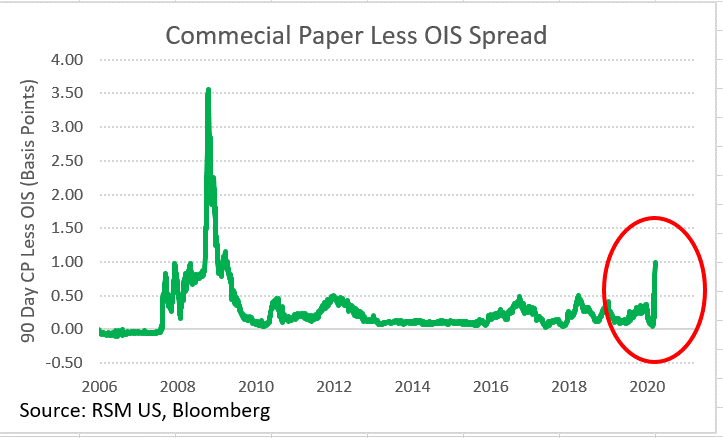

Overseas Wednesday – What will produce meaningful calm in financial markets (SYD, TCL, BHP, V US, TBF US)

The ASX200 staged another phenomenal recovery yesterday to end the day up almost 300-points / +5.8% as it registered its best day in well over 20-years, we continue to break records in both directions, shame the underlying trend is aggressively down. Volatility continues to dominate the market but quality was a clear standout yesterday with heavyweights Commonwealth Bank (CBA) +13.3% and BHP Group (BHP) +11.9% surging in a manner I wouldn’t hope them to achieve, but as we all know these aren’t “normal” times.

I reread my afternoon missive this morning and it actually put a smile on face as did the sign outside my local butcher “Be friendly and courteous, it’s going to be tough BUT we can do it Australia!”. I believe he nailed it, we know the next few months will be extremely tough, after all there’s an ugly road map being drawn up before our eyes by Italy but like China they will come out the other end, even if its not as efficiently as the major Asian nations, hence if we know the approximate endpoint of this journey lets all try and be positive, act responsibly and respectfully. There does continue to be some positives on the COVID-19 front:

1 – Yesterday we only saw one new case of the virus in Hubei Province, China where the old epicentre is now more at risk from people entering the country.

2 – The number of confirmed cases in Italy rose above 31,500 in the last 24-hours, up 12.6% which is its slowest rate of contagion since it was first identified on February 21st.

3 – Governments & Central Banks are now taking the virus extremely seriously with the US promising “helicopter” money and the UK’s moving onto a war footing.

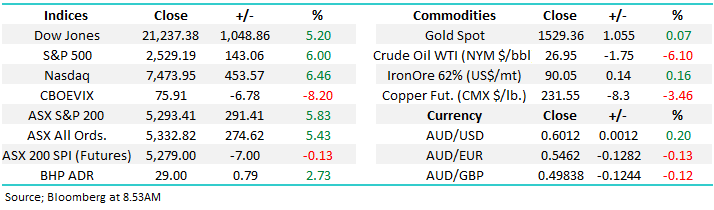

4 – South Korea appears to have stemmed the virus outbreak in under 4-weeks, their total cases is well under 8500 while their population is double our own.

It feels to me the press are continuing to focus on the negative without presenting a balanced argument – nothing new here of course however this is elevating the panic and uncertainty. Also important to recognise that business in Australia are facing a major challenge, no doubt about that at all, however now is the time to lobby government hard for a handout, and that by it’s very nature creates alarming headlines.

The outbreak of COVID-19 in South Korea Chart

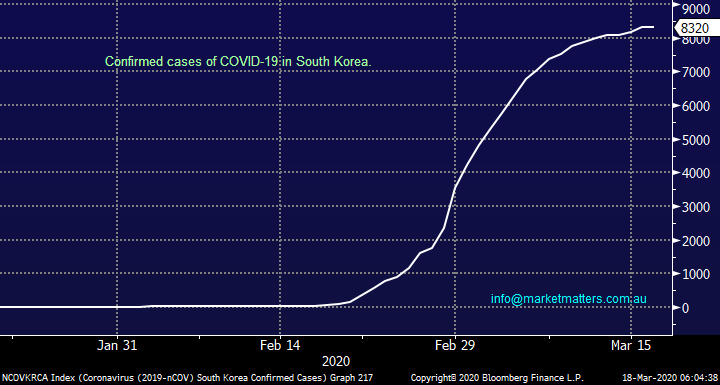

We’ve all read the numerous phrases and clichés around how to invest / trade during market corrections and crashes but I particularly like the illustration below, it implies we are rapidly approaching the “Point of maximum financial opportunity” unfortunately just when I’m hearing the most number of investors considering running to cash, the asset class which has significantly underperformed equities over many decades – remember it’s a “long game”.

The classic “Wall of Worry” Chart

Source: Russell Investments, AMP Capital

Yesterday we expected a bounce from the ASX200 when / if it tested the 4800 area but it felt like too many people had read our report before the opening as the SPI futures and then stocks opened a lot stronger than anticipated. However we mustn’t get too carried away with bounces as we can see below its hardly a dent in the recent virus provoked plunge by equities.

MM still expects the ASX200 to rotate between 4800 and 5600 in the coming weeks, with a slight upside bias.

As I mentioned earlier BHP rallied almost 12% yesterday and this morning the “Big Australian” is trading up another +2.6% in the US reaffirming our view that there is appetite for the quality end of town following this aggressive correction; BHP’s major exposure to China which looks to have successfully quelled COVID-19 is a clear tailwind for the diversified miner, and the mining sector more generally.

ASX200 Chart

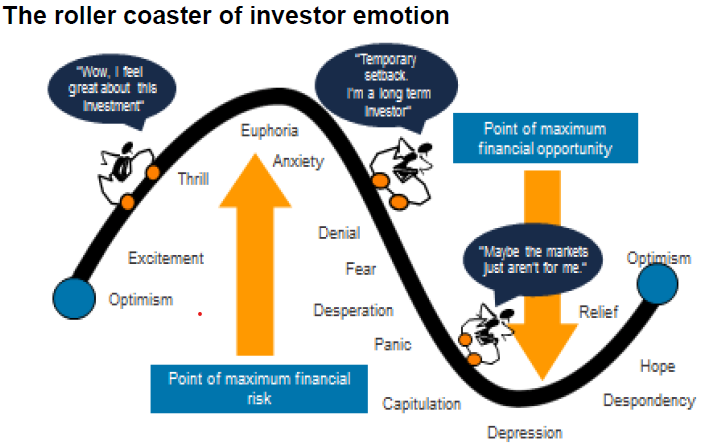

As we’ve discussed previously the largest “canary in the coalmine” for stocks at present is the commercial paper market i.e. where large solid companies go for short-term funding for basic operations like inventory and wages if / when required, unfortunately this is the market the Fed inadvisably ignored when it slashed interest rates on Sunday. Higher funding costs at a time when businesses top line in under immense pressure creates a scary revolving bearish cycle.

As we can see below the cost of corporate money is rallying fast towards levels not seen since the GFC.

When the Fed does add liquidity into the Commercial Paper Market we believe equities will enjoy a sustained bounce

Obviously once the Fed and central banks can pump some liquidity into this market we can focus on the more normal economic factors of how to invest during a recession, plunging earnings and unfortunately some company failure plus of course the exiting prospect of positioning ourselves for the inevitable recovery.

This morning I’m reading that both the Fed and RBA are looking closely at this very issue, a positive sign to MM that some market stability is close at hand.

US Commercial Paper Chart

Capital raisings are rapidly moving into investors’ minds

The dramatic economic slowdown that’s unfolding before our eyes is putting pressure on a number of different groups of businesses as speculation mounts that we might see a GFC style deluge of capital raisings to shore up company balance sheets as uncertainty gathers momentum – any cashed up fund managers will be licking their lips in anticipation of deep discounted stock offerings aka 2008/9. Some obvious candidates for such raisings are:

1 – Tourism is obviously front and centre with Virgin Australia (VAH), Star Entertainment (SGR) and Flight Centre (FLT) catching my eye.

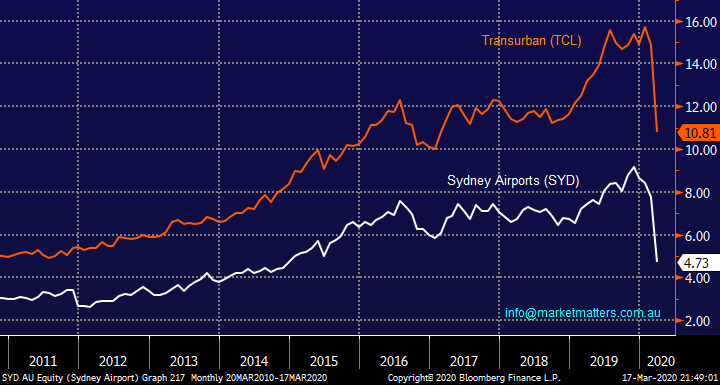

2 – Bond proxies like Sydney Airports (SYD) and Transurban (TCL) who carry huge debt levels - we have considered both of these names in recent times but held off because of debt but TCL sub $10 will be tempting.

3 – Energy companies carrying large levels of debt like Oil Search (OSH) and Santos (STO) – we considered STO yesterday but this was a major reason we’ve put the switch from Beach Petroleum (BPT) on ice.

MM believes stocks under the “capital raise microscope” are likely to underperform in the weeks / months ahead.

Importantly history tells us when businesses start raising capital in times of panic it’s a time to be brave and move overweight equities.

Sydney Airports & Transurban (TCL) Chart

Overseas markets

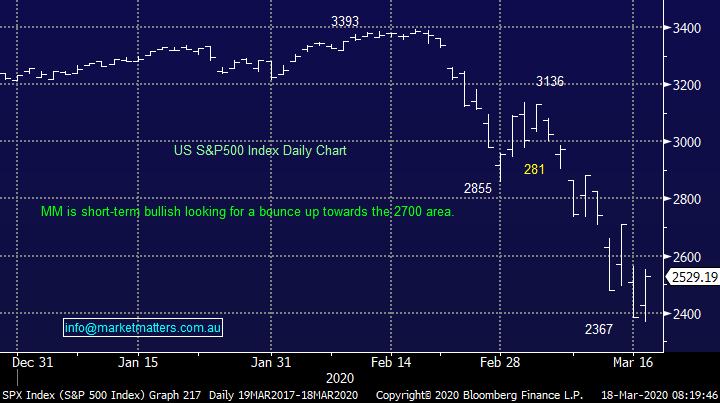

Overnight US stocks bounced strongly rallying more than ~1000-points, we are now short-term bullish looking for another 7-8% in this bounce but our “Gut Feel” is stocks might still have one final spike lower, it’s the normal rhythm of most aggressive sell-offs.

MM has now transitioned to short-term neutral / bullish stance on US equities.

US S&P500 Index Chart

We had a view at the start of 2020 that a major inflection point (bottom for interest rates) was looming in Q1 and that certainly looks the case now after recent events – one important point moving forward as many investors look to position themselves for a painful recession we think rising bond yields or reflation will be a dominant theme, one not getting much air time at present.

The huge amount of stimulus being thrown at the market will have long term impacts and ultimately it will be very supportive of asset prices once the COVID-19 situation is under control and the earnings hit is understood. Right now, that’s the unknown and clearly worrying the market. If we are correct many fund managers may find themselves “facing the wrong way” which will lead to significant and exciting sector realignment later this year.

MM still believes we have seen a major low for bond yields.

US 10-year Bond Yields Chart

MM International Equites Portfolio

MM now holds 18% cash in our International Portfolio after increasing our Microsoft position from 5% to 8%, we are still “looking to go shopping” into the current weakness in equities.

Patience has paid of to-date with this portfolio and we continue to sharpen the pencil as some “bargains” unfold in front of us, we have tweaked our shopping list slightly from last week :

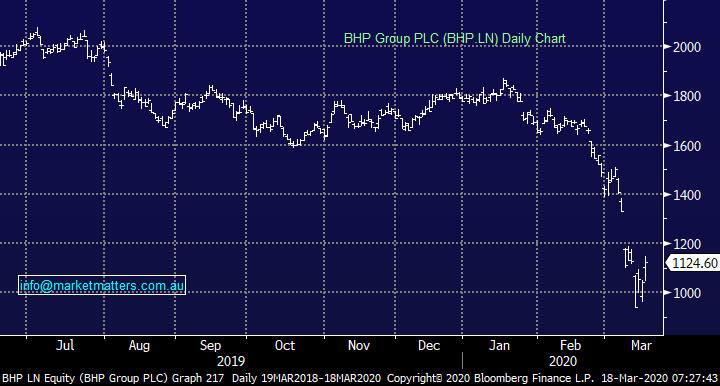

1 - BHP Group PLC (BHP) : is bouncing reasonably well at present, if we see another foray under its 2020 lows MM will look to increase our exposure through its London listing.

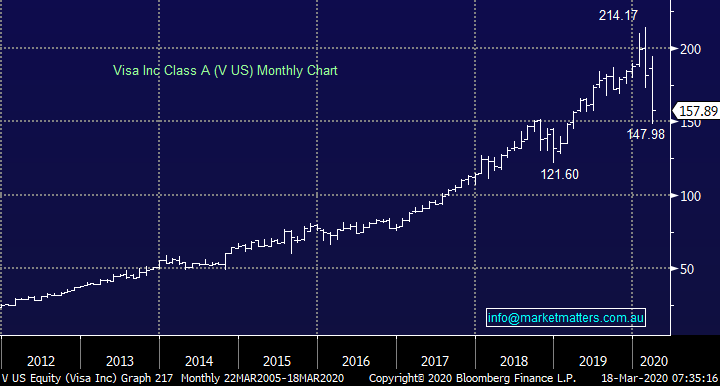

2 – Visa (V US) : we are monitoring Visa carefully and currently another spike below under $US145 we believe will present an excellent buying opportunity.

3 – McDonalds Corp (MCD US) : we like MCD around current $US147 level, but at this stage similar to above we are waiting for a spike under $US135 to consider buying.

MM is looking to slowly deploy our 18% cash position into further weakness.

BHP Group PLC – London (BHP LN) Chart

Visa (V US) Chart

MM Global Macro ETF Portfolio

MM’s cash position remains at a very healthy 39% in our Global Macro ETF Portfolio as we sit poised to act into current volatility

At a macro level the trends playing out are complex, it’s an evolving situation and central banks / governments are very much now in the fray. As in the International Portfolio patience has paid off here reasonably well, we now have 4 “tweaked” plays in our sights:

1 – Switch our iShares Silver ETF (SLVP US) position into the Invesco DB Agricultural Fund (DBA US) i.e. increasing the position size of the later.

2 – Buy Invesco Bearish $US Index ETF (UDN US), we are looking for at least a 15% appreciation in this ETF.

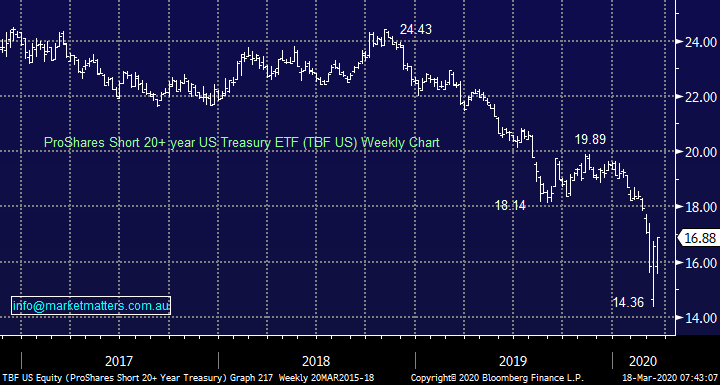

3 – Increase our position in the ProShares Short 20+ year Treasury ETF (TBF US).

4 – Buy the BetaShares crude oil ETF into a fresh dip lower for the underlying commodity - https://www.betashares.com.au/fund/oil-etf-betashares/

ProShares Short 20+ year US Treasury ETF (TBF US) Chart

Overnight Market Matters Wrap

- Wall St has recovered some of its previous day’s wipe out, with the three key indices rallying between 5%-6% as the White House looks set to introduce up to US$1trillion in fiscal stimulus measures in an effort to help offset the impact of the coronavirus on the US economy. European stocks also recovered around 2.5%, as Spain announced a 200bn euro stimulus package, and the EU also announced plans to ban travellers into the Eurozone for 30 days in efforts to contain the virus spreading.

- The Dow recovered just over 1000pts (+5.2%) of Monday’s near 3000pt selloff, while the Nasdaq and the S&P 500 were up around 6%. Bonds sold off aggressively, with the 10year benchmark back at 1.03%, a rise of 30bp. The proposed stimulus plans, which could entail cash handouts and tax breaks, come hard on the heels of the Federal Reserve’s huge monetary stimulus which saw cash rates being cut to zero.

- Fears of a global slowdown, saw oil prices slump another 5%, with the Brent benchmark at a new post GFC low of around US$28.5/bbl, while the copper price also sold off 3% to US$2.32/lb. Gold rallied strongly, up around 3% to US$1530/Oz. The A$ also hit a new post GFC low of below US60c as investors sought the safety and liquidity of the US$. The local futures are pointing to a flat opening on the ASX, having traded in over a 300pt range overnight.

- The March SPI Futures is indicating the ASX 200 to open marginally lower this morning, however things may alter in a heartbeat with government intervention locally and globally.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.