Overseas Wednesday – International Equities & Global Macro ETF Portfolios (WEB, WBC, JPM US, WFC US, UBS US, UNH US, IEM, BNKS)

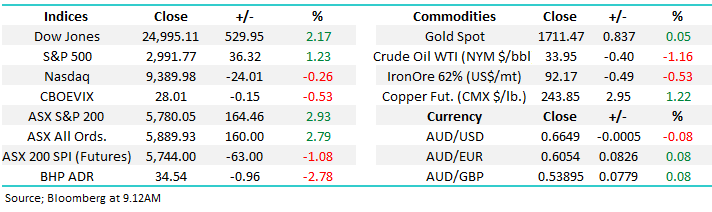

The ASX surged another +2.93% on Tuesday taking the local market up +283-points / 5.1% in just 2-days, in rapid fashion we’ve regained half of the coronavirus plunge, the panic selling back in March has slowly but surely becoming a distant memory. The buying remains strong and very broad-based with only 10% of the ASX200 closing down on Tuesday, it was noticeable that a number of these stocks had rallied hard over the last 5-10 days, in other words aggressive stock to stock & sector to sector rotation remains the order of the day as investors appear more short-term focused at present. When you see Westpac (WBC) surge +6.3% in one day it feels pretty obvious that some fund managers have been” caught with their pants down” with regard to the banks & /or cash too high. Talking with our insto guys this morning, they continue to believe that major funds remain very underweight banks.

We’ve alluded to investors migrating up the “risk curve” over recent weeks but it felt like a stampede yesterday, Webjet (WEB) at one stage was less than 5% below its all-time time high when we take into account new issued shares – seems overly optimistic to me. It felt like some significant FOMO (Fear of missing out) was cascading through markets and I will be fascinated to see if the buying can be sustained into June. Markets have been responding to initial signs of economic recovery but they may be getting slightly ahead of themselves in pockets as they front load the first 3-months of the expansion creating a small valuation issue in some pockets but many other financial markets like the base metals have not followed suit, as of yet.

Webjet (WEB) Chart

Stock markets are currently following a classic recession playbook although nothing felt classic around COVID-19. Sentiment has remained too bearish in recent weeks and the last 48-hours feels like a painful capitulation of this view making it a dangerous time to chase strength in MM’s opinion especially as we’re seeing arguably the lower quality stocks contribute the most to current market gains. The technical picture has clarified somewhat in the last few days with 2 different scenarios emerging:

1 – The last 2-days acceleration will continue as this liquidity fuelled rally surprises many and continues straight towards 6000, and even beyond. The banks joining the liquidity driven party yesterday will have more people now favouring this outcome, but we are mindful that MM called 5800 as a likely target just a few weeks ago – the mid-point of the decline.

2 – The current rally does either run out of steam or receives some fundamental news which outweighs the cashed up buying, a close back under 5600 will trigger sell signals.

We recently increased our Growth Portfolio’s cash position to 16.5% so we will be keeping a close eye on both scenarios especially the former as we have become slightly more defensive in late May - a stance that still feels correct at present.

MM has switched to a more neutral equities stance short-term.

Importantly subscribers should remember MM is bullish medium-term so the real question is where and what we will buy in the weeks and months ahead.

ASX200 Index Chart

As mentioned previously Westpac (WBC) surged over 6% yesterday, a good performance on any level perhaps a few large players read our missive on Tuesday and thought they should get on board early! There was no bank specific news on Tuesday making the sectors rally even more eye catching, I think investors who have been scouring the index for post COVID-19 bargains finally pressed their buy buttons for the embattled banks – I am confident most professional investors are underweight this sector and in many cases extremely so, hence it’s easy to imagine more strength into June.

We feel the banks may have been conservative with their provisions for bad debts especially as government stimulus appears to be just getting going, if this is the case dividends might be back on the menu sooner rather than later.

MM is bullish Westpac (WBC) while its holds above $15.50.

Westpac (WBC) Chart

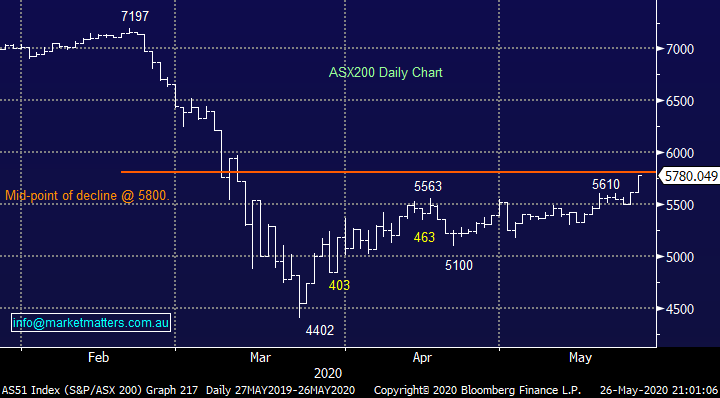

The VIX hasn’t embraced the last few weeks strength in stocks, if anything it’s a definite non-believer as it remains almost 10% above its May low. MM is keen to add to our short volatility position through our Global Macro ETF Portfolio but at this stage we feel a push back towards the 40 area is a strong possibility where the risk / reward clearly improves dramatically.

MM is neutral volatility at current levels.

The VIX (volatility / Fear) Index Chart

Overseas equities

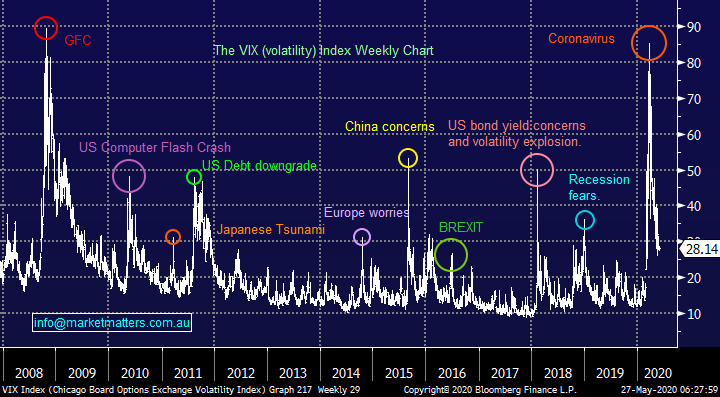

A fascinating night on overseas bourses with both the broad-based Russell 3000 and small cap Russell 2000 indices hitting our multi-week targets before backing-off slightly. However it was the better known indices which showed the rotation unfolding under the hood with US equities i.e. the Dow surged over +500-points whereas the high flying tech based NASDAQ, which has led the advance from March, actually closed down almost -0.3%. As we often say “1-day doesn’t a summer make” but we must be mindful when it occurs around our targeted areas.

MM is now neutral / negative US stocks short-term.

US Russell 2000 Chart

Last nights glimmers of light for the value stocks didn’t even register on the chart which should be no surprise considering the entrenched multi-year trend. A couple of points caught my attention this morning:

1 – The value index remains bullish short-term implying its too early to be calling decent pullbacks by US stocks just yet but the risk / reward is not exciting for buyers here.

2 – The value index is likely to try and fail to outperform growth a number of times before investors really embrace the inflation inspired reversion we are targeting medium-term.

MM prefers Value over growth through the next 12/18-months.

US S&P500 Value & Growth Indices Chart

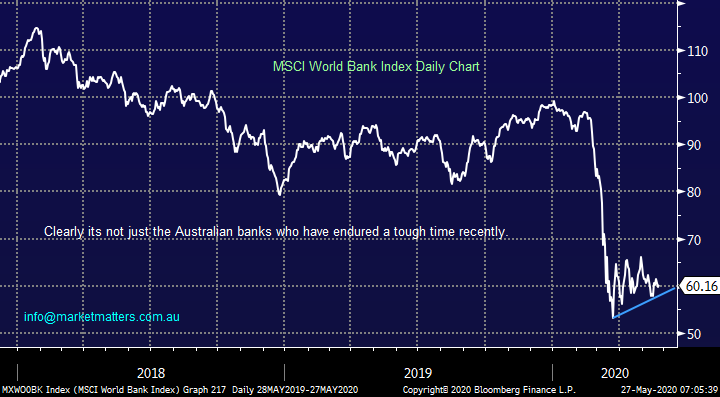

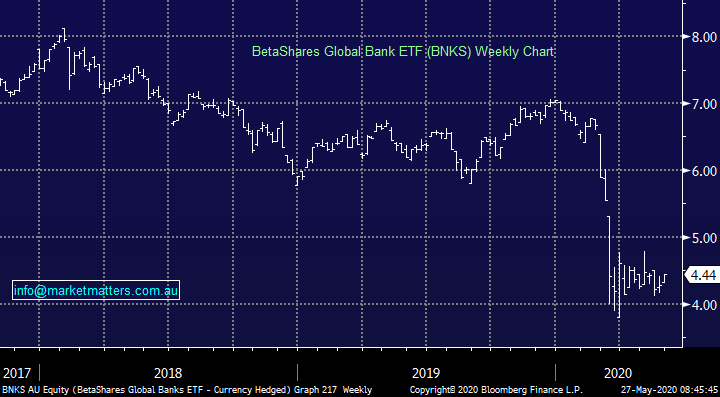

Are International Banks close to a turn?

When we look at the MSCI World Banking Index over the last few years its very clear that its not just our own sector which has endured a very tough time. It would be easy if we wore blinkers and only looked at the domestic offering to pin much of the blame on the painful Banking Royal Commission and subsequent aggressive regulatory environment, very different to say the US which has gone the other way, but their banks have also fallen on tough times.

The underlying economic landscape of plunging bond yields, squeezing margins and now potential elevated bad dates courtesy of COVID-19 has seen the likes of Westpac (WBC) halve in just 6-months, deferring its dividend along the way. We all know the local banks are heavily owned by yield hungry retail investors while many fund managers have been underweight but by definition value will emerge at a price. We feel investors who accumulate say WBC around current levels will be rewarded over the next 1-2 years but we would keep some ammo in the barrel to buy another spike lower if the ASX does correct its recent 31% recovery.

Medium-term MM believes global banks are in an area to be accumulated.

MSCI World Bank Index Chart

Today I have taken a quick look at the 3 banks MM is holding in its International Portfolio as we ask the simple question: “should we average and if so where”.

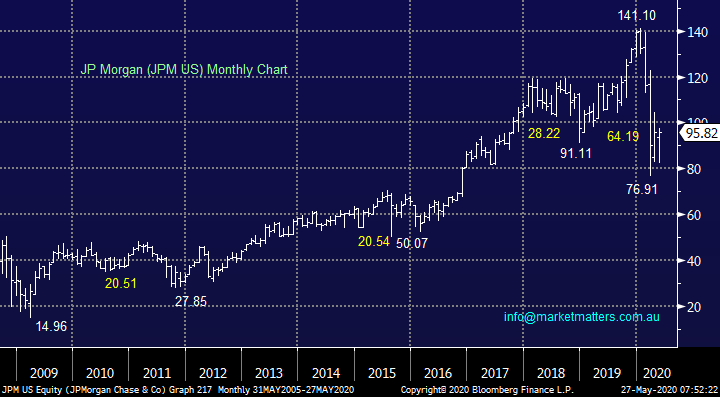

1 JP Morgan Chase (JPM US) $US95.82

Profits at JPM plunged almost 70% in Q1 of 2020 on an annualised basis while the US’s largest bank is also bracing for loan losses from the coronavirus which has hit the US far harder than Australia – net income came in at $US2.9bn. CEO Jamie Diamond warned investors that COVID-19 damages might lead to a suspension of the dividend but it’s all feeling manageable medium-term.

Importantly the bank’s net interest margins have held up okay given favourable wholesale funding markets, a theme that Westpac spoke of at a presentation they gave to us on Monday.

Overall, we see solid upside for JPM into 2021 as the global economy recovers from the current pandemic.

MM likes JPM under $US100.

JP Morgan Chase (JPM US) Chart

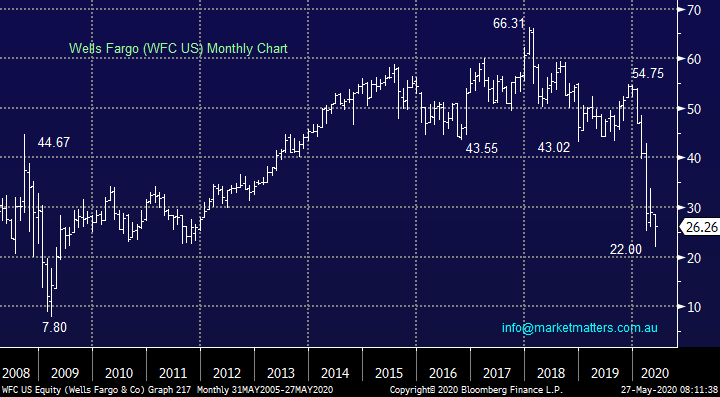

2 Wells Fargo (WFC US) $US26.26

WFC has endured a shocking few years following its “fake accounts scandal” but after plunging over 60% we see solid risk / reward at least for a bounce towards the $US35-40 region.

This bank really needs to lift earnings if the losses incurred because of COVID-19 escalate making it a leveraged play to an economic upturn. In Q1 the bank only delivered earnings of 1c, down from $1.20 last year making it the largest decline of any of the US larger banks. Hence the share price has enormous potential recovery potential if the Fed and President Trump get the economy back on track.

MM likes WFC into current weakness.

Wells Fargo (WFC US) Chart

3 UBS Group AG (UBS US) $US10.39

UBS bucked the global trend by growing Q1 profits by +40% year on year albeit off a very low base. Their income was $US1.6bn dropping down into earnings per share of 43c while they took a $US268m quarterly provision for the virus, obviously some guesswork here but UBS are an investment bank, not a high street bank. Importantly the bank has maintained a strong capital base, down only 0.2% on the year.

MM likes UBS around $US10.

UBS Group AG (UBS US) Chart

Conclusion

MM like these 3 banks into weakness although we’re reticent to press the buy / accumulate button just yet due to our short-term view on the index in general - our order of preference is currently all about the same!

MM International Equites Portfolio

No change just here but MM is looking at 2 things:

1 – Taking a 20-25% profit on United Health (UNH) above $US300.

2 – Hedging our portfolio with an ETF for a short-term pullback but as discussed earlier no sell signs are in place just yet.

*Watch for alerts.

United Health (UNH US) Chart

MM Global Macro ETF Portfolio

Again no change just here but MM is looking at 3 things:

1 – Take profit on our SLVP iShares Global Silver ETF above 13.

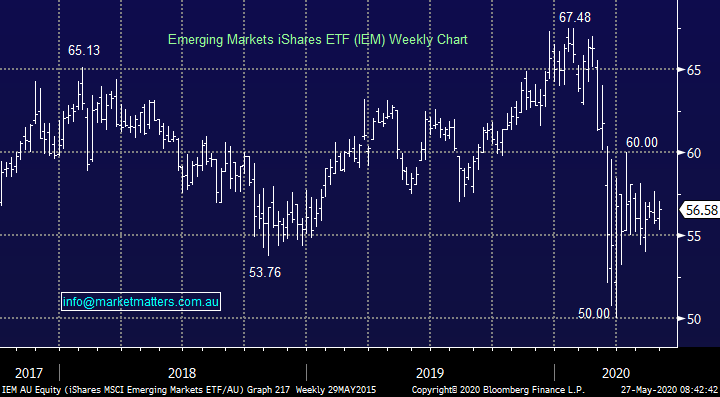

2 – Add to our Emerging Markets position below 55.

3 – Add to our BetaShares Global Banks ETF (BNKS) ideally around 4 but we may pay up on this one.

*Watch for alerts.

Emerging Markets iShares ETF (IEM) Chart

BetaShares Global Banks ETF (BNKS) Chart

Overnight Market Matters Wrap

- The US started the week with optimism, though it faded towards the end of session as White House officials noted they are considering sanctions on Chinese officials.

- On the commodities front, Gold was down 1.9% to US$1703/oz. Base metals had a much better night with everything bar Zinc rising, with the best performer being Lead, which closed up 2.53%.

- Crude oil gave some of its overnight gains this morning, currently trading at US$33.95/bbl. with BHP expected to underperform the broader market after ending its US session off an equivalent of 2.78% from Australia’s previous close.

- The June SPI Futures is indicating the ASX 200 give back some of its recent gains and open 34 points lower, towards the 5745 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.