Overseas Wednesday – Leaders & Laggards in our International Equities portfolios (AAPL US, TTD US, JPM US, WFC US)

It seemed like the ASX200 had a relatively quiet Tuesday down just ~1pt however there was a large +/-73pt range during the session as stocks took issue with Melbourne being put into a six week lockdown due to the rise in community transmission of COVID-19. Victoria makes up around ~25% of Australia’s GDP so the lockdowns are clearly a negative and no doubt very frustrating to many of our southern based subscribers.

Selling was most intense in the travel related companies and the property stocks, particularly those with shopping centre exposure like Vicinity Centres (VCX). Sydney Airports (SYD), a stock we own in the Income Portfolio ended more than 2% lower as the airlines cut flights on what was the world’s second busiest route last year. Qantas said yesterday they would continue to operate limited flights for essential travel only, while the shutdown will provide an early test for Virgins new owners.

The RBA kept rates on hold yesterday as expected plus they committed to their stated target for 3 -year bonds to stay around 0.25%, meaning that rates will be low for an extended period. To achieve that target, the Reserve Bank would step into the market and buy bonds which would put downward pressure on yields, however generally the market is likely to do the bulk of the work for them.

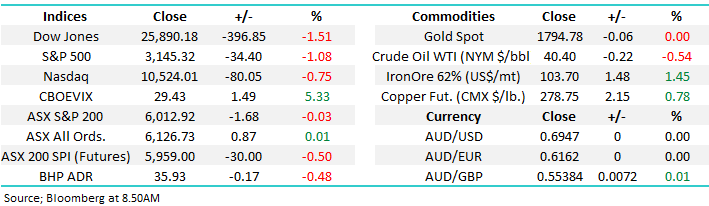

The material stocks were again a standout yesterday with a number of decent catalysts currently playing out:

- Stronger economic data globally and it seems China has successfully contained their recent breakout, Chinese stocks rallying on strong momentum a positive sign, albeit probably a manufactured one.

- Supply concerns remaining in South America, a major producer of commodities due to rising COVID-19 cases.

- Inflation expectations are edging higher

Medium term MM is very bullish global material stocks

MSCI World Materials Index Chart

Gold has been on MMs radar in recent weeks and although we are yet to pull the trigger and buy it, we intend to. We expect a pullback in the short term which will set up a strong medium-term buying opportunity for Gold and Gold equities. i.e. we’re not chasing strength here.

St Barbara (SBM) caught our eye yesterday on the back of the 4th quarter production update which saw a strong finish to the year managing to produce just shy of 382koz of gold which was in line with prior guidance. The update was a good one and SBM is now in the mix when considering our likely gold exposure.

MM is medium term bullish Gold

Spot Gold Chart

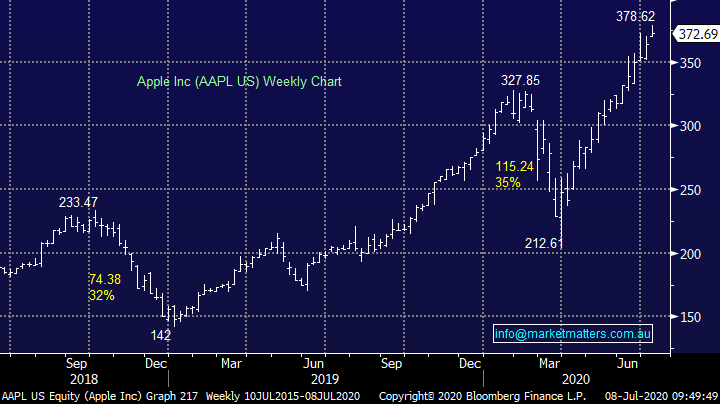

Overnight we saw the Dow Jones finally close down nearly 400-points / -1.51% although the broader S&P 500 fell by less (-1.08%). The technology stocks were down but outperformed in a weak market ending the session off -0.75%. In the short term, we think technology is overbought and could pause here and unless the cyclicals & defensives can grab the batten and run with it, we remain of the view that buying into weakness is the preferred approach.

MM remains bullish US stocks

NASDAQ Chart

South America has become a coronavirus battle ground with Brazil second behind the US on ~1.6m cases, even the President Jair Bolsonaro has tested positive to the virus overnight. In the US, President Trump has vowed as early as this morning, that the US will not go back into lockdown and will remain open, which will of course have health ramifications but is a positive economically, while it also shows Mr Trump’s order of priorities in his run for re-election.

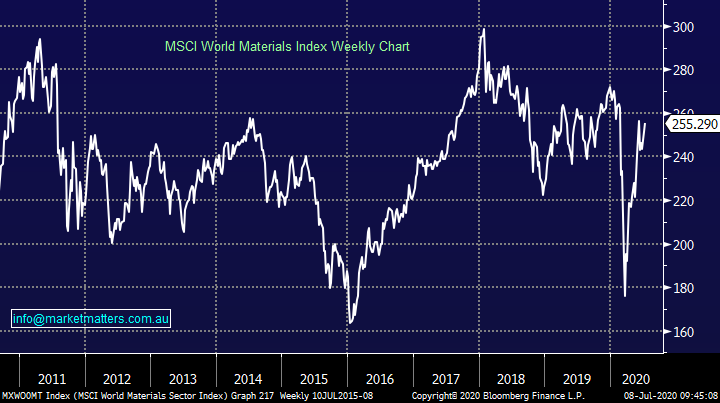

The $A has remained resilient despite the RBA implying that rates will be lower for longer plus it was a risk off session overnight for equities. It’s recent consolidation between 68c and 70c looks to have more to play out and we wouldn’t be surprised to see this unfolding for a few weeks with breakouts in either direction failing to get traction, after rallying 15c in quick fashion MM believes the $A needs a rest. Our view on the $A not surprisingly corresponds with the highly correlated stock market with the upside trend in tact but it feels unlikely that the momentum short-term will manage to take stocks aggressively up into fresh post virus levels, just yet.

In our opinion the “Little Aussie Battler” is showing the way ahead for stocks and it remains up medium-term.

S&P/ ASX 200 v Australian Dollar ($A) Chart

I’m lucky enough to get a broad exposure to a lot of different market views from a wide range of sources, from our own institutional flow, fund managers coming into the office outlining their views to our own internal portfolio management teams and client feedback. The consensus is that this rally has gone too far based on the economic outcomes we are experiencing and the risk of a second wave globally.

At MM we hold a more optimistic view, in terms of the market anyway. While we think that coronavirus volatility will remain high until a vaccine is found, we highly doubt that markets will experience the sort of volatility we saw in March. It takes years for the positions to be built up that led to the most aggressive correction in history, and importantly, as markets settle, the huge risk reduction that occurred in March from big investors, insurance companies, annuity providers and the like will reverse which is bullish for stocks.

We’ve mentioned better than expected economic data in June and there’s no clearer way of highlighting it than through the Economic Surprise Index. Negative numbers = miss, positive numbers = beat and the index is clearly showing that the forecasts that were made for June were clearly way too bearish. US Economic data has surprised on the upside by the biggest magnitude ever!

Citi Economic Surprise Index Chart

Leaders & Laggards in our International Equities Portfolio

The MM International Equities Portfolio returned over 10% in FY20 despite the huge level of volatility that played out globally, however there was a large variance across positions in the portfolio, or in other words, massive divergence between our leaders and our laggards. https://www.marketmatters.com.au/new-international-portfolio/

Not surprisingly, the leaders were squarely in technology which has shown to be incredibly resilient as the significant drop-in interest rates and acceleration in the use of technology as the world increased its evolution has created the perfect backdrop for tech. While we are bullish US tech names, we do believe the time to increase weight to some Value names is approaching

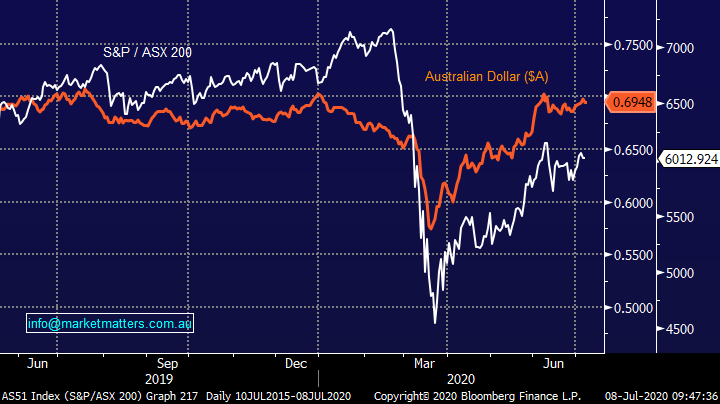

1 Apple (AAPL US) $372.69

MM’s position is sitting up ~90%, clearly a fantastic contributor to the portfolio. Apple at one point was a business that made no money, now it’s extremely profitable and trading on a forward P/E of 29x growing earnings at 10-20%. It’s very hard to question the momentum in the stock and while we wouldn’t be surprised to see the stock take a rest in the short term, we remain bullish AAPL.

MM remains bullish Apple medium-term, but we are becoming slowly cautious short-term.

Apple Inc (AAPL US) Chart

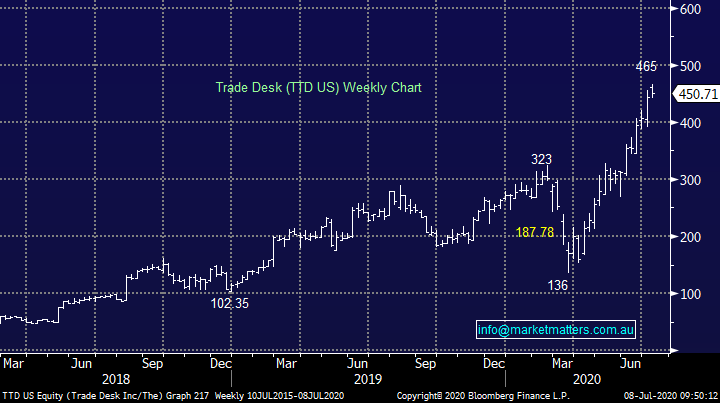

2 The Trade Desk TTD $450.71

MM’s position in TTD is sitting up ~70% however we can’t take full credit for it. A good client held the stock which prompted more investigation from MM. As advertising moves from traditional media to online / streaming channels, TTD has as incredibly strong solution to take advantage of this tectonic change in advertising spend. I covered TTD in a video some month ago – 6 stocks we’re happy to buy – click here

MM remains bullish TTD

The Trade Desk (TTD US) Chart

3 JP Morgan Chase (JPM US) $92.32

US banks are struggling under the vice of low interest rates and the economic hit from COVID-19. The provisioning that has been taken from the likes of JPM has been huge and this is hurting profits. Credit card liabilities are a problem for JP as was the decline in Oil prices. MM’s position is currently down ~30% and given our more positive expectation around stimulus and economic outcomes leading into an election, we will give the position room to improve.

MM remains bullish JPM

JP Morgan (JPM US) Chart

4 Wells Fargo (WFC US) $24.46

WFC has been hit by similar problems however they’ve also had the double whammy of a fraud scandal thrown into the mix. Tellers were creating savings and checking accounts on behalf of customers (without their knowledge) to pick up a sale incentive. While Warren Buffet’s Berkshire Hathaway remains WFC’s no 1 supporter with 8.4% of the stock, I’m sure this year’s performance has tested Mr Buffets patience, just as it has MM’s.

The position is currently down a painful ~50% and while hindsight says we should have cut this sooner, our positive stance around banks globally means we’ll hold for now.

MM is neutral WFC

Wells Fargo (WFC US) Chart

Conclusions

1 - MM believes US tech us due a rest, but remains bullish medium term

2 – US banks are on the nose, however we will hold our laggards for now

Overnight Market Matters Wrap

- The US equity markets pared back its gains with the 3 key indices ending their session in negative territory as covid-19 continue to be the pain in most investors’ butt.

- As the pandemic continues, Melbourne is now in lockdown and we expect to follow the US and see a laggard in the airline and hotel names.

- On the commodities front, safe haven gold hit an 11-year high, while Iron ore traded slightly to the upside.

- BHP is expected to underperform the broader market after ending its US session off an equivalent of -0.46% from Australia’s previous close.

- The September SPI Futures is indicating the ASX 200 to open marginally higher, towards the 6025 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.