Overseas Wednesday – International Equities & Global Macro ETF Portfolios (NSR, PSA US, UBS US, UNH US, QQQ US, SLVP US)

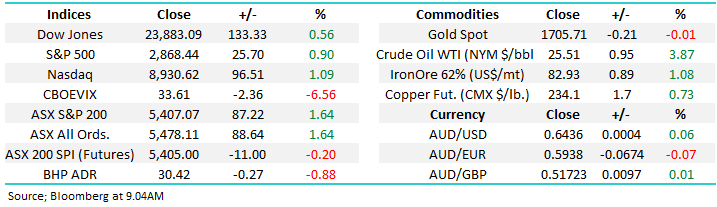

Another strong performance by the ASX200 with the index quickly regaining well over half of Fridays aggressive fall, as we said at the time any volatile shenanigans at a month’s end / start is often best ignored. Yesterday’s +87-point / 1.6% rally was again a classic case of “risk on” with the Resources, IT and Financials leading the gains while Healthcare fell, and Consumer Staples struggled – this is the underlying theme we believe will prevail through 2021 although I’m sure there will be some Trump / COVID-19 bumps in the road. Just for good measure only 18% of the ASX200 closed in the red showing definite broad-based buying, a deep seated encouraging sign for the bulls.

Last night I briefly looked back over MM’s reports since March and the standout feature was the significant reduction in discussion around COVID-19, most of us know the awful statistics of over 3.7m people being reported as infected and more than ¼ million confirmed deaths but with the rate of fresh infections being squashed in the majority of countries all attention is firmly on the speed and effectiveness in which we can all “go back to work”. In Australia restrictions are being slowly but surely lifted with consumer confidence likely to be one of the vital ingredients for a much needed “V-shaped” recovery, the governments understandably concerned around the touted $4bn currently being lost every week.

Small businesses are expecting JobKeeper payments to hit their accounts this week, I spoke with an old friend last night who has over 40 staff on his books and with zero new business rolling through his doors in recent months he anticipates forced pay cuts and then likely layoffs when the payments stop unless things pick up exceptionally fast. Similarly, with New Car Sales plummeting almost 50% we see another industry needing more than just a few friends popping out for coffee, further government tax breaks might be needed with this one. The point is there is a lot of slack in our economy after being closed for around 2-months, many pockets might still be struggling into Christmas, especially when compared to last December.

Hence from an investing perspective stock selection is more important than ever – encouragingly I note that the RBA is becoming increasingly optimistic that our recovery will be stronger than many initially feared.

MM remains bullish equities medium-term and hence were in “buy mode”.

ASX200 Index Chart

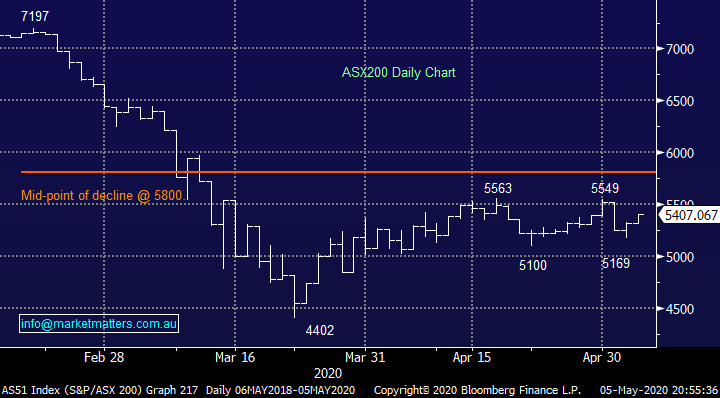

The Fear Gauge / Volatility Index (VIX) appears comfortable above the 30 area, a significant 60% below the panic levels of March but it still remains almost double the level which markets plumbed for much of the last few years. At MM we expect the VIX to continue its drift lower, but March and COVID-19 are still very fresh in people’s minds hence any meaningful break below the psychological 30 area might be months away.

MM believes market volatility will fall slowly but surely through 2020.

Volatility Index (VIX) Chart

Yesterday we saw National Storage (NSR) successfully raise $300m at $1.57, a 7.1% discount to Mondays closing price with another $30m targeted via a SPP from existing shareholders. Importantly NSR is raising capital for acquisitions, not to shore up a flimsy balance sheet. The storage giant already has $120m of expansion plans under consideration with more expected in the year ahead with the COVID-19 pandemic likely to provide increased opportunities and bargains. Following the raise the company has a war chest of over $620m, a great time to be able to go shopping in my opinion.

We believe NSR is just at the start of its Australasian expansion, especially when we compare our marketplace to that of the US. American based Public Storage was considering a takeover of NSR at $2.40 before the pandemic, insiders have been buying, the shares which yield over 5.5% pa and the stocks trading below its NTA, although NTA’s will be revised down I presume. i.e. we believe there are plenty of reasons to like NSR post raise.

MM is bullish NSR around current levels.

National Storage REIT (NSR) Chart

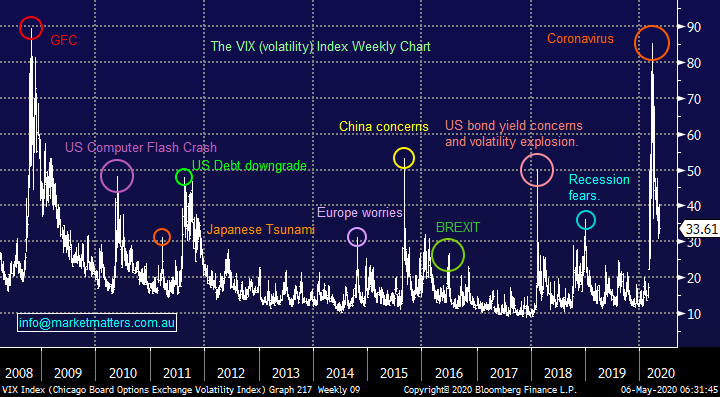

The story is similarly encouraging for the more mature US based Public Storage (PSA US) which has a market cap of $6bn compared to NSR’s at $1.3bn, obviously the US is a far larger market but PSA also has more competition plus NSR has its eyes on Asia. We are actually keen on both NSR & PSA.

MM is bullish PSA around current levels.

Public Storage REIT (PSA US) Chart

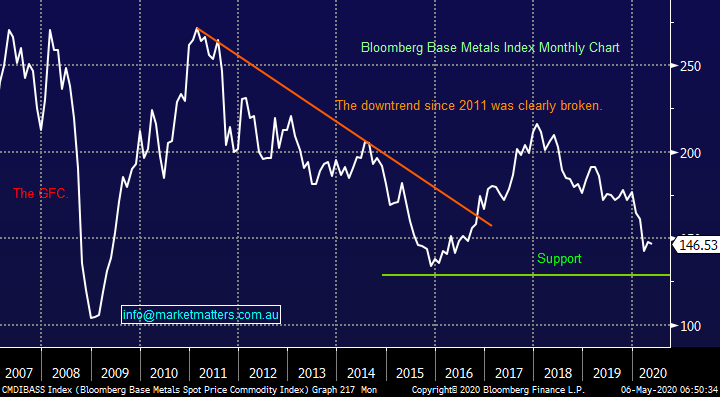

One of our major “calls” for the next few years is that inflation will rise due to the massive global stimulus that’s been injected into the economy, this should in turn lead to outperformance by the Value Stocks for the fist time since the GFC. If this view proves correct, we should by definition see base metal prices rally, a move that has not unfolded so far although iron ore has remained very resilient leading into this week’s holiday period in China). We are watching the likes of copper closely and a “return to the work” by much of the developed world might just be the required catalyst but at this stage it’s all quiet on the Western front.

Medium-term MM remains bullish Base Metals.

Blomberg Base Metals Index Chart

Overseas equities

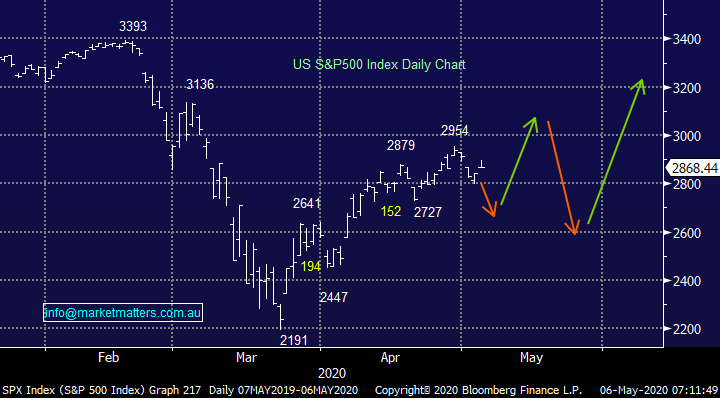

Overnight US stocks rallied although they did close well off their highs, the Dow finished up 133-points but it was up well over +400-points fairly late in the session. Assuming our view for the remainder of this year proves largely on point sessions like last night will be common place as investors continue to buy weakness but are happy to sell into strength.

MM remains bullish US stocks in the medium-term.

US S&P500 Index Chart

Since the sharp, but on reflection relatively tame correction in late 2018, the US Value & Growth Indices had been rallying in tandem but since the pandemic we’ve seen a flock to Growth as the large cap FANGS enjoy very healthy balance sheets e.g. Apple is sitting on well over $US200bn cash! While we believe the Growth Sector will make fresh all-time highs in 2020 /21 if we are correct some of the best gains will be seen in the currently less popular Value Sector but it still feels a touch too early to flock towards the view.

MM prefers Value over Growth through the next 12/18-months.

US S&P500 Value & Growth Indices Chart

MM International Equites Portfolio

MM still holds 8% in cash following our recent purchase of Exxon (XOM US) and The Trade Desk (TTD US) with TTD already soaring towards all-time highs. We are considering increasing our equity market exposure if / when opportunities arise in May but we will be fussy as we’re close to fully invested : https://www.marketmatters.com.au/new-international-portfolio/

Our thoughts have again evolved with fresh buying likely to be more focused in cyclical / value names in line with our view outlined earlier. However, there’s no change with our opinion that stocks will rally into Christmas in a staircase like manner as we see ongoing swings of sentiment hence in general we will continue to look to buy weakness while not being opposed to selling strength. We have updated our 5 most likely purchases / sales moving forward:

1 – Amazon (AMZN US): AMZN the largest global cloud & e-commerce company surged to fresh all-time highs in April, we continue to believe the stock represents value for the years ahead with our current ideal entry around $US2,250, just a few % lower.

2 - UBS Group (UBS US): MM is considering increasing this holdings up from 4% to 6% with the $US9 level currently our ideal averaging level, this still feels like one where we should be pedantic on price.

3 – Public Storage (PSA US): As discussed earlier we like PSA around the current $US180 area.

4 – LVMH (MC FP): MM is considering taking a ~8% loss on this luxury retailer as recently flagged in a few reports.

5 – United Health (UNH US): We are considering taking a ~30% profit on this highflyer if / when we migrate our portfolio further towards Value and away from Growth NB our target still remains fresh all-time highs ~10% higher.

*Watch for alerts.

UBS Group AG (UBS US) Chart

United Health (UNH US) Chart

MM Global Macro ETF Portfolio

MM’s cash position remains at 14% in the Global Macro ETF Portfolio, we are happy with the portfolios latest purchases in the ProShares Short VIX ETF (SVXY US) & BetaShares Global Energy ETF (FUEL US) : https://www.marketmatters.com.au/new-global-portfolio/

Moving forward we only have 2 positions on our radar following recent moves:

1 – Buy / Sell Invesco Bullish NASDAQ ETF (QQQ US) : No change, in line with our choppy bullish stance towards US equities, we are considering averaging this 5% position under $US200 and taking profit around $US220 BUT we will be “fussier” sellers as we’re bullish.

2 – Buy Invesco Bearish $US Index ETF (UDN US) : we like the UDN where it is now, sub $US20, MM is looking for at least a 15% appreciation in this ETF. However we already have exposure to the $A, too early in hindsight, hence any position taken here is likely to be around ½ usual size.

We are now giving our SLVP position more room as its looking good and does coincide with our longer-term outlook for the global economy:

3 – iShares MSCI Global Silver & Metals Miners (SLVP US): MM is now monitoring this position as it approaches our entry level.

*Watch for alerts.

Invesco QQQ Trust (QQQ US) Chart

iShares MSCI Global Silver Miners ETF (SLVP US) Chart

Overnight Market Matters Wrap

- US equity indices closed higher again, led by the tech heavy Nasdaq 100 as news of easing lockdown measures around the world spurred the market.

- Crude oil continues to rally currently at US$25.51/bbl. while the VIX (volatility) index tracks lower.

- The June SPI Futures is indicating the ASX 200 to open with little change this morning, around the 5410 level.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.