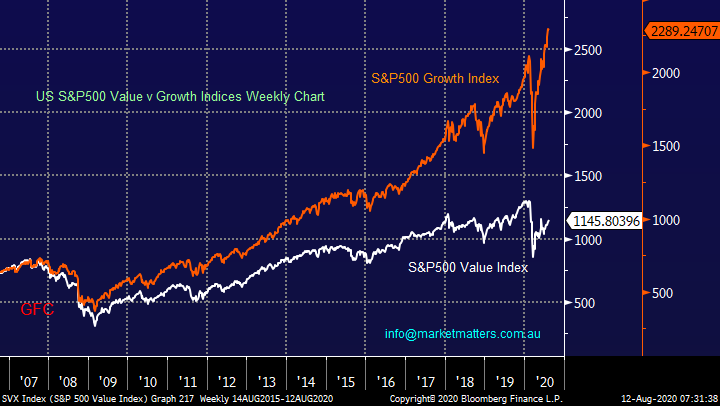

Overseas Wednesday – International Equities & Global Macro Portfolio (GOOGL US, JHG US, BAC US, GOLD US, ETPMAG, DBA US, VAE, ASIA)

LOCAL REPORTING CALENDAR: CLICK HERE **Please note, data sourced from Bloomberg, not all ASX companies are on this list and dates can vary**

Today we have results from CBA, CSL, CPU, DOW, MFG, SEK, TCL, I cover CBA, SEK, TCL in the recording below.

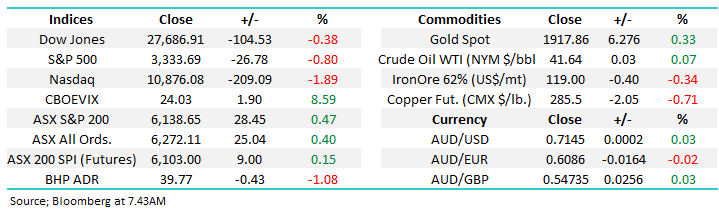

The ASX200 is poised to open flat this morning after US stocks fell sharply in the last hour of trade on concerns that Washington will not be unleashing a spending package any time soon, we’ve repeatedly described the last few months advance by US stocks as liquidity driven hence when investors become concerned that the tap may be turned off pullbacks feel inevitable – it was the outperformers that bore the brunt of the selling with “profit taking” actually feeling the most accurate description of the session e.g. Apple (AAPL US) -3% and Microsoft (MSFT US) -2.3%.

Considering the Dow fell almost 500-points from its intra-day high to close down over 100-points local stocks appear to have held up well, although the financials were up +1.3% in the US helped by rising bond yields which feels likely to again flow through to our Banking Sector, especially as CBA’s result looks good. Commodities had a very bad night courtesy of the above mentioned bond yields ticking higher, most noticeable was the hugely overbought gold which plunged the most in over 7-years, over $US110/oz, or-5.6%, needless to say we are very pleased that it would appear that our patience has paid off. Also, a quick side note which caught my attention overnight was Goldman Sachs placing a $203m parcel of Afterpay (APT) shares almost 2% above yesterdays close, clearly the demand remains strong for this BNPL stock.

On the virus front we saw 2 diametrically opposed pieces of news cross the wires overnight although neither appears to have had the greater impact:

1 – Putin has claimed that Russia has registered the world’s first COVID-19 vaccine – we know they have good chemists in the Soviet Union (just ask their athletes), hopefully they’ve been put to good use this time! I’m actually reading a book on Putin at the moment call New Tsar – scary stuff!

2 – NZ has put Auckland into lockdown after 4 fresh cases have emerged with no known source of infection, another example of how we cannot relax with regard to this invisible enemy.

I feel anyone who is too focused on the day to day news flow around COVID-19 is going to endure a stressful roller-coaster ride of emotions with the only certainty appearing that more twists & turns remain in the tale.

Confirmed Global cases of COVID-19 Chart

Nothing significant to add with regards to the ASX, it’s held up well under an abundance of bad economic news and now the influential Banking Sector is coming to life a push to fresh 4-months highs looks to be just a matter of time. However, under the hood as we enter the crux of reporting season far more volatility is likely, also we’re seeing some distinct sector rotation with most noticeably the banks & resources outperforming the IT stocks. Watch SEK today, it should get hit hard!

MM remains bullish equities medium-term.

ASX200 Index Chart

Overnight US 10-year bond yields continued their recovery of the last fortnight and although they remain only at 0.6366%, they have recovered over 25% in less than 2-weeks.

MM continues to believe bond yields are at a major point of inflection and will rally higher in years to come.

US 10-year Bond Yield Chart

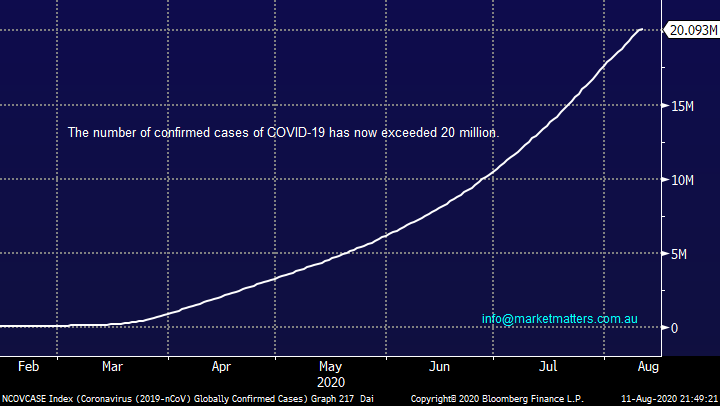

Gold plunged -$US115/oz overnight taking its fall to 8.4% over the same timeframe that bond yields have popped higher i.e. the correlation is very clear. Our preferred scenario is a number of weeks rotation between $US1900 & 2000 before another rally to fresh highs, the economic and fundamental backdrop remains solid for gold but we did caution to the risk when too many people were all on one-side of the fence.

MM remains bullish gold & its respective stock – weakness to be bought, not sold

Gold ($US/oz) Chart

Our preferred exposure to gold remains Newcrest (NCM) as opposed to the higher beta smaller cap pure gold plays that have already run extremely hard – remember our longer-term bullish outlook for bond yields. Overnight gold stocks ETF’s were hammered ~8% implying NCM will trade well under $34 this morning, a great level to start accumulating.

MM is looking to buy Newcrest (NCM) into weakness.

*Watch for alerts.

Newcrest Mining (NCM) Chart

Overseas stocks

Overnight the S&P500 traded within 0.4% of its all-time high before reversing -1.4%, still very impressive in the bigger picture. No change, MM continues to believe US stocks rally significantly higher over the next 12-18 months, but we still feel they need a “rest” around current levels.

MM remains bullish US stocks medium-term but today things feel a touch stretched.

US S&P500 Index Chart

MM International Portfolio

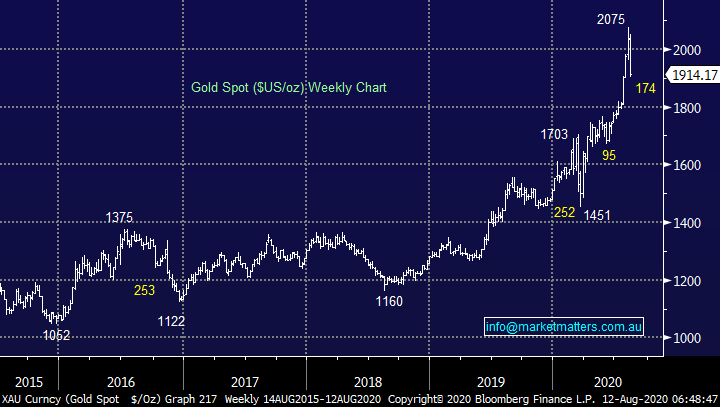

MM continues to hold only 6% of our International Portfolio in cash, in other words we are “very long” equities which feels ok as many US stocks test all-time highs. However as we anticipate the current migration back towards the “Value” end of town has a lot more legs we believe this is an opportune time to continue tweaking portfolios i.e. taking some profits in some IT stocks and increasing exposure to the out of favour banks.

MM International Portfolio : https://www.marketmatters.com.au/new-international-portfolio/

We didn’t transact last week but so far most of the patience has paid off, some portfolio switching feels much closer to hand this morning.

S&P500 Value v Growth Chart

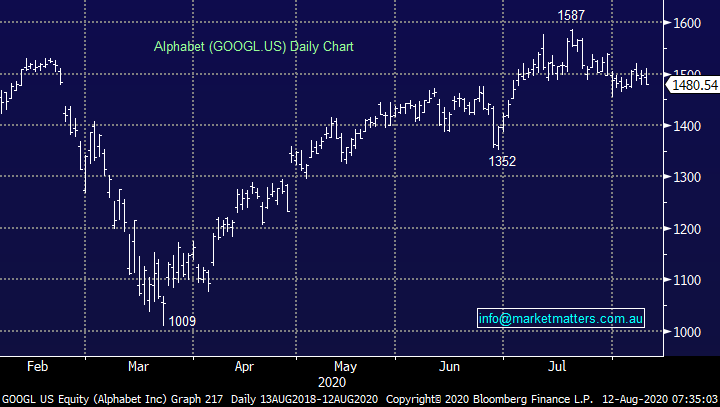

Alphabet (GOOGL US) $US1480

No change, we held back on taking profit on Google giving it the benefit of the doubt, but it’s simply traded sideways while other IT stocks pushed higher. As subscribers know we feel the technology sector is due for a period of underperformance and probably a reasonable pullback short-term – Google remains our preferred candidate to help us de-risk towards the “hot tech space” and hence by definition we prefer our positions in Apple (AAPL US) and Microsoft (MSFT US) moving into 2021.

MM is considering taking profit on our position in Google.

Alphabet Inc (GOOGL US) Chart

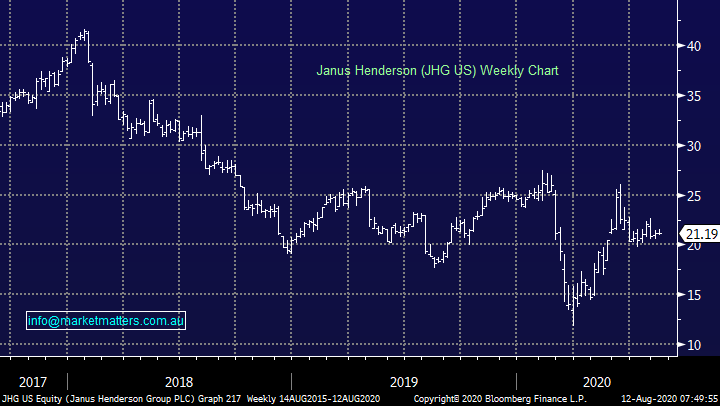

Janus Henderson (JHG US) $US21.09

Similarly, investment manager JHG remains in our sell sights, it has recovered strongly from its 2020 low but after more than doubling since March its started to struggle as outflows continue to disappoint. Hence MM is now neutral the stock technically while there are other, we sectors prefer fundamentally, hence it remains another prime candidate to help us increase cash levels.

MM is neutral JHG at current levels hence cutting the position makes sense.

Janus Henderson (JHG US) Chart

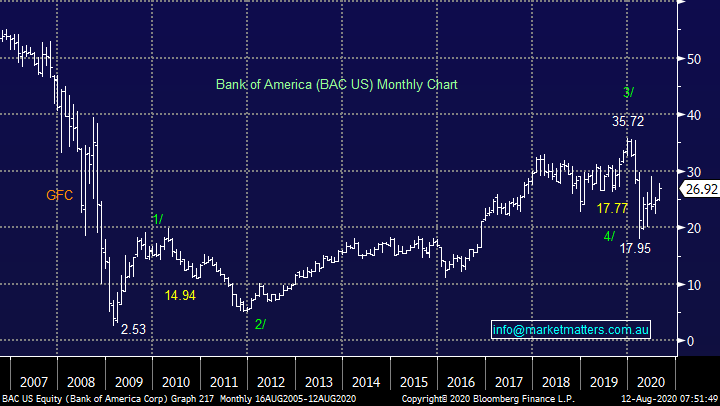

Bank of America (BAC US) $US26.92

Similarly, to Wells Fargo (WFC) which we covered last week as a potential option to average our position MM likes Bank of America (BAC) as a medium-term play after its very poor 2020. The banks are slowly coming to life like a sleeping giant and we believe they are likely strong outperformers over the next 12-18 months.

MM likes BAC & WFC around current levels.

Bank of America (BAC US) Chart

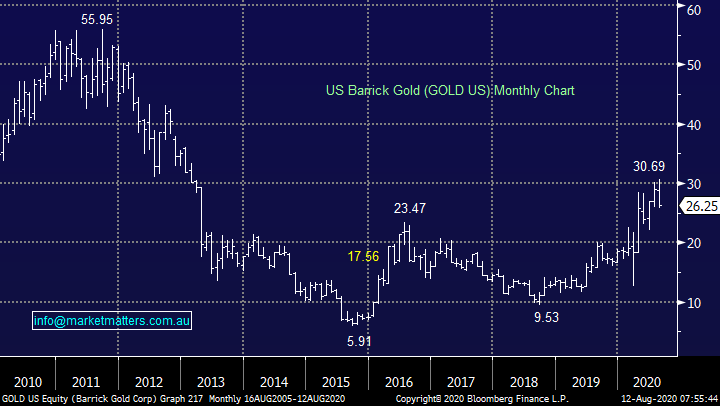

Barrick Gold (GOLD US) $US26.25

International gold miner Barrick Gold (GOLD US) has corrected ~10% over the last week, slightly more than the underlying gold price. We feel this $65bn gold miner has now entered the ideal area to start accumulation.

MM likes Barrick Gold into the current pullback.

Barrick Gold (GOLD US) Chart

MM Global Macro ETF Portfolio

No change, MM currently 24% of our Global Macro Portfolio in cash : https://www.marketmatters.com.au/new-global-portfolio/

There are a couple of areas where we are looking to deploy cash in coming days after patience has paid dividends so far over the last week:

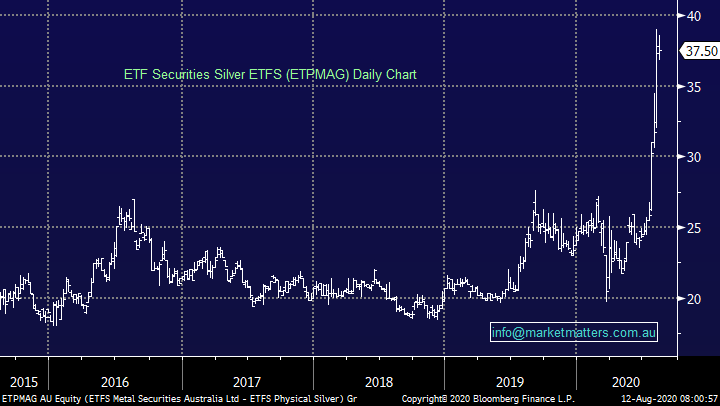

1 ETF Securities Silver Bullion ETF (EFPMAG) $37.50

Our updated preferred way to implement our bullish silver view is through the ASX listed Physical Silver ETF from ETF Securities.

Overnight silver plunged ~14% which is likely to send our targeted EFPMAG ETF into our buy zone this morning.

MM is considering accumulating this local ETF this morning.

ETF Securities Silver Bullion ETF (ETPMAG) Chart

2 Invesco DB Agricultural ETF (DBA US) $US13.93.

We’ve been patient increasing our position in this agricultural ETF but as our reflation view slowly gathers momentum this now feels an opportune time to increase our exposure from 6% to 10%.

MM likes the DBA at current levels.

Invesco DB Agricultural ETF (DBA US) Chart

3 Vanguard FTSE Asia ex-Japan Index ETF (VAE) $70.36.

We continue to like this ETF because it offers ~44% exposure to China plus great correlation to our underlying bearish $US view while also providing ease of access as its traded on the ASX – we remain bullish initially targeting a breakout to fresh contract highs ~$75.

MM likes VAE ideally under $70.

Vanguard FTSE Asia ex-Japan Index ETF (VAE) Chart

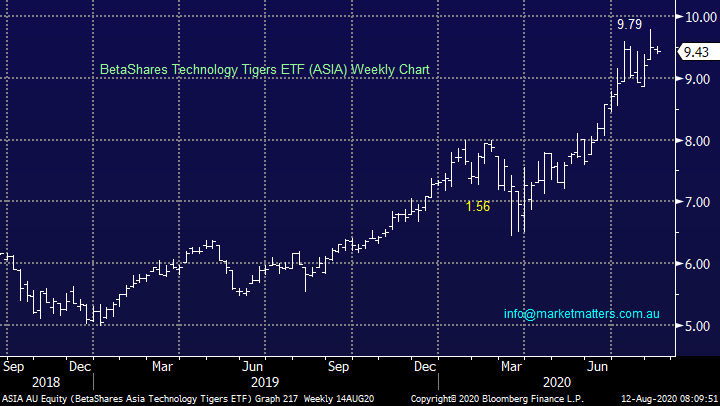

4 BetaShares Technology Tiger ETF (ASIA) $9.43

The Asian based technology stocks have danced the same tune as the NASDAQ breaking out on the upside last week. We don’t advocate chasing at current levels, but we are keen buyers on a pullback towards the 8.80 area.

MM likes ASIA back around $8.80.

BetaShares Technology Tigers ETF (ASIA) Chart

Conclusions

MM is looking to tweak both of our International & Global Macro Portfolios as outlined above, after moves over the last 24-hours action is expected!

Watch for alerts.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.