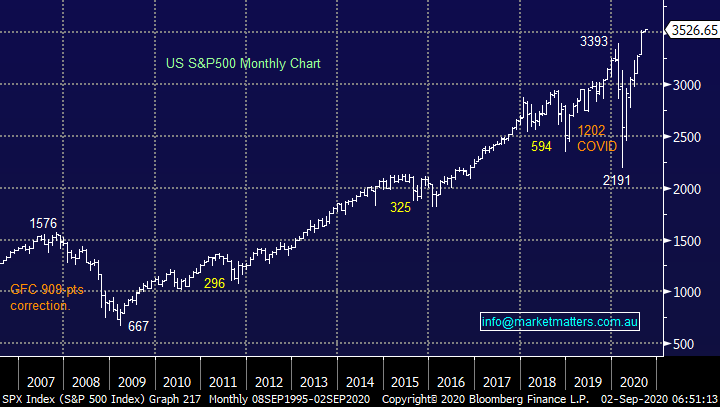

Overseas Wednesday – International Equities & Global Macro Portfolio (APT, ZM US, TTD US, AAPL US, TSLA US, ETPMAG, SVXY US, PSQ)

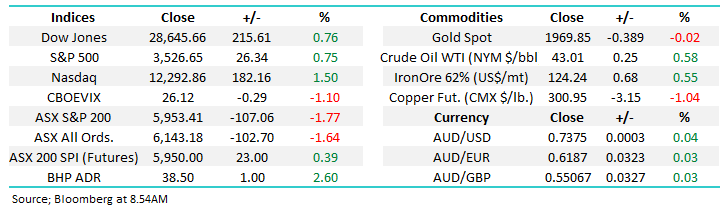

The ASX200 delivered a very sobering blow to the bulls yesterday plunging over 100-popints to kick-off September, the optimist in me would say its good to get the rubbish out of the way early! As the $A rallied above 74c for the first time since late 2018 there was no such love for our equities with broad based selling taking every market sector down although the hardest slap was left for the high flying IT Sector with Afterpay (APT) leading the line plunging over 8% on the day.

The upside momentum has been declining of late and a pullback was feeling increasingly likely as we’ve been alluding to in our reports but I didn’t see this whack coming yesterday morning, sure IOOF (IFL) was tapping the market for $1bn and we had a stock like APT showing some tempting paper profits but the across the board selling did surprise me, especially with Asian indices and US futures firm. Perhaps our negative rhetoric with China is catching up some fund managers attention – Australia v China is real David and Goliath stuff.

The “hot” place needs to be understood when it comes to risk, over recent weeks we’ve seen major retracements in both the gold and now BNPL stocks i.e. with big gains often comes increased risk. Potentially the ASX is again trying to pre-empt a pullback in US stocks leading with our most volatile / successful sectors first. At MM we believe the airs getting thin for US stocks with deteriorating index momentum, further increasing stock selectivity and a CBOE Put/Call ratio at a 10-year low, Q4 is shaping up as a tough quarter for risk assets (shares) before 2021 sees a continuance of the Bull market. Unfortunately we saw yesterday that the ASX still likes to catch a cold when US stocks sneeze, I’m rapidly losing confidence that we will indeed see a “pop” above 6200, the banks and CSL may have sealed the indexes fate for now. NB BNPL is an acronym “for buy now pay later”.

MM remains bullish equities medium-term, but now cautious short term

ASX200 Index Chart

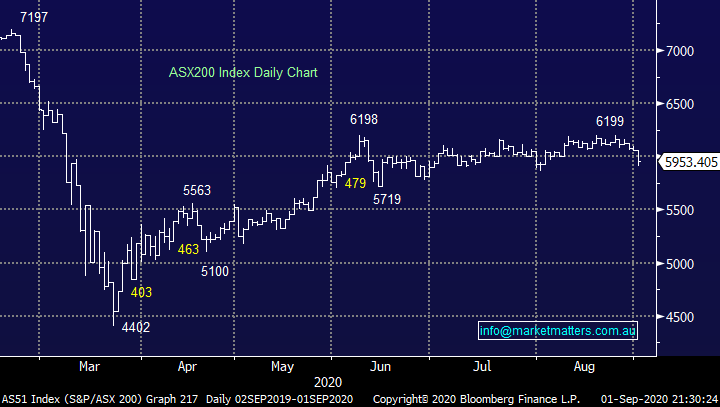

Afterpay (APT) has fallen 12% in just a matter of days, clearly nothing compared to its meteoric rise but still painful if you bought near the top, the “speculative / hot money” was clearly long hence the sell-off after good corporate news. If /when we see the US market experience an almost overdue pullback, albeit one to buy, I can see APT test the $60-65 area, but we would be looking to buy here not panic sell.

MM is bullish APT medium-term.

Afterpay (APT) Chart

Precious metals look good, especially when denominated in their traditional $US. We remain bullish both silver and gold looking for fresh 2020 highs in the coming weeks but we still intend to take profit here and reassess assuming we are correct.

MM is targeting ~10% upside in gold and ~15% in silver.

Silver ($US/oz) Chart

However, the appreciating $A is taking the shine off gold for our local producers and they feel likely to underperform their global peers if we indeed see gold rally towards $US2,200 as MM anticipates. Hence, we will not be too pedantic managing our exposure to the gold sector if such a move unfolds.

Gold ($A/oz) Chart

Overseas stocks

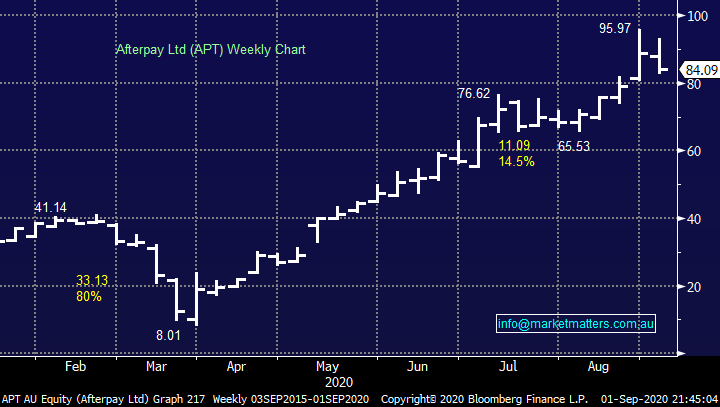

Overnight the S&P500 again registered a fresh all-time high, illustrating how fading any breakout in both stocks and indices requires very careful consideration - the trend is most often your friend. The strength under the hood was again delivered by the heavyweight tech stocks with heavyweight Apple (AAPL US) up almost 4%. No change at MM we remain bullish stocks over the next 12-18 months although another correction in the tech space feels to be looming rapidly on the horizon, we’ve seen one every month since March’s panic low and August was been one-way traffic - at this stage we see no reason to expect the markets rhythm to have changed.

The FANG stocks are quality names who have seen their growth accelerate in major fashion by COVID-19, we believe the many “valuation” doubters should remain conscious that they are significantly cheaper than many lesser names were into the tech wreck of 2000.

MM remains bullish US stocks medium-term but short-term things feel stretched.

US S&P500 Index Chart

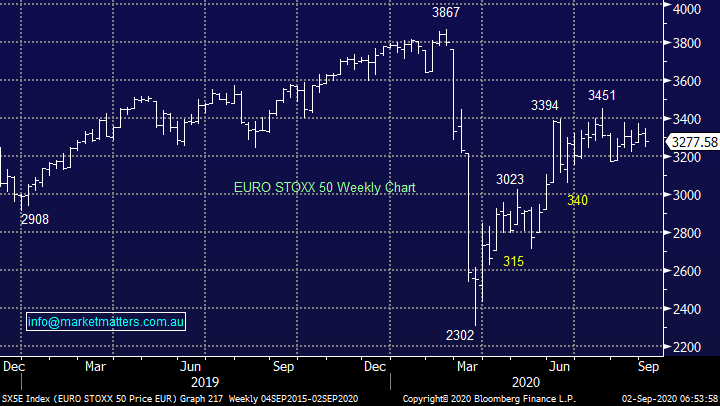

The European markets to which the ASX is very highly correlated is painting a very similar painting to ourselves i.e. struggling to add to its strong bounce since March but it still feels inevitable that it’s the likely path forward into 2021, but not necessarily Christmas.

MM remains bullish European stocks medium-term.

Euro STOXX 50 Chart

MM International Portfolio

Again, no change, MM continues to hold only 6% of our International Portfolio in cash, in other words we remain “very long” global equities which feels on the money as US stocks indices continue to make all-time highs.

MM International Portfolio : click here

Again we didn’t transact last week but as the divergences increase across the US market the time is approaching i.e. the internals are looking tired in the S&P500 with a diminishing number of stocks making fresh all-time highs over the last week e.g. Apple (AAPL US) and Tesla (TSLA US) are stand outs following their stock splits which we will briefly look at today. We stress MM is bullish equities over the next 12-18 months hence any profit taking will be accompanied by a plan of what / where we want to buy with the proceeds.

1 Don’t doubt we live in a new-world.

Overnight we saw 2 moves that caught my eye which should reiterate to investors that we have entered a new era when it comes to doing business. MM should have realised Zoom (ZM US) was a buy when last month we paid them about double what I ever envisaged as our webinars attract record numbers and their premium service is simply way more expensive than many comprehend.

Zoom (ZM US) soared over 40% after it delivered revenue of $663.5m for the quarter, a 4-fold increase on a year earlier and well above the $500m expected – that’s a huge beat! There is competition in the space with Microsoft Teams the main rival, however Zoom is on newer architecture with better / simpler features.

Unless we see a major IT name enter the fray it’s hard not to envisage Zoom trading higher in the years ahead – everybody I speak to likes working from home, as we said it’s a new world both in society and the workplace.

Zoom Video Communications (ZM US) Chart

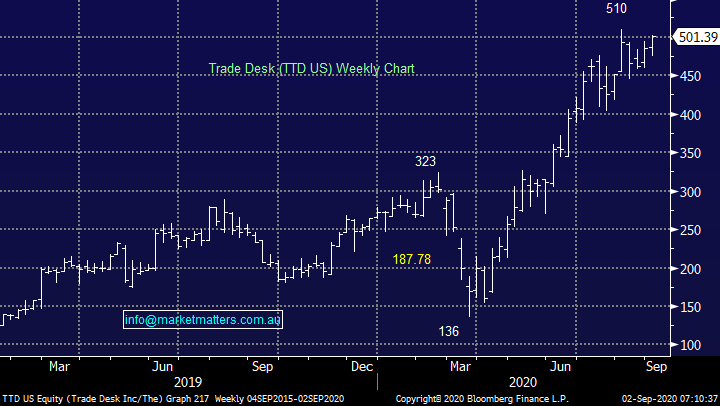

Not as dramatic as Zoom but Trade Desk which happily resides in our International Portfolio closed back above $US500 overnight and again looks destined for fresh all-time highs. This advertising technology company now has a market cap of over $US23bn with its advertising platform which manages social, mobile and video advertising moving from strength to strength.

MM remains bullish TTD.

Trade Desk (TTD US) Chart

2 Stock splits work but they can go too far.

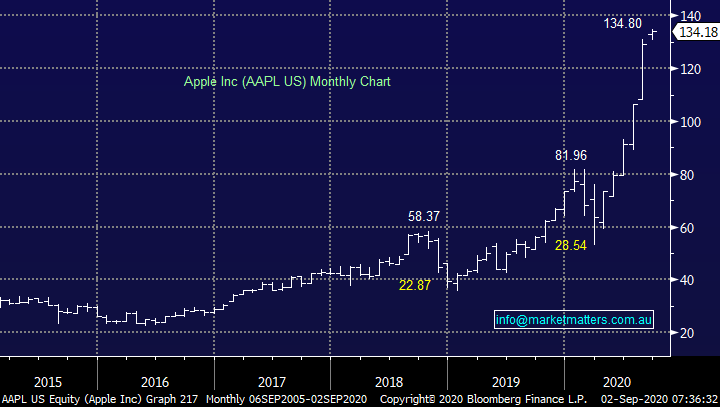

After its 4:1 stock split Apple’s shares should theoretically be trading ~75% cheaper from Monday but it’s simply made them appear more affordable to retail investors and the shares have continued to rally strongly. Happily, its one of our largest positions in the International Portfolio but a period of consolidation feels close at hand with the stock more than doubling in 2020.

We are not looking to close our position but a few months between $US130 and $US150 feels likely and it would be healthy after strong gains.

MM remains long & bullish Apple.

Apple (AAPL US) Chart

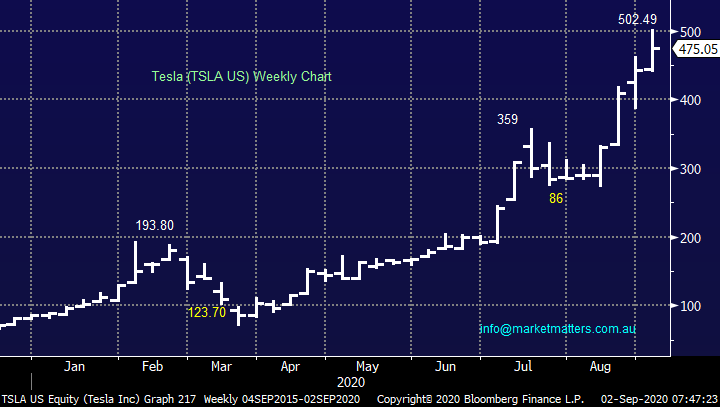

Elon Musk’s Tesla (TSLA US) shares also commenced trading on Monday after a stock change, this time a 5:1 split. The result is similar to Apple (AAPL US) with investors embracing the more affordable shares, as retail investors / traders jump on board we believe another $US90 pullback is not too far away and this would present the opportunity to buy this relatively new kid on the block.

MM is neutral TSLA at current levels.

Tesla (TSLA US) Chart

MM Global Macro ETF Portfolio

No change last week, MM’s Global Macro Portfolios cash position remains at 19% : Click here

After watching markets evolve over the last week, we now have 2 positions where we are looking to take profit and one potential new aggressive play.

1 Silver ETF

We covered our view on precious metals earlier, MM is looking to take profit on our ETPMAG position above $40.

Silver ERFS (ETPMAG) Chart

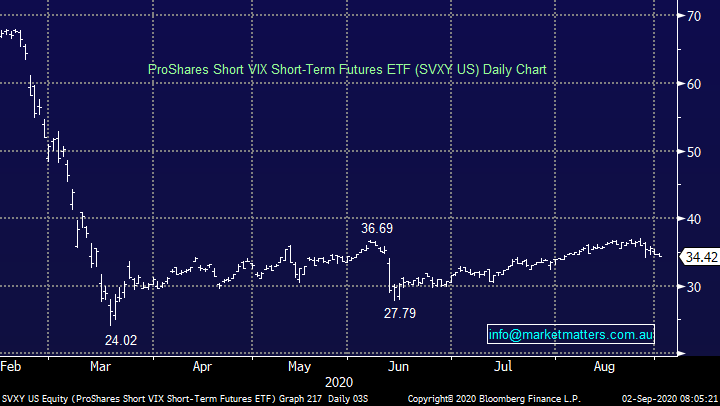

2 Short volatility ETF

We find its disconcerting that The VIX is slowly rallying as stocks make fresh new all-time highs, sending down the SVXY ETF in the process, it implies this market is sniffing trouble for stocks in the weeks / months ahead.

MM is looking to take a ~11% profit from the SVXY sooner rather than later.

ProShares Short VIX ETF (SVXY US) Chart

3 ProShares Short QQQ ETF (PSQ US) $US15.54.

There’s nothing like betting against the house to go broke quickly, its why casinos exist and thrive, but occasionally a “punt” pays off. We are watching carefully the current acceleration higher by the NASDAQ which is in part being fuelled by stock splits and retail investors, historically a dangerous combination. We would not be surprised if we take a countertrend small position in September, or October.

MM expects a 6-10% correction in the NASDAQ in the coming months.

ProShares Short QQQ (PSQ) Chart

US NASDAQ Index Chart

Conclusions

MM is looking to tweak both of our International & Global Macro Portfolios as outlined above, we will be surprised not to see some “action” in the coming few weeks.

Watch for alerts.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.