Panic equals opportunity 9 times out of 10 – what to buy? (SVW, WSA, CWY, IVC, ASB)

Another sea of red yesterday on the ASX200 with over 85% of the market closing on the day, we registered our second consecutive triple digit decline, the markets now plunged over 300-points / 4.4% in the blink of an eye. As would be expected all 11 sectors were hit hard and none particularly performed better or worse than the other, the sellers simply took control.

Over $75bn has been wiped off the ASX200 in just 2 sessions and suddenly nobody’s talking about a Christmas rally, in our opinion the negativity is far too premature – yesterday we took profit on our position in the bearish ASX200 ETF (BBOZ) and bought Computershare (CPU) below $17 as we had been discussing over recent weeks i.e. “plan your trade and trade your plan”. Statistically December usually provides a great buying opportunity around now, or in a weeks’ time – we did some buying yesterday leaving further ammunition to go again next week – time will tell if we are brave, prudent or just wrong!

Our opinion remains unchanged - for all his bluster, and there sure is a lot, President Trump wants / needs a trade resolution with China. A full-blown trade war with the world’s second largest economic superpower will almost inevitably lead to a global recession and remember since the US Civil War only one President, back in 1900, has won re-election after a recession hits town – not great odds for Trump in November. In our opinion this is classic political ego but at the end of day he wants / needs a trade resolution.

MM is now neutral to bullish the ASX200.

Overnight US markets bounced solidly on optimistic trade rhetoric from Trump whose inconsistency remains consistent. The SPI was calling the ASX200 top open up over 50-points at 6am with BHP set to rally a healthy 70c / 2% on the open.

This morning MM has focused on 5 stocks we may buy or simply increase our exposure to in the next 10-days.

ASX200 Chart

Remember our first conclusion around this time of year (Christmas rally) from yesterday’s report:

1 - The risk / reward favours buying the ASX200 during December into weakness – potentially accumulate every 50-points after an initial 150-point decline.

The ASX200 has plunged over 300-points in dramatic fashion and yesterday we covered our short and dipped our toe in on the buy side, adding Computershare (CPU) to the Growth Portfolio – it didn’t “feel right” on Tuesday to start buying when the market was off 150-points, in this case we gave our plan some poetic licence which paid off clearly this doesn’t always occur.

Today we have reiterated 5 stocks that MM is considering buying / adding to as we look to increase our market exposure – when volatility reaches these levels it’s time to focus on pre-laid plans as opposed to reinvent new ones.

1 Seven Group Holdings (SVW) $18.56

The Stokes family’s investment vehicle SVW has its fingers in a number of pies including media & TV, publishing, Telco and a heavy equipment dealership that sells Caterpillar equipment – the later exposure we particularly like.

The stocks trading on a conservative Est P/E for 2020 of 12.7x while the 2.3% fully franked yield helps. This is a stock that would clearly benefit from a trade resolution and an associated uptick in purchasing confidence around the globe.

MM is bullish SVW expecting a breakout above $20 relatively shortly.

Seven Group Holdings (SVW) Chart

2 Western Areas (WSA) $2.71

The nickel miner has been weak thanks a weakening Nickel price while the MD presented yesterday at Macquarie’s WA Forum event reaffirming their FY20 guidance.

We are currently underwater on our 3% holding in the Growth Portfolio and following its 23% correction, MM is considering averaging its position around current levels. This clearly would be a move supporting our view that a US – China trade resolution will occur sooner rather than later and that cheaper cyclicals are set to outperform in 2020.

MM is bullish WSA at current levels.

Western Areas (WSA) Chart

3 Cleanaway Waste (CWY) $2.06

Waste Management business CWY has recovered strongly from its aggressive sell-off in October when they disappointed the market at its AGM by pushing their growth profile back – not ideal news for a stock that had run hard, significantly more so than rival Bingo which we’ve traded well in the past, although don’t own now.

At MM we see improvements moving forward from their acquisition of SKM recycling plus of course the sustainable waste management space makes plenty of sense considering the global environmental direction.

CWY isn’t cheap, trading on an Est P/E for 2020 of 29x, however it’s going to be their ability to grow earnings that will dictate where the shares trade, and currently the market is fairly split with regard to expectations, a trend we generally like – it tends to open up greater opportunity.

MM is bullish CWY from around the $2 area.

Cleanaway Waste (CWY) Chart

4 InvoCare (IVC) $12.53

IVC has experienced a tough couple of years as competition has eaten into its margins and it’s become more competitive to roll up unlisted funeral businesses into a listed structure, however the largest funeral operator in Australia and NZ still enjoys the tailwind of an ageing and growing population.

Overall after the recent hiccup in the share price we see value emerging plus a 4.2% grossed up yield is not to be sniffed at in today’s environment.

MM likes IVC below $13.

InvoCare (IVC) Chart

5 Austal Ltd (ASB) $3.88

The shipbuilder appears to have been hit by simple profit taking, not a phrase we like to throw around as loosely as the press, but it feels correct in this case. We believe a trade resolution will reignite this Australian success story with our next target above $5.

With those unfamiliar with the stock, it trades on a P/E of 25.5x which is not too demanding considering the companies profile while it’s 3% fully franked yield is an added bonus for this growth orientated business.

MM is bullish ASB below $4.

Austal Ltd (ASB) Chart

Conclusion

MM likes the 5 stocks briefly touched on in today’s report with all things being equal the following probable order of preference but note a couple are very close – Western Areas (WSA), Seven Holdings (SVW), Austal (ASB), Cleanaway (CWY and InvoCare (IVC).

Global Indices

No change, previously we have given the benefit of the doubt to the post GFC bull market and fresh all-time highs have been achieved as anticipated, a close well under 3025 is required for the S&P500 to switch us to a bearish short-term stance.

MM remains now neutral / positive US stocks.

US S&P500 Index Chart

No change, European indices continue to “climb a wall of worry” at this point in time MM is neutral but we maintain our slight positive bias with a target ~5% higher looking realistic.

EuroStoxx50 Chart

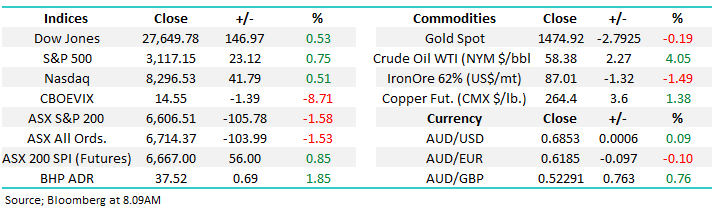

Overnight Market Matters Wrap

- The on again, off again saga with the US-China trade deal continues, this time speculation that the deal will be reached, helped the US equity markets reclaim some of its recent losses, yet still in the red for the week (so far, the Dow is off 1.96% and the broader S&P 500 down 1.52% with 2 sessions left to go).

- Crude oil rallied a massive 4.05% following the Energy Information Administration data disclosed US crude inventories falling more than expected.

- BHP is expected to outperform the broader market after ending the US session up an equivalent of 1.85% from Australia’s previous close.

- The December SPI Futures is indicating the ASX 200 to open 59 points towards the 6665 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.