Overseas Wednesday – scouring the globe for direction (APX, APT, 700 HK, ABI BB, 600519 CH, T US, 005930 KS, UNH US)

The ASX200 gave back a little ground yesterday but still only slipped -0.3% while again closing well off the day’s lows, primarily driven by the banks with 3 of the big 4 managing to close in the green. The resources feel like they are starting to struggle with heavyweights BHP, RIO and OZ Minerals all falling ~1%, no great surprise with China lowering growth targets and cutting taxes in an attempt to stimulate a slowing economy. We closed out our Western Areas (WSA) position in the MM Growth Portfolio yesterday as the nickel miner failed to rally even as nickel makes a 6-month high, unfortunately no huge surprise after an average result - even though the stock is over 10% below its recent high, it’s also up 20% above Januarys low i.e. not a bad result and when something feels wrong, as Cochlear did before they reported, its best to just rip the bandaid off and go to cash.

The RBA left rates on hold as expected at 1.5%, even as the economy shows signs of slowing, but the market is now pricing in the chance of a 0.25% cut in August at 52%, basically a coin toss. Both Westpac and UBS are now looking for two cuts, or a 0.5% reduction in 2019 but we will be very surprised to see any more than one as the RBA are already low on ammunition if a recession looms. Interestingly China is turning to tax cuts to stimulate their economy – by lower VAT rates which are equivalent to our GST, as we said yesterday we can see some form of QE as opposed to large rate cuts if the RBA need to stimulate our economy – property prices, household debt and consumer confidence clearly remain very important at this point in time.

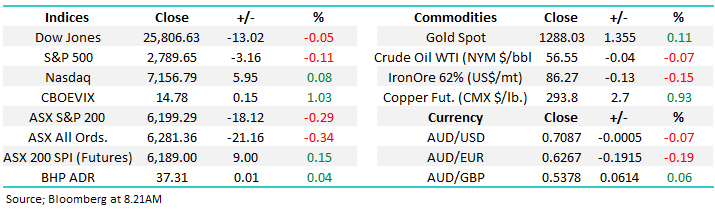

The ASX200 has traded in a fairly tight range between 6240 and 6164 so far this month (March) technically & statistically a clear break of either extreme is likely to result in a meaningful follow through.

MM is now neutral the ASX200 after its almost 17% rally from late December lows.

Overnight US markets were very quiet closing virtually unchanged but the SPI is calling the ASX200 to open up around 7-points.

Today we have looked at 6 overseas stocks which have either significantly over or underperformed during the last 5 trading days as we look for opportunities and trends arising on the global stage.

ASX200 March SPI Futures Chart

We continue to watch the Software & Services sector closely for signs of what lays ahead for the remainder of this financial year – locally this sector often leads the ASX200. In the US the NASDAQ remains relatively firm suggesting the sectors recovery is not in any immediate danger.

Firstly market favourite Appen (APX) which has soared over 40% over the last month following an excellent result. The stocks may have slowed its ascent but there is no weakness in sight.

No change, we are looking to buy the next decent pullback in APX but it’s not showing any signs of materialising at this stage.

Appen Ltd (APX) Chart

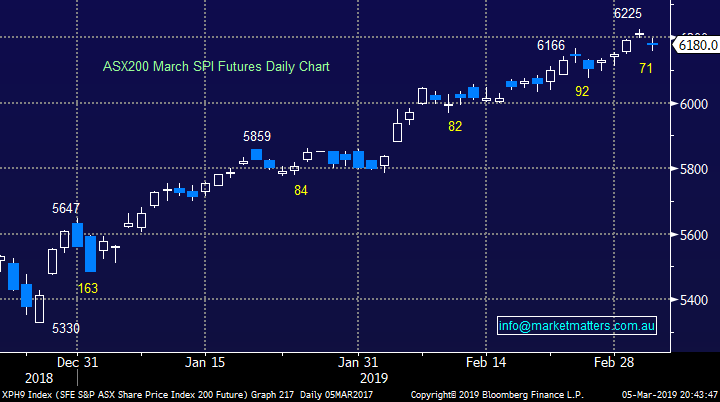

Secondly, Afterpay (APT) which is not our favourite stock in the space but its certainly thrown up some great trading / investment opportunities over the last 12-months.

Technically APT looks good risk / reward buying around $17 with stops below $14.60.

Afterpay Touch (APT) Chart

Global stock markets

No change, US stocks continue to recover after attempts to fall, technically we can actually still see another short-term high by the small cap Russell 2000 but we believe a decent correction is now approaching rapidly – the ASX200 often leads global markets lower, it will be interesting to see how we trade over the coming weeks.

US Russell 2000 Chart

European indices have reached major resistance and our target area following their ~13% bounce, we are now neutral to bearish from a simple risk / reward basis.

This reaffirms our believe that patience is likely to be rewarded with buying of the market in general – clearly not necessarily on a stock by stock basis.

German DAX Index Chart

Overseas stocks

Over the last 5 days we’ve only seen four major global stocks rally by over 5% and two fall by the same degree – markets are calming down.

Winners

Of the winners we have looked at the 3 who came in top of the class.

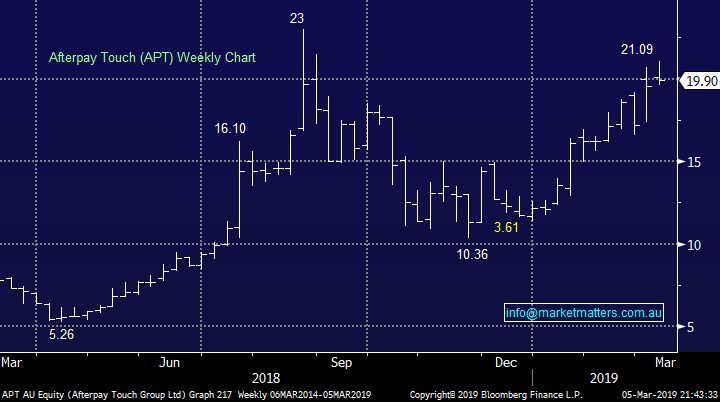

1 Tencent Holdings Ltd (700 HK) HKD361.40

Goliath Tencent Holdings Ltd (700 HK) has rallied over 5% but continues to underperform over the last year or so.

The company continues to struggle with the powerful Chinese regulator which failed to approve any of its games among an approved list of 93 released in January. However it feels likely this landscape will improve in 2019 and the company has the arsenal of games to make a major impact including “Apex Legends” which would likely be a big $$ earner following the success of “Fortnite” and “PlayerUnknown’s Battlegrounds” in China.

Analysts remain extremely bullish Tencent – it’s hard to find a global stock with more buy calls (54 in total) and no sells – although the consensus price target has been ripped back from ~HKD500 to ~HKD400, and we’re not yet seeing any meaningful upgrades (white line) filter through.

MM is now neutral / bullish Tencent at this stage and aggressive players can raise stops to the 350 area, only 3.5% lower.

Tencent Holdings Ltd (700 HK) Chart

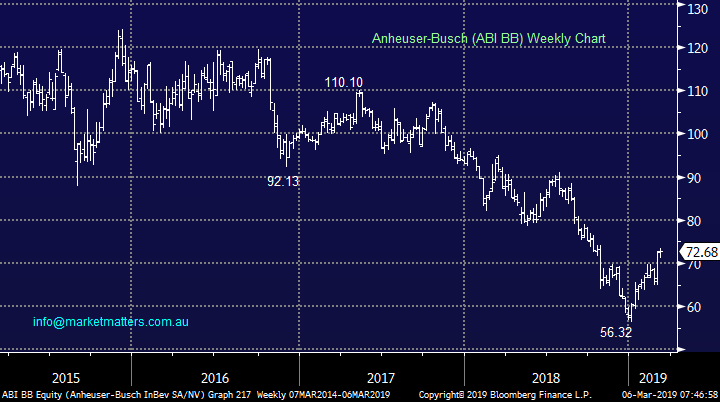

2 Anheuser-Busch InBev SA / NV (ABI BB) Euro72.68

Drinks maker Anheuser-Busch has rallied almost 10% over the last 10-days, perhaps Americans are drinking more Budweiser and Michelob? The answer is probably the opposite as the companies volume growth has struggled since the purchase of rival SAB Miller in 2016 for a whopping $108bn.

It actually appears we are simply seeing a very similar theme to the local market with a “dog” of the last few years bouncing strongly, in this case around 30%.

MM is neutral / negative Anheuser-Busch following its strong countertrend bounce.

Anheuser-Busch InBev SA / NV (ABI BB) Chart

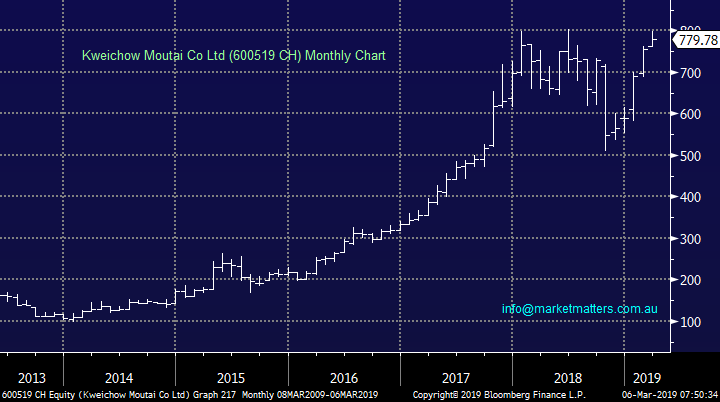

3 Kweichow Moutai Co Ltd (600519 CH) CNY779.78

Chinese Kweichow Moutai Co Ltd (600519 CH) is up over 7% showing that its been a good few days for the alcohol industry – the companies most famous product is the 100% proof Chinese Moutai whisky, basically rocket fuel!

The drink is as you would expect, thousands of years old but this state owned business is only ~70-years old.

Following an almost 50% appreciation since late 2018 MM is neutral Kweichow Moutai although a ”pop” over CNY800 to fresh all-time highs looks likely.

Kweichow Moutai Co Ltd (600519 CH Chart

Losers

With only ~40% of the global top 100 closing in the red over the last 5-days the list of candidates was relatively small but markets are rarely without a “naughty corner”.

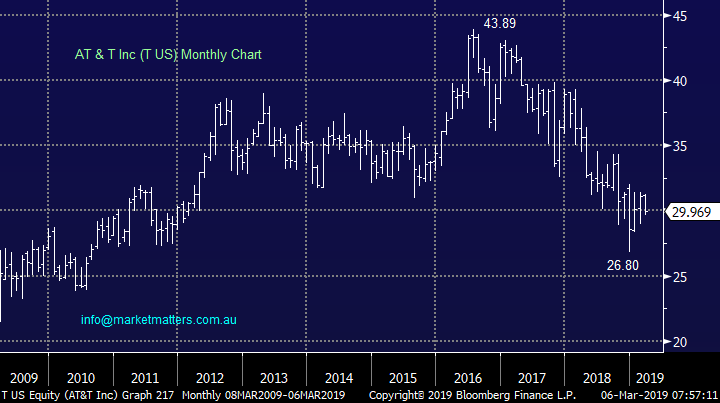

1 AT & T (T US) $US29.97

The US phone conglomerate shows its not just our own Telstra (TLS) that’s been doing it tough.

We see no compelling fundamental or technical reason to jump on AT&T at this point in time – the downtrend remains entrenched.

We are neutral AT & T.

AT & T (T US) Chart

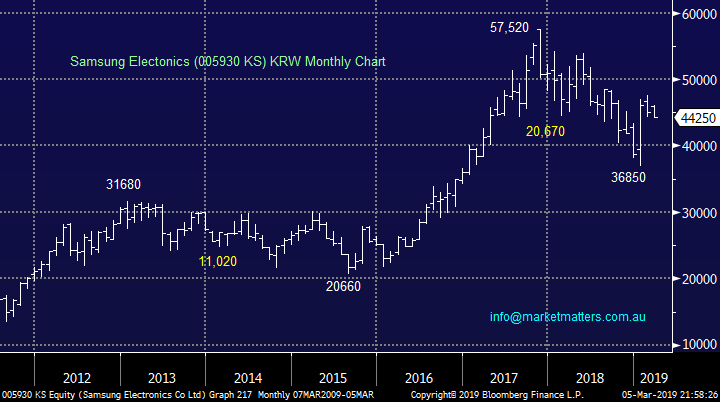

2 Samsung Electronics (005930 KS) KRW44250

Samsung has fallen over 6% following the breakdown in negotiations between North Korea and President Trump – definitely a potential powder keg of volatility when you put these two men in a room.

However we are fans of Samsung as a business and it remains cheap, trading on an Est. P/E for 2019 of below 10x, even after a strong rally in 2019.

MM is bullish Samsung into weakness, ideally another 5% lower.

Samsung Electronics (005930 KS) Chart

3 United Health Group (UNH US)

United Health is down almost 8% over the last 5 trading days and although it bounced last night it looks to be headed lower.

This large US based health system operator has struggled even after beating earnings expectations in January when revenue came in at $58.42bn v an expected $58.01bn plus importantly there appeared to be no “red flags” in the report.

MM is neutral to bearish United Health Group.

United Health Group (UNH US) Chart

Conclusion

Of the 6 stocks reviewed today our favourite at current levels is Samsung followed by Tencent – sorry pretty boring stuff this week.

Overnight Market Matters Wrap

· The US had a breather overnight as investors continue to wait patiently on further developments in the US-China trade negotiations.

· Commodities were generally firmer, in particular copper and nickel, while crude oil and iron ore is slightly weaker.

· Locally, investors will be focused on the release of 4th quarter GDP data (11.30am) which is expected to show small growth of about 0.2% (2.4% annual run rate). Also, the RBA governor Philip Lowe is due to give a speech this morning which will focus on the housing market’s impact on the economy. This follows yesterday’s RBA’s decision to keep rates on hold at 1.5%.

· The March SPI Futures is indicating the ASX 200 to open marginally higher, above the 6200 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 06/03/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.