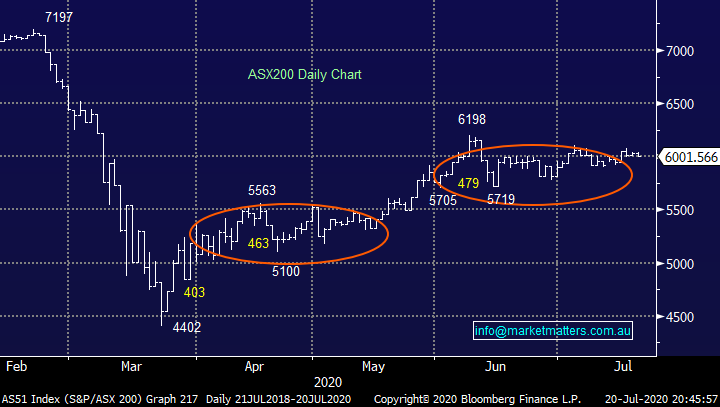

Overnight we saw the Euro make fresh 4-months highs against the Greenback around speculation of a major EU economic rescue package. The anticipated combination of grants and low-interest loans sounded very similar to some of Scott Morrison’s recent remarks as Europe like ourselves sees a jobless recovery as a worrying risk for the EU’s economy. With the US sinking into a COVID-19 abyss and Europe appearing to improve it’s no surprise to MM that the Euro is gaining favour, similar to the Aussie – we stick with our view that the $US is vulnerable to a major correction, hence we are now mindful of local stocks which have outperformed because of their $US / offshore earnings – a crowded trade in our opinion.

MM remains bearish the $US.

EURUSD FX Chart

In yesterday’s PM Report we flagged how Bell Potter’s Steve Anastasiou downgraded Service Stream (SSM) from a buy to a hold with a new $2.05 PT, down from $2.50. Steve is the No 1 rated analyst on the stock hence the share price weakness. SSM resides in the MM Growth Portfolio but has been a disappointment in recent times, his rationale was the combination of – a decline in NBN activations, no more NBN construction revenue plus the re-introduction of stage 3 restrictions in Victoria. Overall, we now believe it will be difficult for SSM to deliver a FY21 result that matches its FY20 performance. Unfortunately, median market consensus is expecting SSM to do just that, we are of the view that current market expectations may be too high.

MM is considering selling our SSM position.

Service Stream (SSM) Chart

Global Markets.

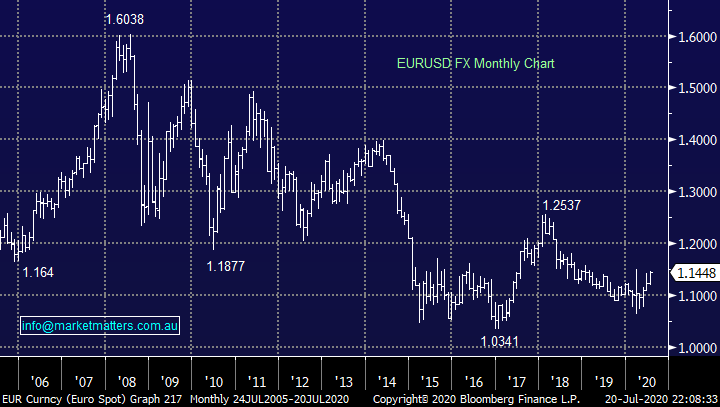

The global tech sector regained its mojo with a bang overnight rallying almost 3% to yet again test its all-time high, it’s becoming a repetitive story just like the ASX200 being clued to the 6000 area – MM sees no reason to fight the 2020 trend at present, we expect more higher all-time highs followed by ~7% corrections i.e. Buy weakness & sell strength with an underlying bullish bias.

MM remains bullish US stocks.

US NASDAQ Index Chart

Is silver a better “bet” than gold?

Gold has been a “hot topic” for MM over recent weeks and we’ve kept no secret that we’re bullish the precious metal as we believe inflation is a strong candidate to raise its head in 2020/21 with massive stimulus packages washing through global economies at a time when interest rates are at historical lows, which creates the concept of negative real rates (interest rates below inflation). The only factor restraining us from buying into the sector has been the existing aggressive speculator bullish position already being held in the space making it a prime candidate for a quick washout of the “weak longs” – similar to that just witnessed in BNPL (buy now pay later) space where we saw in vogue stocks Afterpay (APT), Zip (Z1P) and Openpay (OPY) correct 14%, 27% & 38% respectively.

Investors are now embracing a “U shaped” recovery as opposed to the more optimistic and perhaps unrealistic “V-shape” scenario as further waves of virus infections become commonplace. Whatever the type of recovery I feel the pandemic will remain in people’s minds for years to come reinforcing their attitude towards gold as a strategic asset before we even contemplate the prospect of inflation. Gold has clearly been a standout performer in 2020 with the combination of coronavirus uncertainty and historically low interest rates fuelling the advance – the booming NASDAQ is another standout performer this year while oil & commodities have endured a shocker, an area where we can see some catch-up moving forward.

Gold ($US/oz) Chart

However when we take another look at CFTC gold speculative positions they may be elevated but it’s no longer scary stuff as we can see below plus it has recently corrected ~40% as the underlying gold price hovered around $US1800/oz – a time based consolidation as opposed to price, to us with the same likely outcome, a healthy rest for the underlying core bullish trend.

MM feels that the gold speculators are poised to push positioning back to fresh 2020 highs.

CFTC Net Gold Positioning Chart

No change with our underlying thoughts on the local gold sector, we’re bullish with Newcrest Mining (NCM) screening as best value at today’s prices, especially from a risk / reward perspective.

MM remains bullish Newcrest Mining (NCM).

Newcrest Mining (NCM) Chart

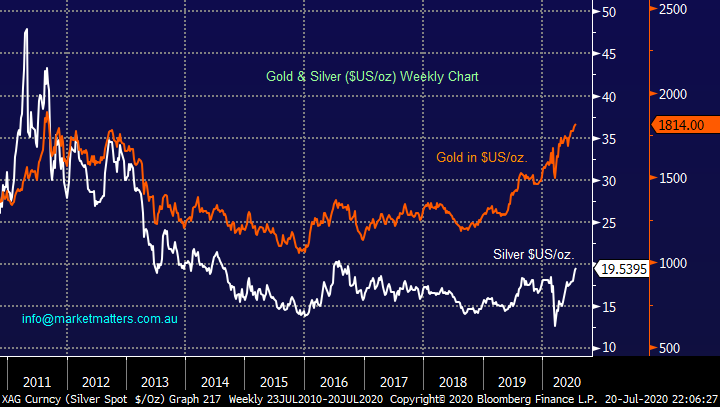

Moving onto the core subject of this report, if we see inflation raise its head or just the market start pricing in the possibility what asset can we expect to outperform? It certainly won’t be bonds / the yield play which should come under pressure. It may surprise many readers to know that silver is historically the major outperformer in a reflation cycle. – when we look at the comparison with gold below its certainly been over the last few years.

Today we have looked at a couple of ways to gain exposure to silver as it feels to us that investors started boarding the gold train in 2018 but silver is being relatively overlooked, it’s been playing the poor cousin role but as we saw with the $US, trends do eventually change and MM feels it’s an ideal time to be long both precious metals, aggressive catch-up feels a strong possibility.

MM is bullish both silver & gold into 2021.

Gold & Silver $US/oz Chart

The silver price is enjoying a clear breakout which has the momentum to soar through its previous major swing high posted in 2016 i.e. the last resistance for a major momentum breakout is $21.14. Historically silver is a fairly tight market where moves when the occur are usually both large and very aggressive. Technically a break of its 2016 high would imply a strategic target a whopping 50% higher = very attractive risk / reward.

MM is bullish silver into 2021.

Silver ($US/oz) Chart

Today I have briefly looked at 5 ways which MM likes to get exposure to a potential explosive rally in silver.

1 South32 (S32) $2.17

The Australian market offers relatively small opportunities for exposure to sliver, heavyweights BHP & RIO are decent sized producers but it has minimal impact on their underlying earnings. If we avoid the more “speccy” end of town South32 is the obvious candidate although it’s currently in the value “naughty corner” primarily because of its coal exposure. S32 actually enjoys revenue from a number of commodities and we are screening it carefully as a candidate to switch into from RIO whose enjoyed a huge tailwind from the massive run in iron ore, the silver contribution certainly doesn’t hurt but we do wish it was more significant.

MM is bullish S32 but it’s not a pure silver play.

South32 (S32) Chart

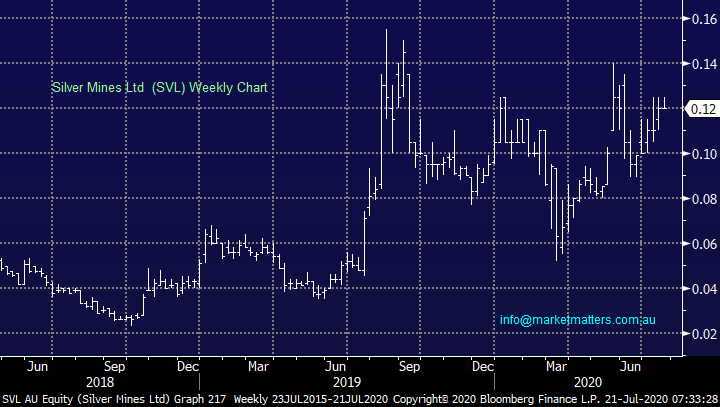

2 Silver Mines Ltd (SVL) 12c

For subscribers who are after a local “speccy” pure silver play on the ASX probably the best pick is SVL with its Bowden’s Project but this $121m company is not one for MM.

MM likes SVL as a punt.

Silver Mines Ltd (SVL) Chart

3 iShares MSCI Global Silver Miners ETF (SLVP US) $15.89

When it comes to international silver stocks, we feel it’s easier to simply buy the leading ETF as opposed to look towards the likes of Mexico, Canada, Switzerland, Peru etc. The iShares Silver Miners ETF has a market cap of $US180m and makes an investors life much easier, assuming we are right and silver’s set to keep rallying. This is listed in the US.

MM is bullish the SLVP ETF.

iShares MSCI Global Silver Miners ETF (SLVP US) Chart

4 iShares Silver ETF (SLV US) $US18.53

An excellent and simple way to gain exposure to silver as a commodity without risking underlying company performance is the SLV and as a $US10bn ETF it’s certainly got some decent depth, as the chart illustrates below it basically mirrors the silver price, again this is listed in the US.

MM is bullish the SLV ETF.

iShares Silver ETF (SLV US) Chart

5 ETF Securities Silver Bullion ETF (ETPMAG) $26.28

While it’s a smaller fund capped around $130m, the easiest way for local investors to play the theme is through the ASX listed Physical Silver ETF from ETF Securities. This tracks the Silver price minus the 0.49% pa management fee and is unhedged, so a higher AUD does detract from performance however that’s the case with the ETFs above given they’re listed overseas. The security is underpinned by Silver bars held in a vault and is known as an exchange traded commodity (ETC). It can be bought / sold like a normal share, using the 6-letter code EPTMAG or on some platforms EPTMAG.AXW.

MM is considering buying this for both our domestic growth and global ETF portfolios.

MM is bullish the ETPMAG listed in Australia

ETF Securities Silver Bullion ETF (ETPMAG) Chart

Conclusion

MM is bullish precious metals and actually believes silver may be the outperformer over the next year. We are particularly keen on the ASX listed ETPMAG however for those that can trade internationally, the SLV US and the SLVP US are larger funds.

South32 (S32) is also on our radar as a more diversified commodity play (with some silver exposure).

*Watch for alerts.

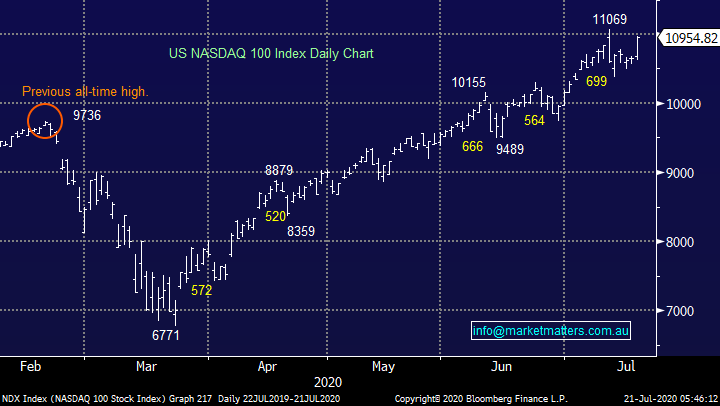

Overnight Market Matters Wrap

· The US market rallied overnight with the key indices hitting their highest levels since February, with compliments to the tech. names.

· Further reports by Oxford University and AstraZeneca on the race for a covid-19 vaccine have been positive

· Crude oil gained on the back of positive sentiment, along with Dr. Copper, currently up 0.61%.

· Domestically, we see the RBA minutes for July, while BHP and Oil Search (OSH) release their second quarter 2020 Production reports.

· The September SPI Futures is indicating the ASX 200 to gain 73 points towards the 6075 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.