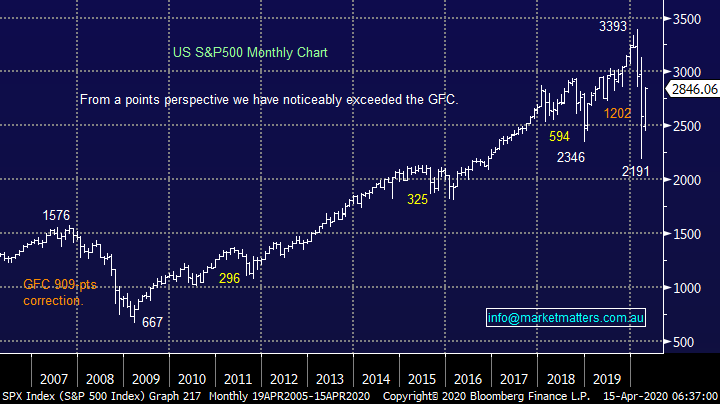

Overseas Wednesday – International Equities & Global Macro ETF Portfolios (MSFT US, AMZN US, FUEL, QQQ US)

The ASX200 enjoyed a stellar start to the post-Easter week as we’ve rapidly found ourselves up +24% in just 15-trading sessions, shame about the COVID-19 inspired plunge of March. The buying remains broad-based with 75% of the ASX200 closing positive yesterday helping the index to rally another 100-points / 1.87%. Capital raisings continue to dominate the news flow on the local bourse with QBE Insurance (QBE) and Invocare (IVC) both enjoying successful raisings – funeral homes operator IVC found very healthy fund manager appetite enabling it to increase their raise by 33% to $200m, while QBE’s raise was oversubscribed.

Interestingly local stocks posted a fresh 1-month high even as we saw business confidence plunge to its lowest level in history, eclipsing the GFC in the process. With the Federal Treasury forecasting unemployment to climb to 10% it’s no surprise that both people and companies are concerned, especially when we consider that small businesses are only just working out how to apply for the respective Federal and State government support grants / programs, any money still feels many weeks away and that’s assuming things move efficiently.

The great news is it appears we’re slowly winning Phase 1 of the fight against COVID-19 i.e. containment. Arguably the next step is harder, getting back to work without a vaccine in a manner which avoids major secondary breakouts. As we said in the Easter Report Bill Gates believes its going to take around 18-months until we get a readily available vaccine which makes navigating Phase 2 a fascinating proposition for the active investor. At this stage we are bullish as much of the initial panic and uncertainty around COVID-19 is now in the rear view mirror, however MM believes the investment landscape ahead of us is lined with both pots of gold and landmines – we have touched on both today.

MM remains both bullish and in “buy mode, for now

ASX200 Index Chart

Three areas / sectors which MM believes requires a degree of trepidation at least for the foreseeable future are as follows:

1 – Travel & Tourism : a week or two ago we were considering a play in this sector but the more thought and analysis we dedicate to the topic the longer the disruption feels likely to last; yesterday we saw Crown (CWN), Webjet (WEB) and Star Entertainment (SGR) all fall in a strong market.

2 – Retail: we believe the consumer will be very cautious moving forward after their quality of life has been threatened by low levels of financial flexibility, similar to what we’re seeing from a number of companies today. Many previously “buy now pay later” orientated Australians will be looking to bolster their savings and reduce debt. The sector has been hammered and MM has bought JB Hi-Fi (JBH) but we have not chased any classic shopfront only businesses.

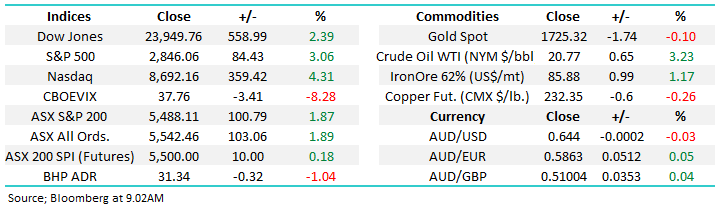

3 – Real Estate: The combination of people getting used to some of the benefits of working from home and traditional retail outlets struggling leads us to see no reason to chase the Property Sector. These stocks continue to struggle compared to many alternative stocks / sectors, even on Tuesday when the ASX soared almost 2% property stocks fell -1%. We feel there are widespread capital raises likely here as asset values are revised down.

ASX200 Real Estate Index Chart

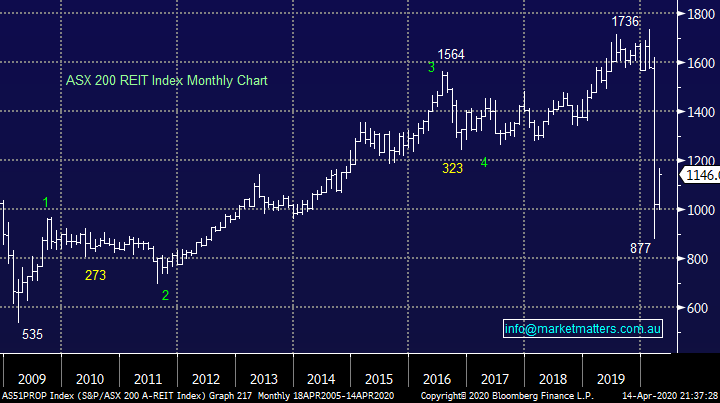

At MM we are always looking for leading indicators to assist us in our entry levels into stocks / positions and the little ”Aussie Battler” has been on the money throughout the COVID-19 pandemic – fundamentally this is not a unfathomable scenario as the $A is often used to illustrate global growth in a similar manner to copper.

The $A turned lower as the coronavirus put the brakes on the Chinese economy at the start of 2020, months before the ASX and global equities rolled over. Similarly, the $A bottomed and commenced an impressive recovery well before equities, a rally which at this stage remains totally intact. As we await the next pullback in stocks the $A may be the key to both the when and most importantly its likely conclusion.

MM is bullish both equities and the $A.

Australian Dollar ($A) & ASX200 Chart

Overseas markets

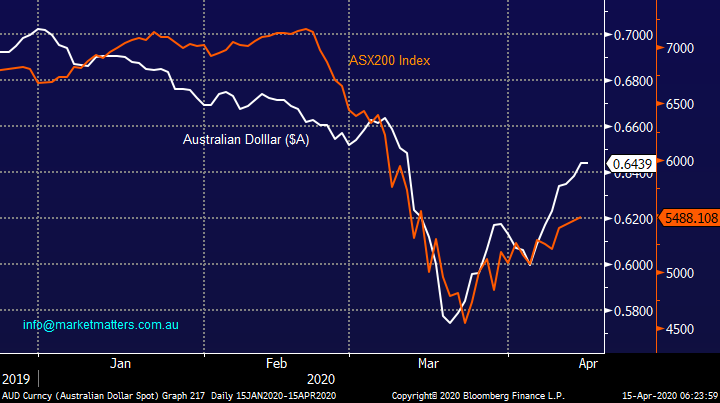

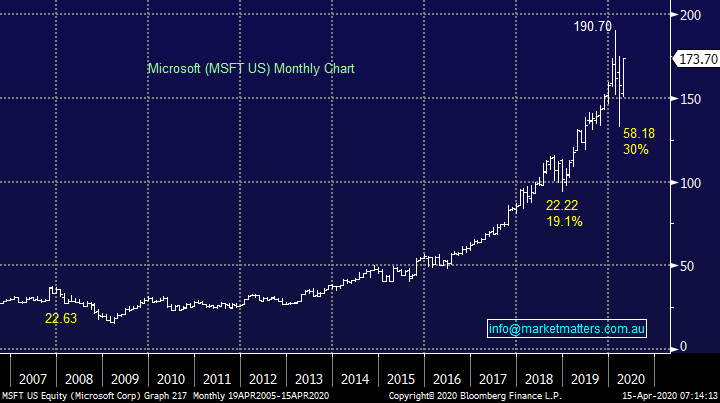

Overnight US stocks continued to enjoy an impressive recovery led by heavyweights such as Apple (AAPL US) and Microsoft (MSFT) who were both basically up +5%. The S&P500 has already rallied +14% and remarkably its now less than 20% below its all-time high, we have 2 important thoughts around the recovery and US stocks at present:

1 – The recovery probably needs a rest, as mentioned earlier Phase 2 hasn’t started yet and its fraught with potential set-backs, according to the IMF (International Monetary Fund) the global recession now appears likely to be the worst since the great depression of 1929 suggesting the current bounce is almost priced for perfection but……

2 – Official global interest rates which currently sit around zero appear likely to remain extremely low for the foreseeable future making stocks / companies who are well positioned to grow in the coming years still relatively “cheap” compared to the underlying market e.g. Microsoft (MSFT US) and Apple (AAPL US).

MM is bullish quality US stocks.

US S&P500 Index Chart

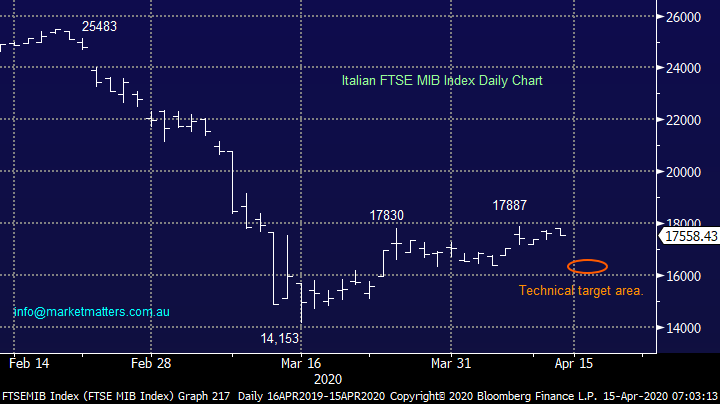

Interestingly the Italian bourse which doesn’t enjoy the abundance of quality IT stocks like the US continues to struggle from a relative perspective, it’s hardly made a dent in its savage COVID-19 decline. Our short-term feeling is European, including Italian, equities are poised to correct a decent portion of the last few weeks recovery which will potentially provide an ideal risk / reward buying opportunity.

MM is in “accumulation mode” for Italian, and global equities.

Italian FTSE MIB Indices Chart

MM International Equites Portfolio

Our international Equities Portfolio is sitting on 18% cash looking to increase equity market exposure through April: https://www.marketmatters.com.au/new-international-portfolio/

However when I look at our current holdings I don’t feel it fully reflects our current view on equities and especially the US, we are very bullish the cashed up quality tech names like Microsoft (MSFT US), Amazon (AMZN US) and Google (GOOGL US), our simple belief is that both cloud and e-commerce businesses are going to accelerate post COVID-19 as the way we perform business will continue to evolve e.g. In just a few weeks Zoom has become a necessity for many Australians, me included.

The message we have been pushing domestically is the same rhetoric that should be applied to our overseas stocks, this is the time to continue moving up the quality end of the curve.

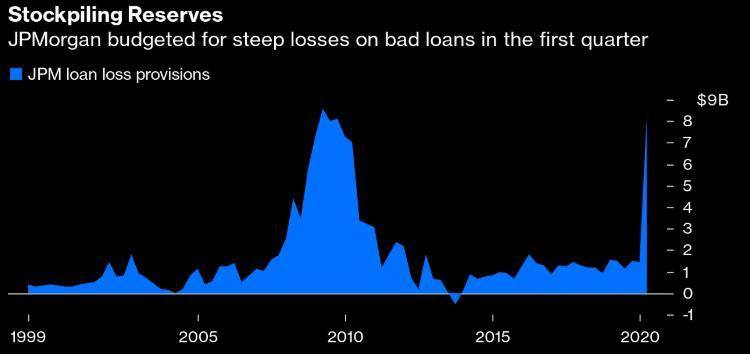

We feel it’s critical that investors focus on where they believe stocks are headed, not levels they plumbed in March during the mass panic selling. We are still holding a significant exposure to financial names which are now entering reporting season, not ideal unfortunately e.g. JP Morgan (JPM US) & Wells Fargo (WFC US) reported last night and both were down on the session.

One slide caught my attention from Bloomberg this morning, that being the quarterly bad debt provision from JP Morgan. To give some context here, they provisioned for $US8.3bn of bad debts, largely linked to car & credit card debt, which compares to the $US8.6bn bad debt charge they took at the height of the GFC.

Source: Bloomberg

MM is net bullish equities so while we don’t necessarily want to panic out of all bank / financial holdings we do need to have our portfolio significantly more skewed to our core underlying market view i.e. 8% in Microsoft (MSFT US) and 6% in Apple (AAPL US) is not “heavy” enough in the quality US based IT names. We have updated our list of likely purchases / switches to reflect these views, when we do sell / switch expect the focus to be financially based:

1 – Amazon (AMZN US) : Last night AMZN the largest global cloud & e-commerce company surged to fresh all-time highs, we believe this is a train that has only just left the station, we are happy to chase strength here especially on a relative basis. The companies just announced they are now hiring an additional 75,000 people on top of the 100,000 it already just hired, that’s expansion in uncertain times!

2 – Google (GOOGL US) : This household name looks destined to follow AMZN to fresh all-time highs, Google Cloud may only have a 6% market share but we believe this goliath is likely to achieve its goal of capturing $US25bn sales pa albeit with some acquisitions to help the journey.

3 - Apple (AAPL US) & Alibaba (BABA US) : MM is looking to increase these holdings up to 8%.

Remember we keep preaching buy the quality and the above 4 names are already significantly outperforming the broad market whereas the 2 below are not.

4 – Janus Henderson (JHG US): UK based fund manager has bounced over 30% from its lows pretty much in-line with the S&P500, we believe that a period of underperformance is now looming.

5 – JP Morgan (JPM US) Wells Fargo (WFC) &/or Bank of America (BAC US) : Following the results from JPM & WFC last night an ongoing short-term recovery from this sector feels unlikely.

*Watch for alerts.

Microsoft (MSFT US) Chart

Amazon (AMZN US) Chart

MM Global Macro ETF Portfolio

MM’s cash position remains at 39% in our Global Macro ETF Portfolio but similar to our International Portfolio we are not convinced this portfolio currently reflects our best core Macro views hence we have tweaked our anticipated actions as below:

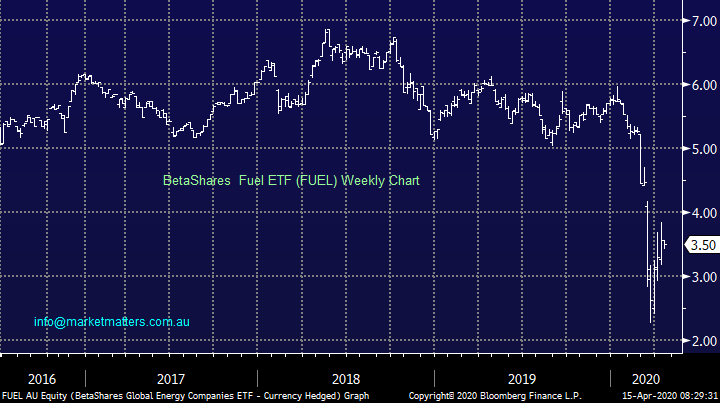

1 – Buy the BetaShares Fuel ETF (FUEL) : around current levels for exposure to a recovery in the global energy stocks, not Crude Oil directly. We feel that holding the stocks that are exposed to energy, over and above the Oil price itself offers more exposure to potential government support for the sector. https://www.betashares.com.au/fund/global-energy-companies-etf/

2 - Buy Invesco Geared Bullish NASDAQ ETF (QQQ US) : after its strong recovery this is a position MM is considering “scaling into” during April with our ideal entry level now sub 200 – note this $US93bn Trust is leveraged ~1.9x.

3 – Buy Invesco Bearish $US Index ETF (UDN US): we are looking for at least a 15% appreciation in this ETF.

4 – Global Banks (BNKS) ETF: for the reasons touched on earlier we are looking to exit this position, but we do believe a better opportunity will present itself later in 2020.

*Watch for alerts.

BetaShares Fuel ETF (FUEL) Chart

Invesco QQQ Trust (QQQ US) Chart

Overnight Market Matters Wrap

- The US equity markets rallied overnight as data on the virus continues to improve.

- Crude oil fell on concern production cuts are not enough to offset falling demand.

-

On a positive note, Copper continued to recover and hit a 4-week high at US$5,200 early in the session.

- The June SPI Futures is indicating the ASX 200 to open 38 points higher towards the 5525 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.