Overseas Wednesday – MM launches its International Equities Portfolio **Buy 2318 HK** (AAPL US, ABX, 2318 HK)

The ASX200 had a very quiet Tuesday as it meandered around between slightly positive & negative over the day, volumes were low and there were no clear signs of the common EOFY shenanigans, either above or below the hood of the market. With the exception of a strong gold sector and an unpopular takeover by Sandfire (SFR) of MOD Resources, which saw the copper stock fall -11.2%, movement was muted with less than 4% of the ASX200 moving by over 5%.

Although the market closed down just -0.1% only 35% of the ASX200 managed to close up on the day reinforcing our view that the market is losing momentum / internal broad strength and the time is approaching to adopt a more defensive stance both via stock selection and cash levels. Yesterday we took profit on our Aristocrat (ALL) position allocating the funds to Australia’s major gold player Newcrest Mining (NCM) – while our entry to ALL was not perfect we rode the stocks 50% recovery from its December low but now MM simply feels the shares are fairly priced. The move tweaks the portfolio to a more defensive stance.

MM is now in “sell mode” looking to adopt a more conservative stance than over the previous 6-months.

Overnight US indices retreated ahead of the G20 meeting with the S&P500 down ~1% following the weakest consumer confidence reading in 18months, comments by Fed Chair Jerome Powell that the chances of a recession have increased plus the Trump administration implied a resolution on US – China trade this weekend is unlikely. The SPI futures are calling the ASX200 to fall ~40-points this morning / 0.6%.

Today we are going to discuss a new International Equities Portfolio which is now available on the Market Matters Website, and will feature in our weekly international note.

ASX200 Chart

I am increasingly becoming mindful of how far bond yields have tumbled in 2019, the chart below illustrates the about turn in the perceived strength of the US and global economies over the last 12-months. Bond yields have now fallen to the rough average of the last 3-years and at least a pause would not surprise with 2 scenarios likely to follow:

1 – The world falls into a recession implying bond yields have further to fall – the Fed are becoming increasingly worried around this outcome.

2 – Central banks again manage to invigorate the global economy with lower interest rates and QE in which case bond yields should again bounce higher.

Either way we believe the “easy money” from lower bond yields is behind us for stocks and caution is warranted especially in sectors that have soared over the last 6-months e.g. IT & the “yield play” stocks.

MM is becomingly increasingly cautious on the chase for yield.

US 5-year bond yields Chart

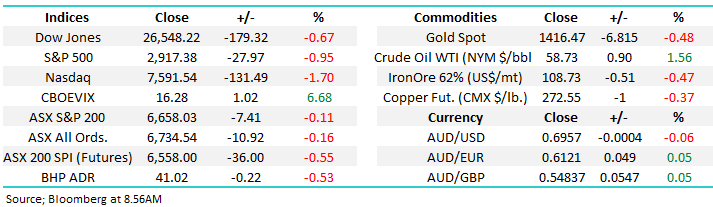

The Australian Real Estate Investment Trusts plunged by ~80% during the GFC enduring more pain than most sectors during this tumultuous time but as is often the case the snapback style recovery since the 2009 lows has been impressive for many (while some did not actually come out the other side). However, the huge sugar hit of falling bond yields which has propelled the index ever higher in 2019 is starting to feel almost FOMO like (Fear of missing out) and we could not consider chasing stocks in the sector at current levels.

At MM is now cautious Australian REITs that have been basking in the current low interest rate environment.

ASX200 REIT Index Chart

The MM International Portfolio – click here to view

Life is never dull at MM and today we are excited to initiate the first of our International portfolios on the MM website being the Market Matters International Equities Portfolio. Next Wednesday will see the launch of the Market Matters International ETF portfolio.

The portfolio’s will be built out over time, and I will shortly hold a webinar to discuss them, including ways to transact in international equities / ETFs, the nuisances of dealing overseas etc., however the first step in the process is simply getting the portfolios live.

Important points to clarify:

- The portfolio (s) is a model portfolio.

- The portfolio (s) are available on the website

- Alerts will be included in the Afternoon & Morning Notes depending where stocks are domiciled, not via individual email alerts & texts – we will include a notation in the subject line when we have an active alert on.

- The Wednesday AM Report will focus on International opportunities, and will include the International portfolio’s within the report, a similar format as the existing Income Note.

Market Matters Global ETF Portfolio (launching next week)

Thematic investing makes sense, from being long the $US, short Gold, bullish the US market versus Emerging Markets, short the Aussie and long Oil to name a few. The Market Matters Global ETF Model Portfolio.

Market Matters International Equities Portfolio (launching today)

Australia is a small market with just ~3% of the worlds listed equities. Many of the more progressive investment opportunities are listed overseas in places like the U.S, Europe and Asia. The Market Matters International Equities Model Portfolio will target large cap, growth oriented global companies with a near term catalyst for share price gains.

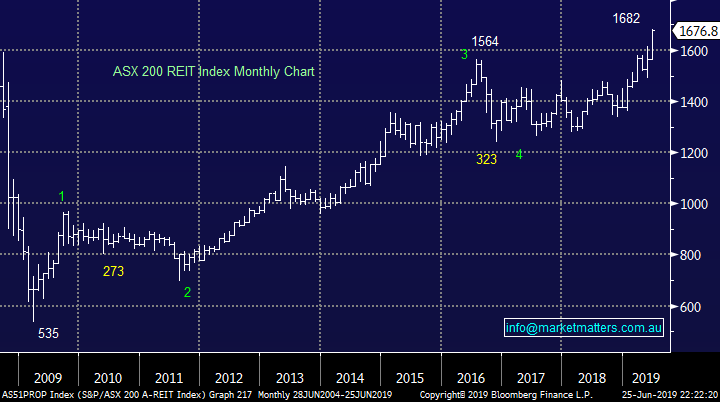

Interestingly, MM is starting a new Financial Year with 2 portfolios just as global equities extend their post GFC bull market i.e. the US S&P500 made a fresh all-time high last Friday but generated short-term sell signals last night. We feel this is an ideal time for MM to slowly construct our International Portfolio as opposed to chasing a runaway train style market. Importantly remember we can also hedge overseas market via negative facing ETF’s if / when we become concerned to the underlying health of equities.

Today we have selected 3 initial positions that we are comfortable to add now as we build out the International Portfolio, including portfolio allocations and targeted entry prices based on the overnight close price. This afternoon, we will include these as alerts in the PM note which will be typical of our US denominated investments.

MSCI Global World Index Chart

We believe that eventually a US – China trade war resolution will occur but “when” is the big question, the Emerging Markets have fallen well over 20% with the respective ETF’s dragging with it the likes of goliath tech business TenCent (700 HK) – however remember most of us thought BREXIT would be sorted by now hence we should always be cognisant of the unexpected. The Beta of Asian domiciled / based stocks is significantly higher than say the US which is basically a market term for volatility i.e. the volatility of Asian markets / domiciled stocks is generally significantly higher than that of the US.

Hence our feeling is it’s a touch too early to be overly exposed to Asia with the risk / reward favouring buying a news induced spike lower but we do like the concept of accumulating from current levels.

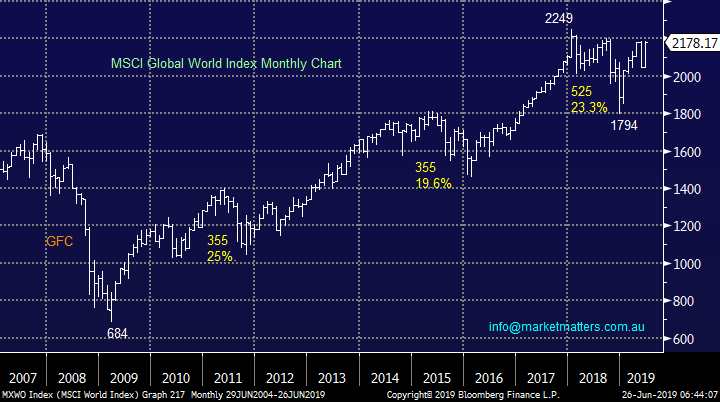

1 Apple Inc (AAPL) $US195.57. (6% allocation)

Apple has been experiencing a correction of late due to fears of deteriorating trade between the US and China. The company’s latest numbers showed they realised $US11.58bn profit on $US58bn revenue with services revenue hitting an all-time high although gross margins fell from 38.3% to 37.6% - plus they announced yet another $75bn in share buybacks which is likely to be just one more of many as they sit on literally “buckets” of cash.

We see solid value in Apple around $US195 with buybacks, large cash balance etc i.e. at this price investors are not paying any premium for growth.

While we acknowledge the current iPhone product cycle is going poorly especially in of course China the business is looking to allay concerns around life after just selling phones / iPads by increasing its services revenue. Stocks with leverage to China have been sold down aggressively on trade concerns but we feel the risk / reward is now attractive with plenty of bad news built into the price.

MM likes Apple around the $US195 area.

Apple (AAPL) Chart

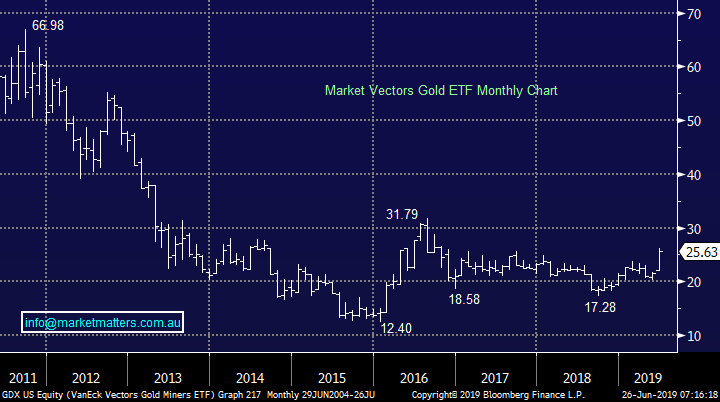

2 Barrack (US ABX) $US16.01 (5% allocation)

Gold is one of our favoured investment themes in 2019 with ABX looking well positioned after its years in the wilderness. US / Canadian gold stocks have not enjoyed the huge tailwind of a depreciating $A like the Australian gold miners have, we feel they may well now outperform moving forward although we do still remain bullish the Australian gold sector in the year ahead.

The business has been performing well of late with the company reporting revenue of $2.1bn for Q1 of 2019, up almost 17% from the same time last year. Technically the stock looks great while it can hold above $US14.

MM is bullish ABX targeting significant upside.

Barrick Gold (ABX) Chart

VanEck Vectors Gold ETF Chart

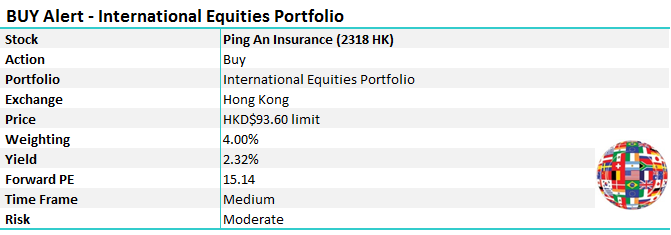

3 Ping An Insurance Group (2318 HK) HKD92.65 (4% allocation)

Ping is China’s largest insurer and has just announced an solid annual profit which beat expectations which has led to a 10 billion yuan ($1.5 billion) buyback, the first in the company’s history.

The robust profit and buyback plan highlight Ping An's strength compared with smaller players during a period of increased scrutiny of insurers' use of leverage -some companies have been punished for risky practices. The buyback reinforces managements message that its shares are undervalued.

MM is Pig initially targeting a break of HKD100.

Ping An Insurance Group (2318 HK) Chart

Conclusion

MM is commencing the international equities portfolio with 3 stocks outlined above, while leaving plenty of powder dry at this stage to take advantage of weakness.

Global Indices

US stocks fell ~1% overnight generating technical sell signals by closing below 2925. A final “pop” towards and medium-term target ~3000 on good news from the G20 meeting would not surprise but we believe the risks to the downside and increasingly rapidly.

MM is now neutral / bearish US stocks.

US S&P500 Index Chart

No change with European indices, we remain cautious in this region believing the next ~5% is now on the downside.

German DAX Chart

Overnight Market Matters Wrap

· The US sold off overnight led by the tech sector, following the weakest consumer confidence reading in 18months and comments from leading officials of the Federal Reserve that nerved investors about the extent and speed of expected rate cuts.

· The Chairman of the Federal Reserve Jerome Powell said the Fed was assessing whether the current economic climate called for rate cuts and was adopting a wait and see approach. He added the Fed was independent of “short term political interests.” The President of the St Louis Fed, James Bullard, also commented that a 50bp cut “would be overdone”. The market is pricing in a 25bp cut next month and further cuts over the coming year. The consumer confidence reading of 121, driven by slowing economic growth, was the lowest since September 2017 and well below expectations of 131.

· US ten year bonds fell below 2% on the growing economic concerns, gold hit fresh 6 year highs of US$1426.8/oz., and crude oil rallied over 1% on rising US-Iran tensions.

· The September SPI Futures is indicating the ASX 200 to open 22 points lower, towards the 6635 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 26/06/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.