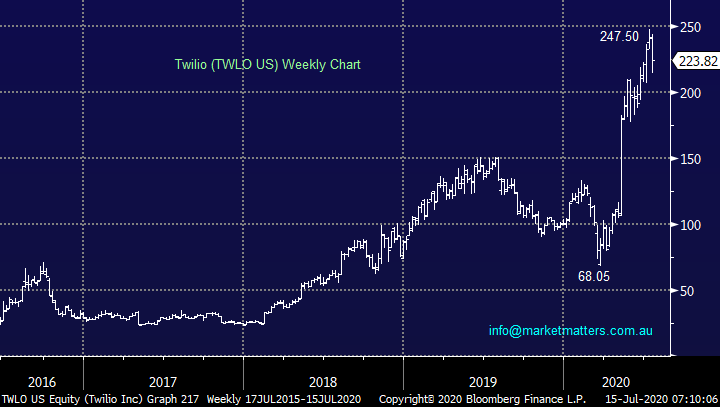

Overseas Wednesday – Reviewing the US tech MM uses on a daily basis (HUBS US, TWLO US, SPT, ZM US, TEAM US, FB US, GOOGL US, TTD US)

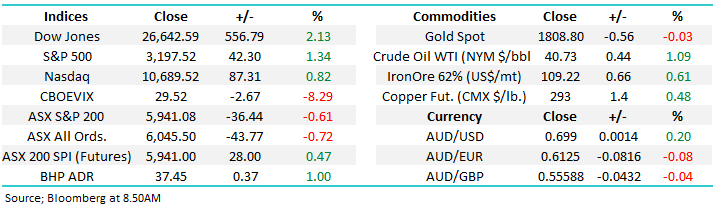

The ASX200 continues to chop around the 6000 area with the primary action remaining under the hood, yesterday only saw 25% of the major Australian index trade higher with the high valuation growth end of town the major drag on the market, conversely resources in particular were again supportive. The IT sector tumbled 4% with Afterpay (APT) leading the decline plunging over -7%, closing within only 1% of its recent major capital raise price of $66. What timing, only yesterday we discussed the volatile BNPL (buy now pay later) sector concluding that APT would only interest MM around $60, another 10% lower although if the whole sector did correct in similar fashion we would be more likely to increase our position in Zip (Z1P).

“At this stage, given the cap raise it doesn’t feel prudent to chase current euphoria, we definitely could miss out on further gains but after the recent rally patience feels justified - MM would consider APT back under $60.” - MM yesterday.

The coronavirus is becoming so dominant in the news it would be almost boring if its wasn’t so concerning, most conversations I have with people that last more than a couple of minutes at the very least touch on whether Australia will see a country wide 2nd lockdown. Fingers crossed as I feel our economic recovery is holding on by its fingertips, it’s a good job stocks are enjoying “free money”. Anybody who doubts how much liquidity is around should consider CBA’s latest 5-year bond placement, it raised $17bn in its 2nd largest ever offering but they received bids for over $50bn! The huge appetite was apparent despite the meagre 0.25% coupon rate and 0.495% yield – the market is clearly still calling interest rates lower for longer.

I actually saw 3 snippets of “virus news” over the last 24-hours which can be definitely interpreted as stock market friendly:

1 – Even though the likes of Florida continue to report a record number of fresh COVID-19 cases US cases only rose 1.8% compared to average 2% over the last week.

2 – US based biotech Moderna reported positive trial news aftermarket this morning, which has underpinned a rise in US futures of another ~1%

3 – NSW Premier Gladys Berejiklian stated that “we can’t keep shutting down” as outbreaks inevitably appear, and NSW will not be going back into lockdown.

Australian 5-year bond yield Chart

I read an interesting article last night in the AFR around the risk / reward currently perceived in equities by Hamish Douglass from Magellan, we agree with both his view points but have stayed a little more aggressively positioned, at least for now – the MM Growth Portfolio is only holding 5.5% in cash with our holdings skewed towards the value end of town i.e. resources and banks.

1 – His best-case scenario is global economies start to recover from COVID-19 and the huge central bank / government support will help equities grind 20% higher – roughly what MM anticipates over the next 12-18 months.

2 – The pandemic continues to spread with ongoing breakout waves relatively common as a vaccine proves hard to produce. He believes in the worst-case stocks could fall as much as 50%, scary thoughts which most certainly cannot be discounted.

Magellan now holds over 15% in cash making it currently more defensive than ourselves but obviously markets are fluid beasts and this could all change over the coming weeks. Our take is the next 20% is far more likely to be up than down necessitating a more bullish stance although this is not the case towards all market sectors.

MM remains bullish equities medium-term.

ASX200 Index Chart

Over the last few weeks we have become bullish Chinese equities as the index has surged to multiyear highs, we’ve also now seen technical confirmation of our bullish reflation outlook from Shanghai Copper which has broken its decade old downtrend – we believe this is a breakout to buy, not one to grab quick profits. With the increasing reflationary pressure MM believes it is just a question of when we see a broad-based rotation from record overbought technology into oversold cyclicals i.e., we continue to prefer value overgrowth moving forward.

Hence yesterday our Growth Portfolio sold Ramsay Healthcare (RHC) and reduced Xero (XRO) while buying a small position in Zip (Z1P) and adding to Alumina (AWC), another net step further in the direction of this core view.

NB We also feel precious metals will remain strong and Newcrest Mining (NCM) is very much in our sights – watch for alerts.

MM maintains our bullish reflation stance.

Shanghai Copper (CNY/MT) Chart

Overseas stocks

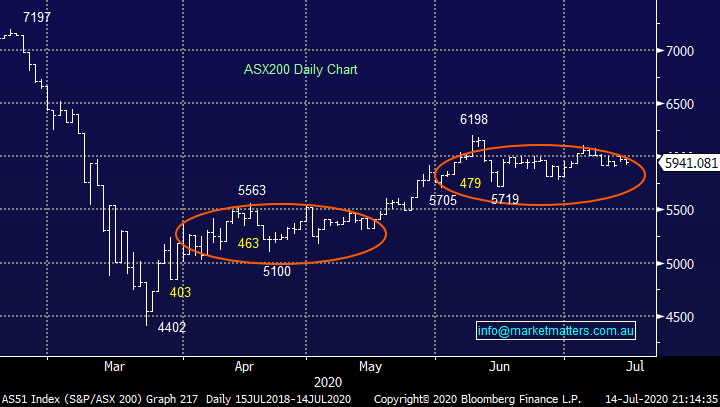

No significant change with regard to US stocks, It remains very important in our opinion that the US futures market are still registering a massive net short position in the S&P500, strategically a bullish contrarian sign. Under-the hood we may be starting to see some rotation from growth to value albeit on a small scale but the most significant point at play for MM is how equities are continually shrugging off almost daily bad news around COVID-19, the broad based Russell 3000 is only 6% below its all-time high!

We remain bullish stocks expecting ongoing strength in the months ahead and although we do believe the NASDAQ will hand over the mantle of top preforming index we feel the hardest thing to determine is the path stocks will tread to reach these higher levels.

MM remains bullish the US S&P500 medium-term.

US Russell 3000 Index Chart

MM is leveraging off US Tech, what have we learnt?

MM has been working hard behind the scenes in 2020 towards the launch of a new website and associated ‘back office’ functions, one we believe will take things to the next level for our subscribers. The learning curve at times has been steep but exciting, and one thing that has literally jumped off the page to us is the enormous depth of quality IT services on offer for the operators of on-line businesses, today we have simply looked at some of the companies MM has used in our new refreshed site which we believe will offer subscribers a significantly superior and more comprehensive service helped largely by some of the companies we are covering today – before I progress we are hoping to unveil the site and its exciting functionality in the coming months but one thing I have learnt is these things always take longer (and cost more!) than anticipated.

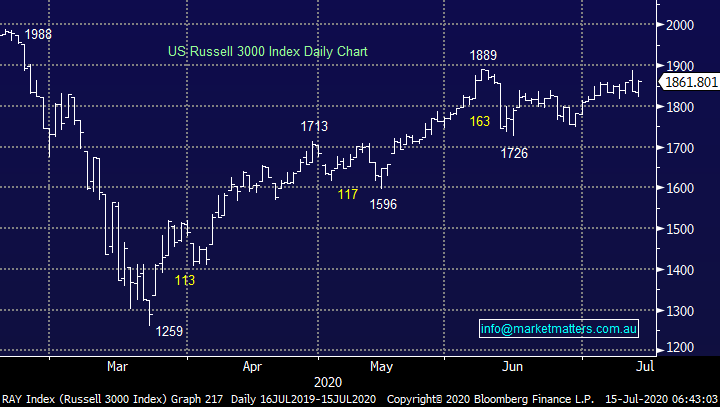

Many of the companies covered are household names but their individual levels of success over recent years may surprise even the most optimistic investor e.g. Twilio (TWLO US) who deliver our alerts to your mobiles has surged to be a $45bn business with most of the gains unfolding this year. Today I have touched on the stocks, how we use them and most importantly whether we believe they’re a buy today.

1 HubSpot (HUBS US) $US211.99

HUBS offers a cloud based marketing and sales software platform which will provide the backbone behind the scenes to the new MM site, its functionality / flexibility should enable us to give subscribers exactly what suits their individual needs i.e. a tailored offering for subscribers, especially ones who are time poor or for example only have interest in certain aspects of the market. HubSpot is not a cheap system, more the Rolls Royce end of town, and they have a scalable model which is charged on a per user basis, or in other words, if we add subscribers, we pay more to Hubspot, if we reduce subsribers we pay less. It provides a flexible approach to growth.

Revenue is forecast to grow from $US807m this year to $US1.2bn in 2022, solid and relatively pedestrian compared to many in the sector. This is undoubtedly an excellent company but with a market cap of over$US9.2bn and a 3-digit P/E there’s already a significant amount of optimism baked into the proverbial pie but while interest rates remain around zero and the growth is delivered the downside should be limited. Technically for the lovers we could be buyers around here with stops ~10% lower.

MM is neutral HUBS at current levels.

HubSpot (HUBS US) Chart

2 Twilio (TWLO US) $US223.82

As mentioned earlier we us Twilio (TWLO US) to deliver SMS’s to subscriber’s mobiles, we pay on a per text basis hence the scalability of their business model is easy to comprehend. Companies doing any sort of SMS integration use Twilio – it’s the go to application in the space.

The company offers a comprehensive stable of quality internet solutions which has seen the share price surging this year taking its market cap to $US31bn. With revenue set to come in ~$US1.5bn this year and an estimated around $US2.4bn in 2022 TWLO is clearly another very real business with exciting prospects where the million dollar question as is so often the case, what price to pay, we like the risk / reward back around $US200 which is obviously 10% lower but this is a very volatile stock.

MM currently likes TWLO ~$US200.

Twilio (TWLO US) Chart

3 Stripe - unlisted

MM uses Stripe to process our on-line payments, a growing area of our business as more consumers become comfortable with-commerce retailing. As would be expected we simply pay Stripe a % of revenue, a very profitable business model as e-commerce booms. Stripe has not yet gone to IPO but it raised $US600m in April to boost its valuation to a whopping $US36bn as its enjoyed COVID-19 pushing the consumer more & faster towards on-line shopping – interestingly it now includes Zoom among its customers who we will look at later. This is now Silicon Valley’s most valuable start up with investment banks queuing up to take the stock to market (IPO). To put the growth into context, in 2012 they raised $2m based on a $100m valuation, that 2m is now worth $720m.

MM thinks this will be an interesting IPO when it finally arrives.

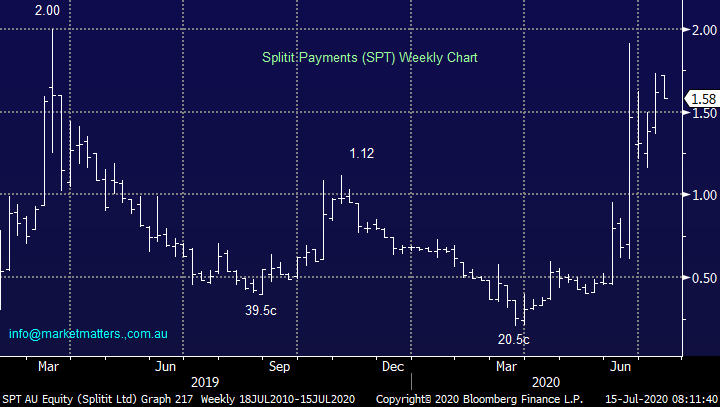

Stripe signed a partnership with Australia’s Splitit (SPT) earlier this year which has capitulated the Aussie business to a $550m valuation, we like SPT as an aggressive play around $1.35 which is not inconceivable in today’s volatile market.

Splitit Payments (SPT) Chart

4 Zoom Video Communications (ZM US) $US260.01

Zoom has arrived in many people’s homes since the COVID-19 outbreak, MM uses it regularly for internal meetings between offices but obviously it’s now become even more front and centre. Also we have purchased / subscribed to one of their offerings for our Webinars which MM will now be running monthly, again I can see how they make decent $$ by an upfront cost and reoccurring revenue but it’s an excellent product, especially when we become proficient with all of its intricacies!

The company’s revenue looks set to come in this year ~$US622m but it’s expected to grow to almost $US3bn in 2023 hence there is not surprisingly some optimism built into the share price thus we would be keen to buy a little lower.

MM likes ZM ~$US240.

Zoom Video Communications (ZM US) Chart

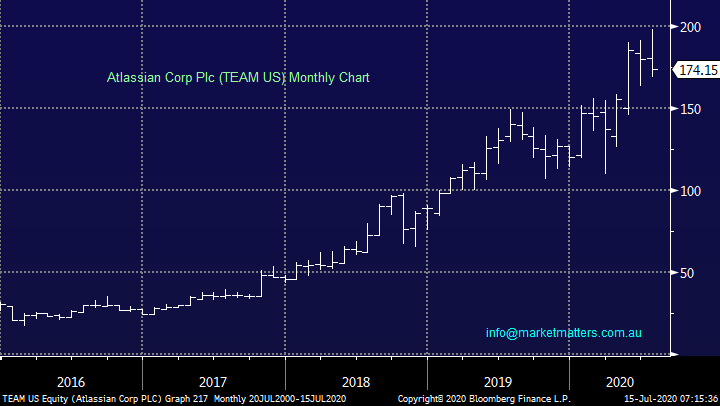

5 Atlassian Corp (TEAM US) $US

Atlassian should need no introductions having made 2 of Australia richest entrepreneurs over recent years – Mike Cannon-Brookes and Scott Farquhar. This huge software business is now valued at a whopping $US43bn making it a fantastic Australian story for the founders. MM uses an Atlassian system for our record sharing, compliance etc and find it not surprisingly to be a very effective.

With last year’s revenue of $US1.2bn estimated to grow to ~$US2bn in 2021 this is a relatively mature business from an income growth perspective hence we are cautious to chase at current valuation, another 5-10% lower and the risk / reward improvers nicely.

MM is neutral TEAM at current levels.

Atlassian Corp (TEAM US) Chart

Marketing

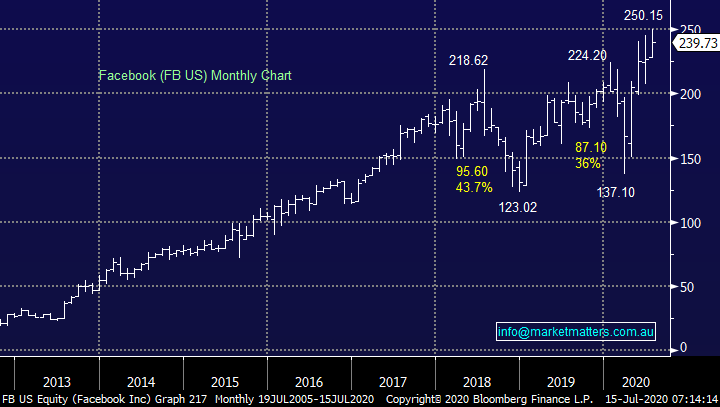

MM uses heavyweights Google and Facebook for some of our marketing although I would say with mixed results, its relatively expensive in the Finance Sector to get either of these vehicles to particularly hum along – we have more commercial success from our general relationships with companies locally.

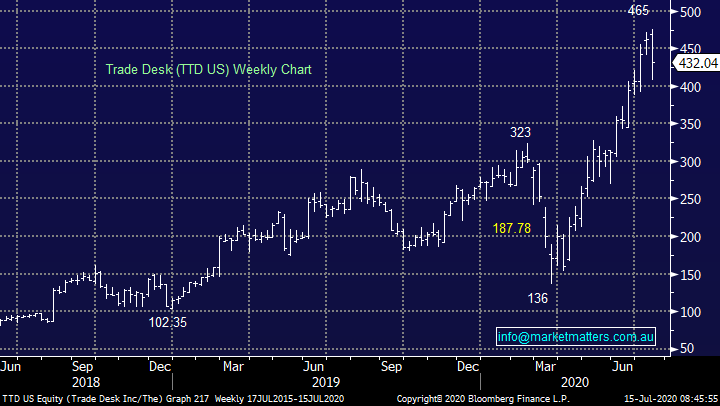

On the stock level Trade Desk (TTD US) is our favourite pick, especially now that Google, which we also hold in our International Portfolio, has hit our target area.

MM still likes Trade Desk (TTD) in the advertising / marketing space.

Facebook (FB US) Chart

Google (GOOGL US) Chart

Trade Desk (TTD US) Chart

Conclusions

MM clearly uses a lot of US tech, and clearly, we’re not alone. The revenue models these companies use mean that growth in our business means we pay them more, multiply that by the millions of customers globally and its easy to see why these sorts of businesses are such incredible growth.

Using products gives investors (like ourselves) a better feel for how businesses operate and the level of scale they could attain

While we likes the companies discussed above that we are using to evolve our business / website, I wouldn’t chase any of the stocks into strength - my favourite 2 into pullbacks are Twilio and Zoom.

Overnight Market Matters Wrap

· The US equity markets rallied overnight, in a see-saw of a week so far as optimism returns on the back of progress being made on a vaccine.

· Crude oil gained on the back of the optimism, however this may fade with the EIA inventory report due tonight

· BHP is expected to outperform the broader market after ending its US session up an equivalent of 1% from Australia’s previous close.

· The September SPI Futures is indicating the ASX 200 to gain 62 points higher, testing the 6000 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.