Overseas Wednesday – Updating our key macro calls

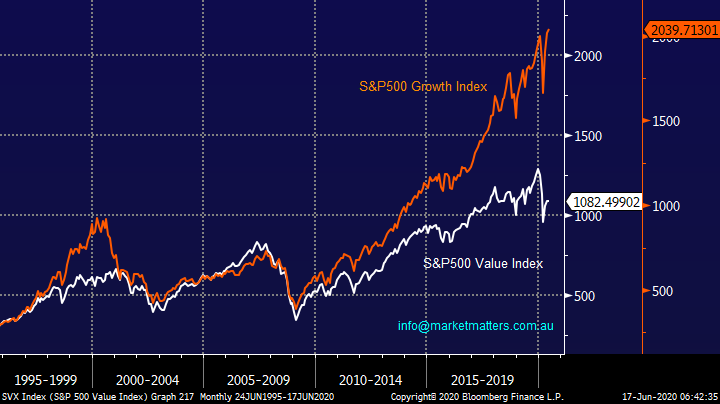

The ASX200 gave us a complete opposite rendition of “what goes up must come down” yesterday soaring almost 4% on a day when only 1% of the index closed lower. The buying was steady throughout the day as the sectors in demand performed a 180 degree about face, everybody jumped back on board the risk train e.g. in the underperformers corner were the likes of golds, healthcare, and yield play stocks. Conversely “Big 4 Banks” all rallied over 4% with the Energy / Consumer Discretionary stocks leading the market higher, if we are correct this trend will be ongoing into the new financial year although its going to be a bumpy / choppy ride in our opinion.

MM bought Woodside (WPL) and National Australia Bank (NAB) yesterday for our Growth Portfolio following the thematic outlined in Tuesday mornings report. – note we plan to again increase cash levels if stocks do indeed make fresh post virus highs in the coming week / months.

Our preferred scenario is the Fed will manage to steady the stock market ship and slowly be surely the ASX200 will again make an assault on the 6200 area although saying “slowly but surely” is the least probable scenario here as swings in financial markets have been unfolding in extremely fast fashion in 2020. We must of course remain aware that a major 2nd wave breakout of COVID-19 may unfold but we cannot invest continually looking over our shoulder, just keep an eye on the potential risks and avoid paying “silly” prices for any stocks however much you like the business. It remains our opinion that markets will remain relatively volatile in 2020/21 making it the perfect backdrop for “Active Investors” who are prepared to sell when things get too heated on the upside.

Overnight we saw the Dow finally close up over 500-points but at one stage it was up well over 800-points as the elevated volatility in both directions continues. The SPI futures are indicating the ASX200 will open up around 30-points this morning, in our opinion the longer the local index can consolidate around 5950 the better the platform becomes for another rally towards 6200.

MM is now bullish short & medium-term.

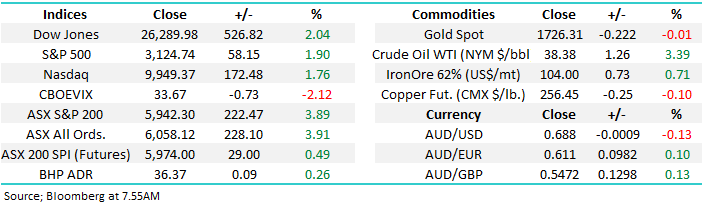

ASX200 Index Chart

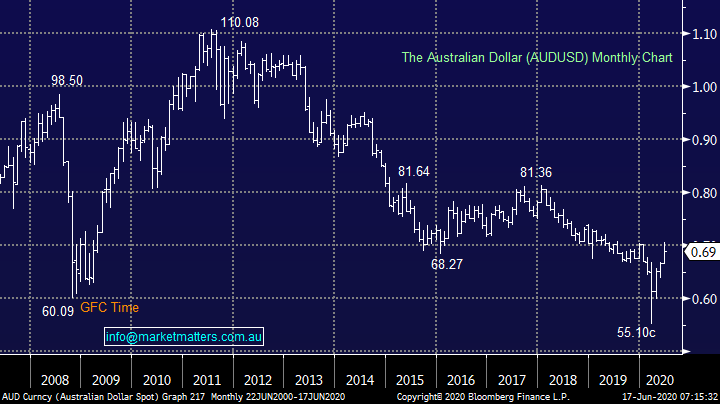

The $A appears to be slowly consolidating between 68c and 70c, we wouldn’t be surprised to see this unfolding for a few weeks with breakouts in either direction failing to get traction, after rallying 15c in quick fashion MM believes the $A needs a rest. Our view on the $A not surprisingly corresponds with the highly correlated stock market with the upside trend in tact but it feels unlikely that the momentum short-term will manage to take stocks aggressively up into fresh post virus levels.

In our opinion the “Little Aussie Battler” is showing the way ahead for stocks and it remains up medium-term.

ASX200 v Australian Dollar ($A) Chart

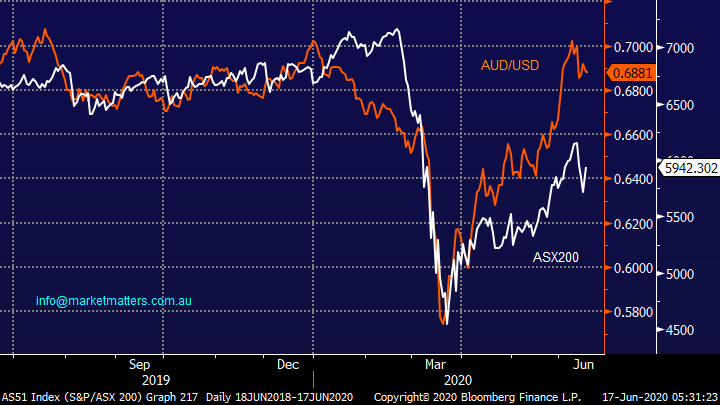

Last week we wrote “the arguments for a correction for stocks both fundamentally and technically is gathering momentum but we reiterate our belief that any decent pullback in risks assets over the coming months would be a buying opportunity.” As has been the norm this year we are seeing moves unfold significantly faster than over the last decade, today only one week later the US Russell 2000 (small cap) Index, which our own ASX200 appears to follow far closer than many other tech dominated US indices, has already corrected -12.6% and now appears to be headed back towards fresh post virus highs. MM’s view at this point in time is no major change from yesterday:

1 – The anticipated correction is over and US stocks are headed back towards new recent highs under the power of the Fed - my best guess is this represents a ~80% chance hence MM bought yesterday but we didn’t use up all our buying $$’s.

2 – or US stocks will again drop ~10% towards their May lows providing an even better buying opportunity hence MM has maintained some cash on hand.

MM is now net bullish the US S&P500 short-term.

US Russell 2000 (small cap) Index Chart

Bond yields are returning to a degree of normality on the volatility front after some unprecedented swings over the last 3-months, something that will probably make the Fed happy. To MM this is another supporting factor of our view that stocks are set for a period of relative stabilisation but in today’s market that might be all over before we even enter July – never over my many years in the market have investors needed to be more open-minded and flexible than today!

MM anticipated US 30-year bonds to remain fairly quiet over the weeks ahead.

US 30-year Bond yield Chart

Updating MM’s current Top Macro views

After the massive swings in equities over the last week this morning felt an opportune time to simply update our “Top Macro ideas / views” which while they haven’t significantly changed have clearly evolved after the Feds bullish & bearish rhetoric plus of course increased concerns of secondary breakouts of COVID-19, this morning I read that Beijing has now closed its schools after describing the recent outbreak as “extremely severe” it feels ominous but at least we can take some comfort from China’s ability to lockdown city’s like no other country.

1 - Equities

We still believe stocks formed a multi-year low in March, similar in many ways to the GFC. I thought this morning would be a good time to illustrate our often requested “best guess” for the coming months in stocks, probably just in time for the landscape to change dramatically! The key take out is MM believes in the current environment when stocks, sectors and even indices are swinging around in significant ranges investors should be prepared to “sell into strength & buy into weakness” to add alpha / value to portfolios.

MM is bullish global equities for the foreseeable future.

US S&P500 Index Chart

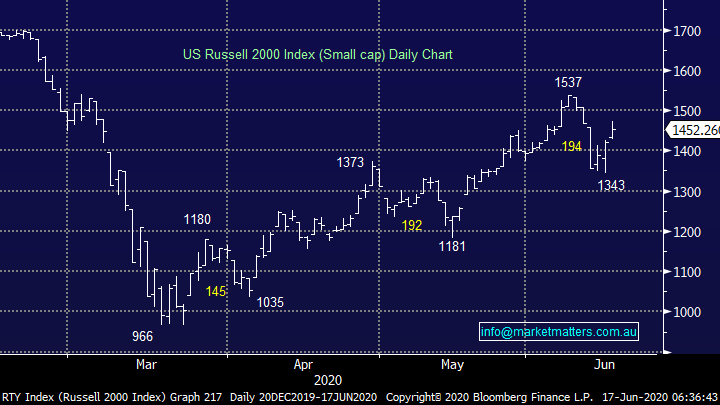

2 MM prefers value overgrowth

MM still believes the huge outperformance from the Growth stocks like IT & Healthcare over the last decade will be reined in by the likes of the Banks and Resources through 2020 /2021. If our underlying view is correct on stocks both short & medium-term the following looks set to unfold:

1 – If US stocks in particular are going to make another assault on fresh all-time highs under the steam of a reinvigorated Fed we feel it’s the large cap tech stocks like Apple (AAPL US) and Microsoft (MSFT US) who will do the heavy lifting.

2 – If this rally is subsequently followed by another 10% pullback, which are becoming fairly common, MM believes this will be the ideal time to increase exposure to the value end of town.

Medium-term MM prefers value stocks overgrowth moving forward.

S&P500 Value & Growth Indices Chart

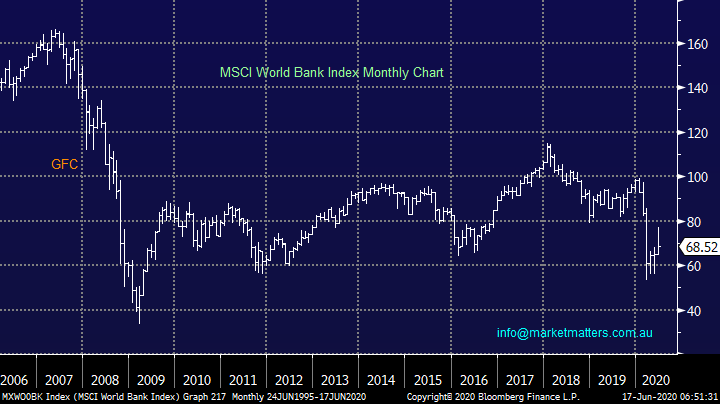

3 Global Banking Sector

The MSCI World Banking Index has bounced well over the last month but has been a clear underperformer during the recent correction – we remain keen buyers of banks into weakness, hence our purchase of NAB yesterday.

Medium-term MM believes global banks should be accumulated into pullbacks.

MSCI World Bank Index Chart

4 Global Resources / Materials Sector

Global Material stocks have surged higher since the March lows confirming our bullish outlook for the sector, we continue to consider buying any pullbacks in this sector both on the international stage and at home.

Medium-term MM is very bullish global Materials stocks.

MSCI World Materials Index Chart

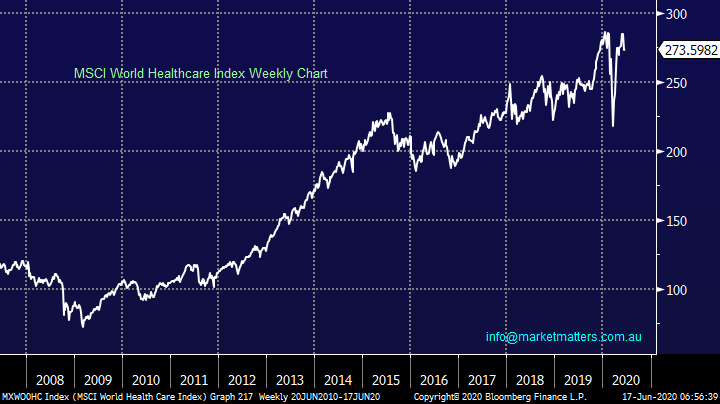

5 World Healthcare Sector

Global healthcare stocks like most of the market have performed strongly since COVID-19 which is easy to understand but we believe the sector is fully valued after more than tripling since the GFC. We still believe the Australian companies who may struggle more if we are correct and the $A is poised to rally towards 80c unfortunately this is not an easy view to exploit except by avoidance.

Medium-term MM still believes Healthcare stocks will underperform in the year ahead.

MSCI World Healthcare Index Chart

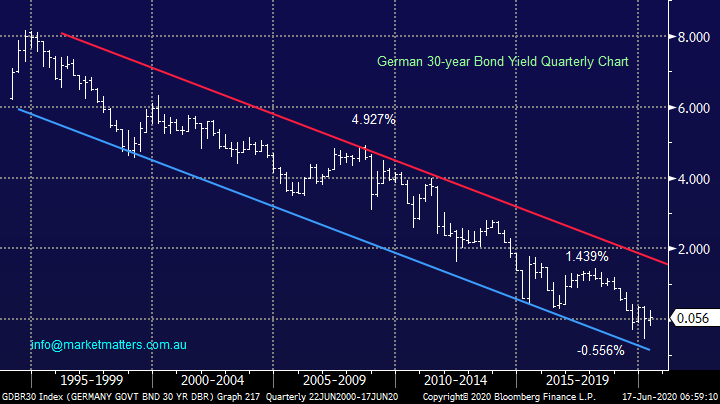

6 Bond Yields (interest rates)

German bond yields have turned positive after spending much of the last year in that tough to comprehend negative scenario, most people probably haven’t read about this because the press prefer headlines conveying sensationalism as opposed to realism. While we don’t anticipate the multi-year bear trend for bond yields / interest rates to be broken in a hurry we can see German 30-years back above 1% fairly quickly implying a global recovery.

Medium-term MM believes Bond yields have bottomed for at least a few years.

German 30-year Bond Yield Chart

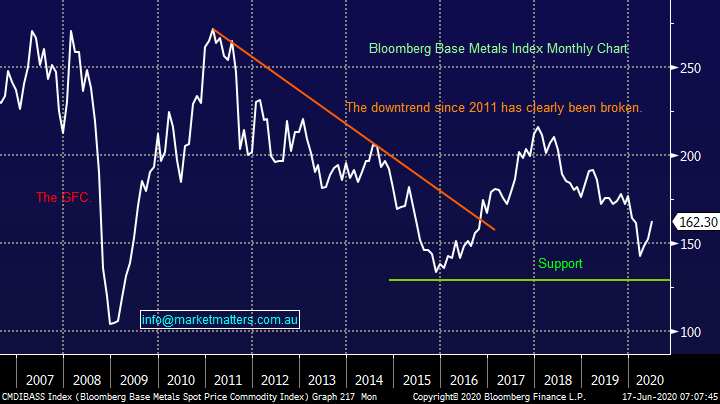

7 Inflation

The world is seeing unprecedented financial stimulation, yet things don’t appear to be too bad after the short-lived pandemic (so far at least). Interestingly, even though the latest choppy week which saw risk assets come under pressure the Blomberg Base Metals index is unchanged as China continues to surprise many with its recovery – fingers crossed on the latest Beijing outbreak.

Medium-term MM believes global inflation is set to rise under the pressure of massive central bank stimulus.

Bloomberg Base Metals Index Chart

8 Currencies

One of our core favourite views is the growth facing $A is heading up to test the 80c region. Similarly, the $US looks destined to weaken further which is common during inflationary periods but overall, we believe buying the $A is the best way to play this scenario. However, after a strong 15c surge a period of consolidation around the 68-70c area feels likely.

Medium-term MM believes the $US will fall and the $A rise on most major exchange rate crosses.

Australian Dollar ($A) Chart

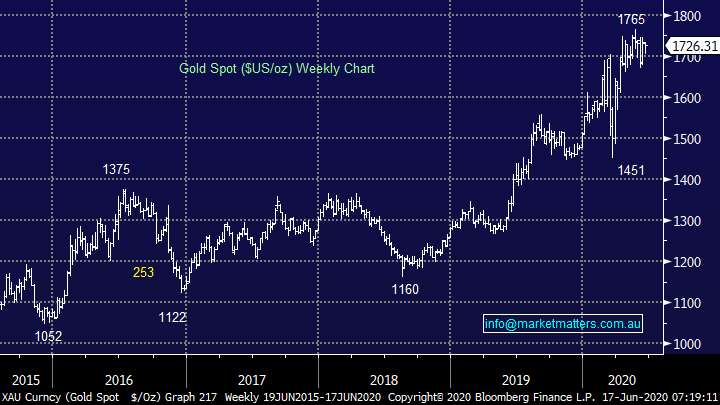

9 Gold

No change, gold has enjoyed a stellar few year as interest rates have plummeted towards zero but as bond yields tick higher this particular tailwind is diminishing but we believe it will be replaced by inflation. We are remaining patient with gold / precious metals at present, but any decent pullback will see us enter on the buy side.

Medium-term MM is bullish gold but shorter-term it remains tricky.

Gold ($US/oz) Chart

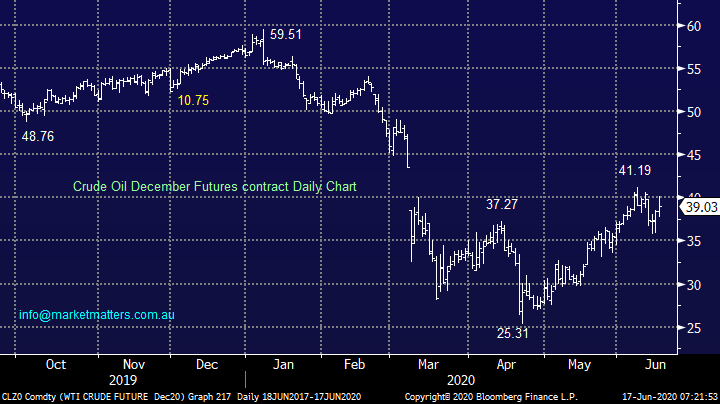

10 Crude Oil

Crude oil looks well positioned to make fresh post virus highs to ~$US42/barrel in the coming weeks but this recovery like that of stocks is unlikely to be in a straight line. As we’ve often said in the past, the remedy to low prices is low prices (production declines), however the same is true on the upside, hence choppy action is likely.

Medium-term MM believes crude oil will rise along with inflation.

Crude Oil ($US/barrel) Chart

Conclusions

MM remains bullish the global economy and stocks for at least the next 12-18 months, but we reiterate we feel its likely to be a choppy advance with plenty of opportunities for the active investor, like ourselves!

Overnight Market Matters Wrap

- The US equity markets continued its ascent overnight following better than expected retail sales data, along with expectations of further fiscal stimulus, this time in the infrastructure sector with close to US$1 trillion likely

- On the energy front, crude oil recovered further, currently sitting at US$38.38/bbl. however, this may be dampened over fears of the second wave of coronavirus in China – the world’s largest crude importer.

- BHP is expected to open in positive territory, after ending its US session up an equivalent of 0.26% from Australia’s previous close.

- The June SPI Futures is indicating the ASX 200 to continue its run and open 31 points higher this morning, testing the 5975 level.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.