Overseas Wednesday – International Equities & Global Macro ETF Portfolios (COH, SUN, CBA, SIQ, A2M, BBOZ, BAC US, SH US, GDX US, QID US, TBF US)

The ASX200 enjoyed a strong Tuesday closing up +0.6%, less than 1.3% below its all-time high set in late January, an exceptional performance considering the coronavirus death toll has exceeded 1,000. Also it’s a perfect illustration of how stock markets evolve on a journey which focuses on different issues along the way, rarely standing still on one news item for too long – it is often the same with individual stocks were focus moves from one driver of performance to another. The buying was broad based yesterday with every sector closing positive while winners trounced losers by almost 3:1, after an out of character lacklustre Monday the IT sector was as often been the case strongest on ground rallying +1.7%.

The coronavirus has certainly lost its impact from a headline perspective and as MM expected the baton has been passed to the domestic reporting season, hold onto your hats it looks likely to another volatile few weeks under the hood – today is likely to have a significant impact on the market with Commonwealth Bank (CBA), Computershare (CPU), CSL Ltd (CSL) and James Hardie (JHX) to name just a few facing the music.

For a list of company reports: CLICK HERE

Our preferred scenario remains that the ASX200 will follow its US peers and make all-time highs in the next 1-2 weeks but that’s no big call after recent gains however if we’re correct equities will then experience another 300-point / 4% correction from these highs – basically no change to our outlook for a 2020 a choppy rally where buying weakness / selling strength should add value as we see a limited possibility of a “runaway train” like advance from current levels as we saw in 2019.

MM remains short-term bullish the ASX200 looking for only ~1.5% more upside.

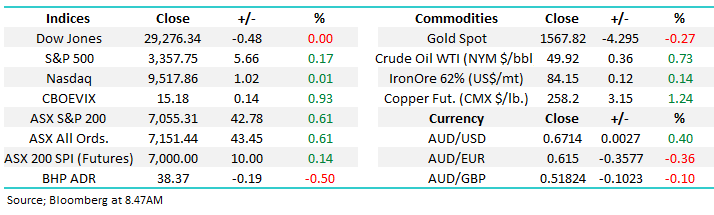

Overnight US stocks were stronger early before selling off into the close, although they still managed to close higher on the session with the S&P 500 up +0.17%, Locally, SPI Futures are 10 points higher.

Today we’ve again focused on our recent moves in the Overseas & ETF Portfolio’s as we position ourselves for what MM believes is a last push higher in risk assets before a pullback / period of consolidation.

ASX200 Chart

US equities main S&P500 Index again made fresh all-time highs last night but ever increasingly we believe the markets showing classic bubble like characteristics in technology & quality growth stocks which fits the late stages of a major bull market. These marginal new highs in the indices like the S&P500 and NASDAQ are selective and mega cap driven, whereas the overall market momentum is waning which is not a good sign for the bulls from a risk / reward perspective.

MM is now transitioning to neutral / bearish stance on US equities.

US S&P500 Index Chart

Yesterday Cochlear (COH) announced a profit warning as surgeries in China were put on hold due to coronavirus, in the process illustrating the ripple effect through markets from this escalating outbreak. The 5% downgrade is not major but it took the edge of one of the markets best performing stocks, interestingly this was one the stocks which was unceremoniously dumped by investors in Q4 of 2018 i.e. we again feel that investors are long and bullish making aggressive pullbacks almost inevitable when nerves reverberate through markets around elevated valuations.

At current prices MM is neutral COH.

Cochlear (COH) Chart

Suncorp (SUN) has been MM’s favourite technical picture/ chart pattern for the last few years and it continues to follow our anticipated path, yesterday’s half-year results which showed a greater than 6% drop in profits clearly disappointed the market.

MM remains neutral / bearish SUN.

Suncorp (SUN) Chart

4 local stocks / ETF’s that remain in the MM “headlights.”

After the last fortnights market recovery MM is increasingly transitioning to “sell mode” but this doesn’t mean we turn our backs on the whole market.

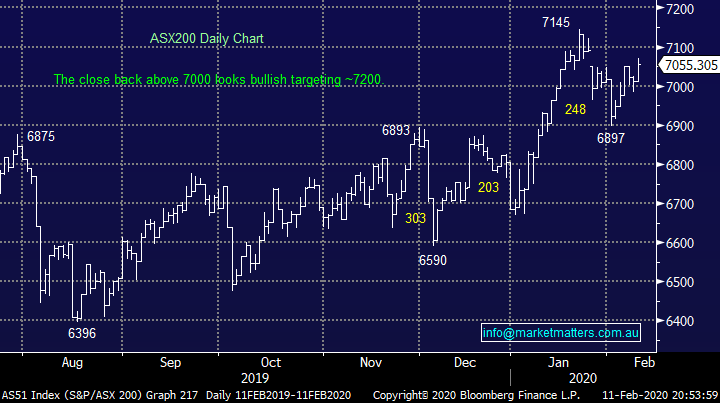

1 Commonwealth Bank (CBA) $84.72

Released 1H earnings this morning that are ~3% better than expected. Cash NPAT came in at $4.477b for the half versus $4.344b expected. Earnings per share (EPS) printed $2.53 v $2.44 expected, a ~3.7% beat while the all-important dividend remained flat at $2.

Earnings were down -4.3% on 1H19 due to a flat top line but rising costs. Operating income was $12.416b, stable on this time last year, while impairments were 12.5% higher and operating expenses were up 2.6%, although that sort of growth in expenses in the current environment is a win. Net Interest Margins (NIM) were 2.11%, up 1bpts which is a good effort in an environment of low rates. Tier 1 capital is very strong, and this opens up the likelihood of some type of capital return towards the end of the year, perhaps at their full year results.

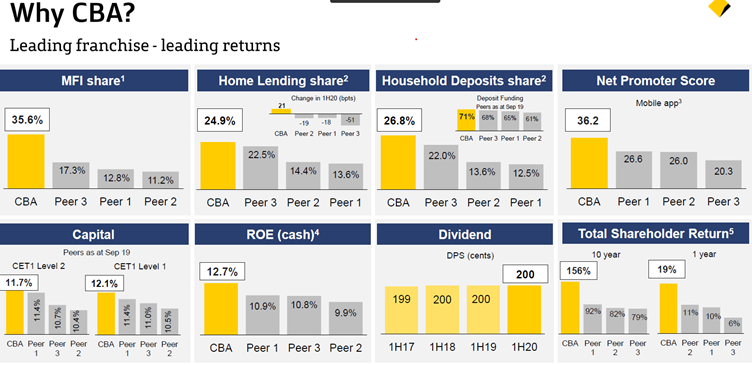

A good result in a tough environment. We have the CFO in tomorrow morning to run through the numbers in more detail however one slide in the pack stood out and shows why CBA trades on 17.1x versus the sector on 13.4x, simply it’s the sector leader in home loans, deposits, capital, ROE and total shareholder return.

While this is clearly a good result and above expectations, we ponder whether or not this had already been priced in given the strong outperformance in recent months.

MM is looking to sell CBA into strength around $87.00 *Watch for Alerts*

Commonwealth Bank (CBA) Chart

2 SmartGroup (SIQ) $6.77

Our last income note for 2019 looked at salary packaging business Smart Group (SIQ) after shares essentially halved (click here). The conclusion in the note being wait for support to be found, however SIQ was an income stock we were looking to buy. SIQ now trades on an estimated P/E of just 10.8x based on downgraded numbers while its Est yield is 6.5% fully franked with the stock going ex-dividend in April after they report on the 17th February.

The company has a very strong industry position, is cheap, carries no debt and also has the capacity to pay a special dividend this year they choose (as they did in April last year)

MM still has SIQ on our radar as an income opportunity

SmartGroup (SIQ) Chart

3 a2 Milk (A2M) $14.89

One stock which remains on our shopping list this week where we haven’t yet pressed the buy button is a2 Milk (A2M), the Food & Beverage sector is one MM likes in the coming months, we believe the virus outbreak in China can only help our food producers over the longer-term.

MM remains bullish A2M now around $14.50.

a2 Milk (A2M) Chart

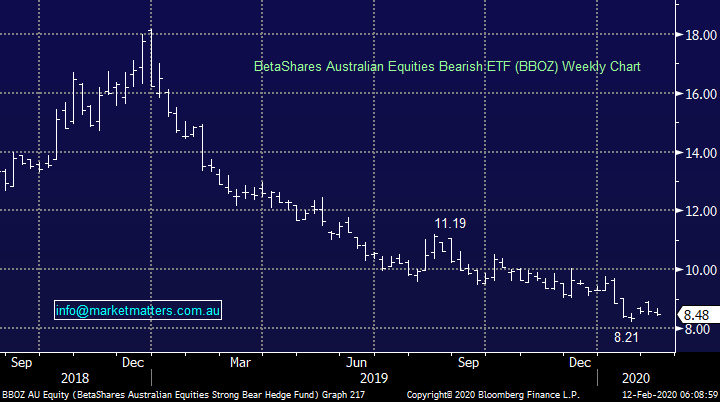

4 Bearish Leveraged ASX200 ETF (BBOZ) $8.48

No change here, MM is looking to reduce our market exposure into current strength with our ideal scenario a test towards 7200 by the ASX200 which should enable us to buy the BBOZ around $8.10 – watch for alerts.

MM is bullish the BBOZ ~4% lower.

BetaShares Australian Equities Leveraged Bearish ETF (BBOZ) Chart

MM International Equites Portfolio

No change to our MM International Portfolio, our cash position remains at a conservative 21% : https://www.marketmatters.com.au/new-international-portfolio/

Last we wrote the below in this section:

“Our current thoughts are aligned with how MM sees equities in general - the recent pullback was a buying opportunity but we aren’t interested in chasing strength believing that when many indices / stocks scale fresh all-time highs it will be a time to take some money from the table. The tech-based NASDAQ continues to lead the way making fresh highs as I type rallying well over 2%, our current technical target area for this high-flying index is 9500-9700.”

Overnight the NASDAQ hit 9600 before failing to hold onto its early morning gains, no sell signals but from a risk / reward perspective MM is now neutral / bearish.

NASDAQ Index Chart

Hence at this stage we are looking for ways to reduce our market exposure as opposed to pressing the “buy button”. Two existing holdings are catching our attention in different ways:

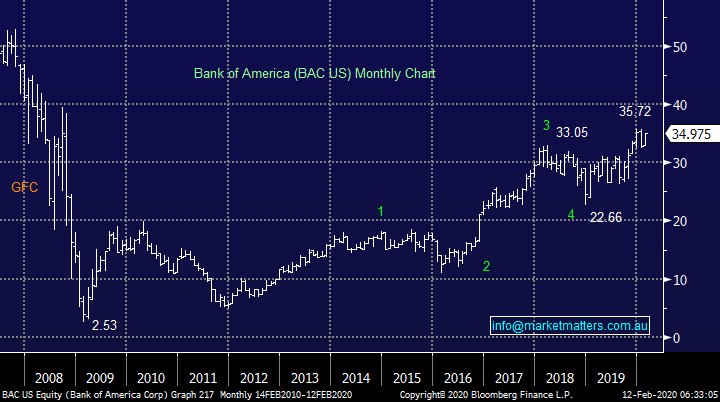

1 Bank of America (BAC) $US34.98

BAC has been looking after MM nicely with our position showing a ~16% paper profit with our initial profit target now less than 3% away, a push to this area over the coming 1-2 weeks is likely to see us take some $$ from the table.

MM is considering taking profit on our BAC position above $US36.

Bank of America (BAC) Chart

2 ProShares Short S&P500 ETF (SH US) $US23.04

Another simple manner for MM to reduce our market exposure is to increase our position in the ProShares bearish ETF (SH US), a similar concept to the BBOZ on this occasion without any leverage. Alternatively, the BBUS is listed on the ASX and provides leveraged short exposure on the S&P 500.

MM is considering increasing our bearish SH US ETF position.

ProShares Short S&P500 ETF (SH US) Chart

Conclusion (s)

MM continues to believe 2020 will be a volatile year where investors should be active - sell strength and buy weakness. Hence if we are correct now is more a time for selling, not buying.

The MM Global Macro ETF Portfolio

No change with the MM Global Macro Portfolio our cash position remains at 41.5% . : https://www.marketmatters.com.au/new-global-portfolio/

We still feel like things continue feel like they are slowly coming together for the MM viewpoint as equities experience increased volatility at the start of 2020, not unusual from a seasonal perspective. We still anticipate being fairly busy in the coming weeks / months assuming our outlook remains on-point. Much of the below is similar to last week:

1 – MM is looking to sell / reduce our positions in the iShares MSCI Silver ETF (SLVP US) and Van Eck Gold Miners ETF (GDX US)– both are currently moving in the opposite direction to equities hence if we are correct and stocks are ready to move higher precious metals are unlikely to follow in their footsteps.

VanEck Gold Miners ETF (GDX US) Chart

2 - MM will look to increase our short S&P500 ProShares ETF position into fresh highs as discussed with the International Portfolio.

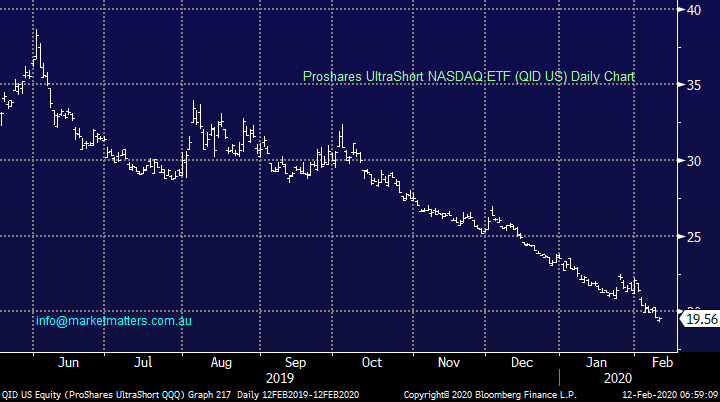

3 – MM may be aggressive and take a bearish NASDAQ ETF position, I believe a leveraged play will show at least 10-15% return over coming months: our preferred vehicle is the ProShares UltraShort QQQ NASDAQ ETF (QID US) which has 2x leverage.

ProShares UltraShort NASDAQ ETF (QID US) Chart

4 – MM is looking to fade a new low in bond yields, our preferred ETF is the ProShares short 20+ Treasury ETF (TBF US) : https://etfdb.com/etf/TBF/#etf-ticker-profile

MM is ideally looking to buy the TBF below 18, although that is very

ProShares Short 20+year US Treasury ETF (TBF US) Chart

Conclusion (s)

MM believes US stocks have bottomed for now and will now rally to fresh all-time highs, just like the NASDAQ. We have tweaked our portfolio for this move and will look to again reverse its skew if / when new highs are achieved.

We are looking to basically reverse our positions if / when the S&P500 rallies another ~3%.

Overnight Market Matters Wrap

· The Australian market is set to open slightly higher this morning, despite Wall St losing its early gains from record levels, to close only slightly higher. Locally, resource stocks should be well supported, after commodity markets rallied overnight, led by copper and oil prices, as hopes rose that China’s coronavirus fallout may be closer to being contained.

· Both the Nasdaq and S&P 500 set fresh all-time highs in early trading, albeit closing off their intra-day peaks. Earlier, European markets closed higher, boosted by the firmer commodity market. The oil price finally rose 1.2% off a 13-month low, after losing more than 20% in the last month on growing fears of a coronavirus hit to both China and global growth. Iron ore, in particular, led the commodity market higher, rising 5% to nearly US$87/tonne, while the base metal market was led by copper, nickel and aluminium.

· The latest reports showed the number of people infected by coronavirus rose to over 43,100 and the death toll to 1018. The Chairman of the Federal Reserve, Jerome Powell, said they were closely monitoring its impact on China and global growth. Locally, the futures are 10 points higher, as the local reporting season gathers pace. Among companies with results today include CBA, CSL, CPU, CAR, DOW, IAG, EVN and JHX.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.