Overseas Wednesday – International Equities & Global Macro Portfolio (XRO, ZM US, QQQ US, ETPMAG)

Before cracking on with today’s note, I wanted to let you know about an important initiative that Shaw & Partners is this running this week to celebrate 5 years of the Shaw & Partners Foundation, which has donated over $3m to incredibly worthwhile causes over the past 5 years. As you may know, I’m a Portfolio Manager at Shaw and Partners along with being the Author of Market Matters. Shaw is also a shareholder in Market Matters owning ~20% of our business while they also provide research support and a bunch of other things that I draw on to pen our daily notes.

This week, the S&P Foundation has committed to donate at least $500,000 in 5 days to a bunch of worthwhile Australian Charities, one of which is Gotcha 4 Life run by Gus Worland. Gus was in the office yesterday morning giving a run down on the great work the charity does to support mental health and reduce suicide in Australia. This is a massive problem, amplified by current conditions, many of us unfortunately have had friends take their own lives and it simply shouldn’t happen. Yesterday the foundation donated $150,000 to this great cause.

At the centre of the week is the Institutional Foundation Day today, where all brokerage written on our institutional desk will be donated to the cause. We’re set for a big day with a target of $200,000. Thanks in advance to all the institutions that support the day and make it such a success year after year.

Gus Worland at our Morning Meeting yesterday

Source: JGs iPhone

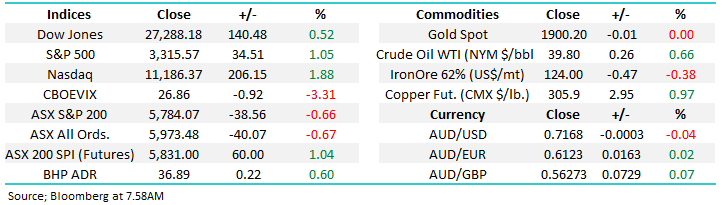

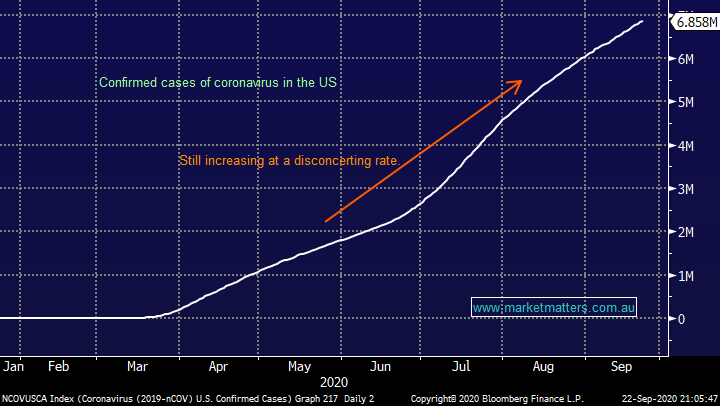

Back to the market and the ASX200 fell away yesterday to levels not seen since mid-June, it was yet another day of rotation, this time out of the recovery names into tech as the global coronavirus numbers continue to deteriorate. Ironically, we saw a loosening of state border controls on Tuesday yet the likes of Corporate Travel (CTD) and Star Entertainment (SGR) were sent to the naughty corner. It’s a real shame that we’re again discussing the pandemic but markets dictate what’s at the front of our minds and with Europe slipping back into secondary lockdowns and the US not even managing to flatten the curve since March its no surprise equities have again become rattled around the future economic direction.

However this time is very different to March / April in our opinion, many unknowns have gone, it’s now primarily down to when will a vaccine be ready, most experts that I read are talking 2021, I’m sure most of us would be delighted with this outcome. Until there’s a vaccine we are staying with our view that only 2 real paths appear likely, it will be interesting to see if many opt for number 2:

1 – Ongoing rotation in and out of partial lockdowns as the virus is proving almost impossible to fully eradicate, just ask New Zealand. Obviously, this can be significantly smoothed over with social distancing etc but as Europe is now showing we can’t have lives as we knew them in 2019 without a vaccine.

2 – Governments become tough and follow Sweden’s lead on herd immunity, easy to justify depending on how you play with the statistics e.g. Australia now has 854 deaths attributed to the virus yet 450 people die in our country on average every single day. I could comfortably argue that the US is heading this way although it’s not been publicly described as such.

Scientists will eventually find a vaccine while politicians will stumble through the above 2 scenarios, second guessing either is fraught with danger, we prefer to simply focus on what we know – stocks.

Confirmed cases of COVID-19 in the US Chart

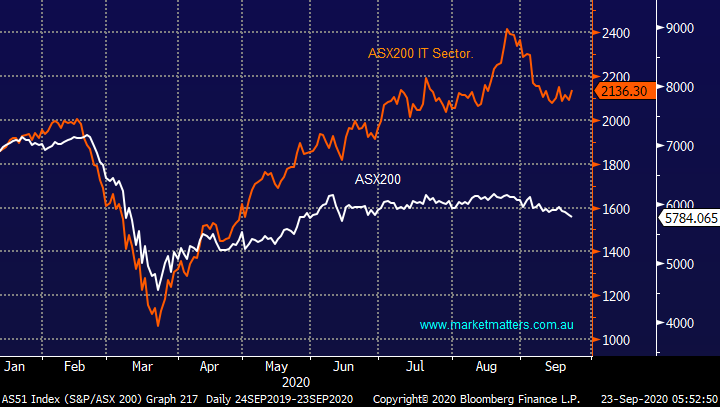

No real change from yesterday, the ASX tested major support after declines overseas but the real action is evolving under the hood on the stock / sector level. Yesterday we beefed up our tech exposure through Appen (APX) and Megaport Ltd (MP1) as we believe this will be the strongest sector through October - the NASDAQ rallied strongly overnight, the switches should at least be on the right foot this morning. Reiterating our view moving into Christmas:

1 – MM expects stocks to recover strongly into October but fresh 2020 highs might be too much to hope for.

2 – Q4 will be choppy and probably a tough time for stocks hence “buy weakness and sell strength” remains our mantra until further notice.

3 – After major underperformance in recent weeks we feel tech is poised to play catch up, remember monthly trends are unfolding almost in days at the moment.

MM remains bullish the ASX200 over the next month.

ASX200 Index Chart

The chart below illustrates the underperformance by the Tech Sector over recent weeks as local stocks followed US heavyweights such as Apple (AAPL US) and Microsoft (MSFT US) sharply lower. We now believe the tech space is poised to play catch up, fresh 2020 highs wouldn’t surprise in at least a few names, if not the whole sector.

MM believes tech will outperform in October.

ASX200 & ASX200 Tech Indices Chart

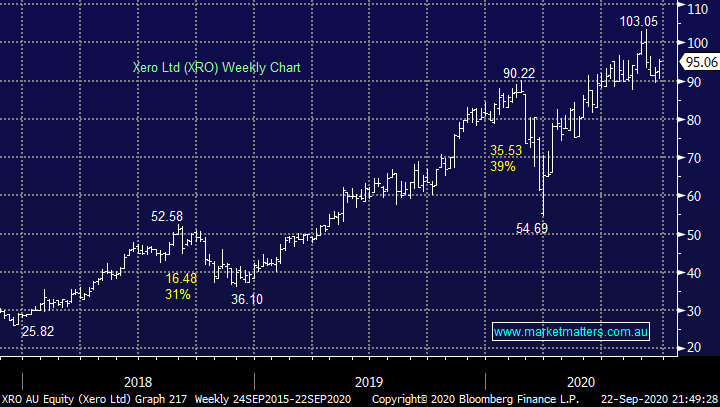

The best performer in the ASX200 yesterday was on-line accounting software business Xero (XRO) which bounced well over 4%. This $13.6bn NZ based business has been excelling at both customer acquisition and retention, a winning combination. XRO’s lofty valuation is all about growth along with much of the tech space, we believe this is a quality company, but it shares are likely to continue to dance the sector & growth jig.

MM remains bullish & long XRO initially targeting ~10% upside.

Xero Ltd (XRO) Chart

Overseas markets

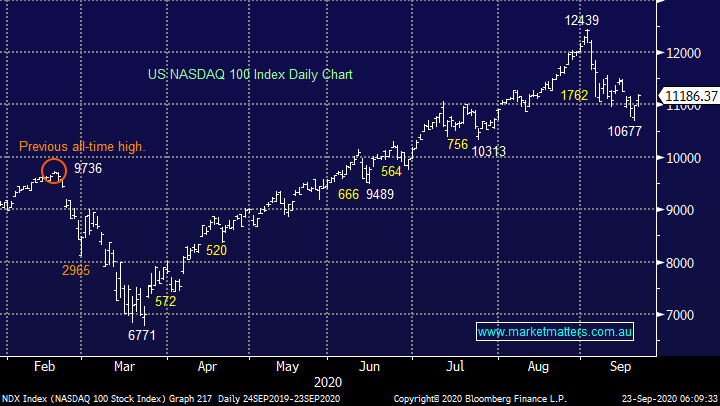

Overnight US stocks rallied strongly led by tech where Amazon soared almost 6% while the likes of Apple (AAPL US) and Microsoft (MSFT US) gained around 2%. “One swallow doesn’t make a summer” but it does support our view that at least that the worst of the NASDAQ’s correction is behind us and after 14.2% potentially all of it! I reiterate MM likes US tech at current levels both fundamentally and technically, in a perfect world we will see another test of 12,500 in October where we will again look to tweak our holdings.

MM is now bullish US tech stocks short-term.

US NASDAQ Index Chart

Following on from yesterday the $US tested our targeted 94 region sell zone overnight, were not ruling out a little more upside but we still feel this is a bounce which will ultimately fail. The current weakness in precious metals in particular is slowly approaching our buy zones but as we did with the NASDAQ, we still feel it’s worth being fussy in these volatile times.

MM remains bearish the $US in the 94 region.

$US Index Chart

Arguably the most important piece of the investment puzzle is bond yields and they continue to tread water, not a bad result considering the ongoing virus worries. Medium-term we believe yields are looking for an important low but when they will get the impetus to again challenge 1% is a tough call, just wait and be patient, as always the “tape” will tell the tale / lead the way.

MM remains bullish bond yields medium-term.

US 10-year Bond Yields Chart

MM International Portfolio

No change to our portfolio this week, although we were looking to switch from Visa to Amazon overnight, we didn’t pull the trigger (it remains on our radar). MM continues to hold only 6% cash - MM International Portfolio : Click here

We remain heavily skewed towards technology with around 40% of the portfolio weighted in this space, a drag in recent weeks but a positive overnight.

Zoom (ZM US) was a recent purchase for this portfolio into the correction, the momentum in both the business and the stock is hard to fault, however like anything, one incumbents success will no doubt incentivise more competition in the space.

We remain bullish ZM

Zoom Video Communications (ZM US) Chart

Aside from the potential switch from Visa to Amazon as discussed yesterday, it feels time to sit back and monitor our positions / market stance, we are long and skewed towards tech, which reflects our current view on the market but obviously we can be wrong hence the ongoing evaluation. If / when we see a strong move in October MM is expecting a further couple of tweaks, out of tech into cash / financials but there’s lots of twists in the road ahead before we hope / expect to be particularly active.

MM Global Macro ETF Portfolio

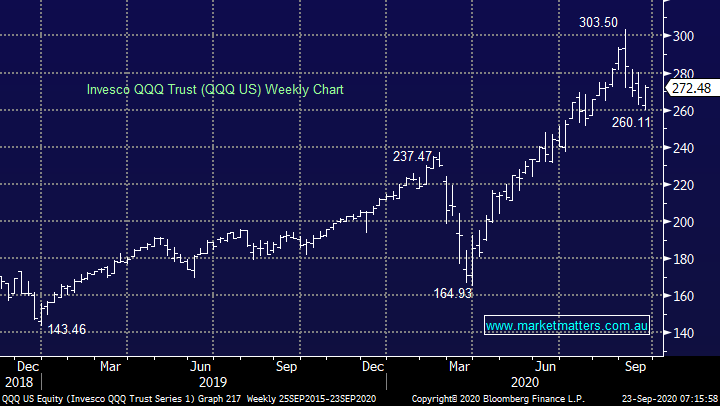

Yesterday we bought the QQQ as outlined in the afternoon note, MM’s Global Macro Portfolios cash position is now down to 9% : Click here

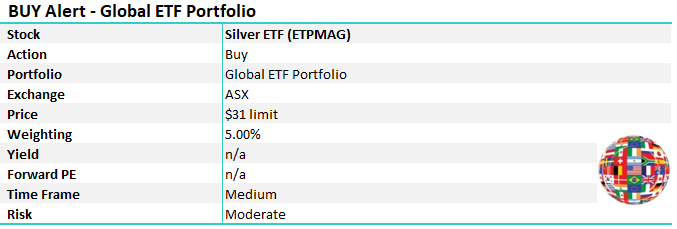

We’re now happy with our current portfolio mix, only silver is now on our radar moving forward and we have placed an alert accordingly below.

Invesco QQQ Trust (QQQ US) $US272.48.

The QQQ ETF which tracks the NASDAQ opened last night at 270.05 enabling us to “get set”, last night’s steady recovery was encouraging but obviously were looking for a lot more.

Invesco QQQ Trust (QQQ US) Chart

1 Silver ETFS (ETPMAG) $32.09

Again, in line with previous comments we are sellers of precious metals into fresh 2020 highs and buyers back below $31 – the buy level has been lowered slightly.

MM is leaving a “resting bid” in the ETPMAG at $31 limit for a 5% position.

Silver ETFS (ETPMAG) Chart

Conclusion

We’re now bullish tech throughout October and have set the portfolio (s) accordingly

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.