Overseas Wednesday – International Equities & Global Macro ETF Portfolios (XOM US, AMZN US, FUEL, QQQ US, UDN US) **Global ETF Portfolio – Buy FUEL. AXW**

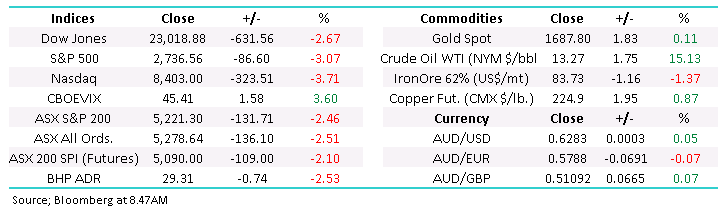

It’s been quick, as has been the nature in 2020, but in what only amounts to 2 ½ days trading the ASX200 has already retreated 6%. As the world starts unveiling their “back to work” plans its becoming apparent that plenty of good news was already well and truly baked into stocks, just as we suspected at MM. No market is characterising equities running ahead of fundamentals more than the Energy Sector, yesterday the news was awash with crashing oil prices yet Woodside Petroleum (WPL) noticeably outperformed during the ASX’s 132-point / 2.5% aggressive retreat – for optimum decision making investors usually need to look around 6-months ahead, not at today’s news! In the Weekend report we were short-term bearish, the question is where do we start increasing market exposure:

“We remain in “buy mode” looking for opportunities to increase our equities exposure through quality stocks but our short-term view is less optimistic with our preferred scenario the next 5-8% move is now to the downside.” – MM’s Weekend Report.

Following Monday’s sale of Magellan (MFG) our cash levels are fairly elevated in the MM Growth Portfolio enabling us the flexibility to commence accumulating into weakness. At this stage we continue to regard this current retracement as a correction to the sharp rally from March’s 4402 low with the initial technical support areas for the ASX200 being 5120 and 5000, the former is likely to be tested this morning. Considering the current market downside momentum and simply how fresh March’s plunge is in most investors’ minds my preference is we will see a test of 5000 this month, or 4% lower.

Following on from yesterday’s Morning Report : “Oil below zero as volatility & opportunity both return!” 5 Australian stocks / sectors in particular remain in our sights – an Energy play, CSL Ltd (CSL), Appen Ltd (APX), Reece Ltd (REH) and Cochlear (COH).

MM remains bullish medium-term and hence in “buy mode”.

ASX200 Index Chart

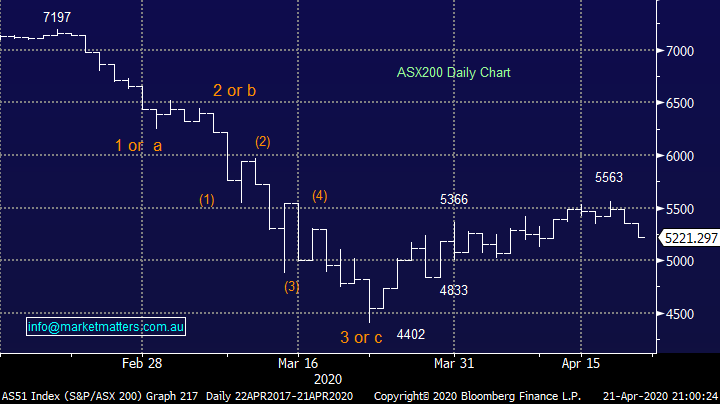

Over the last few years the Healthcare and Energy Indices have been diametrically opposed from a performance perspective and in most scenarios MM would be looking at a potential situation where the elastic band has become simply too stretched, or in other words sell Healthcare & buy Energy. However while we do believe the relative elastic band will probably “close the gap” we like both Energy and high flying Healthcare sectors into further April weakness – for reference we also like quality top performing IT stocks into the markets current pullback.

1 – Healthcare Sector: MM remains bullish into 2021 targeting fresh all-time highs hence buying the quality ends of the spectrum makes sense.

2 – Energy Sector: MM believes a major cycle low is due for the sector in the ensuing days and patient buyers will be rewarded.

ASX200 Healthcare v Energy Indices Chart

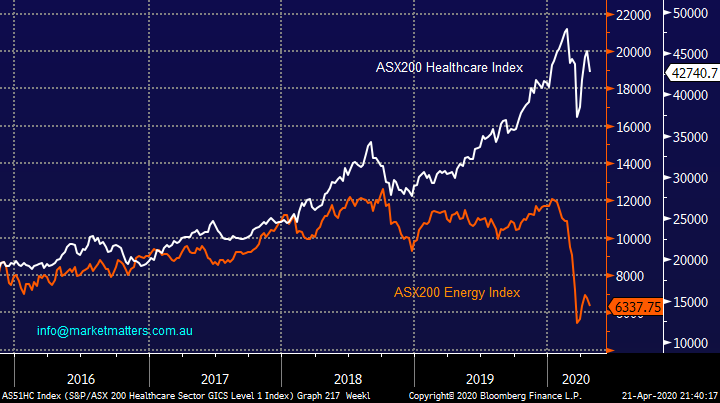

When we look further out in time for the crude oil futures, to avoid the panic shenanigans around storage, the picture is much clearer i.e. overnight crude oil has hit our buy target area. The news flow and panic certainly have all the characteristics of a major long term low / buying opportunity, also a good sign for the medium-term health of the stock market. Interestingly overnight even as longer dated oil contracts continued to decline the US Energy Sector was the 3rd best performing sector out of 11, further supporting our bullish view in the process.

**please note, the huge volatility in Futures is being influenced by ETFs. These ETFs generally hold front month futures contracts and roll them. As the front month turned negative this presents a problem for ETFs because they cannot trade negative themselves**

MM is looking for a more than 50% rally in crude oil from current depressed levels.

Crude Oil December Futures Chart

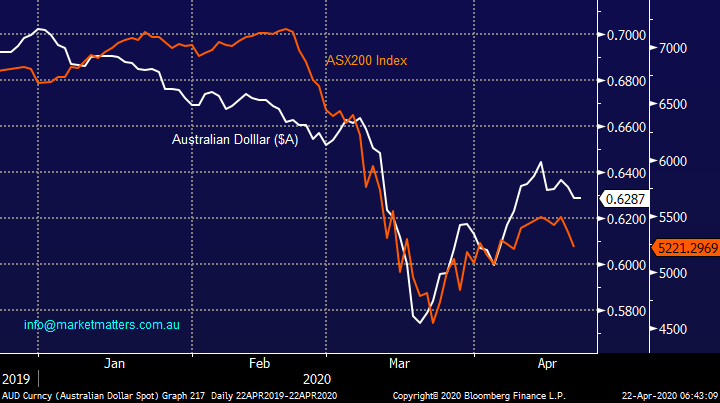

The little ”Aussie Battler” continues to lead equities, it’s now time to see if / when the $A regains its mojo and turns higher, our preferred scenario remains the mid to low 62c area but be mindful we hit 62.54 last night.

Medium-term MM is bullish both equities and the $A.

Australian Dollar ($A) & ASX200 Chart

Overseas equities

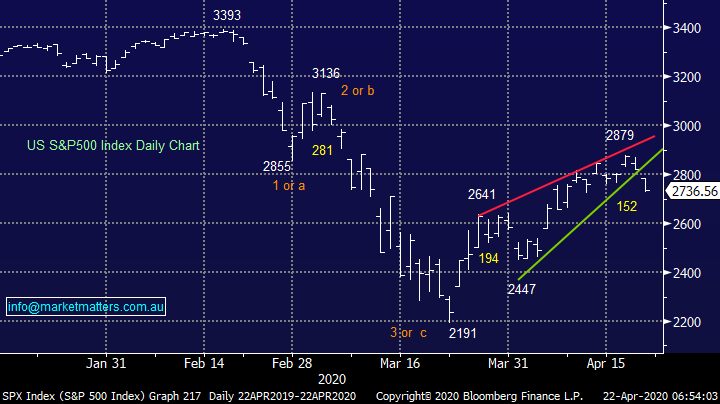

Overnight US stocks broke down out of the bearish “Rising Wedge” illustrated in recent reports, declines from these patterns are usually rapid and that is exactly what we are witnessing, 5% in less than 3-trading days. Importantly our anticipated target is is sub 2650, or another 3% lower – get ready to start buying! Many newsletters are calling a break / test of March’s panic lows, I reiterate that is not our prognosis.

MM remains bullish quality US stocks in the medium-term.

US S&P500 Index Chart

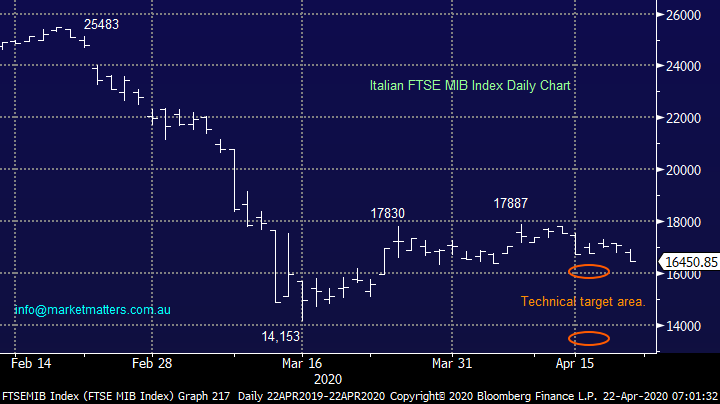

Similarly, overnight we saw the weaker Italian bourse decline by ~3% to challenge our initial downside target area. While we are not intending to focus our buying on Italian stocks, we are watching them closely because like the $A they’ve been leading the pack, both up and down.

MM remains in “accumulation mode” for global equities.

Italian FTSE MIB Indices Chart

MM International Equites Portfolio

MM currently holds 17% cash and is looking to increase equity market exposure through an April pullback in equity indices : https://www.marketmatters.com.au/new-international-portfolio/

Our rhetoric from last week remains consistent we are buyers into weakness with special attention likely to be paid to high quality IT stocks e.g. last week we sold Bank of America for a loss and bought Google Alphabet (GOOGL US). We remain very bullish the cashed up quality tech names like Microsoft (MSFT US), Amazon (AMZN US) and Google (GOOGL US), our view is that both cloud and e-commerce businesses are going to accelerate post COVID-19 assisted by the way we perform business evolving exponentially.

Please excuse the repetition but MM believes this is an important point as our buyers hat starts to get twitchy : “We feel it’s critical that investors focus on where they believe stocks are headed, not levels they plumbed in March during the mass panic selling.”

Our view is that stocks will rally into Christmas in a staircase like manner as we see huge swings of sentiment compared to the norm of the last decade. The current pullback in US stocks looks destined to be around 10%, we feel a few more of this magnitude are highly likely through 2020. Assuming MM is correct, and stocks recover in an overlapping staircase / sawtooth style manner we will continue to look in general to buy weakness & sell strength.

MM remains medium-term bullish equities hence we don’t want to panic out of all financials but the intended path for optimum returns this year is to buy tech into market weakness (like now) and sell financials into strength. We have updated our 3 most likely purchases into the current market correction:

1 – Exxon Mobil (XOM US) : This $173bn petroleum goliath only fell -0.5% overnight putting it in the “Top 10” performers in the world’s largest 100 stocks – a buy trigger for MM as it largely ignores weakness in crude.

2 – Amazon (AMZN US) : Last week AMZN the largest global cloud & e-commerce company surged to fresh all-time highs, we still believe this is a train that has only just left the station, we are happy to chase strength here especially on a relative basis.

3 - Apple (AAPL US) & Alibaba (BABA US) : No change, MM is looking to increase these holdings up to 8%.

*Watch for alerts.

Exxon Mobil Corp (XOM US) Chart

Amazon (AMZN US) Chart

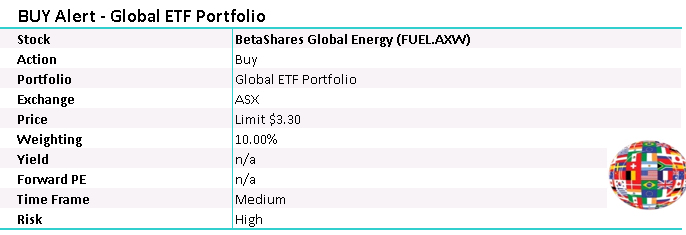

MM Global Macro ETF Portfolio

No change here but this looks likely to be the week for significant movement. MM’s cash position remains at 39% in the Global Macro ETF Portfolio but as we said last week we’re not comfortable that this portfolio currently reflects our “best core Macro views” however for this week we anticipate implementation of all / part of our plan shown below:

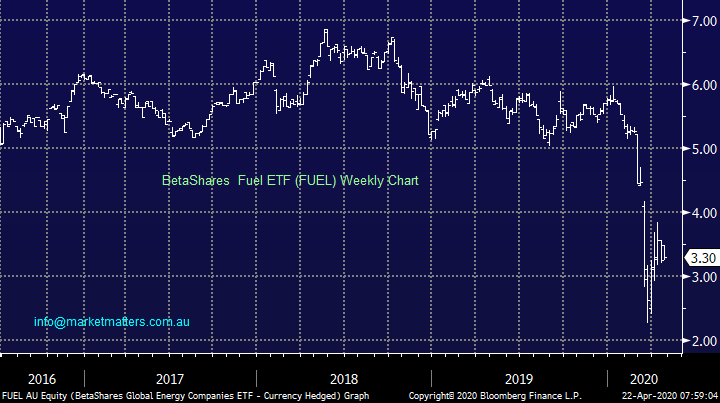

1 – Buy the BetaShares Fuel ETF (FUEL): around current levels for exposure to a recovery in the global energy stocks. NB This is an Australian listed and $A denominated ETF. https://www.betashares.com.au/fund/global-energy-companies-etf/

**We are adding FUEL to the ETF Portfolio Today**

BetaShares Fuel ETF (FUEL) Chart

2 - Buy Invesco Geared Bullish NASDAQ ETF (QQQ US) : MM believes the NASDAQ could easily see fresh all-time highs in late 2020, hence this is a position MM likes during any late April weakness with our ideal entry level now sub 200, getting close! NB This $US93bn Trust is leveraged ~1.9x. For unlevered exposure listed on the ASX, the Betashares NASDAQ 100 ETF (NDQ) is the go.

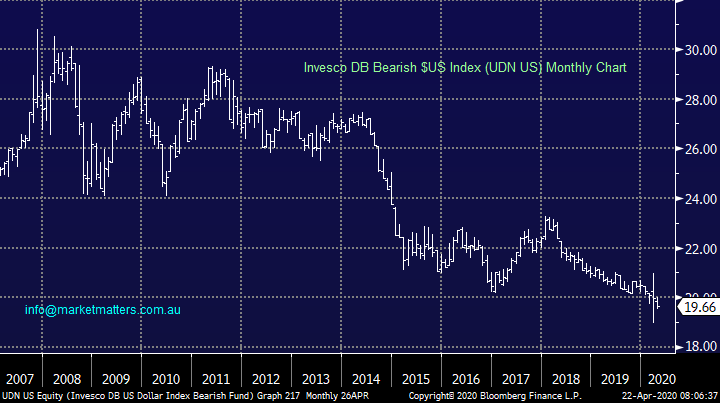

3 – Buy Invesco Bearish $US Index ETF (UDN US): we like the EDN where it is now, sub $US20, MM is looking for at least a 15% appreciation in this ETF.

4 – iShares MSCI Global Silver & Metals Miners (SLVP US): We got too clever here, sticking with gold in hindsight would have been far more beneficial. MM is ideally considering taking a small loss into a late April bounce, a top here will potentially coincide with a low in equities.

Invesco QQQ Trust (QQQ US) Chart

Invesco DB Bearish $US Index (UDN US) Chart

Overnight Market Matters Wrap

- US equity markets were weak overnight as the coronavirus continues to affect the global economy.

- Crude oil continues to trade at unprecedented levels with reports that OPEC will cut production soon.

- The June SPI Futures is indicating the ASX 200 to follow the US lead and open over 100 points lower, testing the 5115 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities, and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.