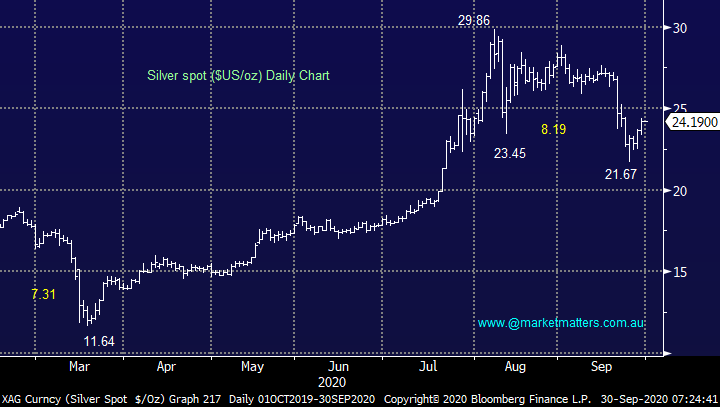

Overseas Wednesday – International Equities & Global Macro Portfolio (A2M, BOQ, TTD US, QQQ US, ETPMAG)

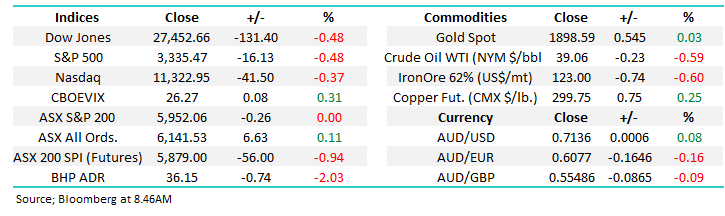

The ASX200 put in another very average performance yesterday, the Dow had gained almost 800-points over its last 2 sessions yet by the close of business on Tuesday the ASX was disappointingly down for the week – the buying might be strong below 5800 but it certainly runs for cover as we approach the 6000 area. It’s becoming repetitive but the action remains firmly under the hood and until further notice paying close attention to the index is a waste of time and emotion.

At this stage we are focusing on a couple of core sector trends:

1 – The IT Sector has been rallying strongly since mid-September e.g. Xero (XRO) and Megaport (MP1) have both recovered more than +13% - we are bullish looking for fresh all-time highs from tech.

2 – The Resources Sector has struggled since mid-September with BHP Group (BHP), RIO Tinto (RIO) and OZ Minerals (OZL) all falling, RIO has led these 3 falling over 10% - we are looking for areas to increase our exposure to the Resources Sector.

3 – The influential Banking Sector is consolidating after the much-welcomed news that APRA was taking over its lending controls from ASIC but the performance remains muted – we are comfortable with our index weighting via the large sector names.

We remain optimistic that the local index can rally through October but arguably our best call this financial year has been: “buy weakness and sell strength until further notice”.

MM remains bullish the ASX200 over the next month.

ASX200 Index Chart

Yesterday we discussed previous highflyer a2 Milk (A2M) following its more 11% drop following a market update for FY21. The reason I’ve mentioned the stock again this morning, after it fell another -4% yesterday, is I’ve noticed of late investors aren’t “bottom fishing “stocks on bad news as they were in Q2 of the year, implying to us that fund managers aren’t as cashed up as they making buying far more selective – a view that ties in with general sector rotation.

MM remains neutral / bearish A2M at current levels.

A2 Milk Co Ltd (A2M) Chart

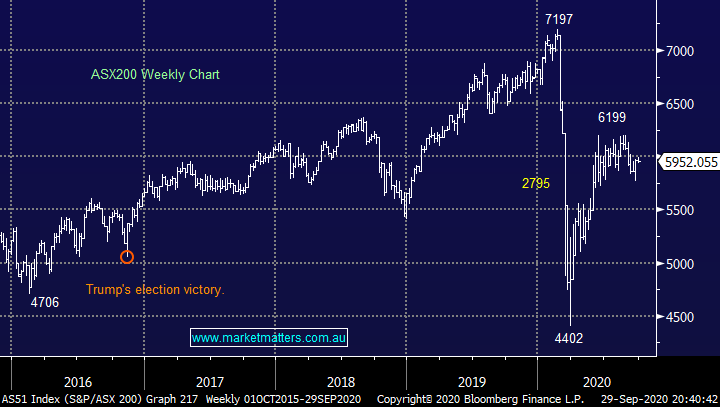

Moving on from the comments above regional Bank of Queensland (BOQ) was smacked over 7% yesterday after announcing items to impact their full year results including taking on provisions of $369m for the second half alone. The ~4% downgrade took into account updated employment forecasts as well as a longer downturn in economic activity and house prices with the provision to account for the expected losses over the life of the current loan book as a result of the changes. As we alluded to above, we don’t believe this is a market cycle where catching falling knives is prudent.

MM is neutral BOQ.

Bank of Queensland (BOQ) Chart

Overseas markets

Overnight US stocks slipped lower as we head into the first Presidential Debate at 11am our time this morning, let the games begin! Our focus is on the market and not politics and we are becoming increasingly mindful that the US NASDAQ is now carrying a record high speculative short position, it remains our view that it’s a case of when, not if, we see another squeeze in technology, sending the Nasdaq to fresh all-time highs.

MM is subsequently positioned very overweight tech across our growth focussed portfolios looking for the elastic band to again stretch too far and we will re-weight accordingly – I know MM is being more active than some subscribers are used to but that’s the nature of the current market i.e. the usual action of 3-months is unfolding in just a couple of weeks!

MM remains bullish US tech stocks short-term.

US NASDAQ Index Chart

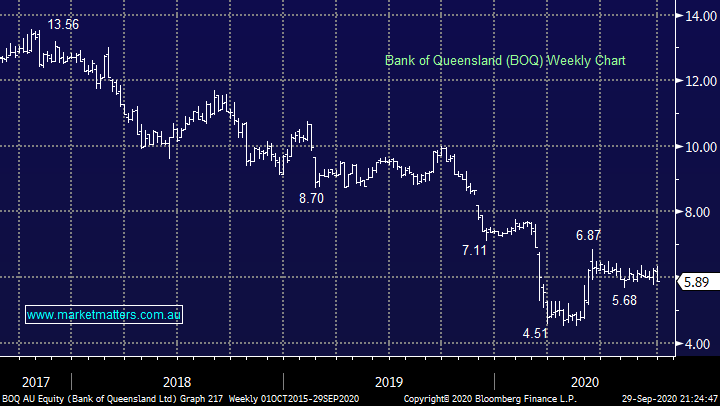

Following on from recent comments around the $US precious metals have started to rally as the $US slowly reverses recent gains. The especially volatile silver price had corrected 27% but it’s now trying to rally, we remain bullish looking for fresh highs ~$30US/oz

MM remains bearish the $US & bullish precious metals.

Silver ($US/oz) Chart

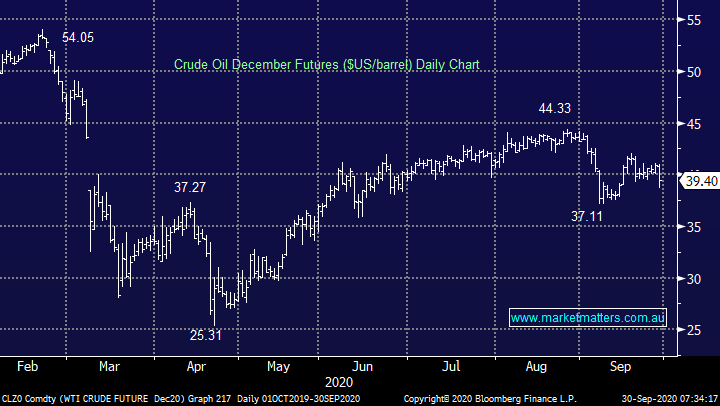

Overnight crude oil caught most of the headlines during what was a quiet session as it fell -3.6%, back below $US40/barrel. We remain bullish the sector and its on our list as a potential area to deploy funds if we reduce tech exposure into strength.

MM remains bullish crude oil medium-term.

Crude Oil ($US/barrel) Chart

MM International Portfolio

MM continues to hold 6% cash in the MM International Portfolio: click here

Boring I’m afraid but we believe it’s still time to sit back and monitor our positions / market stance, we are long and skewed towards tech, which reflects our current view on the market but obviously we can be wrong hence the ongoing evaluation. If / when we see a strong move in October MM is expecting a further couple of tweaks, out of tech into cash / financials / energy etc but there’s lots of twists in the road ahead before we hope / expect to be particularly active.

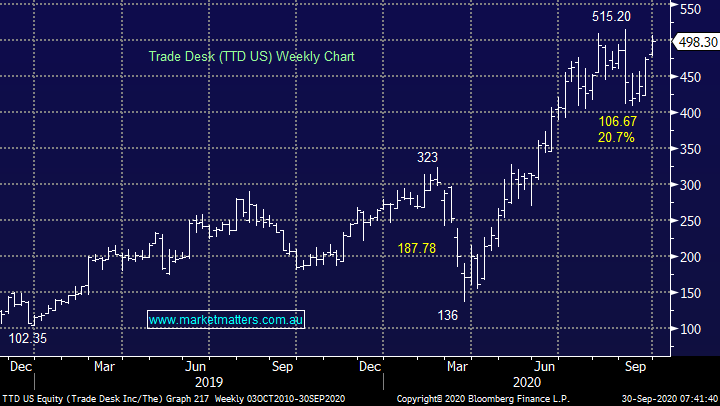

1 Trade Desk (TTD US) $US498.30

Trade Desk is leading from the front amongst our tech names again breaching $US500 overnight. To put things into perspective our target for TTD is still at least 20% higher which is encouraging for both our view and of course this position.

MM remains bullish TTD and US Tech.

Trade Desk (TTD US) Chart

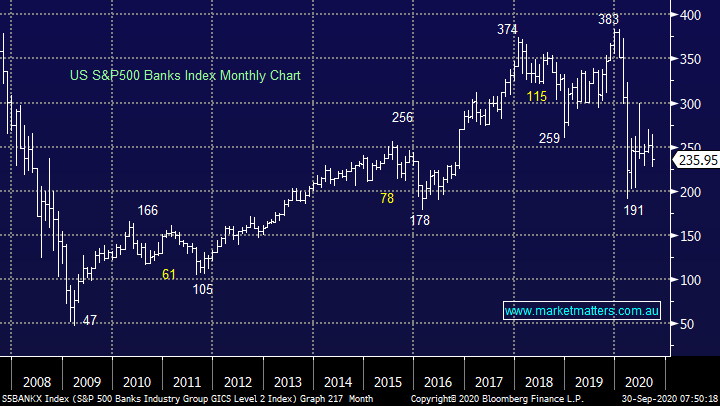

2 US S&P500 Banking Index

Conversely the US Banking Index like our own has drifted lower after attempting a breakout in June. Currently we have no buy signals in place, but the risk / reward is certainly improving, especially on the relative front.

MM is looking for a bottom or catalyst for the Banking sector to rally.

US S&P500 Banking Index Chart

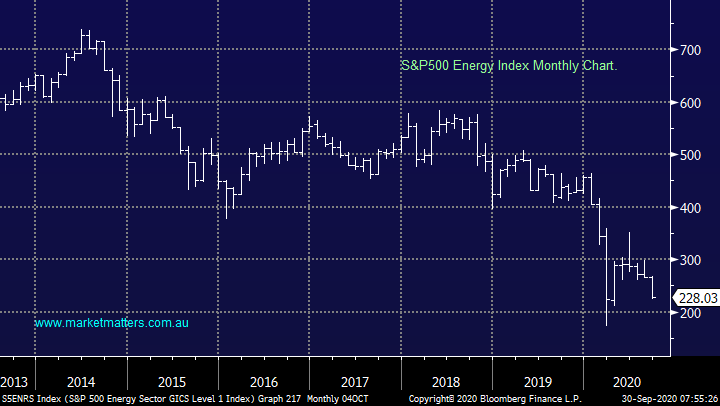

3 US S&P500 Energy Index

The other standout “ugly duckling” amongst the US market is the Energy Sector, again like our own it has drifted lower after attempting a breakout in June, even while the oil price has continued to hover around ~$US40/barrel. Again, we have no buy signals in place but the risk / reward is certainly improving, especially on the relative front.

MM is looking for a bottom or catalyst for the Energy sector to rally.

US S&P500 Energy Index Chart

MM Global Macro ETF Portfolio

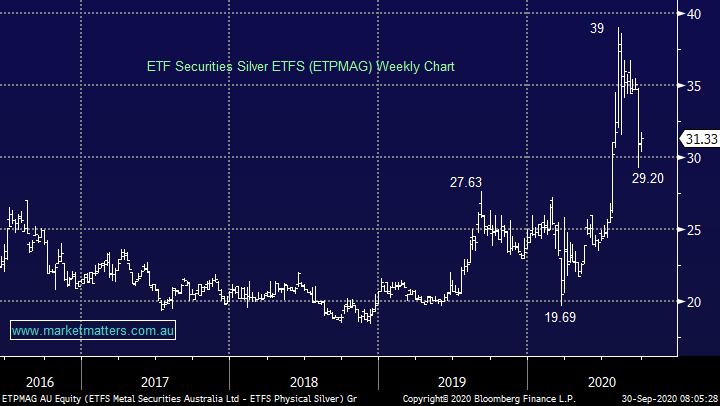

Last week we bought the QQQ and “topped up” our silver exposure through the Silver ETFS (ETPMAG) outlined below, MM’s Global Macro Portfolios cash position is now down to 4% : click here

We are currently happy with our portfolio mix, its time to sit back and carefully monitor our holdings, both recent purchases are tracking according to plan.

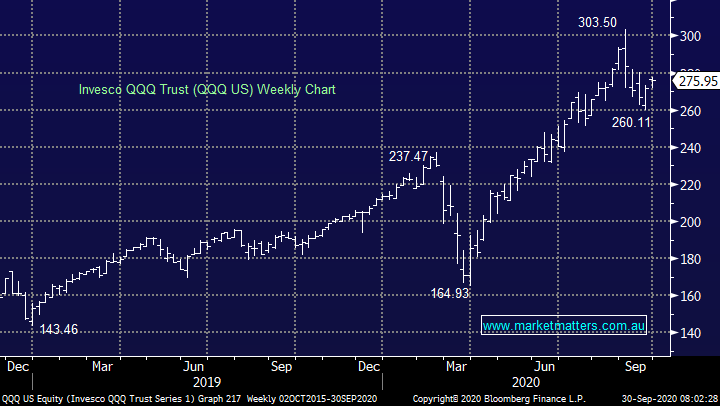

1 Invesco QQQ Trust (QQQ US) $US275.95

The QQQ ETF which tracks the NASDAQ has started to rally as the underlying NASDAQ bounces – our core short-term view into October.

Invesco QQQ Trust (QQQ US) Chart

2 Silver ETFS (ETPMAG) $31.33

Again, in line with previous comments we are bullish silver looking to be sellers of precious metals into fresh 2020 highs – our position should open strongly today after silvers rallied strongly overnight.

MM is long & bullish silver.

Silver ETFS (ETPMAG) Chart

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.