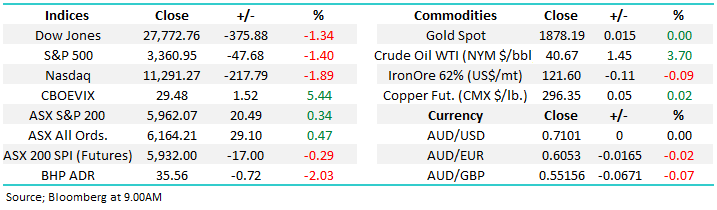

Overseas Wednesday – International Equities & Global Macro Portfolio (APT, CWN)

The ASX200 is trying hard to regain the 6000 area and look poised to do so around 5.30am this morning before President Trump signalled he is ending stimulus talks until after the election – the Dow subsequently fell 500-points in just a matter of minutes. The US market had started to buy cyclicals and the small cap Russel 2000 implying investors were looking for improving economic growth but as Federal Chair Jerome Powell recently warned “the economy will stumble without additional fiscal support”. Obviously with the US election less than a month away we should expect more political financial hand grenades but this is the time to remain focused on our views into 2021, not just next week i.e. don’t panic in the face of adverse day to day news flow.

In Australia we did receive a huge fiscal hit overnight through the Liberals latest budget which revealed a “$100bn cash splash” to quote the AFR in an effort to re-ignite the local economy. There will be undoubtedly be plenty of supporters and detractors of this package, depending on an individual’s financial position and political leaning, either way its refreshing to see our incumbent government remaining focused on kickstarting our COVID ravaged economy.

No change at MM, we remain optimistic that equities can rally through October, but investors shouldn’t be surprised to see elevated volatility day to day. Remember its only 27-days until the US election however in our opinion the high level of volatility across the stock, sector and index level will produce opportunities and is not reason to panic, just let markets come to you.

MM remains bullish the ASX200 through October into the US election.

ASX200 Index Chart

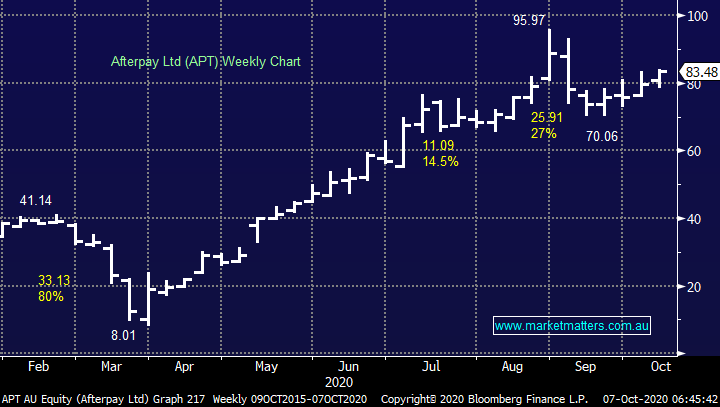

We’re keeping our finger on the pulse of Afterpay (APT) as its slowly but surely unfolding in-line with the technical picture we’ve flagged over recent weeks, important when were overweight the tech sector. Yesterday APT was the 7th best performing stock in the ASX200 rallying 5%, taking its recovery from Septembers low to 19%, around halfway of the rally we’re currently targeting.

MM is looking for ~15% upside from APT.

Afterpay Ltd (APT) Chart

Elsewhere Crown Resorts (CWN) and Jamie Packer are being dragged through the mud in a NSW government inquiry into whether the business is suitable to retain its casino licence, not without some major change is my best guess. I will be surprised if Packer hasn’t sold out of his 36% holding CWN in the not too distant future, he’s tried before and the goings just getting tougher by the day. This is a big overhang of stock plus a suspension of its licence would be a shocking outcome for the business hence we see no reason to accumulate stock yet into current pullback but around the $8 area the risk / reward will start to become attractive in our opinion.

MM likes CWN ~10% lower.

Crown Resorts (CWN) Chart

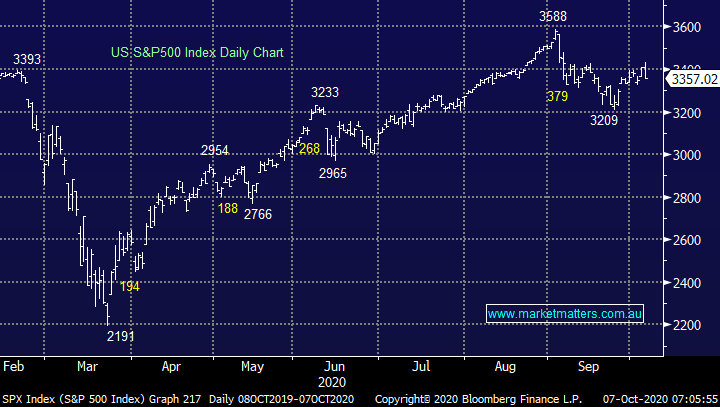

Overseas markets

Overnight US stocks reversed healthy early gains after President Trump cancelled stimulus talks until after the election, the Dow closed down 375-points after being up around 300-points before the bombshell announcement - so much for his COVID recovery to be market friendly! Perhaps he wants to become the market / economic messiah closer to the election but he’s walking a very fine timeline. We all know Trumps well behind in the polls so unfortunately anything’s both possible and probably likely in the coming weeks but as we said earlier investors should simply focus on how they see stocks unfolding into 2021, not next week.

The technical picture points to some ongoing choppy price action around the 3400 area before our anticipated rally to fresh all-time highs.

MM remains bullish US stocks medium-term.

US S&P500 Index Chart

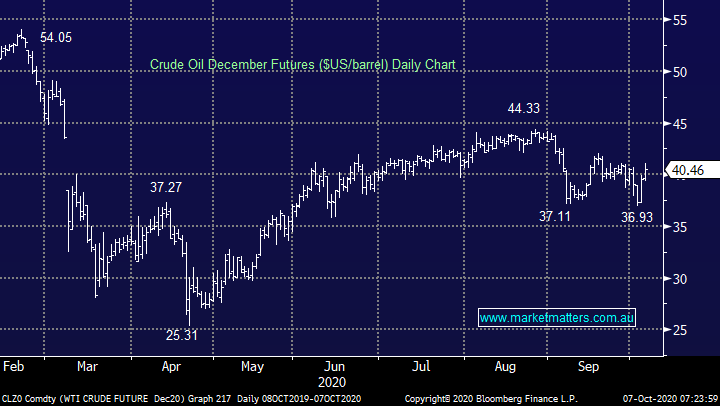

Overnight crude oil rallied over 2% even while Trump sparked concerns around growth after shelving stimulus talks, we feel this is signalling a good read through for the Energy Sector moving forward, if not today.

MM remains bullish crude oil medium-term.

Crude Oil ($US/barrel) Chart

Before Trumps late surprise announcement the small cap Russell 2000 made fresh post March highs while the S&P500 remained ~5% below its equivalent milestone. We believe this recent trend of buying the stocks most exposed / leveraged to an economic recovery will pay dividends moving forward although Trumps clearly sideswiped things short-term. This coincides with our view that the “safe” tech space is likely to underperform through 2021 hence we are monitoring our respective portfolios looking for switching opportunities.

MM likes the recovery stocks into 2021.

S&P500 Index v Russell 2000 Index Chart

MM International Portfolio

No change to our positions / cash holdings this week, MM continues to hold only 6% cash in the MM International Portfolio : Click here

Boring I’m afraid but we believe it’s still time to sit back and monitor our positions / market stance, we are long and skewed towards tech, which reflects our short-term view on the market but obviously we can be wrong hence the ongoing evaluation. If / when we see a strong move in October MM is expecting a further couple of tweaks, out of tech into cash / financials / energy etc but there’s lots of twists in the road ahead before we hope / expect to be particularly active.

Over the last few weeks, we’ve already witnessed a few sessions where there’s been pronounced rotation into cyclical laggards, a trend we can see this following through into 2021 i.e. the direction we expect to tweak towards in the coming months.

1 US S&P500 Banking Index

The US Banking Index like our own has drifted lower after attempting a breakout in June, while we have no buy signals in place the risk / reward has certainly improved. When we see an eventual a tick up in bond yields we believe this will be the sector which delivers the best returns but the market may need some convincing.

MM is looking for a bottom or catalyst for the Banking sector to rally.

US S&P500 Banking Index Chart

2 US S&P500 Energy Index

The other standout “underperformer” within the US market is the Energy Sector, again like our own it has drifted lower after attempting a breakout in June, even while the oil price has continued to hover around ~$US40/barrel. Again, we have no buy signals in place but the risk / reward has again improved – we like accumulating the Energy Sector into current weakness but there’s no clear bottom yet in site.

Similarly, MM is looking for a bottom or catalyst for the Energy sector to rally.

US S&P500 Energy Index Chart

MM Global Macro ETF Portfolio

No change this week to our positions, MM’s Global Macro Portfolios cash position remains at 4% : Click here

We are currently happy with our current portfolio mix, its time to sit back and carefully monitor our holdings.

The key to what comes next for financial markets is bond yields in our opinion with the US 10-years the most closely watched, at this stage they’re trying to rally but as we saw overnight a simple comment from Trump stops them dead in their tracks. MM believes bond yields are “looking for a low” but there’s still plenty of uncertainty to be cleared up before markets can become confident, we’ve turned the global economic corner which would allow bond yields to appreciate.

US 10-year Bond Yield Chart

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.